Professional Documents

Culture Documents

Buscom Exam Notes

Uploaded by

Ma. Althea Sierras0 ratings0% found this document useful (0 votes)

10 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageBuscom Exam Notes

Uploaded by

Ma. Althea SierrasCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

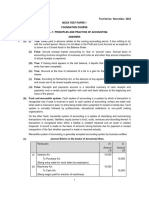

BUSINESS COMBINATION

#1 12/31/24 FC Transaction ($20,000**0.25) P5,000

P Company sells all goods it manufactures to its wholly owned subsidiary Accounts Payable P5,000

S Company at 125% of cost. (under Equity Method) (40.80-40.55=0.25)

During the 1st year of this arrangement, goods that cost P Company 3/1/25 Accounts Payable ($20,000*40.80) P816,000

P100,000 are sold to S Company for P125,000. (Downstream sale) FC Transaction (Gain/Loss) P3,000

During the same year, S Company sold all the goods purchased from P Cash ($20,000*40.65) P813,000

Company to third parties for P135,000 and paid P Company P125,000.

#4

P Company On Nov. 1, 2024, Two firm (USA) ordered 1,000 units of inventory from

Accounts Receivable P125,000 Duwa firm (Phils) for $20,000. The inventory was shipped and invoiced to

Sales P125,000 Two firm on Dec. 1, 2024 to be paid on Mar. 1, 2025. Duwa firm's fiscal

Cash P125,000 year-end is Dec. 31, 2024. Assume further that Duwa did not engage in

Accounts Receivable P125,000 any form of hedging activity.

S Company Duwa (seller)

Purchases P125,000 12/1/24 Accounts Receivable ($20,000*40.00) P800,000

Accounts Payable P125,000 Sales P800,000

Accounts Receivable/Cash P135,000 12/31/24 FC Transaction (Gain/Loss) P14,000

Sales P135,000 Accounts Receivable P14,000

Accounts Receivable P125,000 *Comp: FV ($20,000*40.70) 814,000

Cash P125,000 Recorded 800,000

Decrease 14,000

Working Paper Entries 3/1/25 Cash ($20,000*40.60) P812,000

Accounts Payable P125,000 FC Transaction P2,000

Accounts Receivable P125,000 Accounts Receivable P814,000

Sales P125,000

Purchase P135,000 #5

On July 1, 2021, ABC Co. obtained a $40,000 loan that bears 10% annual

Sales 135,000 125,000 135,000 interest when the spot exchange rate is P50:$1. The closing rate on December

COGS 100,000 100,000 125,000 31, 2021 is P55:$1. No payments had been made on the loan during the year.

Gross Profit 35,000 25,000 10,000 How much is the foreign exchange gain (loss) to be recognized in the year-end

statement of profit or loss?

#2 a. (200,000) b. (220,000) c. (210,000) d. 210,000

On January 1, 2024, P Company sells to S Company a 90% owned

subsidiary, equipment with a book value of P375,000 (original cost of 7/1/21 Loans Payable ($40,000*P50) P2,000,000

P675,000 and accumulated depreciation Of P300,000) for P450,000. Interest Payable ($40,000*10%*6/12*P50)P100,000

(downstream sale) P2,100,000

On the date of sale, the equipment has an estimated remaining useful 12/31/21 Loans ($40,000*P55) P2,200,000

life of 3 years, has no residual value and is depreciated using the straight Interest ($40,000*10%*6/12*P55) P110,000

line method. P2,310,000

No other equipment is owned by S Company or P Company. Foreign exchange gain/loss (P210,000)

P Company 7/1/21 Cash ($42,000*50) P2,100,000

Cash P450,000 Loans Payable ($40,000*50) P2,000,000

Accumulated Depreciation P300,000 Interest Payable ($2,000*50) P100,000

Equipment P675,000 To record the loan obtained.

Gain/Loss P75,000 12/31/21 Forex gain/loss P210,000

Depreciation expense P125,000 Loans payable P200,000

Accumulated Depreciation P125,000 Interest payable P10,000

(1/3*375,000) To record forex loan.

