Professional Documents

Culture Documents

Ic38 Life Insurance Agent Exam

Ic38 Life Insurance Agent Exam

Uploaded by

Joi Girish0 ratings0% found this document useful (0 votes)

7 views31 pagesOriginal Title

IC38 LIFE INSURANCE AGENT EXAM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views31 pagesIc38 Life Insurance Agent Exam

Ic38 Life Insurance Agent Exam

Uploaded by

Joi GirishCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 31

IC38 LIFE INSURANCE AGENT EXAM - Study Notes

Life Insurance - History and evolution - Modern

insurance in India began in early 1800 or thereabouts,

with agencies of foreign insurers starting marine

insurance business.

Oriental Life Insurance Co. Ltd - FIRST LIFE INSURANCE

COMPANY in INDIA is an English Company

Triton Insurance Co. Ltd. - FIRST NON LIFE INSURANCE

COMPANY

Bombay Mutual Assurance Society Ltd - First INDIAN

Insurance Company formed in 1870 in Mumbai

National Insurance Company Ltd. - The OLDEST

INSURANCE COMPANY in India. It was founded in 1906

and it is still in business.

Babylonian Traders - Bottomry loans - the loan taken

against the security of the ship or its goods had to be

repaid only if and when the ship arrived safely, after the

voyage, at its destination

Greeks - Benevolent societies - 7th century AD, to take

care of the funeral - and families - of members who died.

The Friendly Societies of England were similarly

constituted.

The inhabitants of Rhodes adopted a practice whereby, if

some goods were lost due to jettisoning during distress,

the owners of goods (even those who lost nothing) would

bear the losses in some proportion.

Chinese traders in ancient days would keep their goods

in different boats or ships sailing over the treacherous

rivers to distribute or reduce losses

Life Insurance Companies Act, 1912 was passed to

regulate insurance business

Insurance Act, 1938 was the first legislation enacted to

regulate conduct of insurance companies

Nationalisation of life insurance - Life insurance business

was nationalised on 1st September, 1956. The Life

Insurance Corporation of India (LIC) was formed.

Nationalisation of non-life insurance - enactment

of General Insurance Business Nationalisation Act

(GIBNA) in 1972. General Insurance Corporation of India

(GIC) and its four subsidiaries were set up

The passing of the Insurance Regulatory & Development

Act, 1999(IRDA) led to the formation of Insurance

Regulatory and Development Authority (IRDAI) in April

2000 as a statutory regulatory body both for life and non-

life insurance industry.

How insurance works - Process where losses of a few

are shared by many who are exposed to similar

uncertain events / situations.

People who are exposed to the same risks come

together and agree that, if any one of them suffers a loss,

the others will share the loss and compensate the

person who lost.

Anything of monetary value that is owned by a person is

called as an ASSET.

Physical assets - Car or Building, Non-Physical Assets -

Name and Goodwill, Personal Assets - Eyes, Limbs, Parts

of Body etc

Assets may get damaged due to Accidental

occurrences. PERIL is the cause of the loss.

Hazard is a condition that increases the chances of loss.

Lung Cancer is a PERIL. Smoking which increases the

chances of Lung Cancer is a HAZARD

Risk Burden - Burden of risk refers to the costs, losses

and disabilities one has to bear as a result of being

exposed to a given loss situation/event.

Primary burden of risk - Losses that are actually

suffered by households, business units as a result of

pure risk events. These losses are often direct and

measurable and can be easily compensated for by

insurance.

Primary Burden of Risk - If an individual undergoes a

Kidney transplant surgery, the medical cost of the same

is known and compensated.

Secondary Burden of risk - Physical and mental strain

caused by fear and anxiety

Secondary Burden of Risk - Setting aside reserves as a

provision for meeting potential losses in the future

Risk avoidance is not performing any activity that may

carry risk. Risk avoidance is a negative way to handle

risk

Risk retention - to bear the risk and its effects by

oneself. This is known as self-insurance.

Risk reduction and control - taking steps to lower the

chance of occurrence of a loss and/or to reduce severity

of its impact if such loss should occur.

The measures to reduce chance of occurrence are

known as Loss Prevention. The measures to reduce

degree of loss are called Loss Reduction

Risk reduction involves Education and training, Making

Environmental changes, spreading out various items of

property into varied locations etc

Risk financing refers to the provision of funds to meet

losses that may occur

Risk retention through self-financing involves self-

payment for any losses as they occur. this is known

as self-insurance

Risk transfer involves transferring the responsibility for

losses to another party say an INSURER.

Insurance Refers to protection against an event that

might happen where as Assurance Refers to protection

against an event that will happen

Insurance Provides cover against a risk whereas

Assurance Covers an event that is definite. Assurance

policies are associated with life cover

When deciding whether to insure or not, one needs to

weigh the cost of transferring the risk against the cost of

bearing the loss.

Human Life Value - HLV concept considers human life as

a kind of property or asset that earns an income. Prof.

Hubener devised the concept of Human Life Value (HLV).

HLV measures the value of human life based on

an individuals expected net future earnings

Net earnings means income a person expects to earn

each year in the future, less the amount he would spend

on self.

HLV indicates the economic loss a family would suffer if

the wage earner were to die prematurely.

Simple thumb rule or way to measure HLV. Divide the

annual income a family would like to have, with the rate

of interest that can be earned.

HLV helps to determine how much insurance one should

have for full protection. It also tells us the upper limit

beyond which life insurance would be speculative

Insurance should be around 10 to 15 times one's annual

income.

Mr. Shahul earns Rs. 5,00,000 a year and spends Rs.

30,000 on himself. The net earnings his family would lose

in case of his demise is Rs 4,70,000.

Suppose the rate of interest is 8% then the HLV would be

4,70,000 / 0.08 = 5875000. It means that if the Insurance

amount Rs 5875000 were to be invested in an 8% income

earning asset then the Family would get Rs 4,70,000

every year.

Typical concerns faced by ordinary people - Dying too

early, Living too Long, Living with disability

The level premium is a premium fixed such that it does

not increase with age but remains constant throughout

the contract period.

