Professional Documents

Culture Documents

Payroll Report Template 01

Payroll Report Template 01

Uploaded by

FHSOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payroll Report Template 01

Payroll Report Template 01

Uploaded by

FHSCopyright:

Available Formats

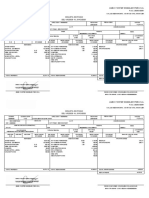

Certified Payroll Report

Report for: Check if Subcontractor1) Contract No: Payroll No:

Company: 1)

If Sub, GC/Prime Contractor Name:

Address: Project Name & Location: Week Ending:

City, State, Zip Public Authority (Owner):

Phone No: Sheet:2) of

7.

2.Work 3.Prevailing Wage Project 4.Total 5.Base 6.Project Fringes: Cash Approved Plans

1. Employee Name, Weekly Payroll Amount

Address, & Last 4 digits of Class3) Hours Worked - Day & Date Hours Rate Gross Cash & Approved Plans

8.Total

the SS #

Fringe Rate Your Company Pays Per Hour Hrs for 9. Total 11. Net

all Gross on All 10. Total Pay on All

H&W Pens Vac Hol Other Total Jobs Jobs Deductions Jobs

OT

ST

OT

ST

OT

ST

OT

ST

OT

ST

1 ) By signing below, I certify that: (1) I pay, or supervise the payment of the employees shown above; (2) during the pay period reported on this form, all hours worked on this project have been paid at the appropriate prevailing

wage rate for the class of work done; (3) the fringe benefits have been paid as indicated above; (4) no rebates or deductions have been or will be made, directly or indirectly from the total wages earned, other than permissable

deductions as defined in ORC Chapter 4115; and (5) apprentices are registered with the U.S. Dept. of Labor, Bureau of Apprenticeship and Training. I understand that the willful falsification of any of the above statements may subject

the Contractor or Subcontractor to civil or criminal prosecution.

Type or Print Name and Title Signature Date

2)

Attach additional sheets as necessary. Type in continuous line, text will wrap.

3)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ProVidaLiquidacion-141855888001 - Veronica Cecilia Olave FloresDocument1 pageProVidaLiquidacion-141855888001 - Veronica Cecilia Olave FloresVerónica OlaveNo ratings yet

- Payroll Sheet QuizDocument5 pagesPayroll Sheet QuizJoneric RamosNo ratings yet

- Field Guide for Construction Management: Management by Walking AroundFrom EverandField Guide for Construction Management: Management by Walking AroundRating: 4.5 out of 5 stars4.5/5 (4)

- Contracts, Biddings and Tender:Rule of ThumbFrom EverandContracts, Biddings and Tender:Rule of ThumbRating: 5 out of 5 stars5/5 (1)

- Caso Práctico MineraDocument4 pagesCaso Práctico MineraWilmer Noe Licapa Mansilla100% (1)

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Winning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertFrom EverandWinning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertNo ratings yet

- Contract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalFrom EverandContract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- The Life of Thomas Telford; civil engineer with an introductory history of roads and travelling in Great BritainFrom EverandThe Life of Thomas Telford; civil engineer with an introductory history of roads and travelling in Great BritainNo ratings yet

- Voyage of the Paper Canoe / A Geographical Journey of 2500 Miles, from Quebec to the Gulf of Mexico, During the Years 1874-5From EverandVoyage of the Paper Canoe / A Geographical Journey of 2500 Miles, from Quebec to the Gulf of Mexico, During the Years 1874-5No ratings yet

- The Poems of Goethe, Translated in the Original MetresFrom EverandThe Poems of Goethe, Translated in the Original MetresNo ratings yet

- The Lock and Key Library The most interesting stories of all nations: French novelsFrom EverandThe Lock and Key Library The most interesting stories of all nations: French novelsNo ratings yet

- TOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2From EverandTOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2Rating: 5 out of 5 stars5/5 (1)

- The Doré Lectures / Being Sunday addresses at the Doré Gallery, London, given in connection with the Higher Thought CentreFrom EverandThe Doré Lectures / Being Sunday addresses at the Doré Gallery, London, given in connection with the Higher Thought CentreNo ratings yet

- Essays; Political, Economical, and Philosophical — Volume 1From EverandEssays; Political, Economical, and Philosophical — Volume 1No ratings yet

- Increasing Human Efficiency in Business / A Contribution to the Psychology of BusinessFrom EverandIncreasing Human Efficiency in Business / A Contribution to the Psychology of BusinessNo ratings yet

- Ten Thousand Dreams Interpreted, or what's in a dream: a scientific and practical expositionFrom EverandTen Thousand Dreams Interpreted, or what's in a dream: a scientific and practical expositionNo ratings yet

- The Complete Works of James Whitcomb Riley — Volume 10From EverandThe Complete Works of James Whitcomb Riley — Volume 10No ratings yet

