Professional Documents

Culture Documents

Recurring Deposit Confirmation: Kanika Chawla Plot No 106 Meenakshi Garden Tilak Nagar So WEST DELHI-110018 India

Recurring Deposit Confirmation: Kanika Chawla Plot No 106 Meenakshi Garden Tilak Nagar So WEST DELHI-110018 India

Uploaded by

Kanika ChawlaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recurring Deposit Confirmation: Kanika Chawla Plot No 106 Meenakshi Garden Tilak Nagar So WEST DELHI-110018 India

Recurring Deposit Confirmation: Kanika Chawla Plot No 106 Meenakshi Garden Tilak Nagar So WEST DELHI-110018 India

Uploaded by

Kanika ChawlaCopyright:

Available Formats

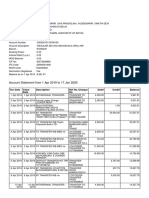

RECURRING DEPOSIT CONFIRMATION

Deposit Account Number: 50400302778392

KANIKA CHAWLA Cust ID of 1st Applicant: 216943077

PLOT NO 106 MEENAKSHI GARDEN Deposit Branch Name: VIKAS PURI G-BLOCK BRANCH

TILAK Deposit Type: RECURRING DEPOSIT

NAGAR SO

WEST DELHI-110018 PAN No: CVBPC4808G

INDIA

Deposit Installment Deposit Period Rate of Deposit Maturity +

Amount( In Rs.) Amount( In Rs.) Start Date of Deposit(in Months) Interest(%p.a.) Maturity Date Amount (in Rs.)

12043.72 4000.00 16 Jan 2023 15 Month(s) 7.00 16 Apr 2024 62864.00

Deposit Amount (in words) : TWELVE THOUSAND FORTY THREE AND SEVENTY TWO PAISE ONLY Thank you for banking with us.

Mode of operations : Single This is a system generated Advice, hence does not require any Signature.

Nomination : Registered

Interest Payment Frequency : ON MATURITY

Maturity Instruction : REDEEM TO 50100577039669

For more information log on to : www.hdfcbank.com

Terms & Conditions

Payment of interest • In the event of death of one of the joint account holders, the right to the deposit proceeds does

not automatically devolve on the surviving joint deposit account holder, unless there is a

• Interest on a Recurring Deposit will be calculated from the date the instalment is paid survivorship clause.

• The method of calculation of interest on RDs will be on Actual / Actual Quarterly • In case of joint deposits with a survivorship clause, the Bank shall be discharged by paying the

Compounding. Bank computes interest based on the actual number of days in a year. In case, Deposit proceeds prematurely to survivor/s, on request, in the event of oneor more Joint

deposit is spread over a leap or a non-leap year, interest is calculated based on the number of Depositor

days i.e. 366 days in a leap year & 365 days in a non- leap year.

• The interest for Recurring Deposits will be corresponding rate as applicable for a Fixed Deposit. • In case joint holder mandate submitted to the bank, any of the holders can sign where mode of

operation is either or survivor / former or survivor.

• Interest on the deposits is compounded at quarterly intervals, at the applicable rates.

• Partial withdrawal/ sweep in / OD not allowed on Recurring deposits

• Interest payment on Recurring deposit is only on maturity.

• All premature encashment will be governed by rules of Reserve Bank of India prevalent at the

Resident-Lock in period time of encashment.

• The Recurring Deposits account has a minimum lock in of one month. • As per Income Tax laws, if the aggregate amount of the deposit/(s) held by a person with the

branch either in his own name or jointly with any person on the date of repayment together with

• In case of premature closure within a month, no interest shall be paid out & only principal the interest at payable is equal to or exceeds 20,000/- then the amount will be paid by bank draft

amount shall be returned. drawn in the name of the deposit holder or by crediting the savings/ current account of the deposit

holder.

NRI-Lock in period

• Effective 01st Dec'06, the interest rate applicable for premature closure of deposits (all

• The minimum lock in period for NRE RD is one year and NRO RD is one month. amounts) will be lower of:

The original rate at which the deposit has been booked OR

• In case of premature closure within a year and NRO RD within a month, no interest will be paid The base rate applicable for the tenure for which the deposit has been in force with the Bank.

out to the depositor & only principal amount shall be returned.

• For deposits booked on or after 7th March’19 the base rate is the rate applicable to deposits of

Maturity less than Rs.2 Cr as on the date of booking the deposit. Prior to this the base rate is the rate

applicable to deposits of less than Rs.1 Cr as on the date of booking the deposit.

