Professional Documents

Culture Documents

I.Functionsof Abank'Ssecurityportfolio: Chapter10:Investmentfunctioninfinancial

I.Functionsof Abank'Ssecurityportfolio: Chapter10:Investmentfunctioninfinancial

Uploaded by

Huế HoàngOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I.Functionsof Abank'Ssecurityportfolio: Chapter10:Investmentfunctioninfinancial

I.Functionsof Abank'Ssecurityportfolio: Chapter10:Investmentfunctioninfinancial

Uploaded by

Huế HoàngCopyright:

Available Formats

Stabilize income

Offset credit risk exposure

Provide geographic diversification.

Provide a backup source of liquidity

I.Functions of Treasury Bills

Reduce tax exposure

a bank’s security portfolio

Short-Term Treasury Notes and Bonds

Serve as collateral

Federal Agency Securities

Hedge against interest rate risk

Certificates of Deposit

Provide flexibility II.Popular Money Market

Investment Instruments

International Eurocurrency Deposits

Dress up the balance sheet

Bankers’ Acceptances

1 Structured Notes

Commercial Paper

2 Securitized Assets IV.Other more recent investment

Short-Term Municipal Obligations

3 Stripped Securities

Treasury Notes and Bonds

Municipal Notes and Bonds

III.Popular Capital Market

Expected rate of return Investment Instruments

Corporate Notes and Bonds

Chapter 10: Investment function in Financial

Asset-Backed Securities

The Tax Status of State and Local Government Bonds

how market interest rates differ( loans + securities of varying term (time) to maturity)

The Tax Exposure

Bank Qualified Bonds

The Tax Swapping Tool More easily with -securities

The Yield Curve

The Portfolio Shifting Tool

Topic branch 1

interest rate < value of bonds

information about under or over securities

VI.Maturity Management Tools

longer-term bonds- greater interest risk Interest Rate Risk

information about risk-return trade-off

Hedgig risk= options, future, swaps

Present Value Weighted Average Maturity of the CFs

Default risk Duration

V.Factors Affecting Choice

Used to Insulate the Securities From Interest Rate Change

of Investment Securities

Business risk

Breadth and Depth of Secondary Market

Liquidity Risk

Treasury Securities are Generally the Most Liquid

corp have the right to retire Securities before their maturity

call when interest rate fall Call risk

investor find new services with lower return

Prepayment risk

Inflation risk

The Ladder or Spaced-Maturity Policy

The Front-End Load Maturity Policy

The Back-End Load Maturity Policy Investment Marturity Strategies

The Barbell Strategy

The rate expectation approach

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BMA Group 7 Tut 3Document27 pagesBMA Group 7 Tut 3Huế HoàngNo ratings yet

- TRM Group 1 VietcombankDocument29 pagesTRM Group 1 VietcombankHuế HoàngNo ratings yet

- (5AM) - TÀI LIỆU WRITING TASK 1 ĐỀ THI THẬTDocument30 pages(5AM) - TÀI LIỆU WRITING TASK 1 ĐỀ THI THẬTHuế HoàngNo ratings yet

- BES - R Lab 5Document4 pagesBES - R Lab 5Huế HoàngNo ratings yet

- Hoàng Thị HuếDocument2 pagesHoàng Thị HuếHuế HoàngNo ratings yet

- CH 08Document2 pagesCH 08Huế HoàngNo ratings yet

- Tutorial 3 QuestionsDocument6 pagesTutorial 3 QuestionsHuế HoàngNo ratings yet

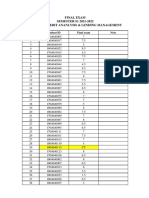

- Credit Analysis and Lending Management S1 23-24.xls - Compatibility ModeDocument5 pagesCredit Analysis and Lending Management S1 23-24.xls - Compatibility ModeHuế HoàngNo ratings yet

- Tutorial 1 QuestionsDocument8 pagesTutorial 1 QuestionsHuế HoàngNo ratings yet

- BES - R Lab 4Document6 pagesBES - R Lab 4Huế HoàngNo ratings yet

- TUT4Document2 pagesTUT4Huế HoàngNo ratings yet

- Room 1Document3 pagesRoom 1Huế HoàngNo ratings yet

- HẰNG HẰNGDocument1 pageHẰNG HẰNGHuế HoàngNo ratings yet

- CLM21 Tut 3 Group 5 1Document20 pagesCLM21 Tut 3 Group 5 1Huế HoàngNo ratings yet

- Credit Analysis Lending Management S1!21!22Document3 pagesCredit Analysis Lending Management S1!21!22Huế HoàngNo ratings yet

- BES - R Lab 3Document2 pagesBES - R Lab 3Huế HoàngNo ratings yet

- Abcd XyzDocument1 pageAbcd XyzHuế HoàngNo ratings yet

- KKKKDocument1 pageKKKKHuế HoàngNo ratings yet

- Hieu Cau VietDocument1 pageHieu Cau VietHuế HoàngNo ratings yet