Professional Documents

Culture Documents

Engage - Kaya Mo!

Uploaded by

Classicchic xx0 ratings0% found this document useful (0 votes)

4 views2 pages1) The publisher recognized a profit of $20,300 after selling 700 books. The bookstore recognized commission income of $110,250 based on a 20% commission rate and 15% markup on retail sales of $315,000. The cost of 300 unsold books was $96,600 including freight.

2) Lunch Co's unadjusted deferred gross profit was $200,000 on sales of $1,000,000 with a cost of sales of $800,000. It collected $600,000 in 2021 with a 20% gross profit rate, realizing $120,000 in gross profit. The adjusted deferred gross profit was $80,000.

3) Dinner Co's installment sales

Original Description:

Original Title

Engage_ Kaya mo!

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The publisher recognized a profit of $20,300 after selling 700 books. The bookstore recognized commission income of $110,250 based on a 20% commission rate and 15% markup on retail sales of $315,000. The cost of 300 unsold books was $96,600 including freight.

2) Lunch Co's unadjusted deferred gross profit was $200,000 on sales of $1,000,000 with a cost of sales of $800,000. It collected $600,000 in 2021 with a 20% gross profit rate, realizing $120,000 in gross profit. The adjusted deferred gross profit was $80,000.

3) Dinner Co's installment sales

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesEngage - Kaya Mo!

Uploaded by

Classicchic xx1) The publisher recognized a profit of $20,300 after selling 700 books. The bookstore recognized commission income of $110,250 based on a 20% commission rate and 15% markup on retail sales of $315,000. The cost of 300 unsold books was $96,600 including freight.

2) Lunch Co's unadjusted deferred gross profit was $200,000 on sales of $1,000,000 with a cost of sales of $800,000. It collected $600,000 in 2021 with a 20% gross profit rate, realizing $120,000 in gross profit. The adjusted deferred gross profit was $80,000.

3) Dinner Co's installment sales

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

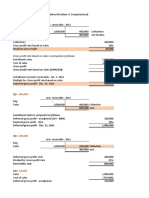

1) Publisher Co.

A. How much profit is recognized by the publisher?

20%+2%=22%

X=69,300/22%

X=315,000/700 (sale of books)

X=450

Sale of books 700

X unit cost 300

total 210,000

Add: Freight (22x70,000) 15,400

Cost of Goods Sold 225,400

Revenue (450x700) 315,000

Less: cost of goods sold (225,400)

Gross profit 86,600

Less: tax expense (2%x315,000) (6,300)

Commission expense(20%x315,000) (63,000)

Profit P20,300

B.How much income is recognized by the bookstore?

Based on retail price:

Commission(315,000x20%) 63,000

Add: Mark up (315,000x15%) 47,250

Commission income P110,250

C. How much is the cost of the unsold books?

Unsold books 300

X unit cost before freight 300

total 90,000

Add: freight 6,600

Inventory, end. P96,600

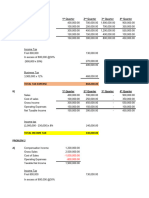

2. Lunch Co.

A. unadjusted balance of “deferred gross profit” on Dec.31, 2021

Sales 1,000,000

Less: cost of sales (800,000)

Unadjusted Deferred gross profit P200,000

B. amount of collection in 2021

Installment accounts receivable – Dec. 31, 2021 P600,000

C. gross profit rate based on sales in 2021

Unadjusted Deferred Gross Profit 200,000/1,000,000 = 20% gross profit rate

D. realized gross profit 2021

Installment AR – Dec. 31, 2021 600,000

x Gross Profit Rate 20%

Realized Gross Profit P120,000

E. adjusted balance of “deferred gross profit” on Dec.31, 2021

Unadjusted Deferred Gross Profit 200,000

Less: Realized Gross Profit (120,000)

Adjusted Deferred Gross Profit P80,000

3) Dinner Co.

A.amount of installment sales in 2021

Deferred gross profit (before year-end adjustment) 200,000 / 20% = P1,000,000

B. balance on installment AR on Dec, 31, 2021

Deferred gross profit (before year-end adjustment) 200,000

Add: Collections during the year 400,000

Installment AR on Dec, 31, 2021 P600,000

C. realized gross profit 2021

Installment AR – Dec. 31, 2021 600,000

x Gross Profit Rate 20%

Realized Gross Profit P120,000

D.adjusted balance of “deferred gross profit” on Dec.31, 2021

Unadjusted Deferred Gross Profit 200,000

Less: Realized Gross Profit (120,000)

Adjusted Deferred Gross Profit P80,000

You might also like

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- Activity - Penury CompanyDocument1 pageActivity - Penury CompanyLydevia Kigangan DiwanNo ratings yet

- Vedantu - June 2019Document1 pageVedantu - June 2019VikashNo ratings yet

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BDocument10 pagesProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Metrillo - Comprehensive ProbDocument12 pagesMetrillo - Comprehensive ProbLordCelene C MagyayaNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Spectra NDocument5 pagesSpectra NRichelle Mea B. PeñaNo ratings yet

- Handsout 06 Chap 03 Part 02Document4 pagesHandsout 06 Chap 03 Part 02Shane VeiraNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- ExploreDocument4 pagesExploreNorlyn RunesNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Accounting Review QuestionsDocument34 pagesAccounting Review Questionsjoyce KimNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Installment T SalesDocument31 pagesInstallment T SalesNiki DimaanoNo ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- Gene Justine Sacdalan Test PaperDocument4 pagesGene Justine Sacdalan Test PaperGene Justine SacdalanNo ratings yet