S Company

Equipment P450,000

Cash P450,000

Depreciation expense P150,000

Accumulated Depreciation P150,000

(1/3*450,000)

Working Paper Entries

Gain/Loss P75,000

Equipment (675,000 - 450,000) P225,000

Accumulated Depreciation P300,000

Accumulated Depreciation P25,000

Depreciation Expense P25,000

EquipmentP375,000

Depreciation P125,000

Book Value P250,000

#3 1/1/23 Cash ($40,000*48) P1,920,000

On Nov. 1, 2024, Duwa firm (Phils) ordered 1,000 units of inventory from Sales P1,920,000

Two firm (USA) for $20,000. The inventory was shipped and invoiced to 9/30/23 Cash ($80,000*45) P3,600,000

Duwa firm on Dec. 1, 2024 to be paid on Mar. 1, 2025. Duwa firm's fiscal Sales P3,600,000

year-end is Dec. 31, 2024. Assume further that Duwa did not engage in 12/16/23 Various debits ($20,000*44) P880,000

any form of hedging activity. Cash P880,000

The spot rates for US dollars at various times are as follows:

Buying Spot Rates Selling Spot Rates Cash in Bank

Nov. 1, 2024 39.80 40.25 1,920,000 800,000

Dec. 1, 2024 40.00 40.55 3,600,000

Dec. 31, 2024 40.70 40.80 P4,640,000

Mar. 1, 2025 40.60 40.65

Duwa (buyer) A. $100,000*45 = P4,500,000

11/1/24 No entry B. Cash in Bank P4,640,000

12/1/24 Purchases ($20,000*40.55) P811,000 P4,500,000

Accounts Payable P811,000 Loss (P140,000)

You might also like

- Partnership FormationDocument18 pagesPartnership FormationHelen Angcon50% (2)

- QUIZ 1 - Preparation of Financial StatementsDocument3 pagesQUIZ 1 - Preparation of Financial StatementsDorothy Romagos100% (7)

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Partnership Liquidation Question#6Document2 pagesPartnership Liquidation Question#6Ivy BautistaNo ratings yet

- Abm 2 Summative TestDocument1 pageAbm 2 Summative TestSarah Mae Aventurado100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Batch 17 2nd Preboard (P1)Document10 pagesBatch 17 2nd Preboard (P1)Jericho PedragosaNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Problem 5Document3 pagesProblem 5Rudy LugasNo ratings yet

- Financial Ratios Analysis for AAV Mfg CorpDocument5 pagesFinancial Ratios Analysis for AAV Mfg CorpAngelita Dela cruzNo ratings yet

- Chapter 22 ACCA F3Document11 pagesChapter 22 ACCA F3sikshaNo ratings yet

- Joint Venture Accounting EntriesDocument8 pagesJoint Venture Accounting EntriesMonica DespiNo ratings yet

- Ppe ProblemDocument3 pagesPpe ProblemJanuary Ann BeteNo ratings yet

- Module 6 - Translation of Financial StatementsDocument9 pagesModule 6 - Translation of Financial StatementsasdasdaNo ratings yet

- Since 1977: Maximizing Profits Through Strategic Decision-MakingDocument3 pagesSince 1977: Maximizing Profits Through Strategic Decision-MakingPaula Villarubia100% (1)

- Buscom Exam NotesDocument1 pageBuscom Exam NotesMa. Althea SierrasNo ratings yet

- UNDERSTANDING INTERCOMPANY TRANSACTIONSDocument2 pagesUNDERSTANDING INTERCOMPANY TRANSACTIONSMark Lyndon YmataNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- Chapter Four Problem P4-8 Part B Adjusted Without VoiceDocument13 pagesChapter Four Problem P4-8 Part B Adjusted Without Voicehassan nassereddineNo ratings yet

- Toaz - Info Joint Venture Quizzers PRDocument4 pagesToaz - Info Joint Venture Quizzers PRMark Anthony BabaoNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- Multiple Choice Computational Problems TranslatedDocument12 pagesMultiple Choice Computational Problems TranslatedFireBNo ratings yet

- Review Problems With AnswersDocument5 pagesReview Problems With AnswersGelai BatadNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Activity 7Document16 pagesActivity 7JEWELL ANN PENARANDANo ratings yet

- AFAR-1ST-PB-OCTOBER-2022_NO ANSDocument15 pagesAFAR-1ST-PB-OCTOBER-2022_NO ANSRhea Mae CarantoNo ratings yet

- Chapter 12 - Multiple Choices - Computational Problems in Financial AccountingDocument18 pagesChapter 12 - Multiple Choices - Computational Problems in Financial AccountingCrystal ApinesNo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualDocument9 pages(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualRENZ ALFRED ASTRERONo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Partnership Formation AccountingDocument7 pagesPartnership Formation AccountingSienna PrcsNo ratings yet

- Exercise 2 Statement of Financial PositionDocument8 pagesExercise 2 Statement of Financial Positionjumawaymichaeljeffrey65No ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- Intacc 1Document4 pagesIntacc 1Jen AdvientoNo ratings yet

- Assignment Chapter 1Document5 pagesAssignment Chapter 1Mark CalimlimNo ratings yet