• The deposit shall be due for repayment & shall mature on completion of the contracted tenure

even if there are installments remaining to be paid. • In case of death of the primary holder of the Recurring deposits prior to the maturity date,

premature termination of the deposit would be allowed as per the terms of contract subject to

• The maturity amount mentioned on the Recurring Deposit confirmation advice is subject to necessary verifications and submission of proof of death of the depositor.

payment of all installments on time.

• Such premature withdrawals will not attract any penal charge.

• In case of any delay in payment of scheduled installments, the maturity amount shall change

due to delay in payments . Insurance Cover for Deposits

• Maturity amount mentioned on the confirmation advice shall also change in case of TDS • The deposits in the Bank are insured with DICGC for an amount of Rs 5 lakhs (principal +

recovery . interest) per depositor.

Tax Deduction at Source (TDS)

Payment of Installment

• Interest paid on resident recurring Deposit would be liable to TDS (Tax Deducted at Source)

• The Installment amount once fixed will not be allowed to be altered at a later date. @10%, under section 194A similar to that of interest paid on FD. TDS applicable on interest paid

on NRO RD would be @ 30% plus applicable surcharge (Not Applicable for NRE RD).

• In case of more than one installment is being overdue at the time of payment, the paid

installment if sufficient to cover only one. installment will be appropriate towards first/earliest • TDS rates will be as applicable from time to time as per the Income Tax Act, 1961 and Income

installment overdue. Tax rules. The current rates applicable for TDS would be displayed by the Bank on Its website.

Currently, TDS is deducted when interest payable or reinvested on FD AND RD per customer,

• Partial payment of installment will not be permitted. across all Branch, exceeds Rs 40,000/- (Rs. 50,000/- for senior citizen) in a Financial Year.

Further, TDS is deducted at the end of the financial year on Interest accruals if applicable.

• HDFC bank shall not be responsible for informing the depositor to maintain adequate balance in

his/her HDFC bank account in recurring deposit to pay his/her installments in the event of failure • If interest amount is not sufficient to recover the TDS amount the same may get recovered from

of the standing instruction due to shortfall of funds in the transacting amount. the principal amount of Fixed Deposit. If customer wishes to have TDS deduction from CASA,

same can be availed by filling separate declaration at branch.

Overdue Installments

• As Per Section 139A(5A) of the Income Tax Act, every person receiving any sum of income or

• If frequent defaults (non-payments) are observed in the monthly installments and six amount from which tax has been deducted under the provisions of the Income Tax Act shall

installments fall in arrears, the bank reserves the right to close the RD account. The interest rate provide his PAN number to the person responsible for deducting such tax. In case your PAN is

applicable on such closed accounts will be as per the premature withdrawal policy of the bank. not updated with the Bank or is incorrect; please visit your nearest HDFC Bank branch to submit

your PAN details.

Premature withdrawal

• In case the PAN number is not provided to the Bank as required, the bank shall not be liable for

• In the case of premature encashment, all signatories to the deposit must sign the encashment the non availment of the credit of Tax deducted at Source and non-issuance of TDS certificate.

instruction.

• No deductions of Tax shall be made from the taxable interest in the case of an individual resident in

India, if such individual furnishes to the Bank, a declaration in writing in the prescribed Format (Form • In case if the RD is not booked as per the applicable T & C of the bank, Bank reserves the right to

15G / Form 15H as applicable) to the effect that the tax on his estimated total income for the year in rebook the same with correct details.

which such interest income is to be included in computing his total income will be Nil. This is subject

to PAN availability on Bank records.

• Minimum installment is Rs. 1000. (in multiples of 100 thereafter) Maximum installment: 1.99 Cr.

• If aggregated value of all outstanding FDs/RDs booked in same customer id during the Financial

Year exceeds INR 5Lakhs limit (*) then PAN/Form 60 is mandatory. • Minimum tenure for resident and NRO RD is 6 months (and in multiples of 3 months thereafter)

upto a maximum of 10 years and minimum tenure for NRE RD is 1 year.

In absence of PAN/Form 60:

• Only Senior Citizens / Retired Personnel (60 years and above) who are Resident Indians are eligible

• (a) FD/RD will not be renewed on maturity and maturity proceeds will be credited to your linked for senior citizen rates. The senior citizen rates are applicable only for Resident deposits.

account or a Demand Draft will be sent to your mailing address as updated in Bank's records.

• The benefit of additional interest rate on deposits on account of being bank’s own staff or senior

• (b) Maturity instructions to convert RD proceeds to FD will not be acted upon and RD proceeds will citizens shall not be applicable to NRE / NRO Deposits.

be credited to your linked account on maturity.

