Professional Documents

Culture Documents

Adobe Scan Apr 19, 2023

Adobe Scan Apr 19, 2023

Uploaded by

kushaelanbillgatesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan Apr 19, 2023

Adobe Scan Apr 19, 2023

Uploaded by

kushaelanbillgatesCopyright:

Available Formats

ERIFICATION AND

ALUATION OF ASSETS AND LIABILITIES 9

CHAPTER

Mesning nd Defnitton ofeiicaioa -Sub-fnctions ofVeriication -0biectives

fleifcsion - Distincton betaeen Vouching nd Verification - Valuation of

Ases nd Lizbilitis - Veifñcon of Diñerent Tpes of Assets - Verifcation

nd lauaia ofLibiliis-Continget Li2bilities

EANING AND DEFINITION OF VERIFICATION

The e viñcaion refers to confrmaion or proving the truth It denotes the procedures

ied out at the end of the period unde audit in order to confimtheowzership, vauation,

eiseoce of 2ssets and lizbilities at the date of the Balace Sheet. The term verification

laies vaaien also. Witù this introducion, we shall now see some of the

defnitions for the

ifcation as below:

Definition of Spicer and Pegler: Accoding to Spicer and Pegler, "The verification of assets

Ss qiry ino tie vale, owrership and itle, existence and possession, and the presence

Definition of Lancaster: In the words of Lancaster, "The vertication of assets is a process

ict the cuditor sabstantiates the cOcracy of the right hand side of the balance shett, and

t be cosidered as having tree distinct objects

(c) serifcanon of the xistence of asses,

6) che vclation of assets, cnd

{ci horiry of theracquisition".

Fromthe sbove definitions, it is clear thst verification isa brozde term and includes

be ssets and liabilities also. valuation

W$-FUNCTIONS OF VERIFICATION

Ibe vernfication function involves the following four

sub-functions:

. lo ee that all assets and all liabilities are cleariy stated in the

2

lo sce that they are in exiStence on the date of the

Balance Sheet.

Balance Sheet

*.lo sce thaf the assets were acquired for the business and are

free from any chrge or

4.

3ortgage and they are in the namc of the client.

To see wbether both the assets and

labiiities are accuraely valuei

DBJECTIVES OF VERIFICATION

he rrain obËectuves of

veification ue as below:

VERIFICATION AND VALUATION OF ASSETS AND LIABILITIES

141

140 PRACTICAL AUDITIE

possession, and titleeof the assets appearing in the

reliesFrom the above

ontrusted

discussion, it is clear that in the

oficials of the company an auditor is absence

of

suspicious circurnstances,

not liable. However, it does not meanifthat

hewillbefreefrom his liability if assets are incorrectly valued|by the officers of th.company as i

be

Exminine the ownership,

Ascertainng the existence of the assets

Verifing the fact whether assets are

appearing in the Balance Sheet

free from charge or not.

Balance Shec atitstothe

management. An auditor is no doubt concerned with values set

certify that final accounts reveal a true and fair view ofagainst the asscts,

the state of affairsbecause

if any, in the books of accounts of the concern ltimatelyheisto an auditor should lexercise reasonable care and sk1ll, of the

Detecting the frauds and

ircgularities, concerm.

Therefore,

valuation from the technical experts, and

aralyse all the figures criticall:.

books of accounts. basis of satisfy

Ensuring the arithmetical accuracy of the assetsshown

inQuire in the Balance Sheet are properly valued in accordance withhimself

intothe that the differers

the generally acceptc

AND VERIFICATION conventions and accounting principles. If he is satisfied with the methods of valuation of th

DISTINCTION BETWEEN VOUCHING

given in Table 9 1 Assets,he is free frombis liability. It has been observed, "Financial accounts are largely a matte

The ponts of differcnce berween vouching and verification are judgement and opinion, not a matter of certainty. The balance sheet can

convention, neve

but only afairest possible estimates of the financial conditions"

of realIfinancialposition,

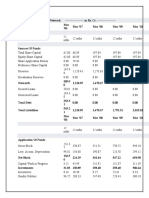

SNo. BASES OF DIFFERENCE VOUCHING

VERIFICATION showthe

auditor can never

claim that the Balance Sheet is absolutely correct.

Nature of Work Vouching checks the entries |Verification examines the a An

1.

as to the transactions recorded|and

in the books of account.

liabilities given in h

Balance Sheet.

Kinds of Values

Some of the

interpretations that are used i in the valuation of assets are given below:

Basis of Examination Vouching is based only on the Verification is based not onl

documentary examination. on documentary examinatioa . Cost Price: Cost price refers to the price paid for the acquisition of an asset. It include

but also it carries on physical of an asset and its installation

inspection. he expenses incurred in the purchase

Market Value: Market value is the value, which an asset can fetch in the market when so!

