Professional Documents

Culture Documents

Ia3 Milan Chap 1 2

Ia3 Milan Chap 1 2

Uploaded by

BENILDA CAMASO0 ratings0% found this document useful (0 votes)

24 views100 pagesOriginal Title

Scribd.vdownloaders.com Ia3 Milan Chap 1 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views100 pagesIa3 Milan Chap 1 2

Ia3 Milan Chap 1 2

Uploaded by

BENILDA CAMASOCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 100

TABLE OF CONTENTS

CHAPTER 1

STATEMENT OF FINANCIAL POSITION.

FINANCIAL STATEMENTS

ComPLETE SET OF FINANCIAL STATEMENTS...

GENERAL FEATURES OF FINANCIAL STATEMENTS

‘Additional Statement of financial position

STRUCTURE AND CONTENT OF FINANCIAL STATEMENTS.

STATEMENT OF FINANCIAL POSITION

PRESENTATION ...

CURRENT ASSETS AND CURRENT LIABILITIE:

Refinancing agreement.

Liabilities payable on demand .

CHAPTER 1: SUMMARY...

PROBLEMS...

CHAPTER 2

STATEMENT OF COMPREHENSIVE INCOME...

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME,

PROFIT OR LOSS

Extraordinary items

Presentation of Expenses .

OTHER COMPREHENSIVE INCOME (OCI;

Reclassification Adjustments

Presentation of OCI.

TOTAL COMPREHENSIVE INCOME.

ADDITIONAL ILLUSTRATION

CHAPTER 2: SUMMARY.

PROBLEM!

Scanned with CamScanner

CHAPTER 3

REVENUE FROM CONTRACTS WITH CUSTOMERS.

REVENUE RECOGNITION ,.

Step 1: Identify the contract with the customer

Combination of contracts...

Step 2: Identify the performance obligations in the contract ..

Step 3: Determine the transaction price

Step 4: Allocate the transaction price to the performance

obligations ..

Step 5: Recognize revenue when (or as) the entity sati

performance obligation

Performance obligations satisfied over time..

Performance obligations satisfied at a point in time

APPLICATIONS OF BASIC CONCEPTS:

CONTRACT COSTS:

PRESENTATION.

Customers’ unexercised rights

ADDITIONAL CONCEPTS RELATED TO STEP

Warranties ..

Principal versus Agent considerations.

Consignment arrangements

Customer options for additional goods or service:

Customer loyalty programs...

Non-refundable upfront fees....

‘ADDITIONAL CONCEPTS RELATED TO STEP.

Variable consideration

Discounts..

Sale with a right of return.

Non-cash consideration

Consideration payable to a customer.

ADDITIONAL CONCEPTS RELATED TO STEP

Bill-and-hold arrangement:

Lay-away sale.. 174

Repurchase agreements 174

CONTRACT MODIFICATIONS .. 176

Scanned with CamScanner

viti

CHANGES IN THE TRANSACTIO

Cuapten 3; SUMMARY

PROBLEMS...

179

186

CHAPTER 4

NON-CURRENT ASSETS HELD FOR SALE

DISCONTINUED OPERATIONS...

CLASSIFICATION AS HELD FOR SALE ..

CONDITIONS FOR CLASSIFICATION AS HELD FOR SALE ..

Exception to the one-year requirement

EXCLUSIVE VIEW OF SUBSEQUENT DISPOSAL...

EVENT AFTER THE REPORTING PERIOD.

PROPERTY DIVIDENDS ..

NON-CURRENT ASSETS THAT ARE TO BE ABANDONED

MEASUREMENT ..

Changes in fair value less costs to sell.

Depreciation and amortization

Disposal group...

CHANGES TO A PLAN OF SALE...

REMOVAL OF AN INDIVIDUAL ASSET OR LIABILITY FROM A DISP(

DISCONTINUED OPERATIONS ...

Presentation of discontinued operations....

Gains or losses on disposal of discontinued operation:

Direct costs associated to decision to dispose a component..

Retrospective application...

PRESENTATION IN THE STATEMENT OF FINANCIAL POSITIOI

CESSATION OF CLASSIFICATION AS DISCONTINUED OPERATION

CESSATION OF CLASSIFICATION AS HELO FOR SALE...

PRESENTING A DISCONTINUED OPERATION THAT HAS BEEN ABANDONED

PRESENTATION IN STATEMENT OF CASH FLOWS ,

ILLUSTRATIVE FINANCIAL STATEMENTS

CHAPTER 4: SUMMARY...

PROBLEM:

AND

'OSAL GROUP 229

Scanned with CamScanner

CHAPTER 5

STATEMENT OF CHANGES IN EQUITY...

STATEMENT OF CHANGES IN EQuiTy

CHAPTER 5: SUMMARY...

PROBLEMS...

267

CHAPTER 6

STATEMENT OF CASH FLows.

CLASSIFICATION OF CASH FLOWS..

Operating activities.

Special items included in operating act

Investing activities

Financing activities...

Cash flows excluded from the activities sections

INTERESTS AND DIVIDENDS

PRESENTATION

269

270

270

Investing and Financing Activities 281

-Non-cash transactions... 282.

ILLUSTRATIONS ..... . 283

CHAPTER 6: SUMMARY... . 303

PROBLEMS...

CHAPTER 7

NOTES - PART 1...

Notes.

ACCOUNTING POLICIE

Changes in Accounting Policies.

Accounting for Changes in Accounting Policie:

Voluntary change in accounting policy....

Change in reporting entity

Changes in Accounting Estimates.

Scanned with CamScanner

Errors «..

Types of errors...

Counterbalancing errors...

Non-counterbalancing error:

EVENTS AFTER THE REPORTING PERIOD...

Adjusting events after the reporting perio

Non-adjusting events after the reporting period.

CHAPTER 8

NOTES — PART 2....

RELATED PARTIES

Disclosure.

OPERATING SEGMENTS...

Reportable segments.

Management approach

Aggregation criteria ...

Quantitative thresholds

Operating segments not meeting any of the quantitative

thresholds...

Limit on external revenue...

Reporting of non-reportable segment:

Segment ceasing to be reportable.

Segment becoming reportable

Limit on the number of reportable segments. 412

Disclosures... 414

Disclosure on general information .. 414

Information about profit or loss, assets and liabilities ........ 414

Reporting of interest revenue and interest expense. 415

Information on segment assets 416

Reconciliations

Changes in internal organization

Entity-wide disclosures .. 417

Information about major customer: 418

Illustrative disclosure of segment information. 419

Scanned with CamScanner

CHAPTER 8: SUMMAR'

PROBLEMS ..

CHAPTER 9

INTERIM FINANCIAL REPORTING...

INTERIM FINANCIAL REPORT ....

SIGNIFICANT EVENTS AND TRANSACTIONS.

OTHER DISCLOSURES ..

PERIODS FOR WHICH INTERIM FINANCIAL STATEMENTS ARE PRESENTED

MATERIALITY.

RECOGNITION AND MEASUREMENT.