- Native Life in South Africa / Before and Since the European War and the Boer RebellionFrom EverandNative Life in South Africa / Before and Since the European War and the Boer RebellionNo ratings yet

- Divine Comedy, Longfellow's Translation, CompleteFrom EverandDivine Comedy, Longfellow's Translation, CompleteRating: 4 out of 5 stars4/5 (2310)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- The Hymns of Martin Luther Set to their original melodies; with an English versionFrom EverandThe Hymns of Martin Luther Set to their original melodies; with an English versionNo ratings yet

- Project Management For Procurement Management ModuleFrom EverandProject Management For Procurement Management ModuleNo ratings yet

- DEL 1/12/2020 AL 31/12/2020: Amec Foster Wheeler Peru S.ADocument1 pageDEL 1/12/2020 AL 31/12/2020: Amec Foster Wheeler Peru S.ADavid CruzaleguiNo ratings yet

- Jhonny Alexander Gonzalez DSDocument1 pageJhonny Alexander Gonzalez DSCarolina HurtadoNo ratings yet

- Código Descrição Referência Vencimentos DescontosDocument1 pageCódigo Descrição Referência Vencimentos Descontoswesley guedesNo ratings yet

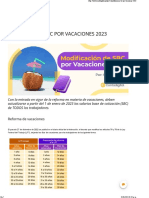

- Modificacion de SBC en Imss en 2023Document5 pagesModificacion de SBC en Imss en 2023FELIX ADANNo ratings yet

- NOMINADocument17 pagesNOMINAmaríaNo ratings yet

- Nomina-En-Excel CostosDocument6 pagesNomina-En-Excel CostosJohanna PreciadoNo ratings yet

- Calculadora Laboral: Tributando en BoliviaDocument8 pagesCalculadora Laboral: Tributando en BoliviaMiguel Martinez AlmendrosNo ratings yet

- Kuis Pertemuan 3 AKLDocument6 pagesKuis Pertemuan 3 AKLDeby KartikaNo ratings yet

- Guia Didactica 2-FSSI PDFDocument52 pagesGuia Didactica 2-FSSI PDFYuleika RamirezNo ratings yet

- 2022 "Retention Incentives" (Local 241/308)Document8 pages2022 "Retention Incentives" (Local 241/308)Chicago Transit Justice CoalitionNo ratings yet

- Reporte Planilla 20529531541190420230953Document1 pageReporte Planilla 20529531541190420230953William ŽfNo ratings yet

- Trabajo Obligaciones LaboralesDocument88 pagesTrabajo Obligaciones LaboralesCristian HerreraNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplateLeonardo GonzalezNo ratings yet

- Paquete Tecnologico TomateDocument9 pagesPaquete Tecnologico TomateEdgar Nucamendi RuizNo ratings yet

- Propuesta Económica Salarial de La Empresa en Respuesta Al Pliego de PeticionesDocument1 pagePropuesta Económica Salarial de La Empresa en Respuesta Al Pliego de PeticionesACDACNo ratings yet

- THVSH13559170000088947 NewDocument4 pagesTHVSH13559170000088947 NewVIVEK PNo ratings yet

- Captura de Pantalla 2021-06-25 A La(s) 11.24.15Document1 pageCaptura de Pantalla 2021-06-25 A La(s) 11.24.15Christiansen DueñezNo ratings yet

- Payroll Salary SlipDocument4 pagesPayroll Salary SlipDeca ErnandoNo ratings yet

- Planilla de OscarDocument3 pagesPlanilla de OscaryuliNo ratings yet

- RFC TDM991012M33: TA 2000, S.A. DE C.V. CFDI de NóminaDocument2 pagesRFC TDM991012M33: TA 2000, S.A. DE C.V. CFDI de NóminaJax CobosNo ratings yet

- Auxiliar Contabilidad Javier AlexisDocument5 pagesAuxiliar Contabilidad Javier AlexisChristian PantojaNo ratings yet

- Department:: Oberlin College Controller's Office Weekly Employment Record - Miscellaneous Hourly EmployeesDocument1 pageDepartment:: Oberlin College Controller's Office Weekly Employment Record - Miscellaneous Hourly EmployeesSuvan AgarwalNo ratings yet

- Clasificador Presupuestario 2014Document22 pagesClasificador Presupuestario 2014patricia202315174No ratings yet

- Adolfo RicoDocument1 pageAdolfo RicoLaura Valeria ColmenaresNo ratings yet

- Latest - Wage Orders Across The CountryDocument14 pagesLatest - Wage Orders Across The CountryJereca Ubando JubaNo ratings yet

- La RémunérationDocument28 pagesLa RémunérationDon RedooNo ratings yet

- Ensayo Prestaciones SocialesDocument14 pagesEnsayo Prestaciones SocialesTatiana Chitiva SaavedraNo ratings yet