Professional Documents

Culture Documents

Sweden - SME Fact Sheet 2023

Uploaded by

turkay17Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sweden - SME Fact Sheet 2023

Uploaded by

turkay17Copyright:

Available Formats

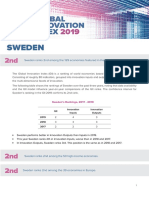

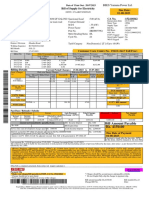

2023 SME COUNTRY FACT SHEET

SWEDEN

Brief introduction

SME DEVELOPMENT 2021-2022

• In 2022, SMEs in Sweden continued their recovery, with SME valued added growing by

2.8% and SME employment increasing by 1.2%. However, as value added growth is not NUMBER OF

adjusted for inflation, in the high-inflation environment of 2022, growth in real terms has been ENTERPRISES +1.5%

lower.

• The Proximity, Social Economy & Civil Security ecosystem, for example, is one of the few NUMBER OF

ecosystems in Sweden that generated significant growth in SME employment in both 2021 PERSONS

EMPLOYED

+1.2%

(3.7%) and 2022 (5.3%). SME value added in this industrial ecosystem also grew, by 9.1%

in 2021 and by 1.2% in 2022. Please note that value added growth is not adjusted for

inflation.

• In 2023, it is expected that SME value added in Sweden will continue to grow by 0.3% but

VALUE ADDED +2.8%

SME employment is expected to decline by 0.3%. Please note that value added growth SMEs in the ‘non-financial business sector’. Estimates produced by JRC.

forecasts are not adjusted for inflation.

ENTERPRISES

ENTERPRISES PERSONS

PERSONS EMPLOYED

EMPLOYED VALUE ADDED

VALUE ADDED

NUMBER SHARE NUMBER SHARE € BILLION SHARE

SMEs 681 183 99.8% 1 868 605 56.2% 135.7 47.4%

(0 -249 persons employed)

LAR GE EN T ER PRI S E S 43.8% 52.6%

1 425 0.2% 1 458 951 150.6

(250+ pers ons em pl oy ed)

The data for 2022 are estimates produced by JRC, based on 2008-2020 figures from national and Eurostat databases.

SME-RELATED STRENGTHS AND CHALLENGES

SME-RELATED STRENGTHS AND CHALLENGES

KEY STRENGTHS KEY CHALLENGES

• Sweden proposes a conducive business environment for firms and • The biggest long-term barrier to investment that Swedish firm highlighted

entrepreneurs. In the 2022 IMD World Competitiveness Ranking, in the 2022 EIB Investment Survey is the availability of skilled staff (90%).

Sweden ranks in 4th place (but losing 2 places compared to 2021). The lack of skilled workers is disproportionately affecting SMEs,

Sweden’s high position in the ranking is secured by its very good hampering their growth and productivity.

performance on business efficiency and infrastructure indicators. • According to the 2023 Country Report, labour shortages of digital experts

• According to the 2022 EIB Investment Survey, business regulation is are particularly problematic. More action is needed to increase the pool

much less of an obstacle for firms in Sweden than in average for the of those experts. Estimates indicate that Sweden will have a shortage of

firms in the EU, with only 9.2% of Swedish firms reporting business 70,000 ICT specialists by 2024.

regulation as an obstacle to long-term investment compared to the EU • On connectivity, while Sweden still ranks high comparatively to the rest

average of 28%. of the EU, the 2022 Digital Economy and Society Scoreboard indicates

• Access to finance conditions in Sweden remain good. While the that the country has fallen back to 9th place and is below the EU average

country’s EIF loan index in 2021 was slightly below the EU average on 5G coverage. It has also fallen back to 9th place for digital public

and on a continuous declining trend, the equity index remained services.

increasing and well above the EU average (1 in 2021 compared to the • The Single Market Scoreboard shows that the participation of Swedish

EU average of 0.23). SMEs in public procurement is substantially lower than the EU average.

• According to the JRC Pitchbook data, a steep increase trend has been In 2021, only 27% of bids came from SMEs in Sweden whereas the EU

observed in venture capital investments in climate tech start-ups and average was 70.15%.

scale-ups, with EUR 2.9 billion in 2021 compared to 0.78 in 2020 (39%

of total venture capital investments in 2021, compared to 23.7% in

2020).