Same accounting policies as annual

Two views on interim reporting ..

Measurement...

Revenues received seasonally, cyclically, or occasionally

Costs incurred unevenly during the financial year...

Examples of application of the recognition and measurement

principles.

CHAPTER 9: SUMMARY

PROBLEMS...

CHAPTER 10 2

CASH BASIS TO ACCRUAL BASIS OF ACCOUNTING..

‘ACCRUAL BASIS OF ACCOUNTING.

CASH BASIS OF ACCOUNTING...

CASH BASIS TO ACCRUAL BASIS

PROBLEMS...

CHAPTER 11

PFRS FOR SMALL AND MEDIUM-SIZED ENTITIES (SMES).519

INTRODUCTION...

Overview on the topi

Purpose...

Scanned with CamScanner

SECTION 15 INVESTMENTS IN JOINT VENTURES ssusssssernsn

SECTION 16 INVESTMENT PROPERTY .

Measurement wee

Transfers...

SECTION 17 PROPERTY, PLANT AND EQUIPMENT ..

Subsequent measurement

Cost model 1 STB

Revaluation model... 578

Depreciation ...., 100 579

SECTION 18 INTANGIBLE ASSETS OTHER THAN GOODWILL

Initial measurement...

Subsequent measurement...

Amortization over useful life

SECTION 19 BUSINESS COMBINATIONS AND GOODWILL

SECTION 20 LEAsES..

Classification of leases

Finance leases ~ Lessees

Finance leases - Lessors

Operating lease...

Sale and leaseback transaction:

SECTION 21 PROVISIONS AND CONTINGENCIES

Initial measurement...

Subsequent measurement

Contingent liabilities .

Contingent asset:

SECTION 22 LIABILITIES AND EQUITY

* Instruments classified as equity

Instruments classified as liabilities ,

Classification of financial instrument as liability or equit

Original issue of shares or other equity instruments...

Sale of options, rights and warrants 595

Capitalization or bonus issues of shares and share Splits....444.595

Convertible debt or similar compound financial instruments. 596

Extinguishing financial liabilities with equity instruments ......596

Treasury shares., 597

Distributions to owners 597

Property dividends. 597

SECTION 23 REVENUE. 598

Scanned with CamScanner

Measurement...

Customer loyalty program

Sale of goods..

Rendering of services.

Construction contracts

Percentage of completion method

Interest, royalties and dividends

SECTION 24 GOVERNMENT GRANTS

Recognition and measurement ..

SECTION 25 BORROWING COSTS

Recognition

SECTION'26 SHARE-BASED PAYMENT ..

Measurement of equity-settled share-based payment

transactions ...

Cash-settled share-based payment transactions

Share-based payment transactions with cash alternatives.

SECTION 27 IMPAIRMENT OF ASSETS.

Impairment of inventorie:

Impairment of assets other than inventories.

Indicators of impairment...

Measuring recoverable amount ..

Fair value less costs to sell

Value in use.

Recognizing and measuring an impairment loss for a cash-

generating unit ..

SECTION 28 EMPLOYEE BENEFITS ....

General recognition principle for all employee benefits.

Short-term employee benefits

Defined contribution plans...

Defined benefit plans...

Actuarial valuation method ..

Defined benefit plan asset.

Cost of a defined benefit plan

Recognition — accounting policy election

Other long-term employee benefits...

Termination benefits

SECTION 29 INCOME TAX

Recognition and measurement of current tax ..

Scanned with CamScanner

Recognition of deferred tax.....

Tax bases and temporary differences.

Taxable temporary differences

Deductible temporary differences.

SECTION 30 FOREIGN CURRENCY TRANSLATION

SECTION 31 HYPERINFLATION .

Hyperinflationary economy.

Measuring unit in the financial statements.

Procedures for restating historical cost financial statements 634

Gain or loss on net monetary position ..

SECTION 32 EVENTS AFTER THE END OF THE REPORTING PERIOD

Recognition and measurement .

Disclosure...

SECTION 33 RELATED PARTY DISCLOSURES.

Definition of Related party ..

Disclosures...

SECTION 34 SPECIALIZED ACTIVITIES ..

Agriculture ...

Exploration for and evaluation of mineral resources.

Service concession arrangements ....

SECTION 35 TRANSITION TO THE PFRS FOR SMES.

REFERENCEG...........

Scanned with CamScanner

tement of Financial Position 1

Chapter 1

Statement of Financial Position

Related standard: PAS 1 Presentation of Financial Statements

Learning Objectives

1, Enumerate and describe the components of a complete set of

financial statements.

2. Classify assets and liabilities into current and noncurrent.

3,__ Prepare a statement of financial position.

Financial Statements

Financial statements are the “structured representation of an

entity's financial position and results of its operations.” (PAS 19)

Financial statements are the end product of the financial

reporting process and the means by which the information

gathered and processed is periodically communicated to users.

The financial statements of an entity pertain only to that entity

and not to the industry where the entity belongs or the economy

asa whole.

General purpose financial statements. (‘financial

statements’) are “those intended to meet the needs of users who

are not in a position to require an entity to prepare reports tailored

to their particular information needs.” (Pas 1.7)

General purpose financial statements cater to most of the

common needs of a wide range of external users. General purpose

financial statements are the subject matter of the Conceptial

Framework and the PFRSs.

Purpose of financial statements

1. Primary objective: To provide information about the financial

position, financial performance, and cash flows of an entity that is

useful to a wide range of users in making economic decisions.

2. Secondary objective: To show the results of management's

stewardship over the entity’s resources.

Scanned with CamScanner

Chapter 1

oa eee

To meet the objective, financial statements provide

information about an entity's:

Assets (economic resources);

. Liabilities (economic obligations);

Equity;

Income;

Expenses;

Contributions by, and distributions to, owners; and

Cash flows.

amenaosPp

This information, along with other information in the

notes, helps users assess the entity's prospects for future net cash

inflows.

Complete set of financial statements

A complete set of financial statements consist of:

1... Statement of financial position;

Statement of profit or loss and other comprehensive income;

Statement of changes in equity;

Statement of cash flows;

Notes;

(6a) Comparative information; and

6. ‘Additional statement of financial position (required only

when certain instances occur).

seen

An entity may use other titles for the statements. For

example, an entity may use the title “balance sheet” in lieu of

“statement of financial position” or “statement of comprehensive

income” instead of “statement of profit or loss and other

comprehensive income.”

However, an “income statement” is different from a

“statement of profit or loss and other comprehensive income” or @

“statement of comprehensive income.” We will elaborate on this

later.

at

Scanned with CamScanner

‘statement of Financial Position 3

Reports that are presented outside of the financial

statements, such as financial reviews by management,

environmental reports and value added statements, are outside

the scope of PFRSs.

General Features of financial statements

1, Fair Presentation and Compliance with PFRSs

Fair presentation is faithfully representing, in the financial

statements, the effects of transactions and other events in

accordance with the definitions and recognition criteria for

assets, liabilities, income and expenses set out in the

Conceptual Framework.