Premiums collected in early years would be more than

the amount needed to cover death claims of those dying

at these ages, while premiums collected in later years

would be less than what is needed to meet claims of

those dying at the higher ages. The level premium is an

average of both.

Level premium has two components - Term or protection

component and Cash value element

Term or Protection component consists of that portion of

premium actually needed to pay the cost of the risk

Cash value element is made up of accumulated excess

payments of the policyholder. It constitutes the savings

component

Mutuality & Diversification - Mutuality is one of the

important ways to reduce risk in financial markets, the

other being diversification

Under diversification the funds are spread out among

various assets (placing the eggs in different baskets).

Under mutuality or pooling, the funds of various

individuals are combined (placing all eggs in one basket).

Under diversification we have funds flowing from one

source to many destinations. Under mutuality we have

funds flow from many sources to one

Insurance involves a contractual agreement known as

Insurance Policy in which the insurer agrees to provide

financial protection against certain specified risks for a

price or consideration known as the premium

Elements of a valid contract - Offer and acceptance,

Consideration, Agreement between parties, Free

consent, Capacity of the parties, Legality

Offer and Acceptance - the offer is made by the

proposer, and acceptance made by the insurer. The

policy bond becomes the evidence of the contract

Consideration - Premium is the consideration from the

insured, and the promise to indemnify, is the

consideration from the insurers.

Agreement between the parties - Both the parties should

agree to the same thing in the same sense - consensus

ad-idem

Consent is said to be free when it is not caused by

Coercion, Undue Influence, Fraud, Misrepresentation,

Mistake

Coercion involves pressure applied through criminal

means

Undue influence - When a person who is able to dominate

the will of another, uses his / her position to obtain an

undue advantage over the other

Fraud - When a person induces another to act on a false

belief that is caused by a representation he or she does

not believe to be true. It can arise either from deliberate

concealment of facts or through misrepresenting them.

Mistake - Error in ones knowledge or belief or

interpretation of a thing or event. This can lead to an

error in understanding and agreement about the subject

matter of contract

Uberrima Fides or Utmost Good Faith - Insurer & Insured

must disclose all material facts relating to the subject

matter of insurance. A positive duty to voluntarily

disclose, accurately and fully, all facts material to the

risk being proposed, whether requested or not

If utmost good faith is not observed by either party, the

contract may be avoided by the other

Material facts - It has been defined as a fact that would

affect the judgment of an insurance underwriter in

deciding whether to accept the risk and if so, the rate of

premium and the terms and conditions

Past history of illness, Existence of past policies taken

from all insurers and their present status, All questions

in the proposal form or application for insurance are

considered to be material

Material information is that information which enables

the insurers to decide: Whether they will accept the risk?

If so, at what rate of premium and subject to what terms

and conditions?

Facts such as Measures implemented to reduce the risk,

Facts which the insured does not know or is unaware of,

Matters of law etc need not be disclosed

Once the policy is accepted, there is no further need to

disclose any material facts that may come up during the

term of the policy.

Utmost Good Faith - Click here for Video

Insurable interest refers to Financial interest of the

person in the asset to be insured. It makes an insurance

contract valid and enforceable under the law.

Insurable interest can be in Self (Own life), Spouses life,

Childrens life, Assets owned

In Life insurance, insurable interest should be present at

the time of taking the policy. In general insurance,

insurable interest should be present both at the time of

taking the policy and at the time of claim with some

exceptions

Insurable Interest - Click here for Video

Subject matter of insurance relates to property being

insured against, which has an intrinsic value of its own.

Subject matter of an insurance contract on the other

hand is the insured's financial interest in that property. It

is only when the insured has such an interest in the

property that he/she has the legal right to insure.

Proximate cause - It is defined as the active and

efficient cause that sets in motion a chain of events

which brings about a result, without the intervention of

any force started and working actively from a new and

independent source

Proximate Cause - Click here for Video

Principle of Indemnity implies that insurance will restore

the financial situation of the insured to where it was

before the event which caused the loss or damage.

Life Insurance Contracts are not contracts of

Indemnity. Indemnity principle mainly applies to general

insurance contracts

Principle of Indemnity - Click here for Video

Free-look period - a policyholder, after taking a policy,

has the option of cancelling the it, in case of

disagreement, within 15 days of receiving the policy

document. Premium less expenses and charges will be

refunded

Subrogation: It is the process an insurance company

uses to recover claim amounts paid to a policy holder

from a negligent third party.

Subrogation Principle - Click here for Video

Financial Planning - a process of identifying ones life

goals, translating these identified goals into financial

goals and managing ones finances in ways that will help

one to achieve those goals

Elements of financial planning include: Investing -

allocating assets based on ones risk taking appetite,

Risk management, Retirement planning, Tax and estate

planning, and Financing ones needs

The Economic Life Cycle - Life Stages and Priorities -

Learner, Earner, Partner (getting married), Parent,

Provider, Empty Nester, Twilight years (retirement years)

Provider (say age 35 to 55): this is the age when children

have grown into teenagers, and includes their crucial

high school years and college.

Empty Nester (age 55 to 65):This is the period when

children have married and sometimes have migrated to

other places for work, leaving the parents.

the economic life cycle has three phases - Student

Phase, Working Phase, Retirement Phase

Savings may be considered as a composite of two

decisions - Postponement of consumption, Parting with

liquidity

Postponement of consumption: an allocation of

resources between present and future consumption

Parting with liquidity in exchange for less liquid assets.

E.g. purchase of a life insurance policy implies

exchanging money for a contract which is less liquid.

Financial planning includes both kinds of decisions.

Financial products - Transactional products - Bank

deposits and other savings instruments that enable one

to have adequate liquidity

Financial products - Contingency products like

insurance - protection against large losses that may be

suffered in the event of sudden unforeseen events

Financial products - Wealth accumulation products -

Shares and high yielding bonds or real estate

The challenges facing our society and our customers -

Disintegration of the joint family, Multiple investment

choices, Changing lifestyles, Inflation, Other

contingencies and needs

Financial Planning Advisory Services - Cash Planning,

Investment Planning, Insurance Planning, Retirement

Planning, Tax Planning, Estate Planning

Cash planning - prepare a budget, analyse the expenses

and income flows over last six months, predict future

monthly income and expenses over the whole year

Investment planning - determining the most suitable

investment and asset allocation strategies based on an

individual’s risk taking appetite, financial goals and the

time horizon to meet those goals.