OTHER KEY SME-RELATED BRIEF INSIGHTS

The 2022 Digital Economy and Society Scoreboard shows Swedish SMEs perform above the EU average on

that Sweden has the highest proportions of SMEs with at environmental measures. According to the data from

least basic level of digital intensity (86%) and enterprises the 2021 Eurobarometer survey, more Swedish SMEs

using cloud services (69%) in the EU. 19% of enterprises have taken resource-efficiency measures, offered

analyse big data and 10% of enterprises use artificial green products or services and invested in clean

intelligence technologies, which puts Sweden above the technologies than the EU average. However, the

EU average. Sweden is one of the leaders in the EU when percentage of SMEs that have benefited from public

it comes to SMEs selling online (33%) and total turnover support measures for their production of green products

from e-commerce (19%). is lower in Sweden (20.4%) than the EU average

The SME Performance Review monitors SME-related developments across the EU. (29.1%).

For more information, please see: https://ec.europa.eu/growth/smes/sme-strategy/performance-review_en

You might also like

- Greece - SME Fact Sheet 2023Document1 pageGreece - SME Fact Sheet 2023turkay17No ratings yet

- Croatia - SME Fact Sheet 2022Document1 pageCroatia - SME Fact Sheet 2022Lino LamNo ratings yet

- Italy - SME Fact Sheet 2023Document1 pageItaly - SME Fact Sheet 2023turkay17No ratings yet

- Germany - SME Fact Sheet 2022Document1 pageGermany - SME Fact Sheet 2022Lino LamNo ratings yet

- Hungary - SME Fact Sheet 2022Document1 pageHungary - SME Fact Sheet 2022Lino LamNo ratings yet

- Greece - SME Fact Sheet 2022Document1 pageGreece - SME Fact Sheet 2022Lino LamNo ratings yet

- Poland - SME Fact Sheet 2022Document1 pagePoland - SME Fact Sheet 2022Lino LamNo ratings yet

- Slovakia - SME Fact Sheet 2022Document1 pageSlovakia - SME Fact Sheet 2022Lino LamNo ratings yet

- Bosnia Bih - Sme Fact Sheet 2021Document1 pageBosnia Bih - Sme Fact Sheet 2021DIAN FAJARIKANo ratings yet

- 2023 141 Startups and Scaleups in The Oslo Region 2023Document35 pages2023 141 Startups and Scaleups in The Oslo Region 2023veda.norwayNo ratings yet

- Sweden - 2018 Fact SheetDocument20 pagesSweden - 2018 Fact SheetMudassar_JadoonNo ratings yet

- Annual Report Imexhs 2022 1Document95 pagesAnnual Report Imexhs 2022 1Eduardo RodriguezNo ratings yet

- EDB Annual Report 2021-22Document14 pagesEDB Annual Report 2021-22RajatNo ratings yet

- 218825965MOFSL Annual-Report 2022Document370 pages218825965MOFSL Annual-Report 2022Mayank SinhaNo ratings yet

- Nespresso CaseDocument9 pagesNespresso CaseScribdTranslationsNo ratings yet

- Marine Electricals Annual Report 2022Document261 pagesMarine Electricals Annual Report 2022Hazem AhmedNo ratings yet

- Homeboyz FR2022Document1 pageHomeboyz FR2022Zidane GimigaNo ratings yet

- Sweden: Sweden Ranks 2nd Among The 129 Economies Featured in The GII 2019Document9 pagesSweden: Sweden Ranks 2nd Among The 129 Economies Featured in The GII 2019AnnaNo ratings yet

- 2012 Property and Constrution Industry 2012Document110 pages2012 Property and Constrution Industry 2012mestre51No ratings yet

- MIDA Newsletter December 2020 FINALDocument28 pagesMIDA Newsletter December 2020 FINALbicarahidup98No ratings yet

- Total Factor Productivity For Major Industries - 2022Document15 pagesTotal Factor Productivity For Major Industries - 2022Novica SupicNo ratings yet

- Atos Annual Results 2021Document28 pagesAtos Annual Results 2021Anand TajneNo ratings yet

- Motilal Oswal FinancialDocument393 pagesMotilal Oswal FinancialReTHINK INDIANo ratings yet

- 2022 - Kick-Off Meeting - Presentation VersionDocument32 pages2022 - Kick-Off Meeting - Presentation VersionCindy CinintyaNo ratings yet

- Taxing Wages BrochureDocument16 pagesTaxing Wages BrochureRuben HutabaratNo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- CI T 2Q22 Earnings DeckDocument23 pagesCI T 2Q22 Earnings DeckMARCUS LUZNo ratings yet