Compliance with the PFRSs is presumed to result in

fairly presented financial statements.

Fair presentation also requires the proper selection

and application of accounting policies, proper presentation of

information, and provision of additional disclosures whenever

relevant to the understanding of the financial statements.

Inappropriate accounting policies cannot be rectified

by mere disclosure.

(PAS Vrequires an entity whose financial statements

comply with PFRSs to make an explicit and unreserved statement

of such complian he notes. However, an entity shall not

make such statement unless it complies with all the

requirements of PFRSs.

There may be cases wherein an entity's management

concludes that compliance with a.PFRS requirement is

misleading. In such cases, PAS 1 permits a departure from a

PERS requirement if the relevant regulatory framework

requires or allows such a departure. :

When an entity departs from a PERS requirement, it

shall disclose the management's conclusion as to the fair

presentation of the financial statements; that all other

* requirements of the PFRSs are complied with; the title of the

Scanned with CamScanner

rn Chapter

age ee ee

PERS from which the entity has departed; and the finay,

ial

effect of the departure.

2. Going Concem

“Financial statements are normally prepared on a Boing

concern basis unless the entity has an intention to liquidate

has no other alternative but to do so.

When preparing financial statements, Managemen,

Shall assess the entity’s ability to continue as a going cong i

taking into account all available information about the future,

which is at least, but not limited to, 12 months from the

reporting date. ;

Af the entity has a history of profitable operations and

teady access to financial resources, management ma,

conclude that the entity is a going concern without detailed

analysis.

or

—Hf there are material uncertainties on the entity’s abi

to continue as a going concem, those uncertainties shall be

disclosed.

Af the entity is not a going concem, its financial

Statements shall be prepared using another basis, This fact

shall be disclosed, including the basis used, and the reason

why the entity is not regarded as a going concern,

3. Accrual Basis of Accounting

All financial statements shall be prepared using the accrud

basis of accounting except for the statement of cash flows,

which is prepared using cash basis,

4. Materiality and Aggregation

Each material class of similar it

class of similar items is called

are presented

Individually im:

items,

fems is presented separately. A

a “line item.” Dissimilar items

Separately unless they are immaterial.

material items are aggregated with other

_

Scanned with CamScanner

Statement of Financial

5, Offsetting

Assets and liabilities or income and expenses are presented

separately and are nof offset, unless offsetting is required or

permitted by a PERS.

Offsetting is permitted when it reflects the substance

of the transaction. Examples of offsetting:

ax” Presenting gains or losses from sales of assets net of the

related selling expenses,

b. Presenting at net amount the unrealized gains and losses

arising from trading securities and from translation of

foreign currency denominated assets and liabilities, except

if they are material,

c. Presenting a loss from a provision net of a reimbursement

from a third party.

Measuring assets net of valuation allowances is not

offsetting. For example, deducting allowance for doubtful

accounts from accounts receivables or deducting accumulated

depreciation from a building account is not offsetting.

6, Frequency of reporting

Financial statements are prepared at least annually. If an

entity changes its reporting period to a period longer or

shorter than one year, it shall disclose the following:

a. The period covered by the financial statements:

b.. The reason for using a longer or shorter period, and

c. The fact that amounts presented in the financial statements

are not entirely comparable.

‘omparative Information

AS 1 requires y to present comparative information in

— an entity presents two of each of the

statements and related notes. For example, when an entity

Scanned with CamScanner

Chapter;

62 eee

nancial statements, the 2p,,

s sents i nt year fi

presents its 20x2 current y re shall also be Presenteg ‘i

preceding year financial statemen'

comparative information. Poi 4

3 PAS 1 permits entities to provide comparatiy,

= information in addition to the minimum requirement, Fo,

example, an entity may provide. a third pape of

comprehensive income. In this case, however, # . entity Neeg

not provide a third statement for the other financiay

statements, but must to provide the related notes for tha,

additional statement of comprehensive income.

Additional Statement of financial position

As mentioned earlier, a complete set of financial statements

includes an additional statement of financial position when certain

instances occur. Those instances are as follows:

a. The entity applies an accounting policy retrospectively, makes

a retrospective restatement of items in its financial statements,

or reclassifies items in its financial statements; and

. The instance in (a) has a material effect on the information in

the statement of financial position at the beginning of the

= preceding period.

For example, if any of the instances above occur, the entity

shall present three statements of financial position as follows:

Statement of financial position Date

1._ Current year >, As at December 31, 20x2

2. Preceding year > Asat December 31, 20x1

(comparative information)

3._ Additional > _Asat January 1, 20x1

The opening (additional) statement of financial position is

dated as at the beginning of the preceding period even if the entity

presents comparative information for earlier periods, The entity

need not present the related notes to the opening statement of

financial position.

Scanned with CamScanner

Statentent of Financial Position 7

8. Consistency of presentation

The presentation and classification of items in the financial

statements is retained from one period to the next unless a

change in presentation:

a. is required by a PFRS; or

b. results in information that is reliable and more relevant.

~“A change in presentation requires the reclassification

of items in the comparative information. If the effect of a

reclassification is material, the entity shall provide the

“additional statement of financial position” discussed earlier.

eneral Features

© Summary:

f= Fair presentation & Compliance

with PFRSs Offsetting

5.

“2. Going Concern 6. Frequency of reporting period

%

8.,

13, Accrual Basis Comparative information

4. Materiality & agpregatior Consistency of presentati

Structure and content of financial statements

Each of the financial statements shall be presented: with equal

prominence and shall be clearly identified and distinguished from

other information in the same published document. For example,

financial statements aré usually included in an annual report,

which also contains other information. The PFRSs apply only to

the financial statements and not necessarily to the other

information.

The following information shall be displayed prominently

and repeatedly whenever relevant to the understanding of the

information presented:

a The name of the reporting entity

-b> Whether the statements are for the individual entity or for a

group of entities

«© The date of the end of the reporting period or the period

covered by the financial statements

‘d. The presentation currency

€- The level of rounding used (¢.g., thousands, millions, etc.)

Scanned with CamScanner

‘

a

Chap

Se ee

Illustration: A heading for a financial statement is shown, beloy,

‘ABC Group Name of the reper

ity

statement of tnancl postion ——H tetra a

As of December 31, 20x2 pertains toa rou

(in thousands of Philippine Pesos)

Date of the end of the reporting period

Level of rouncing-off ang

presentation currency

The statement of financial position is dated as at the end

of the reporting period while the other financial statements

dated for the period that they cover.