Parameters on which investment decisions are based -

Diversification, Taxation, Risk Tolerance, Time Horizon,

Liquidity, Marketability

Risk tolerance: How much risk someone is willing to take

in purchasing an investment.

Marketability: The ease with which an asset can be

bought or sold

Retirement planning - Accumulation Stage, Conservation

Stage, Distribution Stage

Estate planning - Planning for Transfer of one's assets

after demise. Nomination and assignment or preparation

of a will are examples.

Overview of life insurance products - What is a product? -

From a marketing standpoint, a product is a bundle of

attributes

The difference between a product (as used in a

marketing sense) and a commodity is that a product can

be differentiated. A commodity cannot.

Products may be Tangible or Intangible. Life Insurance

is an Intangible Product

Customer value would depend on how life insurance is

perceived as a solution to a set of customer needs.

A rider is a provision typically added through an

endorsement, which then becomes a part of the

contract.

A term insurance is a Traditional Insurance policy which

comes handy as an income replacement plan

In a term Insurance Sum Assured will be paid only if the

Insured dies during the term. There is no Maturity /

Survival Benefit

The unique selling proposition (USP) of term

assurance is its low price, enabling one to buy relatively

large amounts of life insurance on a limited budget

Decreasing term assurance - provide a death benefit

that decreases in amount with term of coverage.

Marketed as Mortgage Redemption and Credit Life

Insurance

Mortgage Redemption Insurance (MRI) - Financial

protection for home loan borrowers. A decreasing term

life insurance policy taken by a mortgagor to repay the

balance on a mortgage loan if he / she dies before its full

repayment

Increasing term assurance - the plan provides a death

benefit, which increases along with the term of the

policy.

Term insurance with return of premiums - Premiums paid

will be repaid if the policy holder survives the term

Term Assurance - Click here for Video

Whole Life Insurance - There is no fixed term of cover

but the insurer offers to pay the agreed upon death

benefit when the insured dies, no matter whenever the

death might occur

A whole life policy is a good plan for one who is the main

income earner of the family and wishes to protect the

loved ones from any financial insecurity in case of

premature death

After the insurance company takes the amount of money

it needs from the premium, to meet the cost of term

insurance, the balance money is invested on behalf of

the policyholder. This is called cash-value in Whole Life

Insurance.

Endowment Assurance: Combination of 2 plans: (1) A

term assurance which pays the Sum Assured in case of

death during the term (2) A pure endowment plan which

pays this amount if the insured survives the term.

Money back plan - Endowment plan which returns of a

part of the sum assured in periodic installments during

the term and balance of sum assured at the end of the

term

Participating (Par) or with profit plans - 'Par' implies

policies which are participating in the profits of the life

insurer. 'Non ' Par' policies represent policies which do

not participate in the profits

Profits are payable as bonuses or dividends. Bonuses are

normally paid as reversionary bonuses. They are

declared as a proportion of the sum assured

Simple Reversionary Bonus - declared as amount per

thousand sum assured.

Compound Bonus - bonus as a percentage of basic

benefit and already attached bonuses. It is thus a bonus

on a bonus.

Super Compound bonus - the bonus is arrived at as a

percentage of basic benefit and applying another

percentage for attached bonus.

Terminal Bonus - this bonus attaches to the contract

only on its contractual termination (by death or

maturity). It increases as the term increases. terminal

bonus for a contract that has run for 25 years would be

higher than one which has run for 15 years.

Unit Linked Insurance Plan - ULIP Premium - PAC,

Mortality, Investment. PAC - Policy or Premium

Allocation Charge - which is comprised of agents

commission, policy setup costs, administrative costs

Investment fund options offered by ULIPs - Equity Fund,

Debt Fund, Balanced Fund, Money Market Fund

Equity fund invests major portion of the money in equity

and equity related instruments. High Risk Category

Debt fund invests major portion of the money in

Government Bonds, Corporate Bonds, Fixed Deposits etc.

Balanced fund invests in a mix of equity and debt

instruments.

Money Market fund invests money mainly in instruments

such as Treasury Bills, Certificates of Deposit,

Commercial Paper etc.

In ULIP the value of the units is given by the net asset

value (NAV), which reflects the market value of assets in

which the fund is invested.

Insurance cover in ULIP is a multiple of the premiums

paid.

Universal Life Insurance - Universal life insurance is a

form of permanent life insurance characterised by its

flexible premiums, flexible face amount and death

benefit amounts, and the unbundling of its pricing factors

Key man Insurance - It can be described as an insurance

policy taken out by a business to compensate that

business for financial losses that would arise from the

death or extended incapacity of an important member of

the business

Married Women's Property Act 1874 (MWP Act) - Section

6 provides for security of benefits under a life insurance

policy to the wife and children.

Section 6 of the Married Women’s Property Act, 1874

also provides for creation of a Trust

Beneficiaries under Section 6 of MWP Act - Wife alone,

Wife and one or more children jointly, One or more

children

The policy under MWP Act shall be beyond the control of

court attachments, creditors and even the life assured.

The claim money shall be paid to the trustees under

MWP Act 1874

Each policy under MWP Act will remain a separate Trust.

Either the wife or child (over 18 years of age) can be a

trustee.

The policy enacted under MWP Act cannot be

surrendered and neither nomination nor assignment is

allowed.

If the policyholder does not appoint a special trustee to

receive and administer the benefits under the policy, the

sum secured under the policy becomes payable to the

official trustee of the State

The term children in MWP Act refers to the sons and

daughters - both natural and adopted

The Term Married Man under MWP Act includes a

Widower or a Divorced Man

The rates that are printed in premium tables are known

as 'Office Premiums'

Rebate for sum assured - offered to those who buy

policies with higher amounts of sum assured

Rebate for mode of premium - premiums to be paid on

annual, half yearly, quarterly or monthly basis. More

frequent the mode, more the cost of service. Hence

Monthly mode of Premium is slightly costlier than Yearly

mode

Tabular Premium is only for Standard Lives (Lives with

no extra risk factors). Such rates are called Ordinary

Rates.