• Form 15G/H is not applicable to NRIs

• The maximum interest not charged to tax during the financial year where form 15 G/H is

submitted is as below: • Please Ignore this advice if you have redeemed this deposit on or after the maturity date as

mentioned herein.

• Upto 2,50,000/- for residents of India below the age of 60 years or a person (not being a company or

firm). • Any changes made online in respect to change in maturity instruction / tenure, details can be viewed

online itself post the changes

• Upto 5,00,000/- for senior citizen residents of India who are between the age of 60-79 years at any

time during the FY • In case your recurring deposit is booked without nomination details, please visit the Branch to update

the same.

• Upto 5,00,000/- for senior citizen residents of India who is 80 years or more at any time during the

FY. • Please visit our website / nearest branch / contact Relationship Manager for further clarification.

• In case of Non-filer of income Tax return, TDS shall also be deducted at higher rate as provided by

• Form 15 G / H should be submitted by customer in Triplicate copy to the bank, for submitting one Section 206AB w.e.f 1-Jul-2021.

copy to Income Tax Department, one copy for use by Branch and the third copy to be returned to the • Income-tax provisions outlined in this document are updated as of the Finance Act, 2021.

customer with Branch seal as an acknowledgment copy.

• A fresh Form 15G / 15H needs to be submitted in each new Financial Year by the start of the

Financial Year. In case form 15G/H is submitted post interest payout/credit, waiver shall be effective

from the day next to the interest payout /credit immediately preceding the date of submission of form

15G/H.

• Form 15G / H needs to be submitted for every recurring Deposits booked with bank for Tax

exemption. .

• The bank shall not be liable for any consequences arising due to delay or non-submission of Form

15G/ Form 15H

• To enable us to serve you better kindly submit the Form No. 15G/15H latest by April 1st of the new

financial year.

Note: The above guidelines are subject to change as per Income Tax regulations / directives of

Finance Ministry Govt of India prevalent from time to time

Important Points:

• Please record change of maturity instructions with us well in advance to enable us serve you better.

Maturity Instructions: __________________________________________________________________________________

_______________________________________

Signature

For Office Use only:

Liquidation Instructions

Liquidation : On Maturity / Premature withdrawal

Credit Account No. : ____________________________

Issue Pay order favouring : ____________________________

Date of Liquidation : ____________________________

You might also like

- International Joint Ventures Handbook - Baker McKenzieDocument152 pagesInternational Joint Ventures Handbook - Baker McKenziefrancois_dupas7198No ratings yet

- Acct Statement XX4557 31122022Document21 pagesAcct Statement XX4557 31122022Santosh Kumar JhaNo ratings yet

- Booking DetailsDocument1 pageBooking DetailsBaren RoyNo ratings yet

- Statement of Account: State Bank of IndiaDocument7 pagesStatement of Account: State Bank of IndiaPriyabrata MishraNo ratings yet

- Akash Shinde: Loan Account Statement For 402Cdd92213452Document2 pagesAkash Shinde: Loan Account Statement For 402Cdd92213452Akash ShindeNo ratings yet

- The Institution of Civil Engineers (India)Document3 pagesThe Institution of Civil Engineers (India)U Are NiceNo ratings yet

- Vijay Patil - MFDocument1 pageVijay Patil - MFVijay S PatilNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMohan ChaudharyNo ratings yet

- Crip Theory Cultural Signs of Queerness and Disability 94 To 153Document60 pagesCrip Theory Cultural Signs of Queerness and Disability 94 To 153Sanggeetha Rajendran100% (1)

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementKirti Kant SrivastavaNo ratings yet

- 1579221808448drMLsyEUj3DzHZPx PDFDocument13 pages1579221808448drMLsyEUj3DzHZPx PDFVuddemarri SivaprasadNo ratings yet

- Account Statement (From 12-JAN-2023 To 12-JAN-2023)Document2 pagesAccount Statement (From 12-JAN-2023 To 12-JAN-2023)shekhy123No ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Adviceekta rajoriaNo ratings yet

- Acct Statement - XX1211 - 28012023Document4 pagesAcct Statement - XX1211 - 28012023Baria HarivandanNo ratings yet

- Vikky Kumar Asset Composition: Folio: 7842012793Document4 pagesVikky Kumar Asset Composition: Folio: 7842012793etezaziqbal287No ratings yet

- Sa April 2022Document1 pageSa April 2022Ranjith Kumar ANo ratings yet

- People v. Mendoza, G.R. No. 191267 Case Digest (Criminal Procedure)Document5 pagesPeople v. Mendoza, G.R. No. 191267 Case Digest (Criminal Procedure)AizaFerrerEbinaNo ratings yet