PAS 1 requires particular disclosures to be Presenteq

either in the notes or on the face of the other financial statements

(e.g., footnote disclosures). Other disclosures are addressed by

other PFRSs.

ate

Management’s Responsibility over Financial Statements

The management is responsible for an. entity's financial

statements. The responsibility encompasses:

a. the preparation and fair presentation of financial statements in

accordance with PERSs.;

b. internal control over financial reporting;

¢. going concern assessment;

d. oversight over the financial reporting process; and

e. review and approval of financial statements,

——Thie ‘responsibilities are expressly stated in a document

called “Statement of Management's Responsibility for Financial

Statements,” which is attached to the financial statements as @

cover letter. This document is signed by the entity's

a. Chairman of the Board (or equivalent),

b. Chief Executive Officer (or equivalent), and

c. Chief Financial Officer (or equivalent)

Scanned with CamScanner

tement of Financial Position 9

statement of Financial Position

‘The statement of financial position shows the entity’s financial

condition (status of assets, liabilities and equity) as at a certain

‘date. It includes line items “that present the following amounts:

\ar Property, plant and equipment;

Investment property;

Intangible assets;

Financial assets (excluding (e), (h) and (i));

Investments accounted for using the equity method;

Biological assets;

Inventories;”

._ Trade and other receivables;

Cash and cash equivalents;

Assets held for sale, including disposal groups;

_ Trade and other payables;

Provisions;

. Financial liabilities (excluding (k) and (1));

_ Current tax liabilities and current tax assets;

. Deferred tax liabilities and deferred tax assets;

. Liabilities included in disposal groups;

. Non-controlling interests; and

Issued capital and reserves attributable to owners of the

repos grrr ra me aos

parent.

(PAS 1.54)

(ine item is a caption used to describe a group of accounts with similar nature,

PAS 1 does not/prescribe the order or format of presenting

items in the statement of financial position. The foregoing is

simply a list of items that are sufficiently different in nature or

function to warrant separate presentation.

Accordingly, an entity may modify the descriptions used

and the sequence of their presentation to suit the nature of the

entity and its transactions. Moreover, additional line items may be

presented whenever relevant to the understanding of the entity's

financial position.

Scanned with CamScanner

x

Chapt

gO a et SC

Presentation ot ee

A statement of financial position may be presented in a “classified

oran “unclassified” manner.

a. A classified presentation shows distinctions benwnen current

and noncurrent assets and current and noncurrent liabilities,

b. An unclassified presentation (also called ‘based on liquidity’)

shows no distinction between current and noncurrent items.

CLASSIFIED, UNCLASSIFIED

‘ASSETS ASSETS

Current assets Cash and cash equivalents a

Cash end cesh equivalents ~ Receivables ~

‘Trade and othor receivables ~ Inventories ~

Inventories ~ Investments in equity instruments

Other current assots _x__| | Property, plant and equipment ax

Tote! current assots “2 | | Other intangible assets ~

Non-current assets Goodwill x

Investments in equity instruments x Other assets x

Property, plant ond equipment x ‘| | TOTAL ASSETS. x

(Other intangible assets a :

Goodwill a

Total non-current assets oe

[TOTAL ASSETS =~

A classified presentation shall be used except when an

unclassified presentation provides information that is reliable and

more relevant. When that exception applies, assets and liabilities

are presented in order of liquidity (this is normally the case for

banks and other financial institutions).

PAS 1 also permits a mixed presentation, i.c,, presenting

some assets and liabilities using a current/non-current,

classification and others in order of liquidity. This may be

appropriate when the entity has diverse operations.

Whichever method is used, PAS 1 requires the disclosure

of items that are expected to be recovered or settled (a) within 12

months and (b) beyond 12 months, after the reporting period.

A classified presentation highlights an entity's working

capital and facilitates the computation of liquidity and solvency

ratios.

Scanned with CamScanner

Statement of Fina

i

> Working capital = Current Assets — Current Liabilities

Current assets and Current liabilities

Current Assets

are assets that are:

~ Expected to be realized, sold,

or consumed in the entity’s

normal operating cycle;

. Held primarily for trading;

Expected to be realized within

Current Liabilities

_| -are liabilities that are: _

Expected to be settled in the

entity’s normal operating

cycle;

Held primarily for trading;

Due to be settled within 12

months after the reporting

period; or

. The entity does not have an

unconditional right to defer

settlement of the liability for

at least twelve months after

the reporting period.

12 months after the reporting

period; or

|. Cash or ‘cash equivalent,

unless restricted from being

exchanged or used to settle a

liability for at least twelve

months after the reporting

eriod.

Allother assets and liabilities are classified as noncurrent.

“Thecoperating cycle’of an entity is the time between the

acquisition of assets for processing and their realization in cash or

cash equivalents. When the entity's normal operating cycle is not

clearly identifiable, it is assumed to be 12 months.” (PAS 1.68)

Assets and liabilities that are realized or settled as part of

the entity’s normal operating cycle (eg., trade receivables,

inventory, trade payables, and some accruals for employee and

other operating costs) are presented as current, even if they are

expected to be realized or settled beyond 12 months after the

reporting period.

Assets and liabilities that do not form part of the entity’s

normal operating cycle (e.g, non-operating assets and liabilities)

are presented as current only when they are expected to be

realized or settled within 12 months after the reporting period.

Scanned with CamScanner

Si

a

Deferred tax assets and liabilities are always Present

Roncurrent items in a classified statement of financial Positig®

Tegardless of their expected dates of reversal, "

Examples:

Current assets

Current liabilities

* Cash and cash equivalents

* Accounts payable

* Accounts receivable * Salaries payable

* Non-trade receivable * Dividends payable

collectible within 12 months

Held for trading securities

* Inventory

* Prepaid assets

Income (Current) tax

Uneamned revenue

* Portion of notes /loansy

bonds payable due within

12 months

Payable

Noncurrent assets

* Property, plant & Equipment

* Non-trade receivable

Noncurrent liabilities

Portion of notes/loans/

bonds payable duue beyong

collectible beyond 12 12 months

months * Deferred tax liability

* Investment in associate

* Investment property

* Intangible assets

+ Deferred tax asset

Refinancing agreement

A long-term obligation that is maturing within 12 months after the

reporting period is classified as current, even if a refinancing

agreement to reschedule payments on a long-term basis is

completed after the reporting period but before the financial

statements are authorized for issue.

However, the obligation is classified as noncurrent if the

entity expects, and has the discretion, to refinance it on a long

term basis under an existing loan facility.

i wenacinieell

Scanned with CamScanner

statement of Financial Position 7

If the refinancing is not at the discretion of the entity (for

example, there is no arrangement for refinancing), the financial

jiability is current.

> (Refinancing refers to the replacement of an existing debt with a

new one but with different terms, e.g; an extended maturity

date or a revised payment schedule. Refinancing normally

entails a fee or penalty. A refinancing where the debtor is

under financial distress is called “troubled debt

restructuring,”

> Loan facility refers to a credit line.

Illustration:

_Hlustratiom: ________._-__ Jeon

Entity A’s current reporting date is December 31, 20x1. A bank

| Joan taken 10 years ago is maturing on October 31, 20x2.

Len ee er a eee

‘Analysis: A currently maturing’ obligation (Le, due within 12

months after the reporting date) is classified as current even if that

obligation used to be noncurrent. Therefore, the loan is presented

as a current liability in Entity A’s December 31, 20x1 statement of

financial position.