Extra Charges - If the proposer suffers from certain

health problems like heart ailments or diabetes, it can

pose a hazard to his life. Such a life is considered to be

sub-standard. The insurer may decide to impose an extra

premium by way of a health extra

Components of Premium - Mortality, Interest, Expenses

of management, Reserves, Bonus loading

The estimates of mortality and interest give the 'Net

Premium' which is the estimate of present value of future

claim costs.

Gross premium = Net premium + Loading for expenses +

Loading for contingencies + Bonus loading

Higher the mortality rate in the mortality table, higher

the premiums would be

A lapse means that the policyholder discontinues

payment of premiums

Surplus is the excess of value of assets over value of

liabilities. If it is negative, it is known as a

strain. Surplus = Assets - Liabilities

Assets are valued in one of the following three ways -

Book Value, Market Value, Discounted Present Value

At Book Value - This is the value at which the life insurer

has purchased or acquired its assets

At Market Value - The worth of the life insurers assets in

the market place

Discounted Present Value - Estimating future income

stream from various assets & discounting them to

present

Prospectus - It is a formal legal document used by

insurance companies that provides details about the

product

Agent's report - The agent is the primary underwriter

Moral hazard is the likelihood that a client's behaviour

might change as a result of purchasing a life insurance

policy and such a change would increase the chance of a

loss.

Standard age proofs - School or college certificate, Birth

certificate extracted from municipal records, Passport,

PAN card, Service register, Certificate of baptism,

Certified extract from a family bible if it contains the

date of birth, Identity card in case of defense personnel,

Marriage certificate issued by a Roman Catholic church

Non-standard age proofs - Horoscope, Ration card, An

affidavit by way of self-declaration, Certificate from

village panchayat

Money laundering is the process of bringing illegal

money into an economy by hiding its illegal origin so that

it appears to be legally acquired.

The Government of India launched the Prevention of

Money Laundering Act (PMLA) ,2002 to rein in money-

laundering activities.

Money laundering as an offense which is punishable by

rigorous imprisonment from 3 to 7 years and fine up to

Rs. 5 lakhs.

Anti Money Laundering Policies - Appointment of a

principal compliance officer, Training of agents on AML

measures, Internal audit/control etc

Know Your Customer (KYC) - objective is to prevent

financial institutions from being used by criminal

elements for money laundering activities. KYC

documents like address proof, PAN card and photographs

etc. need to be collected as a part of the KYC procedure.

First Premium Receipt (FPR) - An insurance contract

commences when the life insurance company issues a

FPR. The FPR is the evidence that the policy contract

has begun

First premium receipt contains - Name and address of

the life assured, Policy number, Premium amount paid,

Method and frequency of premium payment, Next due

date of premium payment, Date of commencement of the

risk, Date of final maturity of the policy, Date of payment

of the last premium, Sum assured

Grace period - clause grants the policyholder an

additional period of time to pay the premium after it has

become due. Grace period is ONE Month or 31 days

Reinstatement - It is the process by which a life

insurance company puts back into force a policy that has

either been terminated because of non-payment of

premiums or has been continued under one of the non-

forfeiture provisions

Ordinary revival - payment of arrears of premium with

interest. A declaration of good health or some other

evidence of insurability like a medical examination is

necessary

Special revival - the policy has run for less than three

years and has not acquired minimum surrender value

Loan cum revival - the facility of loan cum revival would

be allowed only for policies that have acquired surrender

value as on date of revival.

Section 39 - Nomination is where the life assured

proposes the name of the person(s) to whom the sum

assured should be paid by the insurance company after

their death

A nominee does not have any right to the whole (or part)

of the claim. Nomination can be made when the policy is

bought or thereafter

The life assured can nominate one or more than one

person as nominees. Policy money's payment is made to

surviving nominee/s

Addition, change or cancellation of nomination is

allowed. Nomination shall be by endorsement

Where the nominee is a minor, the policy holder needs to

appoint an appointee. The appointee needs to sign the

policy document to show his or her consent to acting as

an appointee.

Section 38 - Assignment - ordinarily refers to transfer of

property by writing as distinguished from transfer by

delivery

Conditional assignment provides that the policy shall

revert back to the life assured on his or her surviving the

date of maturity or on death of the assignee

Absolute assignment provides that rights, title and

interest of the assignor in the policy are transferred to

the assignee without reversion to the former or his / her

estate in any event

Absolute Assignment - The policy vests absolutely with

the assignee. The latter can deal with the policy in

whatever manner he or she likes without the consent of

the assignor

Assignment has to be by endorsement. Assignment

notice should be in writing

Insurer should record and register assignment.

Assignment should be supported by valuable

consideration

Assignee can do another assignment. Assignment

cancels nomination

Assignment - Wholly or partially. In case of a partial

assignment, liability of an insurer shall be limited to the

amount secured by partial assignment.

Main types of alterations - Reduction in the sum assured,

mode of payment of premium, without profits to with

profits plan, Correction in name, Splitting up of the policy

into two or more policies, change in term, Removal of an

extra premium or restrictive clause, Settlement option

for payment of claim and grant of double accident benefit

Non medical Underwriting - A large number of life

insurance proposals may typically get selected for

insurance without conducting a medical examination to

check the insurability of a life to be insured. Such cases

are termed as non-medical proposals

Factors like income, occupation, lifestyle and habits,

which contribute to moral hazard, are assessed as part

of financial underwriting, while medical aspects of health

are appraised as part of medical underwriting

Underwriting purpose - To prevent anti-selection or

selection against the insurer, To classify risks and

ensure equity among risks

A claim is a demand that the insurer should make good

the promise specified in the contract

While a death claim arises only upon the death of the life

assured, survival claims can be caused by one or more

events

A maturity or death claim or a surrender leads to

termination of the insurance cover under the contract

and no further insurance cover is available

Survival claims are Maturity of the policy, An instalment

payable upon reaching the milestone under a money-

back policy, Critical illnesses covered under the policy

as a rider benefit, Surrender of the policy either by the

policyholder or assignee

Early Death Claim - If death happens before 3 years from

the commencement of the policy.