Pernod Vouching is done for the Verification is done at the cnl

whole year. of the year only. 3, Replacement Value: Replacement value is a price at which a particular asset can

freight, etc.

Uuity Factor Vouching indicates that a Verification certifies the

particular asset must belexistence ofassets and liabilitis

replaced. It includes expenses like commission,

appears in the books of accounts. Usual

4. Book Value: This is the value at which an assetwritten

possessed by the concern. at Balance Sheet date. depreciation off so far.

Valuzt1on Vouching does not primarily| Verification includes valuation assets appcar in the books at cost minus

concerned with valuation. also in its scupe. 5. Realisable Value: Realisable value is one, which will be realised in the market and receiv

Personnel Involved Auditclerk does vouching of The auditor himself doe from the sale of an asset. It is normally used in the valuation of existing assets.

books of accounts. verification.

Concern Value or Historical Value: It is also called commercial value or tok

6. Going

value. It is equivalent to the cost less a reasonable amount of depreciati

TABLE 9.1 - DIFFERENCE BETWEEN VOUCHING AND VERIFICATION value or conventional

Written ofT.

scr

which may be obtained from the asset if it is sold as

VALUATION OF ASSETS AND LIABILITIES 7. Scrap Value: It refers to the value.

The terrn valuation refers to the critical examination and testing of determined values of asse5 Basls of Valuation

by tue auditor based on generally accepted accounting principles and conventions. The accurs) While valuing the assets the auditor

must keep in mind the following points:

of the Balance Shect and Profit and Loss Account depends very much upon the valuation ofasea

sndiiabiliies in a proper nanner. Both under valuation and over valuation of assets and liabite 1. Original cost of the assets.

would exhibit a wrong prcture about the financial position of the concerm. Hence, the auditor shou Z. Expected working life of the assets.

see whether allhe assets and liabilities are shown in uhe Balance Sheet at their proper valu. 3 Wear and tear of the assets.

Audiior's Duty regarding Valuation of Asseis & Liabiltiles 4. Scrap value of the assets.

An zud1tor is not a valuer and he cannot be expected to act as such. Actually, the propi S. Chances of the assets becoming obsolete.

or responsible ofhcials of the concern who have a practical knowledge of such assets Methods of Valuatlon categories as shown bel

valuatioas. An auditor's duty is confined to testing the valuations as far as he can and in ths underfive main

For the purpose of valuation, assets are classified

satisfying tum with the position shown to be corect. In Kingston Cotton Mills Co. Case, 1

I. Fixed Assets.

heid hat Although it is no par of anauditor s duty to value the assets and liabilities, yet he 2

exercise rasonable shll and care in scrulinising tle basis of valuation. tle should testguaranlee

the acehthe Current Assets.

f the sglues put by the officers of the business ln any cuse, the auditor cannot

zcCAraC of the valuation'

149

3. Wasting Assets.

RACTICAL AUb VERIFICATION,AND VALUATION OF ASSETS AND LIABILITIES

VERIFICATION OF DIFFERENT TYPES OF ASSETS

143

4. Fictinous Assets.

$. Intangiblc Assets. discuss the procedure, which the auditor follows while

Weshall now verifying various assets

those assets, which1are purchased for

1. Fixed Assets: Fixed assets are the pernanent separately.

continuously used in the

the industrial concerms. They are

these

concerns. Earnings of

assets remains so 1. FixedAssets

depend upon these assets. The utility of

resale in the ordinary course of

long as they are he co are calledcapital assets. They are

condition. They are neither meant for These assets required permanently for the conduct of the

totaly or partially in the business. business nor conu business. They are not purchased1for re-sale. We shall now analyse the

verification of these assets.

Plant & machinery, land &building, furniture, etc. are some of the 1) Goodwill

examples offixed

them. land is not subjected to depletion in value and so it is usually valued at cost Goodyilllis an intangible asset. Itis the value of the reputation of the firm It enables

fixed assets are valued at historical value because they are acquired for the

and put to ther repeated uses. They are valued at cost less a reasonable

tprice. The

running of :abu

earn morethantheenormal rate ofprofit. It has no physical existence as such. It does notthediminish

fim to

in value with use. It has the potentiality of self-growth. It can be raised merely by book entries.

and any fluctuation in their market value is not considered for their depreciFurattihoern, wita

valuation. Goodwillissocalculated and shown in the Balance Sheet only under the following circumstances:

gong to be continuously used, their realisable value is also need not be taken into as tht 1. Attthe Time of its Purchase: The amount of goodwill is equal to the ditference between