[On january 15, 20%2, Entity A enters into a refinancing agreement |

to extend the maturity date of the loan to October 31, 20x7. Entity

| A’s financial statements are authorized for issue on March 31,

[202

Analysis: Continuing with the general rule, a currently maturing

obligation is classified as current even if a refinancing agreement,

ona long-term basis, is completed after the reporting period and

before the financial statements are authorized for issue.

Accordingly, the loan is nevertheless presented as a current

liability,

Scanned with CamScanner

4 Chapter

SET

| Under the original terms of the loan agreement, Entity, A has 4,

unilateral right to defer (postpone) the payment of the loan up toa

maximum period of 5 years from the original maturity date, Eng,

| A expects to exercise this right after the reporting date but befo,,

| the financial statements are authorized for issue.

Analysis: Entity A has the discretion (ie, unilateral right) jg

refinance the obligation on a long-term basis under an existing

loan facility (.e., the unilateral right is included in the origina

terms of the loan agreement). Accordingly, the loan is classified ag

noncurrent.

In this scenario, Entity A has an unconditional right tg

defer the settlement of the loan for at least twelve months after the

teporting period. Therefore, condition ‘d’ above for curren,

classification (i.e,, ‘...does not have an unconditional right to defer

settlement...’) is inapplicable.

Liabilities payable on demand

Liabilities that are payable upon the demand of.the lender are

classified as current.

A long-term obligation may become payable on demand

as a result of a breach of a loan provision. Such an obligation is

classified as current even if the lender agreed, after the reporting

period and before the authorization of the financial statements for

issue, not to demand payment. This is because the entity does not

have an unconditional right to defer settlement of the liability for

at least twelve months after the reporting period.

However the liability is noncurrent if the lender provides

the entity by the end of the reporting period (e.g., on or before

December 31) a grace period ending at least twelve months after

the reporting period, within which the entity can rectify. the

breach and during which the lender cannot demand immediate

repayment.

Scanned with CamScanner

statement of Financial Position s

Illustration:

In 20x1, Entity A took a long-term Joan from a bank. The loan

agreement requires Entity A to maintain a current ratio of 2:1. If

the current ratio falls below 2:1, the loan becomes payable on

demand. On December 31, 20x1 (reporting date), Entity A’s

current ratio was 1.8:1, below the agreed level. Entity A’s financial

statements were authorized for issue on March 31, 20x2.

Case 1:

On January 5, 20x2, the bank gives Entity A a chance to rectify the

breach of loan agreement within the next 12 months and promises

not to demand immediate repayment within this period.

Analysis: The loan is classified as current liability because the grace

period is received after the reporting date.

Case 2:

On December 31, 20x1, the bank gives Entity A a chance to rectify

the breach of loan agreement within the next 12 months and

promises not to demand immediate repayment within this period.

Analysis: The loan is classified as noncurrent liability because the

grace period is received by the reporting date.

Illustration 1: Current assets :

The ledger of ABC Co. as of December 31, 20x1 includes the

following:

Assets :

Cash 5,000

Trade accounts receivable (net of P5,000 credit balance in acets.) 20,000

Held for trading securities 40,000

Financial assets designated at FVPL. 15,000

Investment in equity securities at FVOCI 35,000

Investment in bonds measured at amortized cost (duein3 yrs) 30,000

Prepaid assets ° 5,000

Deferred tax asset (expected to reverse in 20x2) 6,000

Scanned with CamScanner

x

6 Chapter

SS - ToT

Investment in Associate 3B

Investment property ‘ey

Sinking fund 009

Property, plant, and equipment 50,09)

Goodwill 14,0¢9

Totals 280,099

Requirement: Compute for the total current assets.

Solution:

Curentassets SSCS

Trade accounts receivable (20,000 +: 5,000) 25,000

Held for trading securities 40,000

Financial assets designated at FVPL 15,000

Prepaid assets 5,000

Total current assets 90,000

e—ee—e——asSsS 00

¥ Notes:

* Accounts receivables should not have abnormal balances,

Therefore, the credit balance is added back to accounts

receivable and presented as liability.

Assets which are held primarily for trading (e., financial

assets measured at fair value through profit or loss ‘FVPL’ -

Held for trading securities and Designated financial assets) are

presented as current assets,

Investments in equity securities measured at fair value

through other comprehensive income (FVOCI)-are classified

as noncurrent in the absence of evidence to the contrary. However,

if the investment in FVOCT is expected to be realized within 12

months from the end of Teporting period, the investment is

classified as current,

© Deferred tax assets are Presented as noncurrent irrespective of

their expected reversal dates,

Sinking fund Parallels the classification of the related liability

on which the fund is set up. In the absence of evidence to the

contrary, sinking fund is classified as noncurrent.

Scanned with CamScanner

sutement of Financial Position

a Investment in Associate, Investment property, Property, plant and

equipment, and Goodill are noncurrent items.

Illustration 2: Current liabilities

The ledger of ABC Co. as of December 31, 20x1 includes the

following:

Liabilities ies

Bank overdraft 5,000

Trade accounts payable (net of 5,000 debit balance in accounts) 20,000

Notes payable (due in 20 semi-annual payments of £2,000) 40,000

Interest payable 15,000

Bonds payable (due on March 31, 20x2) 35,000

Discount on bonds payable, (15,000)

Dividends payable 5,000

Share dividends payable 6,000

Deferred tax liability (expected to reverse in 20x2) 18,000

Income tax payable 22,000

Contingent liability 50,000

Reserve for contingencies 14,000

Totals 215,000

Requirement: Compute for total current liabilities.

Solution:

Current liabilities

Bank overdraft 5,000

Trade accounts payable (P20,000 + P5,000) 25,000

Notes payable (2,000 semi-annual instalment x 2) 4,000

Interest payable 15,000

Bonds payable (dire on March 31, 20x2) 35,000

Discount on bonds payable (15,000)

Dividends payable 5,000

Income tax payable 22,000

Total current liabilities 96,000

Scanned with CamScanner

it Chapter 1

3B Chapter

& Notes:

Bank overdrafts are repayable on demand, thus, they are

classified as current liability,

© Accounts payables should not have abnormal balances,

Therefore, the debit balance is added back to accounts payable

and presented as asset.

= Only the currently maturing portion of the notes payable is

classified as current liability,

* Unless stated otherwise, interest payable, cash dividends payable,

and income taxes payable are presumed to be due currently,

© -Thé bonds payable (and the related discount) are classified as

current because they mature within 12 months. from end of

Teporting period.

Share dividends payable is not a liability but rather a contra-

equity item,

© Deferred tax liabilities are presentéd as noncurrent irrespective

of their expected reversal dates,

‘© Contingent liability is not recognized as liability but rather

disclosed only in the notes if they are reasonably possible.

“* Appropriated reserves for contingencies are components of

equity.

Illustration 3.1; Current and noncurrent liabilities

The ledger of ABC Co. as of December 31, 20x1 includes the

following:

10% Note payable 40,000

12% Note payable, 60,000

14% Mortgage note payable 30,000

Interest payable

Additional information:

* ABC Co.'s financial statements were authorized for issue on

April 15, 20%2.