Forms to be submitted for Death Claim - Claim form by

nominee, Certificate of burial or cremation, Treating

physicians certificate, Hospitals certificate, Employers

certificate, Certified court copies of police reports in

case of death by accident

Section 45 states: No policy of life insurance shall be

called in question on any ground whatsoever after the

expiry of three years from the date of the policy, i.e from

the date of issuance of the policy or the date of

commencement of risk or the date of revival of the policy

or the date of the rider to the policy, whichever is later.

Indian Evidence Act provides for presumption of death in

person missing cases, if he/she has not been heard of

for seven years.

Customer lifetime value may be defined as the sum of

economic benefits that can be derived from building a

sound relationship with a customer over a long period of

time.

IRDAI has launched an Integrated Grievance

Management System (IGMS) which acts as a central

repository of insurance grievance data and as a tool for

monitoring grievance redress in the industry.

Consumer Protection Act - District Forum - entertain

complaints up to Rs. 20 lakhs, State Forum - exceeds 20

Lakhs upto 100 Lakhs, National Commission - exceeds

100 Lakhs

National Commission has supervisory jurisdiction over

State Commission. All the three agencies have powers of

a Civil Court.

Complaint under Consumer Protection Act can be filed by

the complainant himself or by his authorised agent. It

can be filed personally or can even be sent by post. It

may be noted that no advocate is necessary for the

purpose of filing a complaint. No fee for filing a complaint

or filing an appeal

Insurance Ombudsman, by mutual agreement of the

insured and the insurer can act as a mediator and

counsellor within the terms of reference

Any complaint made to the Ombudsman should be in

writing, signed by the insured or his legal heirs,

addressed to an Ombudsman within whose jurisdiction,

the insurer has a branch/ office

Complaints can be made to the Ombudsman if: The

complainant is not satisfied with the reply given by the

insurer The complainant had made a previous written

representation to the insurance company and the

insurance company had: Rejected the complaint or The

complainant had not received any reply within one month

after receipt of the complaint by the insurer

The complaint is made within one year from the date of

rejection by the insurance company

The complaint is not pending in any court or consumer

forum or in arbitration. The decision of the Ombudsman,

whether to accept or reject the complaint, is final

Award by Insurance Ombudsman should not be more

than Rs. 20 lakh and should be made within a period of

3 months from the date of receipt of a complaint

insured should acknowledge the receipt of the award

within 30 days

The insurer shall comply with the ombudsman award and

send a written intimation to the Ombudsman within 15

days

insured does not intimate in writing the acceptance of

such award, the insurer may not implement the award

Soft skills relate to one’s ability to interact effectively

with other workers and customers, both at work and

outside. Communication skills are one of the most

important of these soft skills.

SERVQUAL - 5 major indicators of service quality -

Reliability, Responsiveness, Assurance, Empathy,

Tangibles

Active Listening - is where we consciously try to hear

not only the words but also, more importantly, try to

understand the complete message being sent by another

Elements of active listening - Paying Attention,

Demonstrating that you are listening, Provide feedback,

Not being Judgmental, Responding appropriately,

Empathetic listening

Communication may take place several forms - Oral,

Written, Non-verbal, Using body language

Non-verbal communication - Making a great first

impression - Be on time always, Present yourself

appropriately, A warm, confident and winning smile,

Being open, confident and positive, Interest in the other

person

Empathetic listening: Being empathetic literally

means putting yourself in the other persons shoes and

feeling his or her experience as he or she would feel it.

Ethical behaviour - placing the customer's interest

before self, Full and adequate disclosure of all facts to

the clients and Maintaining confidentiality of client's

business and personal information

If the dispute is not settled by intermediation, the

Ombudsman will pass award to the insured which he

thinks is fair, and is not more than what is necessary to

cover the loss of the insured.

As far as insurance business is concerned, the majority

of consumer disputes fall in categories such as delay in

settlement of claims, non-settlement of claims,

repudiation of claims, quantum of loss and policy terms,

conditions

Composite Insurance Agent means an individual who is

appointed as an insurance agent by two or more insurers

subject to the condition that he/she shall not act as

insurance agent for more than one life insurer, one

general insurer, one health insurer and one of each of the

mono-line insurers

Mono-Line Insurer - carrying on one particular

specialized line of business such as agriculture

insurance, export credit guarantee business

No person shall act as an insurance agent for more than

one life insurer, one general insurer, one health insurer

and one of each of other mono-line insurers

A contract is an agreement between parties, enforceable

at law. The provisions of the Indian Contract Act, 1872

govern all contracts in India, including insurance

contracts.

IRDAI guidelines for traditional products - more than 10

years term - a minimum sum assured of 10 times the

annual premium for individuals below 45 years of age and

7 times the annual premium if age is above 45 years.

Single premium policies it will be 125% of the single

premium for those below 45 years and 110% of single

premium for those above 45 years.

Non-disclosure of facts material to the assessment of the

risk, providing misleading information, fraud or non-co-

operation by the insured will nullify the cover under the

policy issued

As per IRDAI guidelines, the insurer has to process the

proposal within 15 days time.

the premium related to all the riders put together should

not exceed 30% of the premium of the main product.

There is no legal obligation on the part of insurers to

advise the insured that his policy is due to expire on a

particular date.

The first stage of documentation is the proposal form

through which the insured informs about herself and

what insurance she needs

The duty of disclosure of material information arises

prior to the inception of the policy, and continues

throughout the policy period in case of Health Insurance

The process of scrutinising the proposal and deciding

about acceptance is known as underwriting.

Primary health care - services offered by the doctors,

nurses and other small clinics which are contacted first

by the patient for any sickness

Secondary health care refers to the healthcare services

provided by medical specialists and other health

professionals who generally do not have first contact

with patient.