2. Current Assets: Current assets are those assets, which can't be put to account. ihe total purchase price paid for the business and the net assets (ie., Assets - liabilities)

They are also called as floating assets or circulating assets. They are meant for constant t purchased.

resale.

either purchased or produced or processed for the purpose of sale. Closing stock, bills They At the Time of Revaluationof Whole of Assets: Sometimes,companies revalue vvhole

book debts, cash. bank balance, etc. are some of the examples of floating assets. Curreat of their assets and raise goodwill account in their books. In such cases also, the goodwill

such as book debts, bills receivable, etc., are normally valued at book value. In case ofbonki so raised will be shown in the Balance Sheet.

a provision is made for bad and doubtful debts. Raw materials and

semi-manufactured po. 3, At the Time of Writing off the Capital Loss or the Debit Balance of Proßt&Loss

valued at cost. The closing stock of goods is valued at the date of the Balance Sheet eitherats. Account: Sometimes, the goodwill acquired by the company and witten off as such has

price or market price whichever is lower. been later brought back to accounts to write off the debit balance in the Proft &Los

3. Wasting Assets: Wasting assets such as mines, quarries, oil wells, etc. are offixed na

account or the capital loss which the company incurred subsequently.

4, At the time of Admission, Retirement or Death of a Partner in case of Partnership

Wasting assets are found in certain industries only. If we look at the terms of the decision of Firms: In case of partnership fims, goodwill is calculated and shown in the books when

case of Lee V. Nauchatel Asphalte Co. Ltd. (1889) it appears that there is no anew partner is admitted or an old partner dies or retires.

necessit

provide depreciation on wasting assets. But as a matter of principle, the theory

case does not hold good. Wasting assets exhaust by working and propounded in In case of purchase of the business, the auditor should verify it with the help of the agreement

hence the process invo made with the vendor, which shows the price paid for it. However, if the amount ofgoodwillis not

depletion of the capital employed. Hence, a charge should necessarily be made to maintaib

capital employed so as to exhibita true and fair value of the assets for the specifcally mentioned, it is to be treated as the difference betveen the purchase price paid for the

purpos of costaccout business and the net assets taken over.

However, it is difficult to ascertain how much of the mine is exhausted and how

remains more. Hence, wasting assets are shown in the Balance Sheet at much mi In case of revaluation of assets, which has raised the goodwill acount in the books of a

their original valu company, the auditor should refer the basis on which the assets have been revalued While in the

provision is made for depreciation or depletion on the basis of their estimated

exhaustion. case of goodwill, which has been wIiten off but later brought back to write offcapital loss or the

4. Fictitious Assets: Fictitious assets are debit balance of Profit & Loss Account, he should investigate the period over which the goodwill

those

though, of course, money is spent on them The examplesassets, of such

which are not physically vs

Was written off. He should also ascertain the amount of goodwill. He should also see whether

in a new company, special advertising assets are- preliminaryexp

expenses, development expenses, debenture debtors as well as shareholders approved it by passing necessary resolutions in ther meeing.

issue expenses, discount on issue of shares, discoun Deed. He may also verify the

of expenditure not represented by actual share issue expenses. etc. These items are realy n he case of partnersiip firm, he should verify the Partnership

values and so have no exchange value. Cianges made in the goodwi!l account from time to time based on the provisions made in the

5. Intangible Assets:

in their concrete form. Intangible assets do not have thei form. Hence, they

are nol Partnership Deed.

However, they

assets. They are actually fixed assets are equally valuable for a business concern like any o 2) Patents

patents, copyrights, trademarks, etc., arethough they do not have any concrete form. Godw exclusive right for years to make, use

more or less treated as fixed assets for some of the examples of this kind of assets. Theye ralent is an officialdocument, which gives an inventor

depreciation. The valuation basis must be

the purpose of Invention. It must be valued at cost less right

valuation. of 20 yearssafer which the

specified in the Balance Sheet. It should be written offin a periodperiod expired and the remaining

the

automatically lapsess unless the term is extended. He must note

142

4

Wast1ng Assets.

Ficnbous Assets.

PRACTICALA VERIFICATION

AND VALUATIONI OF ASSETS AND LIABILITIES

VERIFICATION OF pIFFERENT TYPES OF

now

ASSETS

143

discuss the procedure, which the auditor follows while verifying various assets

Intangible Asscts.