- C CCDebitEasyAccess SampleReport PDFDocument2 pagesC CCDebitEasyAccess SampleReport PDFsaeed50% (2)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRithvik MallikarjunaNo ratings yet

- Complete History of The Inquisition of Spain Vol 1 1908Document652 pagesComplete History of The Inquisition of Spain Vol 1 1908Mary T. Sullivan100% (6)

- FDAdvice 10157741355 153214457Document2 pagesFDAdvice 10157741355 153214457Nagaraj VukkadapuNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAnupam GuptaNo ratings yet

- DEEPAKDocument54 pagesDEEPAKBittu ChoudharyNo ratings yet

- OpTransactionHistoryUX502 02 2023Document18 pagesOpTransactionHistoryUX502 02 2023Aniket BhalekarNo ratings yet

- Fdreceipt2022 10 12 09 45 43Document3 pagesFdreceipt2022 10 12 09 45 43Murali YNo ratings yet

- India OCT 2021Document1 pageIndia OCT 2021Sunil YadavNo ratings yet

- Statement 2022Document14 pagesStatement 2022Amrish VenkatesanNo ratings yet

- NiyoX-Statement-Biswas Jigar-24Jan22 - To - 06oct22 - Stphei6qDocument25 pagesNiyoX-Statement-Biswas Jigar-24Jan22 - To - 06oct22 - Stphei6qJIGAR B (BASS BOOSTR)No ratings yet

- 912010060239834Document2 pages912010060239834DrAmit Kumar ChandananNo ratings yet

- Account Statement 01 Sep 2022-15 Dec 2022Document18 pagesAccount Statement 01 Sep 2022-15 Dec 2022vivaan shahNo ratings yet

- 1503XXXXXXXXX006409 12 2022Document9 pages1503XXXXXXXXX006409 12 2022Prem PanigrahiNo ratings yet

- Forex MarketDocument102 pagesForex Marketbiker_ritesh100% (1)

- E FDRDocument1 pageE FDRktsingh2024No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument24 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceiiMuddu creationii MudhuNo ratings yet

- Statement of Account: State Bank of IndiaDocument9 pagesStatement of Account: State Bank of IndiaBhati HusenshaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHarshal AjmeraNo ratings yet

- Suraj STMTDocument30 pagesSuraj STMTVishal BawaneNo ratings yet

- Aurangjeb BankingDocument8 pagesAurangjeb BankingJaved akhtarNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDeepak MehtaNo ratings yet

- Savings Account - 25480100018370 Dharm Singh So Shiv RamDocument8 pagesSavings Account - 25480100018370 Dharm Singh So Shiv RamParveen SainiNo ratings yet

- HDFC 2021 2022Document34 pagesHDFC 2021 2022prakashNo ratings yet

- PEFTOKDocument10 pagesPEFTOKlouie21No ratings yet

- Payslip LIM559 13082019Document1 pagePayslip LIM559 13082019SonuNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancedeepak sharnagatNo ratings yet

- DM Car Rental CalculatorDocument5 pagesDM Car Rental CalculatorNisarvurdRehhman AkrumButtNo ratings yet

- Emarksheet - AmityDocument2 pagesEmarksheet - AmityshobhitacutebabeNo ratings yet

- Preliminary ExaminationDocument6 pagesPreliminary ExaminationMags BadongenNo ratings yet

- 0 - Payslip 2018 2019 3 5112660 CMS PDFDocument1 page0 - Payslip 2018 2019 3 5112660 CMS PDFVijay RahiNo ratings yet

- Treason Cases Digested (Crim Law 2)Document5 pagesTreason Cases Digested (Crim Law 2)Jacob Castro100% (2)

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit ConfirmationMANISH KUMARNo ratings yet

- FDAdvice 10131659197 090233352Document2 pagesFDAdvice 10131659197 090233352Mettela SureshNo ratings yet

- Account Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Document6 pagesAccount Statement (From 01-JAN-1990 To 22-JAN-2024) : Folio No.: 12644481 / 56Avtar SinghNo ratings yet

- Acct Statement XX6194 28072023Document4 pagesAcct Statement XX6194 28072023Mohammad Sharafat KhanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRajendra Prasad YadlapallyNo ratings yet

- Jagmeet Singh StatementDocument6 pagesJagmeet Singh StatementBALKAR SINGHNo ratings yet

- Socialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034Document4 pagesSocialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034subba reddyNo ratings yet

- 1529302103778Document6 pages1529302103778Bibhuranjan MohantaNo ratings yet

- PF FormDocument1 pagePF FormLalit SharmaNo ratings yet

- Ref - No. 2203166-16309213-4: Prashant KaushikDocument4 pagesRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaNo ratings yet