Tertiary Health care is specialized consultative

healthcare, usually for inpatients and on referral from

primary/secondary care providers. The tertiary care

providers are present mostly in the state capitals and a

few at the district headquarters

Tertiary Health Care - Advanced Medical Facilities like

Oncology (cancer treatment), Organ Transplant facilities,

High risk pregnancy specialists etc.

Payment of Premium in Advance (Section 64 VB of

Insurance Act, 1938) - As per Insurance Act, premium is

to be paid in advance, before the start of the insurance

cover. the risk may be assumed only from the date on

which the premium has been paid in cash or by cheque.

Where the premium is tendered by postal or money order

or cheque sent by post, the risk may be assumed on the

date on which the money order is booked or the cheque

is posted as the case may be.

Where an insurance agent collects a premium on a policy

of insurance on behalf of an insurer, he shall deposit with

or dispatch by post to the insurer the premium so

collected in full without deduction of his commission

within twenty-four hours of the collection excluding bank

and postal holidays.

Warranties are used in an insurance contract to limit the

liability of the insurer under certain circumstances.

A warranty is a condition expressly stated in the policy

which has to be literally complied with for validity of the

contract. Warranty is not a separate document. It is part

of the policy document.

If certain terms and conditions of the policy need to be

changed at the time of issuance, it is done by setting out

the amendments / changes through a document

called endorsement.

Health insurance products - Indemnity covers, Fixed

benefit covers, Critical illness covers

A co-payment is a cost-sharing requirement under a

health insurance policy that provides that the

policyholder/insured will bear a specified percentage of

the admissible claim amount. A co-payment does not

reduce the Sum Insured.

Deductible is a cost-sharing requirement under a health

insurance policy that provides that the insurer will not be

liable for a specified rupee amount in case of indemnity

policies and for a specified number of days/hours in case

of hospital cash policies which will apply before any

benefits are payable by the insurer. A deductible does

not reduce the Sum Insured.

Pradhan Mantri Suraksha Bima Yojana - PMSBY -

Premium: Rs.12/- per annum per member will be

deducted from the account holder's savings bank

account

PMSBY - Benefits - Death Rs. 2 Lakh, Total and

irrecoverable loss of both eyes or loss of use of both

hands or feet or loss of sight of one eye and loss of use

of hand or foot Rs. 2 Lakh,

PMSBY Benefits - Total and irrecoverable loss of sight of

one eye or loss of use of one hand or foot Rs. 1 Lakh

PMSBY - All savings bank account holders in the age 18

to 70 years

Pradhan Mantri Jan Dhan Yojana - PMJDY - ZERO

minimum Balance Bank accounts, Overdraft facility upto

Rs.10000/- is available in only one account per

household, preferably lady of the household.

PMJDY - Accidental insurance cover of Rs.1.00 lac, Life

insurance cover of Rs.30,000/-

PMJDY - RuPay Debit Card which must be used at least

once in 45 days.

Click here for Video

Personal Accident and disability cover - provides

compensation due to death and disability in the event of

unforeseen accident

Permanent total disability (PTD): means becoming

totally disabled for lifetime viz. paralysis of all four limbs

Permanent partial disability (PPD): means becoming

partially disabled for lifetime viz. loss of fingers, toes,

phalanges etc

Temporary total disability (TTD): means becoming

totally disabled for a temporary period of time.

If a person has more than one policy with different

insurers, in the event of accidental death, PTD or PPD,

claims would be paid under all the policies.

Independent organizations for managing health

insurance claims are known as the TPAs or Third party

administrator appointed by Insurers

Health Insurance is a contract between the insurer and

the insured wherein the insurer agrees to pay

hospitalisation expenses to the extent of an agreed sum

insured in the event of any medical treatment arising out

of an illness or an injury

Family Floater - The sum insured floats among the family

members. Family floaters usually cover husband, wife

and children. Premium will normally be charged based on

the age of the oldest member of the family proposed for

insurance.

Cashless Facility - a facility extended by the insurer to

the insured where the payments of the costs of

treatment undergone by the insured are directly made to

the network provider by the insurer.

Group health insurance policy - available to groups/

associations/ institutions/ corporate bodies, provided

they have a central administration point and are subject

to a minimum number of persons to be covered. The

group must belong to a category that is approved

Expenses covered under health insurance - Cost of

room / bed, Boarding expenses, Nursing expenses,

Doctors fees, Diagnostic tests, Operation theatre

charges, Expenses related to surgical appliances and the

like

Portability - It is the right accorded to an individual

health insurance policyholder (including family cover), to

transfer the credit gained for pre-existing conditions and

time bound exclusions, from one insurer to another

insurer or from one plan to another plan of the same

insurer, provided the previous policy has been

maintained without any break

DOMICILIARY HOSPITALIZATION - a provision to take

care of expenses incurred for medical treatment taken at

home without being admitted to a hospital. the condition

of the patient is such that he cannot be moved to a

hospital or there is lack of accommodation in hospitals.

Pre-existing diseases - Any condition, ailment or injury or

related condition(s) for which you had signs or

symptoms, and/or were diagnosed, and/or received

medical advice/treatment within 48 months prior to the

first policy issued by the insurer

Waiting periods: This is applicable for diseases for which

typically treatment can be delayed and planned

Cost of pre policy check up - mandated by IRDAI that

insurer would bear at least 50% of health checkup

expenses.

Critical illness policy is a benefit policy with a provision

to pay a lump sum amount on diagnosis of certain named

critical illness. As a standalone policy or As an add-on

cover to a few health policies or As an add-on cover in

some life insurance policies

standard condition seen in all critical illness policies is

the waiting period of 90 days from inception of policy for

any benefit to become payable under the policy and the

survival clause of 30 days after diagnosis of the illness.

Pre hospitalization expenses would be relevant medical

expenses incurred during period up to the defined

number of days (generally 30 days) prior to

hospitalization and will be considered as part of claim.

Post hospitalization expenses would be relevant medical

expenses incurred during period up to the defined

number of days (generally 60 days) after hospitalization

and will be considered as part of claim.

A hospital daily cash policy provides a fixed sum to the

insured person for each day of hospitalization.