$. assets arcthose

assets, which are purchased for Weshall

1. Fixed Acsets: Fixed continuously used in the concerms. the perman separately.

che industrial

concems. They are

assets. The utility

depend upon these neither meant for resale

of these assets remains so long as

the ordinary course of Earnitnhgeys of t

ae in v

1. .FlxedAssets

are called I capital assets. They are required permanently forthe conduct of the

condition. They are

totally or partially in the

business.

building, furniture, etc. are some of the

ibusiness DoT e

Theseassets

business. They

are not purchasedfor re-sale. We shall now analysethe verification ofthese assets.

Plant & machinery, land &

them. land is not subjected to

depletion in value and so it is usually examplecosts of fuxed n

valued.at 1)

GoodwilI

Goodwill is an

intangible asset. It is the value ofthe reputation of the fim It enables the fim to

historical value because they are acquired for the price, than theenormal rate

ofprofit. It has no physical existence as such. It does not diminish

fixed assets are valued at

They are valued at cost lesssa reasonable Tunning of ab earn more It has the potentiality of 'self-growth. It can be raised merely by book entries.

and put to their repeated uses.

and any fluctuation in their market value is not depr

considered for their valuation

realisable value is also need not be taken

eciation w

her,axaodwill

use.

invalue

with

is calculatcd and shown in

the Balance Sheet only under the following circumstances:

Time of its Purchase: The amount of goodwill is equal to the ditference between

going to be continuously used, their into ac oum A+ +he Assets - liabilities)

2. Current Assets: Current assets are those assets,

which

can't be put to be total purchase price paid for the business aad the net assets (i.e.,

resalcones.tam

They are also called as floating assets or circulating assets. They are

purchased.

mtant for companies revalue wvhole

either purchased or produced or processed for the purpose of sale. Closing stock, bills

T At theTime of Revaluation of Whole of Assets: Sometimes,

2.

oftheir assets and raise goodwill account in ther books. In such cases also, the goodwill

book debts, cash, bank balance, etc. are some of the examples of floating assets c Balance Sheet.

such as book debts. bills receivable, etc., are nomally valued at book value, In case SO raised will be shown in the

At the Time of Writing off the Capital Loss or the Debit Balance of Profit & Loss

aprovision is made for bad and doubtful debts. Raw materials and semi-manufachiral Account: Sometimes, the goodwill acquired by the company and written off as such has

valued at cost The closing stockofgoods is valued at the date of the Balance Sheeteithe debit balance in the Profit & Loss

price or merket price whichever is lower. been later brought back to accounts to write off the subsequently.

account or the capital loss which the company incurred

of Partnership

3. W2sting Assets: Wasting assets such as mines, quarries, oil wells, etc. are At the time of Admission, Retirement or Death of a Partner in case

Wasting 2ssets are found in certain industries only. If we look at the terms of the offixed

n

decision

4.

goodwill is calculated and shown in the books when

Firms: In case of partnership firms,partner

case of Lee V. Nauchatel Asphalte Co. Ltd. (1889) it appears dies or retires.

that there is no neces a new partner is admitted or an old

provide depreciation on wasting assets. But as a matter ofprinciple, the theory verify it with the help of the agreement

case does not hold good. Wasting assets exhaust propoundel: In case ofpurchase of the business, the auditor should if the amount ofgoodwill is not

by working and hence the process in made with the vendor, which shows the price paid for it. However,

depletion of the capital employed. Hence, a charge should treated as the difference between the purchase price paid for the

capitalemployed so as to exhibit atrue and fair value of the necessarily be made to maintai Specifically mentioned, it is to be

assets for the purpos of costacon business and the net assets taken over.

Howeve. it is difficult to ascertain how much of the mine is goodwill account in the books of a

remains more. Hence, wasting assets are shown exhausted and how much m In case of revaluation of assets, which has raised the have been revalued. While in the

assets

provision is made for depreciation or depletion oninthethebasis

Balance Sheet at their original vaz company, the auditor should refer the basis on which the

brought back to write off capital loss or the

4. Fictitious Assets: of their estimated exhauston case of goodwill, which has been wnuten off but later investigate the period over which the goodwill

Fictitious assets are those assets. which are debit balance of Profit & Loss Account, he should

though, of course, money is spent on thern not physicaly should also ascertain the amount of goodwill. He should also see whether

in a new

company, special advertising The examples ofsuch assets are- preliminary e was written off. He

debtors as well as shareholders approved it by passing necessary resolutions in their meeting.

issue expenses, expenses, development expenses, debenture discout

of expenditure notdiscount on issue of shares, share issue the Partnership Deed. He may also verify the

expenses, etc. These items are1reallyi

represented by actual values and so have no In the case ofpartnersiip firm, he should verify

time time based on the provisions made in

to the

5.