* The 10% note payable is due on July 1, 20x2 and pays semi-

annual interest every July 1 and December 31. On January 28,

20x2, ABC Co. entered into a refinancing agreement with a

Scanned with CamScanner

statement of Financ

pank to refinance the entire note by issuing a long-term

obligation.

The 12% note payable is due on March 31, 20x2 and pays

annual interest every March 31. On January 31, 20x2, ABC Co-

extended the maturity of the note to March 31, 20x3 under the

existing loan agreement. The extension of maturity date is at

the option of ABC Co.

The 14% mortgage note is due on December 31, 20x9. Per

agreement with the creditor, ABC Co. is to pay quarterly

interests on the note, failure to do so will render the note

payable on demand. ABC Co. failed to pay the 3" and 4"

quarterly interests on the note during 20x1.

Requirement: Compute for the current liabilities.

Solution:

10% Note payable 40,000

Inorest payable on the 12% note (60,000 12% x 9/12) 5400

14% Mortgage note payable 30,000

Interest payable on the 14% note (30,000 x 14% x 6/12) 2,100

Current liabilities 77,500

—_

¥ Notes:

w The 10% note that is currently maturing is presented as

current liability because the refinancing agreement is not at

the discretion of ABC Co.

© The 12% note is noncurrent because the refinancing under the

existing loan facility is at the discretion of ABC Co. However,

since the 12% note pays annual interest every March 31 and

there is no balance in the “Interest payable” account, the

accrued interest for the months of April to December 31, 20x1

must not have been recorded yet. The accrued interest is

computed and included in current liabilities.

© The 14% mortgage note is current because it is due on

demand, Again, since the “interest payable” account has no

balance, the unpaid interest for the 3“ and 4" quarters must

Scanned with CamScanner

DOE sos Ss at

not have been recorded yet. The accrued interest is computed

and included in current liabilities.

It is presumed that there are no unpaid interests on the 10%

note because the scheduled interest payment dates are on July

and December 31, which coincide with the reporting period.

Illustration 3.2; Current and noncurrent liabilities

The ledger of ABC Co. as of December 31, 20x1 includes the

following;

15% Note payable 25,000

16% Bonds payable 50,000

18% Serial bonds payable 100,000

Interest payable "

Additional information:

* ABC Co.'s financial statements were authorized for issue on

April 15, 20x2.

© The 15% note payable was issued on January 1, 20x1 and is

“due on January 1, 20x5. The note pays annual interest every

year-end. The agreement with the lender provides that ABC

Co. shall maintain an average current ratio of 2:1. If at any

time the current ratio falls below the agreement, the note

payable will become due on demand. As of the 3% quarter in

20x1, ABC Co.'s average current ratio is 0.50:1. Immediately,

ABC Co. informed the lender of the breach of the agreement.

On December 31, 20x1, the lender gave ABC Co. a grace

period ending on December 31, 20x2 to rectify the deficiency

in the current ratio. ABC Co, promised the creditor to

liquidate some of its long-term investments in 20x2 to increase

its current ratio.

* The 16% bonds are 10-year bonds issued on December 31,

1992, The bonds pay annual interest every year-end.

¢ The 18% serial bonds are issued at face amount and are due in

semi-annual installments of P10,000 every April 1 and

September 30. Interests on the bonds are also due semi-

peel

Scanned with CamScanner

‘statement of Financial Position 1

annually. The last installment on the bonds is due on

September 30, 20x7.

‘Requirement: Compute for the current liabilities.

Solution:

16% Bonds payable 50,000

Interest payable on the serial bonds (100k x 18% x 3/12) 4,500

Current liabilities 54,500

& Notes:

# The 15% note is noncurrent because ABC Co. received a grace

period from the lender as of the end of reporting period (i.e.

December 31, 20x1) covering a 12-month period to rectify the

breach of loan agreement.

& The 16% bonds are presented as current liability because they

mature on December 31, 20x2.

© The 18% serial bonds are-due in 10 semi-annual installments

(P100,000 face amount + P10,000 semi-annual installments) to

be paid over 5 years (10 semi-annual installments + 2

installments per year). Since the last installment payment is

due on September 20x7, the first installment will be paid on

April 1, 20x3 (i.e. two installments in each of years 20x3

through September 30, 20x7). Therefore, none of the serial

bonds is currently maturing in 20x2. However, since interests

are due semi-annually, the accrued interest on the serial bonds

for 3 months (September 30 to December 31, 20x1) is

computed and presented as current liability.

¢Tis presumed that there are no unpaid interests on the 15%

and 16% notes because their scheduled interest payment date

is every year-end, which coincides with the reporting period.

Ilustration 4: Working capital

Below are the account balances prepared by the bookkeeper for

ABC Co. as of December 31, 20x1:

Scanned with CamScanner

Chapter 1

2 ent

Se

Accounts receivable, net 44,000 Notes payable 100,000

Inventory 40,000

Prepaid income tax 8,000

Prepaid assets 5,000

Investment in subsidiary 10,000

Land held for sale 28,000

Property, plant, and

equipment 50,000

Totals 200,000 120,000

SS

Additional information:

* Cash consists of the following:

Petty cash fund (unreplenished petty cash expenses, P 1,500) 2,000

Cash in bank (10,000)

Payroll fund 14,000

Tax fund 7,000

Cash to be contributed to a sinking fund established for

the retirement of bonds maturing on December 31, 20x3 2,000

Total Cash _ 15,000

50

Checks amounting to P30,500 were written to suppliers and

recorded on December 30, 20x1, resulting to a bank overdraft

(of P10,000. The checks were mailed on January 5, 20x2,

* Accounts receivable consists of the following:

Accounts receivable

40,000

Allowance for uncollectability (6,000)

Credit balance in customers’ accounts (3,000)

Sale price of unsold goods sent on consignment to XYZ,

Inc. at 120% of cost and excluded ftom ABC Co's

inventory 12,000

Accounts receivable, net 44,000

* The inventory includes cost of goods amounting to 10,000

that are expected to be sold beyond 12 months but within the

Scanned with CamScanner

sgatemet of Financial Position B

ordinary course of business. Also, the inventory includes cost

of consigned goods received on consignment from Alpha-

Numerix Co. amounting to P5,000,

« Prepaid income tax represents excess of payments for

quarterly corporate income taxes during 20x1 over the actual

annual corporate income tax as of December 31, 20x1.

Prepaid assets include a 2,000 security deposit on an

_ operating lease which is expected to expire on March 31, 20x3.

The security deposit will be received on lease expiration.

The land qualified for classification as “asset held for sale”

under PERS 5 Non-current Assets Held for Sale and Discontinued

Operations as of December 31, 20x1.

‘Accounts payable is net of P6,000 debit balance in suppliers’

accounts. Accounts payable includes the cost of goods held on

consignment from Alpha-Numerix Co. which were included

in inventory.

The notes payable are dated July 1, 20x1 and are due on July 1,

20x4. The notes payable bears an annual interest rate of 10%.

Interest is payable annually.

Requirement: Compute for the adjusted working capital.