- Reporte Anual Empresa Electrica Dominica 2020Document60 pagesReporte Anual Empresa Electrica Dominica 2020rubenpeNo ratings yet

- MRSD Report On Wage Practices 2020Document32 pagesMRSD Report On Wage Practices 2020felixkerNo ratings yet

- 183677Document172 pages183677asad.muraniNo ratings yet

- Raport Startup-Uri CEE 2022Document66 pagesRaport Startup-Uri CEE 2022start-up.roNo ratings yet

- Salary Guide 2022 PK NgheNhanSuVietNamDocument73 pagesSalary Guide 2022 PK NgheNhanSuVietNamDuyen DoNo ratings yet

- Spain Is A Moderate InnovatorDocument1 pageSpain Is A Moderate InnovatorAlinaAltynguzhinaNo ratings yet

- An Inclusive Ecosystem of Progress: 1,25,951 One of The LargestDocument1 pageAn Inclusive Ecosystem of Progress: 1,25,951 One of The LargestPapu SahooNo ratings yet

- MediaProjectPortsInvestorInvestor DownloadsAnnual ReportFY23 PDFDocument719 pagesMediaProjectPortsInvestorInvestor DownloadsAnnual ReportFY23 PDFpratham.mishra1809No ratings yet

- APAC Construction Forecast 2022Document28 pagesAPAC Construction Forecast 2022hrsimtyzNo ratings yet

- Tata ElxsiDocument34 pagesTata Elxsijameelk786No ratings yet

- B&FS Salary Survey 2024Document22 pagesB&FS Salary Survey 2024Pham Hai YenNo ratings yet

- Special Economix Zone LodzDocument18 pagesSpecial Economix Zone Lodzdata commNo ratings yet

- MPRC Ogse100 Fy2021 - 1Document52 pagesMPRC Ogse100 Fy2021 - 1Sathia ShekarNo ratings yet

- Nel1123 Our Economy 2021 FinalDocument25 pagesNel1123 Our Economy 2021 FinalWing CrabNo ratings yet

- CroatiaDocument1 pageCroatiaTea KalinićNo ratings yet

- International Practise TestingDocument6 pagesInternational Practise TestingchandoraNo ratings yet

- ECON1269 ASM1 SGS06 Team07-1Document16 pagesECON1269 ASM1 SGS06 Team07-1Duy BuiNo ratings yet

- National In-Country Value Program Suppliers SessionsDocument19 pagesNational In-Country Value Program Suppliers SessionsCharles EvansNo ratings yet

- 15e06 04 November 2022Document4 pages15e06 04 November 2022DendukuriPrudhviNo ratings yet

- Presentation For Telia - 21 STRDocument21 pagesPresentation For Telia - 21 STRStefanMladenoskiNo ratings yet

- Robi Axiata Limited: Q2 2021 ResultsDocument20 pagesRobi Axiata Limited: Q2 2021 ResultsNiamul HasanNo ratings yet

- Poland: Priorities Supported by IndicatorsDocument2 pagesPoland: Priorities Supported by IndicatorsPengais HarahapNo ratings yet

- 2022 ReportDocument27 pages2022 ReportHaiyun ChenNo ratings yet

- The Effects of Globalisation On Labour Markets, Productivity and InflationDocument27 pagesThe Effects of Globalisation On Labour Markets, Productivity and InflationAmar Kumar JhaNo ratings yet

- Tech & Data UK Salary Guide 2022Document12 pagesTech & Data UK Salary Guide 2022Harley JustNo ratings yet

- Covestro Overview Key DataDocument9 pagesCovestro Overview Key DataTobias JankeNo ratings yet

- Startups and Scaleups in The Oslo Region 2022 1Document34 pagesStartups and Scaleups in The Oslo Region 2022 1Dragutin VujovicNo ratings yet

- Technology: IndiaDocument9 pagesTechnology: IndiabradburywillsNo ratings yet

- DSInnovate MSME Empowerment Report 2021Document51 pagesDSInnovate MSME Empowerment Report 2021juniarNo ratings yet

- Annual Report 2021Document137 pagesAnnual Report 2021Mandisi MoyoNo ratings yet

- 1 s2.0 S1544612322004342 MainDocument9 pages1 s2.0 S1544612322004342 MainAgung PurwokoNo ratings yet