- Andhra Bank StatementDocument2 pagesAndhra Bank StatementDarren Joseph VivekNo ratings yet

- OpTransactionHistoryUX513 09 2023Document10 pagesOpTransactionHistoryUX513 09 2023Rajendra YogiNo ratings yet

- 46th WR Connectivity and LTA MoM - R1-Merged (1985) PDFDocument18 pages46th WR Connectivity and LTA MoM - R1-Merged (1985) PDFBala JiNo ratings yet

- Unit Holder Previleges: Account Statement 3192455114 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3192455114 Folio NumberDheeraj SharmaNo ratings yet

- Op Transaction History 04!07!2023Document13 pagesOp Transaction History 04!07!2023Sachin PatelNo ratings yet

- Jan 2022Document5 pagesJan 2022BHASKAR pNo ratings yet

- BankDocument31 pagesBankMANISHNo ratings yet

- Ibsat - 2020Document4 pagesIbsat - 2020Gaurav gusaiNo ratings yet

- Ref - No. 10506691-23186469-6: Sourav Kanti MannaDocument6 pagesRef - No. 10506691-23186469-6: Sourav Kanti MannaSourav kanti 21No ratings yet

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit ConfirmationLokesh ShettyNo ratings yet

- political system of Switzerland - копіяDocument4 pagespolitical system of Switzerland - копіяСофія КізимаNo ratings yet

- 1-9 Sources of Obligations CasesDocument100 pages1-9 Sources of Obligations CasesVhinj CostillasNo ratings yet

- Integration UsecasesDocument9 pagesIntegration UsecasesLooryNo ratings yet

- VA - 90s Allstars (2010)Document3 pagesVA - 90s Allstars (2010)schafskaeseNo ratings yet

- Information Technology Act 2000Document6 pagesInformation Technology Act 2000ganapathy2010svNo ratings yet

- Clu3m NCR Essay 2014 Law EssayDocument1 pageClu3m NCR Essay 2014 Law Essayapi-241505258100% (1)

- Purchases Day BookDocument8 pagesPurchases Day Bookdrishti.singh0609No ratings yet

- Your Plan For Ramadhan - Sheikh Haitham Al HaddadDocument12 pagesYour Plan For Ramadhan - Sheikh Haitham Al HaddadstarofknowledgecomNo ratings yet

- Key To Pronunciation - Oxford English DictionaryDocument4 pagesKey To Pronunciation - Oxford English DictionarytheophobeNo ratings yet

- PunishmentDocument1 pagePunishmentNicholas GoriNo ratings yet

- Mendoza 04quiz1 PDFDocument1 pageMendoza 04quiz1 PDFchllwithmeNo ratings yet

- 1-7 Buck Ruxton & The Jigsaw Murders Case v1Document9 pages1-7 Buck Ruxton & The Jigsaw Murders Case v1Francisco GonzálezNo ratings yet

- INE721A08DE4 Shriram Transport Finance Company Limited 2024Document3 pagesINE721A08DE4 Shriram Transport Finance Company Limited 2024speedenquiryNo ratings yet

- Consolidated Spec. Pro. CasesDocument54 pagesConsolidated Spec. Pro. CasesLiz ZieNo ratings yet

- RoyDocument5 pagesRoymikekvolpeNo ratings yet

- TW Pornstars - LacyLennon. Pictures and Videos From Twitter. Page 3Document1 pageTW Pornstars - LacyLennon. Pictures and Videos From Twitter. Page 3Samantha DurandNo ratings yet

- 12 Days 11 Nights - South India Tour: Hotel PoppysDocument3 pages12 Days 11 Nights - South India Tour: Hotel PoppysTanam AnushaNo ratings yet

- VANET Security Research and Development EcosystemDocument11 pagesVANET Security Research and Development EcosystemDr.Irshad Ahmed SumraNo ratings yet

- Finished OhanaApplicationDocument2 pagesFinished OhanaApplicationJesus SalazarNo ratings yet

- Subject-Land Laws Topic - Throw A Light On The Provision Relating To The Acquisition of Land For Companies Supervised By: Rupa PradhanDocument18 pagesSubject-Land Laws Topic - Throw A Light On The Provision Relating To The Acquisition of Land For Companies Supervised By: Rupa PradhanSubhankar AdhikaryNo ratings yet

- Case16 Bun Siong Yao Vs Atty Aurelio AC No. 7023Document8 pagesCase16 Bun Siong Yao Vs Atty Aurelio AC No. 7023ColenNo ratings yet