- Microsoft Word - Unit 2 Understanding Statement of Financial PositionDocument17 pagesMicrosoft Word - Unit 2 Understanding Statement of Financial PositionKamille C. CerenoNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Some Advac Problems by DayagDocument6 pagesSome Advac Problems by DayagElijah Montefalco100% (1)

- Problem 4 Activity 3 SolutionsDocument7 pagesProblem 4 Activity 3 SolutionsResty VillaroelNo ratings yet

- Problem: Echon - Dizon - TuazonDocument12 pagesProblem: Echon - Dizon - TuazonChela Nicole EchonNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- CPA Review: Partnership FormationDocument19 pagesCPA Review: Partnership FormationJuja FlorentinoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Week 6 7 ULOb Lets Analyze SolutionDocument2 pagesWeek 6 7 ULOb Lets Analyze Solutionemem resuentoNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Chapter 9 ExerciseDocument4 pagesChapter 9 ExerciseKaila Clarisse CortezNo ratings yet

- Partnership Distribution of $60,000 in DissolutionDocument9 pagesPartnership Distribution of $60,000 in DissolutionAllynna JoyNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Module 2 - Topic 3 (Notes Receivable)Document7 pagesModule 2 - Topic 3 (Notes Receivable)GRACE ANN BERGONIONo ratings yet

- Practical Accounting 1Document13 pagesPractical Accounting 1Sherrizah Ferrer MaribbayNo ratings yet

- MODULE 3 Step 1Document7 pagesMODULE 3 Step 1yugyeom rojasNo ratings yet

- Chapter 1 The Context of Systems Analysis and Design MethodsDocument5 pagesChapter 1 The Context of Systems Analysis and Design MethodsAlta SophiaNo ratings yet

- Partnership FormationDocument25 pagesPartnership FormationMacie MenesesNo ratings yet

- REVIEW ADJUSTING ENTRIESDocument4 pagesREVIEW ADJUSTING ENTRIESElleana DNo ratings yet

- Study Note - 4: Preparation of Final AccountsDocument48 pagesStudy Note - 4: Preparation of Final Accountsshivam kumarNo ratings yet

- Chapter 24Document11 pagesChapter 24Viana Baucas EstrellaNo ratings yet

- Funds Flow StatementDocument30 pagesFunds Flow StatementVinayak SaxenaNo ratings yet

- Understanding Financial Statements: Student - Feedback@sti - EduDocument6 pagesUnderstanding Financial Statements: Student - Feedback@sti - Eduvince mendozaNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- Performantele Economico-Financiare Ale FirmeiDocument10 pagesPerformantele Economico-Financiare Ale FirmeiCristina MihaelaNo ratings yet

- Beneish M ScoreDocument11 pagesBeneish M ScorePuneet SahotraNo ratings yet

- Bhai Bhai SpinningDocument18 pagesBhai Bhai SpinningSharifMahmudNo ratings yet

- InterAcc 14-33Document11 pagesInterAcc 14-33Marinella LosaNo ratings yet

- Financial Accounting AssesmentDocument5 pagesFinancial Accounting AssesmentAnn Calabdan100% (1)

- Homework Solutions Chapter 1Document9 pagesHomework Solutions Chapter 1Evan BruendermanNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Exam 2022 AccountingDocument2 pagesExam 2022 AccountingEditz meniaNo ratings yet

- FinancialStatement 2016 I ACESDocument73 pagesFinancialStatement 2016 I ACESHany BachmidNo ratings yet

- Accountancy Question Bank for Class XIDocument9 pagesAccountancy Question Bank for Class XIlasyaNo ratings yet

- Indocement Tunggal Prakarsa TBK - Bilingual - 31dec2016 - Released PDFDocument136 pagesIndocement Tunggal Prakarsa TBK - Bilingual - 31dec2016 - Released PDFNANDITANo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Balance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMDocument1 pageBalance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMharshit abrolNo ratings yet

- Enabling ActivityDocument5 pagesEnabling ActivityQuienilyn SanchezNo ratings yet

- Ayala Corporation Reports Third Quarter 2019 ResultsDocument87 pagesAyala Corporation Reports Third Quarter 2019 ResultsJohanna Lindsay CapiliNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFaizaNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Partnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesDocument2 pagesPartnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesJohn BryanNo ratings yet

- Osiris Export 8Document49 pagesOsiris Export 8leddy teresaNo ratings yet

- PT Sepeda NusantaraDocument74 pagesPT Sepeda NusantaraRexy Fitra JayaNo ratings yet

- Solution Chapter 9 Accounting For Account ReceivableDocument5 pagesSolution Chapter 9 Accounting For Account ReceivableIsmahNo ratings yet

- Ratio Analysis Mapple Leaf & BestWay CementDocument46 pagesRatio Analysis Mapple Leaf & BestWay CementUmer RashidNo ratings yet