Intangible Assets: Intangible assets exchange value. Cnanges made in the goodwi!| account from

in their concrete do not have

form However. thei they are not vs Partnership Deed.

assets. They 2re actually fixed I they are equally valuable for aform. Hence, concern like any 2) Patents

patents, copyTights, trademarks. , assets though they do not business

have any Concrete fom. Good gives an inventor exclusive right for years

to make, use

more or less treated as fixed assetselc.,for theare some of the examples ralent is an oflicial document, which The valuation basis must be

of this kind of assets. Th cost less depreciation.

purpose of sel nis invention. It must be valued at offin a period of20 years after which the right

valuation. Peclned in the Balance Sheet. It should be written

extended. He must note the period expired and the remaining

Onatically lapses unless the term is

142 VERIFICATIONI AND VALUATIONI OF ASSETS AND LIABILITIES 143

3 Wasting Asscts. VERIFICATION OF DIFFERENT TYPES OF ASSETS

Fictitious Assets.

5.1. Intangible Assets. We shallInow discuss the procedure, which the auditor

Fixed Assets: Fixed asscts arcthose assets, which are purchased for the pemanent ty

separately.

follows while verifying various assets

concerne

continuously used in the

he industrial

concems. They are

The utility of these asscts remains so long Earnings of he cone

as they

1. Fixed Assets

depend upon these assets.

condition. They are neither meant

for resale in the ordinary course of

business arenor in wot These assets are called capital assets. They are

ess They are not purchased for re-sale. We shallrequired permanently for the conduct of the

totally or partially in the business. consUr now analyse the verification of these assets.

furniture, etc. are some offthe examples of fixed, 1) Goodwill

Plant &machinery, land &building,

them, land is not subjected to depleion

fixed assets are valued at historical

in value and so it is usually vvalued at costp

value because they are acquired for

the

cost less a reasonable running

tpice. asThe's.o

of

Goódwill is an intangible asset. Itis the value of the reputation of the firm It

more than the normal rate of profit. It has no physical enables the firm to

and put to theiu repeated uses. They

and any fluctuation in their market value is

are valued at

not considered for their depreciFurther,

valuation.

value is also need not be taken into

abusite

ation wilta

,as

ale with use. It has the potentiality of self-growth. Itexistence

luillis calculated and shown in the Balance Sheet onlycan

as such. It does not diminish

be raised merely by book entries.

under the following

accountth,eye

going to be continuously used, their realisable

1 At the Time of its Purchase: The amount of circunstances:

2. Current Assets: Current assets are those assets, which can't be put

to the total purchase price paid for the business goodwill is equal to the ditference between

called as floating assets or circulating constant

assets. They are mtant for purchased.

and the net assets (i.e., Assets - liabilities)

They are also

either purchased or produced or processed for the purpose of sale. Closing resale.

stock, bills They a 2 At the Time of Revaluation of

Whole of

book debts, cash, bank balance, etc. are some of the examples of floating assets. receiab of their assets and raise goodwill account inAssets: Sometimes, companies revalue whole

Cuurrent

such as book debts, bills receivable, etc., are normally valued at book value. In case of book assa so raised will be shown in the Balance Sheet.

their books. In such cases also, the goodwill

a provision is made for bad and doubtful debts. Raw materials and semi-manufactured goods z 3. At the Time of Writing off the Capital Loss or the

Debit Balance of Profit & Loss

valued at cost. The closing stock ofgoods is valued at the date ofthe Balance Sheet eitherat Account: Sometimes, the goodwill acquired by the

price or market price whichever is lower. been later brought back to accounts to write of thecompany and written off as such has

debit balance in the

3. Wasting Assets: Wasting assets such as mines, quarries, oil wells, etc. are of fxed nohe account or the capital loss which the company incurTed subsequently. Profit & Loss

4. Atthe time of Admission, Retirement or Death of a

Wasting assets are found in certain industries only. If we look at the terms of the decision af

Firms: In case of partnership firms, goodwill is calculatedPartner in case of Partnership

case of Lee V. Nauchatel Asphalte Co. Ltd. (1889) it appears that there is no necessiy anew partner is admitted or an old partner dies or retires. and shown in the books when

provide depreciation on wasting assets. But as a matter of principle, the theory propounded in t

case does not hold good. Wa_ting assets exhaust by working and hence In case of purchase of the business, the auditor should verify it with the help

of

the process invoh

depletion of the capital employed. Hence, a charge should necessarily be made to maintain b made with the vendor, which shows the price paid forit. However, if the amount of the agreement

goodwill is not

capital employed so as to exhibit a true and fair value of he assets for the purpos of cost specifically mentioned, it is to be treated as the difference between the purchase price paid for the

accountra business and the net assets taken over.