Solution:

> The adjusted cash is computed as follows:

Cash - unadjusted 15,000

Unreplenished petty cash expenses (1,500)

Unreleased checks recorded as disbursement resulting to

overdraft 30,500

Contribution to sinking fund (2,000)

Aafjsted cash balance 42,000

> The adjusted accounts receivable is computed as follows:

Accounts receivable < 40,000

Allowance for uncollectability 6,000)

Aajusted accounts receivable, net 35,000

Scanned with CamScanner

Chapie

4 pel

> The adjusted inventory is computed as follows:

Inventory* 40,000

Cost of unsold goods sent out on consignment excluded

from inventory (12,000 + 120%) 10,000

Cost of goods held on consignment (5,000)

Feast eo

Adjusted inventory 45,000

“The cost of inventory expected to be sold beyond 12 months but within the

normal operating cycle is properly included as part of cost of inventories

presented as current assets.

> The adjusted prepaid assets are computed as follows:

Prepaid assets 5,000

Security deposit (to be presented as noncurrent) (2,000)

Adjusted prepaid assets 3,000

> The adjusted accounts payable is computed as follows:

Accounts payable (20,000 + 6,000 debit balance) 26,000

Unreleased checks recorded as disbursement resulting to

overdraft 30,500

Cost of goods held on consignment 5,000)

Adjusted accounts payable, net 51,500

> Accrued interest on the notes payable is computed as follows:

(100,000 x 10% x 6/12) . 5,000

The following are the adjusting entries:

Dec. | Various expense accounts 1,500

a Petty cash fund 1,500

to record unreplenished petty cash expenses

Dez. | Cash in bank 30,500

a Accounts payable 30,500

to revert back unreleased checks to cash and accounts

payable

Dec. | Sinking fund 2,000

at Cash in bank 2,000

to segregate from cash the contribution to a sinking fund

Scanned with CamScanner

sqaement of Financial Position a

Accounts receivable 3,000

Advances from customers 3,000

toeliminate the credit balance in customers’ accounts

Sales 12,000

Accounts receivable 12,000

Inventory

Cost of goods sold 10,000

to reverse entries made to record unsold goods sent ot on 10,000

consignment as sale

De. | Accounts payable 5,000

3, Inventory 5,000

201 || to derecognize cost of inventory held on consignment

improperly included in inventories and accounts payable

De | Advances to suppliers 000

3h Accounts payable 6,000

2081 | to elinninate debit balance in suppliers’ accounts

‘Dec. | Interest expense 5,000

3h, Interest payable : 5,000

201 | io recognize accrued interest payable currently

The current assets and current liabilities are computed as follows:

Curent assets Current liabilities

Cash 42,000 Accounts payable 51,500

‘Accounts receivable, net 35,000 Advances from customers 3,000

Advances to suppliers 6,000 Interest payable 5,000

Inventory 45,000

Prepaid income tax 8,000

Prepaid assets 3,000 é

Land held for sale 28,000 *

Total current assets 167,000 __Total current liabilities 59,500

‘The adjusted working capital is computed as follows:

Working capital = Current assets ~ Current liabilities

Working capital = P167,000 - 959,500

Working capital = 107,500

Scanned with CamScanner

26 Chapter}

a ee!

Illustration 5: Working capital

The ledger of ABC Co. as of December 31, 20x1 includes the

following:

Cash in bank - Banco De Oro 15,000

Gash in bank - Metrobank 5,000

Accounts receivable (including P15,000 pledged accounts) 35,000

Accounts receivable - assigned 23,000

Equity in assigned receivables 10,000

Notes receivable (including #20,000 notes receivable discounted) 45,000

Notes receivable discounted 20,000

Advances to subsidiary 32,000

Held for trading securities : 20,000

Inventory 62,000

Deferred charges 18,000

Cash surrender value 6,000

Bond sinking fund : 100,000

Total assets 400,000

Liabilities

‘Accounts payable 40,000

Estimated warranty liability x 14,000

Loans payable related to assigned receivables (due in 12 mos.) 15,000

Accrued expenses 13,000

Bonds payable (due on December 31,2012) 100,000

Premium on bonds payable 8,000

Total liabilities 190,000

Additional information:

* Petty cash fund includes IOU's from employees amounting to

2,000. The remaining balance of P5,000 represents bills and

coins.

* Cash in bank - Banco de Oro represents the balance per bank

statement. As of December 31, 20x1, deposits in transit

amounted to P10,000 while outstanding checks amounted to

i Daa

Scanned with CamScanner

yatement of Financial Position ”

3,000. Included in the bank statement as of December 31,

20x1 is an NSF check amounting to P8,000.

Cash in bank - Metrobank represents the balance per ledger.

‘As of December 31, 20x1, deposits in transit amounted to

p2,000 while outstanding checks amounted to P1,000.

Accounts receivable (unassigned) includes uncollectible past

due accounts of P4,000 which need to be written-off.

Also included in accounts receivable (unassigned) is a P5,000

receivable from a customer which was given a special credit

term. Under the special credit term, the customer shall-pay the

5,000 receivable in equal quarterly installments of P625. The

Jast payment is due on Decembér 31, 20x3.

‘The held for trading securities include the reacquisition cost of

ABC Co's shares amounting to P4,000.

Inventory includes P30,000 goods in transit purchased FOB

Destination but excludes P12,000 goods in transit purchased

FOB Shipping point.

Requirement: Compute for the working capital.

Solution:

Current assets

Petty cash fund (7,000 - P2,000 1OU's) 5,000

Cash in bank - Banco De Oro (15,000 + 10,000 DIT -3,000 OC) 22,000

Cash in bank - Metrobank 5,000

Advances to employees (representing the IOU's) 2,000

Accounts receivable* 28,500

Accounts receivable - assigned 25,000

Notes receivable 45,000

Notes receivable discounted (20,000)

Held for trading securities (?20,000 - P4,000 Treasury shares) 16,000

Inventory (P62,000 - P30,000 FOB Dest. + ?12,000 FOB SP) 44,000

100,000

Bond sinking fund

Total current assets 272,500

Scanned with CamScanner

28 Chapter 1

i

Current liabilities

Accounts payable (40,000 - 30,000 FOB Dest. + 12,000 FOB SP) 22,000

Estimated warranty liability 14,000

‘Loans payable related to assigned receivables (due in 12 mos.) 15,000

‘Accrued’ expenses 13,000

Bonds payable (due on December 31, 20x2) 100,000

Premium on bonds payable 8,000

Total current liabilities 172,000

Working capital (272,500 - 172,000) 100,500

& Notes:

@ The IOU's (‘I owe you’) represents advances to employees that

are presented as current receivables.

© The balance of “Cash in bank — Banco De Oro” is the balance

per bank statement, thus, the deposits in transit are added

while the outstanding checks are deducted in order to

compute for the adjusted balance of cash. The NSF check is

ignored because this is a book reconciling item and not a bank

reconciling item.

© The balance of “Cash in bank - Metrobank” is the balance per

ledger (or per books), thus, the’ deposits in transit and

outstanding checks are ignored because they are bank

reconciling items.