- D.O. No. 20-63 - Revised Guidelines For The Implementation of LSP-NSB (Change Indicator)Document9 pagesD.O. No. 20-63 - Revised Guidelines For The Implementation of LSP-NSB (Change Indicator)Mark Kennedy AbedesNo ratings yet

- Freddie Addaer Go CrazyDocument11 pagesFreddie Addaer Go CrazyfreddieaddaeNo ratings yet

- Lecture - Basic Concepts in Supply Chain ManagementDocument23 pagesLecture - Basic Concepts in Supply Chain Managementtimesave240No ratings yet

- Various Interests in Chinese Trade and First WarDocument15 pagesVarious Interests in Chinese Trade and First WarDhruv Aryan KundraNo ratings yet

- Internship Project Report" OnDocument60 pagesInternship Project Report" OnDiksha Sawhney80% (5)

- Part III - Accounting UnitDocument16 pagesPart III - Accounting Unitmoshi kpop cartNo ratings yet

- Review of Related Literature and StudiesDocument14 pagesReview of Related Literature and StudiesAtasha MarLi IbbotsonNo ratings yet

- Comparative Analysis of Multi-Domestic Strategy of P&G and Unilever CorporationDocument5 pagesComparative Analysis of Multi-Domestic Strategy of P&G and Unilever CorporationHUONG NGUYEN VU QUYNHNo ratings yet

- Savings Account - 32320100005638 Shaik MD Khadeer AhamedDocument4 pagesSavings Account - 32320100005638 Shaik MD Khadeer AhamedKhadeer AhamedNo ratings yet

- Husky Brochure EnglishDocument26 pagesHusky Brochure EnglishPandega DewantoNo ratings yet

- Auto Brics PP PDFDocument57 pagesAuto Brics PP PDFAnonymous RoJQVhSbw100% (1)

- Change of CharactorDocument11 pagesChange of Charactorgovind bhosleNo ratings yet

- Departmental Accounts PDFDocument41 pagesDepartmental Accounts PDFAryan ChoudharyNo ratings yet

- Raju N Print Udyam Registration CertificateDocument3 pagesRaju N Print Udyam Registration CertificateOmkar kaleNo ratings yet

- Unit 6 InflationDocument26 pagesUnit 6 InflationdawsonNo ratings yet

- Letter of Introduction To The Executive Governor of Kano StateDocument1 pageLetter of Introduction To The Executive Governor of Kano StateA&A CYBER CAFE LIMITEDNo ratings yet

- BMAK Lectures III Part4Document51 pagesBMAK Lectures III Part4theodoreNo ratings yet

- External Exam On Sale Deed - LAW 469Document8 pagesExternal Exam On Sale Deed - LAW 469raj vardhan agarwalNo ratings yet

- Services Marketing: Jashandeep Singh, PHDDocument103 pagesServices Marketing: Jashandeep Singh, PHDmannatNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingIrtiza HaiderNo ratings yet

- UNite America PACDocument96 pagesUNite America PACPat PowersNo ratings yet

- BAM 040 - TG #8B (Quiz 2)Document5 pagesBAM 040 - TG #8B (Quiz 2)mkrisnaharq99No ratings yet

- JUL 23 Shiv Chamber BillDocument1 pageJUL 23 Shiv Chamber BillZubair SiddiquiNo ratings yet

- The Impact of Instability in The Business Environment On The Competitiveness of Enterprises Using The Example of The Apparel IndustryDocument24 pagesThe Impact of Instability in The Business Environment On The Competitiveness of Enterprises Using The Example of The Apparel IndustryCHARUVI RANJANNo ratings yet

- Iso 50005 - 2021Document51 pagesIso 50005 - 2021Lilia LiliaNo ratings yet

- Identify and Discuss Direct TaxDocument7 pagesIdentify and Discuss Direct Taxsamuel asefaNo ratings yet

- SIM-42 B Oriental Bank of Commerce Stock StatementDocument4 pagesSIM-42 B Oriental Bank of Commerce Stock StatementkapilgsmNo ratings yet

- Multiplier and IS-LM ModelDocument49 pagesMultiplier and IS-LM ModelPRATIKSHA KARNo ratings yet

- P12 TugasDocument5 pagesP12 TugasAnti HeryantiNo ratings yet

- 22BSPHH01C1021 - Sandip Kumar BhuyanDocument45 pages22BSPHH01C1021 - Sandip Kumar BhuyanRoshni BeheraNo ratings yet