However, it is difficult to ascertain how much of the mine is exhausted and how much mina

remains more. Hence, wasting assets are shown in the Balance Sheet at In case of revaluation of assets, which has raised the goodwill account in the books of a

their original value an company, the auditor should refer the basis on which the assets have been revalued While in the

provision is made for depreciation or depletion on the basis of their estimated

4. Fictitious Assets: Fictitious assets are

exhaustion. case of goodwill, which has been writen off but later brought back to write off capital loss or the

those assets, which are not physically visih, debit balance uf Profit &Loss Account, he should investigate the period over which the goodwill

though, of course, money is spent on them The

in a new company, special examples of such assets are- preliminary expensd was written off. He should also ascertain the amount of goodwill. He should also see whether

issue expenses, discount on advertising

issue of

expenses, development expenses, debenture discount debtors as wellas shareholders approved it by passing necessary resolutions in their meeting.

of expenditure not represented by shares, share issue expenses, etc. These items are realy a In the case of partnersiuipfirm, he should verify the Partnership Deed. He may also verify the

actual values and so have no exchange

5. Intangible Assets: value. Changes made in the goodwilaccount from time to time based on the provisions made in the

in their concrete form. Intangible assets do not have theiu form. Hence, they are Partnership Deed.

However, they are

assets. They are actually fixed assets equally valuable for a business concern like B

not

2) Patents

patents, though they do not bave any concrete form. ou

more or copyrights,

less treated astrademarks, etc., are some of the

fixed assets for the purpose of examples of this kind of assets. 109 Patent is an oticial document, which gives an inventor exclusive right for years to make, use

valuation. or sell his invention. It must be valued at cnst less depreciation. The valuation basis must be

Specified in the Balance Sheet. It should be written off in aperiod of 20 years afler which the right

auomatically lapses unless the term is extended. He must note the period expired and the remaining

You might also like

- Audit CapsuleDocument20 pagesAudit Capsulevishnuverma100% (1)

- Substantive Procedures For ReceivablesDocument3 pagesSubstantive Procedures For ReceivablesChristian PerezNo ratings yet

- Module 5 - Audit Process, Accepting An EngagementDocument9 pagesModule 5 - Audit Process, Accepting An EngagementMAG MAGNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Quarter 3 - Module 3: The Accounting EquationDocument22 pagesFundamentals of Accountancy, Business and Management 1: Quarter 3 - Module 3: The Accounting EquationMarissa Dulay - Sitanos92% (13)

- Audit of Trade Receivables and Sales BalancesDocument3 pagesAudit of Trade Receivables and Sales BalancesdidiaenNo ratings yet

- DocxDocument15 pagesDocxjhouvanNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Solutions Images Bingham 11-02-2010Document46 pagesSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- Unit 5. Verification and Valuation of Assets and LiabilitiesDocument16 pagesUnit 5. Verification and Valuation of Assets and LiabilitiesAmit PatelNo ratings yet

- Adobe Scan May 07, 2021Document22 pagesAdobe Scan May 07, 2021T.Gayatri Devi Guest FacultyNo ratings yet

- Unit 4 Verification and Valuation of Assets and LiabilitiesDocument54 pagesUnit 4 Verification and Valuation of Assets and LiabilitiesHIMANI PALAKSHANo ratings yet

- Unit Iii, IvDocument10 pagesUnit Iii, IvVeronica SafrinaNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Samaya CA Inter Audit Notes-1Document40 pagesSamaya CA Inter Audit Notes-1Deepika AnandhanNo ratings yet

- CA Inter (Chap. 1 To Chap. 13) Combine PDFDocument277 pagesCA Inter (Chap. 1 To Chap. 13) Combine PDFGunjan KelaNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- Group 5 - Assignment 5Document40 pagesGroup 5 - Assignment 5Rhad Lester C. MaestradoNo ratings yet

- AuditDocument3 pagesAuditSushant MagdumNo ratings yet

- Accounts TitleDocument1 pageAccounts TitlenovyNo ratings yet

- Ais Fraud-Case StudyDocument3 pagesAis Fraud-Case StudyErica AlimpolosNo ratings yet

- Masalah Bukti Dan Pembuktian Dalam Audit Serta Kertas Kerja PemeriksaanDocument39 pagesMasalah Bukti Dan Pembuktian Dalam Audit Serta Kertas Kerja PemeriksaanMalinda KharistaNo ratings yet

- Sales Procedure: Internal Control (COSO) Internal Control WeaknessDocument2 pagesSales Procedure: Internal Control (COSO) Internal Control WeaknessPaul Christian Lopez FiedacanNo ratings yet

