Professional Documents

Culture Documents

Practice Question 2-1

Practice Question 2-1

Uploaded by

moeid477Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Question 2-1

Practice Question 2-1

Uploaded by

moeid477Copyright:

Available Formats

Practice Question 2

Question One

1. Assume that Borama City collects property taxes for its own purpose as well as

for the towns of Saylac and the total property tax levy for 2021 are as follows:

Borama City 800,000 86.96%

Saylac City 120,000 13.04%

Totals $920,000 100%

2. $480,000 of the tax levy is collected during the 1st quarter of 2021.

3. Borama City charges to Saylac City a fee of 6 percent of taxes collected.

4. Taxes collected were distributed to the respective governmental units.

Required: Prepare respective Journal entries for Borama and Saylac Cities?

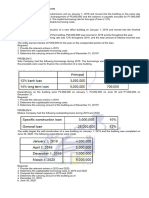

Question Two

To illustrate accounting for capital project funds, assume the city of Berbera plans to

build $600,000 Bridge. The project will begin in 2018 and is to be completed in 2019.

The following are the events that occur during the construction of the bridge:

1. A $600,000, 6% general obligation bond issue and received a cash of $620,000.

2. The bond premium is transferred to the debt service fund.

3. A contract is signed for a construction company at an estimated cost of

$500,000.

4. A partial billing is received from the contractor for $450,000.

5. The contractor is paid.

6. Books for 2018 are closed

7. The encumbrances are reinstated at the beginning of 2019.

8. The additional construction contract is signed with the contractor at a cost of

$158,000.

9. The contract is completed in 2019.

10. The construction is accepted and the contractor is paid.

11. The residual balance is transferred to the debt service funds.

12. Books for 2019 are closed.

Instruction: Prepare Journal Entries?

Page 1

You might also like

- Final Taxation PreboardDocument14 pagesFinal Taxation PreboardEmerita Modesto25% (4)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Acctng Reviewer 1Document19 pagesAcctng Reviewer 1alliahnah50% (2)

- Module 13 Notes Payable - Debt ResructuringDocument10 pagesModule 13 Notes Payable - Debt ResructuringryanNo ratings yet

- Financial Accounting and Reporting: 1 Open Preboard Examination, Batch 3Document14 pagesFinancial Accounting and Reporting: 1 Open Preboard Examination, Batch 3Merliza JusayanNo ratings yet

- Acco 30033 q3 - Ma'Am LizDocument7 pagesAcco 30033 q3 - Ma'Am LizNicah AcojonNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The Question. Strictly No Erasures AllowedDocument12 pagesIdentify The Choice That Best Completes The Statement or Answers The Question. Strictly No Erasures AllowedErwin Labayog MedinaNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- AssignmentDocument1 pageAssignmentAbdifatah AbdilahiNo ratings yet

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Practice Set # 7B: Long-Term Construction ContractsDocument2 pagesPractice Set # 7B: Long-Term Construction ContractsRey Joyce AbuelNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Exercises - Wasting Assets, Borrowing Costs, and Government GrantsDocument3 pagesExercises - Wasting Assets, Borrowing Costs, and Government GrantsMeeka CalimagNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Accounting For Borrowing Costs and GG ProblemsDocument2 pagesAccounting For Borrowing Costs and GG ProblemsRenalyn Ps MewagNo ratings yet

- CPAR - 91 - AFAR First Preboard ExamDocument18 pagesCPAR - 91 - AFAR First Preboard ExamAllyson VillalobosNo ratings yet

- Borrowing CostsDocument1 pageBorrowing CostsJulliena BakersNo ratings yet

- Final Xam BAC 212 BAF 112Document3 pagesFinal Xam BAC 212 BAF 112Prince-SimonJohnMwanzaNo ratings yet

- A. Technical MalversationDocument8 pagesA. Technical MalversationDinosaur Korean100% (1)

- ADJUSTING AND CLOSING ENTRIES Assignment Nov 20 2020Document2 pagesADJUSTING AND CLOSING ENTRIES Assignment Nov 20 2020Kayle MallillinNo ratings yet

- Income Taxes Batch 4 (Repaired)Document10 pagesIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoNo ratings yet

- LTCC SeatworkDocument2 pagesLTCC SeatworkCaselyn Clyde UyNo ratings yet

- Icare Batch 6 Joshua 1 Preboard AFARDocument17 pagesIcare Batch 6 Joshua 1 Preboard AFARRica Mae TestaNo ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- PartnershipDocument2 pagesPartnershiplearningcantstop561No ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- Longterm Conat QuizDocument3 pagesLongterm Conat QuizKurtNo ratings yet

- Quiz 2nd YearDocument4 pagesQuiz 2nd YearJeryco Quijano BrionesNo ratings yet

- Chapter-9 ReviewDocument2 pagesChapter-9 ReviewColeen BiocalesNo ratings yet

- AP 2001 - Students PDFDocument15 pagesAP 2001 - Students PDFdave excelleNo ratings yet

- Level 4 ThoeryDocument25 pagesLevel 4 ThoeryEdomNo ratings yet

- AnswerQuiz - Module 6Document4 pagesAnswerQuiz - Module 6Alyanna Alcantara100% (1)

- Toaz - Info Afar Reviewer PRDocument10 pagesToaz - Info Afar Reviewer PRLiliNo ratings yet

- FA Adjusting Entries ReviewDocument11 pagesFA Adjusting Entries ReviewNicka MinasNo ratings yet

- Tutorial Set 4 2018Document5 pagesTutorial Set 4 2018fa6604711No ratings yet

- Modul 4 - Pengakuan Pendapatan-1Document3 pagesModul 4 - Pengakuan Pendapatan-1Anis RahmawatiNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Intacc1 PrelimDocument5 pagesIntacc1 PrelimSarah Del RosarioNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Level 4 Thoery-1Document25 pagesLevel 4 Thoery-1EdomNo ratings yet

- Section A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)Document11 pagesSection A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)wainikitiraculeNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- Atok Benguet Source3 PDFDocument4 pagesAtok Benguet Source3 PDFkaye carrancejaNo ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionsnoumantamilNo ratings yet

- AFAR-03 Revenue RecognitionDocument3 pagesAFAR-03 Revenue RecognitionRamainne RonquilloNo ratings yet

- Icare Far First Preboard Examinations Batch 3Document14 pagesIcare Far First Preboard Examinations Batch 3Merliza Jusayan100% (1)

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Prae03 HoDocument3 pagesPrae03 HoDiane MagnayeNo ratings yet

- NU - Correction of Errors Single Entry Cash To AccrualDocument8 pagesNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNo ratings yet

- Problems Problem 9-1 (ACP)Document11 pagesProblems Problem 9-1 (ACP)Emey Calbay33% (3)

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Bacc 233 Assignment 1 Jan-June 2023Document3 pagesBacc 233 Assignment 1 Jan-June 2023emmanuel.mazivireNo ratings yet