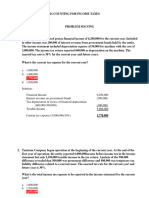

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- Acc 142 - ReviewerDocument6 pagesAcc 142 - ReviewerRiezel PepitoNo ratings yet

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Document10 pagesKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNo ratings yet

- Assignment 20 (Financial Accounting) BY M.Mansoor 19U00063Document4 pagesAssignment 20 (Financial Accounting) BY M.Mansoor 19U00063Muhammad MukarramNo ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Acctngmodule 2Document9 pagesAcctngmodule 2Verlyn ElfaNo ratings yet

- ACC 1 Activity Assignment 10.31.23Document1 pageACC 1 Activity Assignment 10.31.23Maria Caroline PunoNo ratings yet

- Problem 24-11Document25 pagesProblem 24-11anneliban499No ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Cost Accounting Assignment #2Document5 pagesCost Accounting Assignment #2BRIANNIE ASRI VIVASNo ratings yet

- Post Quiz 1Document3 pagesPost Quiz 1Randelle James FiestaNo ratings yet

- Chapter 18 ProblemsDocument4 pagesChapter 18 ProblemsAhritch DalanginNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- Assignment On Installment SalesDocument12 pagesAssignment On Installment SalesTricia Nicole Dimaano100% (1)

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Exercise ProblemsDocument6 pagesExercise ProblemsDianna Rose Vico100% (1)

- VARAIBLE COSTING (Solutions)Document8 pagesVARAIBLE COSTING (Solutions)Mohammad UmairNo ratings yet

- Geme CostDocument6 pagesGeme CostBiruk Chuchu NigusuNo ratings yet

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Discountinued Operation QuestionsDocument8 pagesDiscountinued Operation QuestionsBabylyn NavarroNo ratings yet

- Chapter 10 Installment Sales AccountingDocument13 pagesChapter 10 Installment Sales AccountingFaithful FighterNo ratings yet

- QuizDocument3 pagesQuizSam VNo ratings yet

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- Investments: SolutionDocument8 pagesInvestments: SolutionAce LimpinNo ratings yet

- Topic 2 Installment Sales Module Part 1Document5 pagesTopic 2 Installment Sales Module Part 1Maricel Ann BaccayNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Chapter 4 Best Master Budget IllustrationDocument23 pagesChapter 4 Best Master Budget IllustrationLeykun GizealemNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Dc-44Document1 pageDc-44priyapatil56565No ratings yet

- Chapter 14 - Documentary Stamp TaxDocument3 pagesChapter 14 - Documentary Stamp TaxairishcuteNo ratings yet

- Hba 2302 Advanced TaxationDocument4 pagesHba 2302 Advanced TaxationprescoviaNo ratings yet

- R PosDocument4 pagesR PosBirendra EkkaNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- So 2023 2024 1966Document2 pagesSo 2023 2024 1966nawazhoney92No ratings yet

- AprilDocument6 pagesAprilcindy pecañaNo ratings yet

- 2009 International Student Tax Rate 1040NR Tax Rate H1B Tax RateDocument14 pages2009 International Student Tax Rate 1040NR Tax Rate H1B Tax RateNon Resident Tax ExpertNo ratings yet

- Rebates and Releifs Page 415 To 418Document4 pagesRebates and Releifs Page 415 To 418Nitin RajNo ratings yet

- Afisco Insurance Corporation v. CA 302 SCRA 1Document2 pagesAfisco Insurance Corporation v. CA 302 SCRA 1Kayee KatNo ratings yet

- Contract Labour FORM XIXDocument1 pageContract Labour FORM XIXhdpanchal86No ratings yet

- Multiply Choice - Theory Part 1Document16 pagesMultiply Choice - Theory Part 1Bloom ArisNo ratings yet

- I.t.challan BlankDocument4 pagesI.t.challan Blankmaliktariq78100% (1)

- PrmPayRcpt 75852124Document3 pagesPrmPayRcpt 75852124thinglikesurajNo ratings yet

- Accounting Research Memo - 2Document2 pagesAccounting Research Memo - 2api-247273217No ratings yet

- 1601c FormDocument8 pages1601c FormPingLomaadEdulanNo ratings yet

- Flipkart Labels 06 Jul 2022 09 52Document37 pagesFlipkart Labels 06 Jul 2022 09 52Dharmesh ManiyaNo ratings yet

- Laws of Taxation in TanzaniaDocument508 pagesLaws of Taxation in TanzaniaRuhuro tetere100% (3)

- Cess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Document4 pagesCess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Darth VaderNo ratings yet

- Act Bill Dec-2021Document2 pagesAct Bill Dec-2021RAJESH BISWASNo ratings yet

- Industrial Waste Management Association: GSTIN: 33AAAAI0746E1Z8Document1 pageIndustrial Waste Management Association: GSTIN: 33AAAAI0746E1Z8Mohan RajNo ratings yet

- Problem 8 - 1 Deductible or Nondeductible From Gross IncomeDocument2 pagesProblem 8 - 1 Deductible or Nondeductible From Gross Incomeriza147No ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- Presentation Article 25 Income Tax in IndonesiaDocument11 pagesPresentation Article 25 Income Tax in IndonesiatantriwidyasNo ratings yet

- Tax Filing Basics For Stock Plan TransactionsDocument8 pagesTax Filing Basics For Stock Plan Transactionshananahmad114No ratings yet

- 1 Condidional Acceptance IRS 3176C VerdanaDocument6 pages1 Condidional Acceptance IRS 3176C VerdanaKenneth Michael DeLashmuttNo ratings yet