- Vouching: Manipulation of GoodsDocument3 pagesVouching: Manipulation of GoodsNevidita BhengraNo ratings yet

- Verification of Assets and Liabilities: Basic ConceptsDocument59 pagesVerification of Assets and Liabilities: Basic ConceptsHarikrishnaNo ratings yet

- Acctng 9.4 Substantive Tests of Assets (Summary)Document6 pagesAcctng 9.4 Substantive Tests of Assets (Summary)03LJNo ratings yet

- Audit AssertionsDocument1 pageAudit AssertionsDevice Factory UnlockNo ratings yet

- Audit of Trade Receivables and Sales BalancesDocument2 pagesAudit of Trade Receivables and Sales BalancesDiane VillarmaNo ratings yet

- Auditing Assignment-2 Submitted To Keerti Mam Submitted by Bhavna PathakDocument9 pagesAuditing Assignment-2 Submitted To Keerti Mam Submitted by Bhavna PathakBhavnaNo ratings yet

- Intangible Assets: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument1 pageIntangible Assets: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNo ratings yet

- Verification of Assets and LiabilitiesDocument51 pagesVerification of Assets and Liabilitiessherly joiceNo ratings yet

- Substantive ProcedureDocument8 pagesSubstantive ProcedureGoldaNo ratings yet

- Audit of Trade Receivables and Sales BalancesDocument3 pagesAudit of Trade Receivables and Sales BalancesdidiaenNo ratings yet

- Audit of Trade Receivables and Sales BalancesDocument3 pagesAudit of Trade Receivables and Sales BalancesdidiaenNo ratings yet

- Unit 4 VouchingDocument22 pagesUnit 4 VouchingAmit PatelNo ratings yet

- Audit Procedur ES Cash Accounts Receivable Accounts Payable InventoryDocument2 pagesAudit Procedur ES Cash Accounts Receivable Accounts Payable InventoryRoseyy GalitNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Unit-4 Vouching-And-Verification PDFDocument25 pagesUnit-4 Vouching-And-Verification PDFShraddhanjali NayakNo ratings yet

- ICAB & ICAEW: 225) : Worked Example: Non-Current Asset Assurance EngagementDocument4 pagesICAB & ICAEW: 225) : Worked Example: Non-Current Asset Assurance EngagementFozle Rabby 182-11-5893No ratings yet

- Jun PDFDocument20 pagesJun PDFCA Guru MadevuNo ratings yet

- 358763050Document15 pages358763050kristelle0marisseNo ratings yet

- VERIFICATIONDocument4 pagesVERIFICATIONHamxa AlyNo ratings yet

- Notes Internal IIDocument15 pagesNotes Internal IIRahil JainNo ratings yet

- Revision Notes Towards Jan 2022 ExamDocument28 pagesRevision Notes Towards Jan 2022 ExamDiana GajuNo ratings yet

- Auditing CaseDocument5 pagesAuditing CaseBright AntonyNo ratings yet

- Gathering Appropriate Audit Evidence: by Laura Morgan, Examiner - Professional 2 Audit PracticeDocument4 pagesGathering Appropriate Audit Evidence: by Laura Morgan, Examiner - Professional 2 Audit PracticeGodfrey MakurumureNo ratings yet

- Audit Assertions For Loans Receivables An SCRDocument12 pagesAudit Assertions For Loans Receivables An SCRHygie AlocodNo ratings yet

- SVFC BS Accountancy1Document29 pagesSVFC BS Accountancy1Lorraine TomasNo ratings yet

- Auditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsDocument6 pagesAuditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsHarutraNo ratings yet

- Account Assertion Audit Procedure Money Market PaperDocument1 pageAccount Assertion Audit Procedure Money Market PaperTrisha Mae RodillasNo ratings yet

- Improving The Conduct of Compulsory Auditing On The Basis of International Auditing StandardsDocument6 pagesImproving The Conduct of Compulsory Auditing On The Basis of International Auditing StandardsEditor IJTSRDNo ratings yet

- Chapter 9 Audit of Investing CycleDocument11 pagesChapter 9 Audit of Investing CycleconsulivyNo ratings yet

- Verification of AssetsDocument27 pagesVerification of Assetsmehakrotra256No ratings yet

- Meaning, Scope, Origin of AuditingDocument15 pagesMeaning, Scope, Origin of AuditingpoojaNo ratings yet

- Basic: Unit 1 ConceptsDocument8 pagesBasic: Unit 1 ConceptsUtkarshNo ratings yet