High Deductible or Top-up Covers offer cover for higher

sum insured over and above a specified chosen amount

(called threshold or deductible).

Out-patient covers provide for medical expenses like

dental treatments, vision care expenses, routine medical

examinations and tests etc. that do not require

hospitalization

A group policy is taken by a group owner who could be

an employer, an association, a banks credit card

division, where a single policy covers the entire group of

individuals.

Overseas Mediclaim / Travel Policies provide cover to an

individual against exposure to the risk of accident, injury

and sickness during his stay overseas.

TPA enter into an MOU with hospitals or health service

providers which has at least 10 inpatient beds in those

towns having a population of less than 10,00,000 and 15

inpatient beds in all other places

Cumulative bonus on the sum insured for every claim

free year. This means that the sum insured gets

increased on renewal by a fixed percentage say 5%

annually and is allowed up to a maximum of 50% for ten

claim-free renewals. The insured pays the premium for

the original sum insured and enjoys a higher cover.

cumulative bonus can be provided only on indemnity

based health insurance policies and not benefit policies

(except PA policies).

Malus - if the claims under a policy are very high, a malus

or loading of premium is collected at renewal.

As per IRDAI guidelines, a 30 days grace period is

allowed for renewal of individual health policies.

Standard risks - These consist of those people whose

anticipated morbidity (chance of falling ill) is average.

Preferred risks - These are the ones whose anticipated

morbidity is significantly lower than average and hence

could be charged a lower premium.

Substandard risks - These are the ones whose

anticipated morbidity is higher than the average, but are

still considered to be insurable. Higher Premiums

Declined risks - These are the ones whose impairments

and anticipated extra morbidity are so great that they

could not be provided insurance coverage at an

affordable cost.

Field level underwriting may also be known as primary

underwriting. It includes information gathering by an

agent or company representative to decide whether an

applicant is suitable for granting insurance coverage

The second level of underwriting is at the department or

office level. It involves specialists and persons who are

proficient in such work and who consider all the relevant

data on the case to decide whether to accept a proposal

for insurance and on what terms.

Some of the factors which affect a person's morbidity are

age, gender, habits, occupation, build, family history,

past illness or surgery, current health status and place of

residence.

Initial Waiting Period -A typical health insurance policy

covers illnesses only after an initial 30 days (except

accident related hospitalization).

Scrutiny/process sheet - It is usually a single sheet

where the entire processing notes are captured.

Discharge summary - It details the complete information

about the condition of the patient and the line of

treatment.

Investigation reports assist in comparing the diagnosis

and the treatment like Blood test reports; X-ray reports;

Scan reports and Biopsy reports

Reserving - This refers to the amount of provision made

for all claims in the books of the insurer based on the

status of the claim

Bail bond cases and financial emergency cases are paid

upfront by Assistance Company and later claimed from

insurance company

Current Procedure Terminology (CPT) codes capture the

procedures performed to treat the illness.

You might also like

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- The Complete Dictionary of Insurance Terms Explained SimplyFrom EverandThe Complete Dictionary of Insurance Terms Explained SimplyNo ratings yet

- Insurance Made Easy: A Comprehensive Roadmap to the Coverage You NeedFrom EverandInsurance Made Easy: A Comprehensive Roadmap to the Coverage You NeedRating: 5 out of 5 stars5/5 (1)

- A Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealFrom EverandA Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealNo ratings yet

- IC-67 Marine InsuranceDocument294 pagesIC-67 Marine InsuranceAshish Keshan83% (18)

- Terminos y Condiciones Banamex Libra Plus PDFDocument30 pagesTerminos y Condiciones Banamex Libra Plus PDFFrancisco Rivera100% (1)

- Systeme National de Santé MarocDocument35 pagesSysteme National de Santé MarocOtmane Abouri88% (8)

- Insurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5From EverandInsurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5No ratings yet

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Personal Emergency Fund: The Importance of a Personal Emergency FundFrom EverandPersonal Emergency Fund: The Importance of a Personal Emergency FundNo ratings yet

- Startup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingFrom EverandStartup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingNo ratings yet

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Mastering Your Emergency Fund: A Comprehensive Guide to Building, Managing, and Utilizing Your Financial Safety NetFrom EverandMastering Your Emergency Fund: A Comprehensive Guide to Building, Managing, and Utilizing Your Financial Safety NetNo ratings yet

- Safe Money First: Your Guidebook to Annuities and Safe Retirement Financial Planning StrategiesFrom EverandSafe Money First: Your Guidebook to Annuities and Safe Retirement Financial Planning StrategiesNo ratings yet

- Trust Funds: Hometown Investments and Mutual Funds for BeginnersFrom EverandTrust Funds: Hometown Investments and Mutual Funds for BeginnersNo ratings yet

- Money Made Easy: A Simple Guide for Accumulating, Spending, and Protecting Your MoneyFrom EverandMoney Made Easy: A Simple Guide for Accumulating, Spending, and Protecting Your MoneyNo ratings yet

- Risk Management: How to Use Different Insurance to Your BenefitFrom EverandRisk Management: How to Use Different Insurance to Your BenefitNo ratings yet

- Personal Lines Endorsements Coverage Guide, 2nd EditionFrom EverandPersonal Lines Endorsements Coverage Guide, 2nd EditionNo ratings yet

- Securing Your Superannuation Future: How to Start and Run a Self Managed Super FundFrom EverandSecuring Your Superannuation Future: How to Start and Run a Self Managed Super FundNo ratings yet

- A Fighting Chance: The High School Finance Education Everyone DeservesFrom EverandA Fighting Chance: The High School Finance Education Everyone DeservesNo ratings yet

- Asset Protection for the Rest of Us: A Layman's Guide to Asset Protection PlanningFrom EverandAsset Protection for the Rest of Us: A Layman's Guide to Asset Protection PlanningRating: 4.5 out of 5 stars4.5/5 (2)

- Investing for the Future: A Beginner's Guide: Investment, #1From EverandInvesting for the Future: A Beginner's Guide: Investment, #1No ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- The Beginner's Handbook to Retirement Funds: Investing for a Secure FutureFrom EverandThe Beginner's Handbook to Retirement Funds: Investing for a Secure FutureNo ratings yet