- Ifthekhae 3cbcd Ay 18-19Document14 pagesIfthekhae 3cbcd Ay 18-19Sneha ChavanNo ratings yet

- Ican b2 Aa Mock As 2019 v2Document15 pagesIcan b2 Aa Mock As 2019 v2demshubedada472No ratings yet

- Audit Term Paper 2Document3 pagesAudit Term Paper 2Yani IanNo ratings yet

- T A T I: Investing Cycle Learning ObjectivesDocument15 pagesT A T I: Investing Cycle Learning ObjectivesAngelo PayawalNo ratings yet

- (Auditing Theory) - Midterm ReviewerDocument8 pages(Auditing Theory) - Midterm ReviewerPenryu LeeNo ratings yet

- Business Processes - Part 2Document17 pagesBusiness Processes - Part 2Malinda NayanajithNo ratings yet

- Module 1: Introduction To Auditing in A Computer Infromation System EnvironmentDocument5 pagesModule 1: Introduction To Auditing in A Computer Infromation System EnvironmentYani IanNo ratings yet

- QUESTION 11 - Financial Statements (CAF1 A16)Document6 pagesQUESTION 11 - Financial Statements (CAF1 A16)Jona FranciscoNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Business Combi Part 1Document20 pagesBusiness Combi Part 1Rica Joy RuzgalNo ratings yet

- Assignment Far 110 UitmDocument56 pagesAssignment Far 110 UitmFarah HusnaNo ratings yet

- TCS Data SheetDocument90 pagesTCS Data SheetKrina ParekhNo ratings yet

- Balance Sheet of Sun TV NetworkDocument2 pagesBalance Sheet of Sun TV NetworkMehadi NawazNo ratings yet

- Tutorial 7 - Problem 7Document3 pagesTutorial 7 - Problem 7Joe DicksonNo ratings yet

- Cabutotan Jennifer 2ADocument12 pagesCabutotan Jennifer 2AJennifer Mamuyac CabutotanNo ratings yet

- Third Quiz For FABM2 (On Adjusting, Closing, and Reversing Entries)Document2 pagesThird Quiz For FABM2 (On Adjusting, Closing, and Reversing Entries)SITTIE RAYMAH ABDULLAHNo ratings yet

- Others Important Terms: LiabilitiesDocument5 pagesOthers Important Terms: LiabilitiesLegacy GuptaNo ratings yet

- Franchise AccountingDocument16 pagesFranchise AccountingJi YuNo ratings yet

- CV GJL - Cokorda Istri Trisna Dewi PemayunDocument15 pagesCV GJL - Cokorda Istri Trisna Dewi PemayunMichael SoindemiNo ratings yet

- Eeff Kallpa q2-2023Document25 pagesEeff Kallpa q2-2023carlos cribilleroNo ratings yet

- Accounting Lecture 3Document5 pagesAccounting Lecture 3Anabel PhamNo ratings yet

- Template Jawaban UTS Aplikasi Audit Ganjil 20Document14 pagesTemplate Jawaban UTS Aplikasi Audit Ganjil 20Steven TanNo ratings yet

- ACCT 2001 Exam 2 Review ProblemsDocument11 pagesACCT 2001 Exam 2 Review Problemsdpa7020No ratings yet

- BFIN AssignDocument3 pagesBFIN AssignFiona Antoinette BesaNo ratings yet

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDocument12 pagesA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagargmb117No ratings yet

- CH 05Document99 pagesCH 05Reinch Closs100% (1)

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- ACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsDocument2 pagesACCT 1005 Worksheet 1 Selected Solutions 2016 Practice QuestionsChan SynergisticNo ratings yet

- Far Reviewer - Bale (Millan)Document27 pagesFar Reviewer - Bale (Millan)Chiee Takahashi100% (1)

- PTAccountingDocument13 pagesPTAccountingLAN ONLINENo ratings yet

- Corp. AccountingDocument214 pagesCorp. Accountingayxan0013No ratings yet

- Instruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedDocument2 pagesInstruction: 1. Closed Book Exam 2. Use Calculator For All Calculations Use of Laptop/Mobile Is Not AllowedPalak MendirattaNo ratings yet

- Final Exam in Fundamental of Accounting, Business and Management 2 Grade 12 Name: - Date: - Section: - ScoreDocument2 pagesFinal Exam in Fundamental of Accounting, Business and Management 2 Grade 12 Name: - Date: - Section: - ScoreLeylaNo ratings yet

- 3310-Ch 10-End of Chapter solutions-STDocument30 pages3310-Ch 10-End of Chapter solutions-STArvind ManoNo ratings yet

- Ia3 CH1Document3 pagesIa3 CH1Reen DomingoNo ratings yet