- Value Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementFrom EverandValue Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementNo ratings yet

- Risk Management and Insurance - Learn how to Manage Risks and Secure Your FutureFrom EverandRisk Management and Insurance - Learn how to Manage Risks and Secure Your FutureNo ratings yet

- Emergency Fund 101: A Beginner's Guide to Building, Managing, and Protecting Your Financial Safety NetFrom EverandEmergency Fund 101: A Beginner's Guide to Building, Managing, and Protecting Your Financial Safety NetNo ratings yet

- Investing In Real Estate: How To Invest In Real Estate And Make Money With Proven StrategiesFrom EverandInvesting In Real Estate: How To Invest In Real Estate And Make Money With Proven StrategiesRating: 4.5 out of 5 stars4.5/5 (8)

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- 15 Laws of Money: The Strangest Secrets The Super-Rich Don't Want You to KnowFrom Everand15 Laws of Money: The Strangest Secrets The Super-Rich Don't Want You to KnowNo ratings yet

- Wealth, Prosperity & Life Insurance: Strategies for the Affluent: Leveraging Life Insurance as a Tax-Free Savings BoosterFrom EverandWealth, Prosperity & Life Insurance: Strategies for the Affluent: Leveraging Life Insurance as a Tax-Free Savings BoosterNo ratings yet

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketFrom EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketNo ratings yet

- Short NotesDocument5 pagesShort NotesJoi GirishNo ratings yet

- Ic38 MaterialDocument28 pagesIc38 MaterialJoi GirishNo ratings yet

- Maths GraphDocument20 pagesMaths GraphJoi GirishNo ratings yet

- Thesis FormatDocument11 pagesThesis FormatJoi GirishNo ratings yet

- Model Project ReportDocument77 pagesModel Project ReportJoi GirishNo ratings yet

- P6 Brief and Earned ValueDocument37 pagesP6 Brief and Earned Valueay2010No ratings yet

- 1o Bim Tabelas Global 500Document34 pages1o Bim Tabelas Global 500Error UniversoNo ratings yet

- De Los Asesores PrevisionalesDocument2 pagesDe Los Asesores PrevisionalesGuillermo Daza100% (1)

- MHL 2018Document16 pagesMHL 2018miha3la33No ratings yet

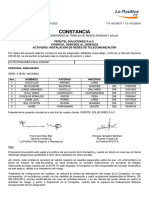

- PDFConstancia 20220823 060158 30303947Document2 pagesPDFConstancia 20220823 060158 30303947Jaime Yarihuaman QuispeNo ratings yet

- Contrato de Seguro ColombiaDocument14 pagesContrato de Seguro ColombiaFELIPE CASTILLO ROMANNo ratings yet

- 5218 Admiralty HOA DocsDocument262 pages5218 Admiralty HOA DocsnerochualongNo ratings yet

- Coberturas Aplicables BENEFLEXDocument57 pagesCoberturas Aplicables BENEFLEXcinthyuxNo ratings yet

- Final Tax Planning ProjectDocument14 pagesFinal Tax Planning ProjectyashNo ratings yet

- Arrangement of Section in Income Tax Act 1961Document8 pagesArrangement of Section in Income Tax Act 1961Jitendra VernekarNo ratings yet

- PCE Trial Exam 1Document55 pagesPCE Trial Exam 1Kenny Chen68% (22)

- Aml Case StdyDocument5 pagesAml Case Stdyammi25100% (2)

- Commercial Law Review AbellaDocument174 pagesCommercial Law Review AbellaMae NavarraNo ratings yet

- Synopsis Online Health Insurance ManagementDocument20 pagesSynopsis Online Health Insurance ManagementRaj Bangalore50% (2)

- Arts 1223-1230Document9 pagesArts 1223-1230Kareen Baucan100% (1)

- PMO Two Decades CVC DysfunctionalDocument12 pagesPMO Two Decades CVC DysfunctionalShri Gopal SoniNo ratings yet

- Ic 38Document15 pagesIc 38Rajkumar SharmaNo ratings yet

- FSD AMetlife Phase 1a 140715Document192 pagesFSD AMetlife Phase 1a 140715rajsundarsNo ratings yet

- United States Court of Appeals, Tenth Circuit.: No. 94-2103. (D.C. No. CIV-90-992-JB)Document15 pagesUnited States Court of Appeals, Tenth Circuit.: No. 94-2103. (D.C. No. CIV-90-992-JB)Scribd Government DocsNo ratings yet

- Topic 1 Introduction To International Risk Management PresentationDocument25 pagesTopic 1 Introduction To International Risk Management PresentationSuvaid KcNo ratings yet

- How To Register As A General Contractor in California USDocument2 pagesHow To Register As A General Contractor in California USHamza IkhlaqNo ratings yet

- Service Charges Popcorn Service ProviderDocument3 pagesService Charges Popcorn Service ProviderRajesh SharmaNo ratings yet

- Libro DiarioDocument20 pagesLibro Diarioalquimba57% (7)

- Poliza N 11268921 - Soc - Educacional Loyola - Unificada 2023Document45 pagesPoliza N 11268921 - Soc - Educacional Loyola - Unificada 2023Gonzalo BahamondesNo ratings yet

- Barbara Houston v. John Houston, III, 3rd Cir. (2011)Document9 pagesBarbara Houston v. John Houston, III, 3rd Cir. (2011)Scribd Government DocsNo ratings yet

- Accounting Fundamentals II: Lesson 11 (Printer-Friendly Version)Document8 pagesAccounting Fundamentals II: Lesson 11 (Printer-Friendly Version)gretatamaraNo ratings yet

- Gmac Mortgage Ceo David Applegate Engaged in Mortgage FraudDocument3 pagesGmac Mortgage Ceo David Applegate Engaged in Mortgage FraudRoy WardenNo ratings yet

- Procedimiento Trabajo de Alto Riesgo JGODocument5 pagesProcedimiento Trabajo de Alto Riesgo JGOJoselo HidalgoNo ratings yet