“The adjusted accounts receivable is computed as follows:

Accounts receivable 35,000

Uncollectible accounts written-off (4,000)

Accounts with special credit term — noncutrent portion (625

quarterly installment x 4 installments in 20x3) (2,500)

Adjusted accounts receivable (unassigned) 28,500

© The pledged accounts receivables are properly included in

current receivables. "1

® The “accounts receivable ~ assigned” is properly included as

part of current assets. However, the equity in assigned

receivables (computed as the difference between the balance

of the assigned receivables and the outstanding balance of the

Scanned with CamScanner

semen of Financial Position 29

related loan) is presented as a disclosure only in the notes- The

assigned receivable and the related loan are presented

separately on the face of the statement of financial position.

The “notes receivable discounted” is deducted from total

receivables and disclosed as a contingent liability in the notes.

The shares of ABC Co. inappropriately included in “held for

trading securities” are treasury shares..Tteasury shares are

presented as unallocated deduction from shareholders’ equity.

The classification of the bond sinking fund parallels the

dassification of the related bonds. The related bonds are

maturing currently, thus the bond sinking fund is also

presented as current item.

‘Adoances to subsidiary are presented as noncurrent in the

absence of evidence to the contrary.

@ Deferred charges are similar to “prepaid assets” except that

deferred charges are long-term.

e-ersh surrender value is normally included as part of “other

long-term investments.”

” ustration 6: Reconstruction of financial statement

The edger of ABC Co. in 20x! includes the following:

fan. 1, 20x1 Dec. 31, 20x1

Current assets 600,000 ?

Noncurrent assets 2,000,000 ?

Current liabilities . 450,000 500,000

? 1,500,000

Noncurrent liabilities

Aiditional information:

+ ABC’s working capital as of December 31, 20x1 is twice as

much as the working capital as of January 1, 20x1.

* Total equity as of January 1, 20x1 is P850,000. Profit for the

year is P1,200,000 while dividends declared amounted to

P500,000. There were no other changes in equity during the

year,

Requirements: Compute for the following:

Scanned with CamScanner

30

a. Noncurrent liabilities as of January 1, 20x1.

b. Current assets as of December 31, 20x1.

c. Noncurrent assets as of December 31, 20x1.

Solutions:

Requirement (a): Noncurrent liabilities as of January 1, 20x1,

Current z Noncurrent Current Noncurrent

assets assets liabilities liabilities * Equity

(600,000 + 2,000,000) = (450,000 + Noncurrent liabilities) + 850,000

Noncurrent liabilities = 2,600,000 ~ 450,000 ~ 850,000

Noncurrent liabilities, Jan. 1, 20%1 = 1,300,000

Requirement (b): Current assets as of December 31, 20x1.

Working capital = Current assets ~ Current liabilities

Working capital, Jan. 1, 20x1 = 600,000 - 450,000

Working capital, Jan. 1, 20x1 = 250,000

Working capital, Dec. 31, 20x1 = Working capital, Jan. 1,20x1 times 2

Working capital, Dec. 31, 20x1 = 150,000 x 2-= 300,000

Working capital = Current assets - Current liabilities

300,000 = Current assets, Dec. 31, 20x1 - 500,000

Current assets, Dec. 31, 20x1 = 800,000

Requirement (c): Noncurrent assets as of December 31, 20x1.

Equity

850,000 Jan. 1

Dividends 500,000 | _1,200,000_ Profit for the year

Dec. 31 1,550,000

Current assets + Noncurrent assets = Current liabilities + Noncurrent

liabilities + Equity

(800,000 + Noncurrent assets) = (500,000 + 1,500,000) + 1,550,000

Noncurrent assets, Dec. 31, 20x1 = 2,000,000 + 1,550,000 ~ 800,000

Nontcurrent assets, Dec. 31, 20x1 = 0

Scanned with CamScanner

saatemet of Financial Position 31

llustration 7: Reconstruction of financial statements

‘The ledger of ABC Co. in 20x1 includes the following:

Cash 100,000

‘Accounts receivable 200,000

Inventory 500,000

Accounts payable 150,000

Note payable 50,000

During the audit of ABC's 20x1 financial statements, the following

were noted by the auditor:

Cash sales in 20x2 amounting to P10,000 were inadvertently

included as sales in 20x1. ABC recognized gross profit of

3,000 on the sales.

‘A collection of a P20,000 accounts receivable in 20x2 was

recorded as collection in 20x1. A cash discount of P1,000 was

given to the customer.

During January 20x2, a short-term bank loan of 25,000

obtained in 20x1 was paid together with P2,500 interest

accruing in January 20x2. The payment transaction in 202

was inadvertently included as a 20x1 transaction.

Requirement: Compute for the adjusted working capital as of

December 31, 20x1.

Solution:

> The adjusted balance of cash is computed as follows:

Cash (unadjusted) 100,000

Cash sales in 20x2 recorded as 20x1 sale (10,000)

Collection of account in 20x2 recorded as 20x1

collection (20,000 account less 1,000 cash discount) (19,000)

Loan payment in 20x2 recorded as 20x1 transaction 25,000

2,500

Interest payment in 20x2 recorded as 20x1 transaction

Adjusted cash balance, Dec. 31, 20x1

10.

> The adjusted balance of accounts receivable is computed as

follows:

Scanned with CamScanner

» Chapter]

ee

Accounts receivable (unadjusted) ; ee

Collection of account in 20x2 recorded as 20x1 collection : ),000

Adjusted accounts receivable balance, Dec. 31, 20x1 220,009

> The adjusted balance of inventory is computed as follows:

Inventory (unadjusted) 500,000

Cost of cash sale in 20x2 recorded as 20x1 sale j

(10,000 sale - 3,000 gross profit) 000

Adjusted inventory balance, Dec. 31, 20x1 507,000

Adjusted current assets, Dec. 31, 20x1: (98 5K + 220K + 507K) = 825,500

> The adjusted current liabilities are computed as follows:

Accounts payable 150,000

Note payable 50,000

Loan payable 25,000.

ss ties 2

Adjusted current liabilities, Dec. 31, 20x1 5,000

Working capital, Dec. 31, 20x1 = Current assets - Current liabilities

Working capital, Dec. 31, 20x1 = (825,500 ~ 225,000) = 600,500

Notice that the accrued interest is not a liability in 20x1

because it has accrued in January 20x2,

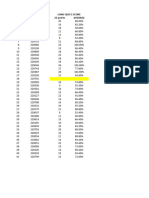

Illustration 8: Preparation of Statement of financial position

ABC Co.'s post-closing trial balance on December 31, 20x2 shows

the following account balances:

COO

A

counts Dr. Cr.

Petty cash fund 15,000

Cash in bank 1,900,000

90-day money market instruments 800,000

Accounts receivable 122,000

Allowance for bad debts 30,000

Notes receivable (Trade) 8,000

Inventory 200,000

Land 6,000,000

Scanned with CamScanner

statement of Financial Position

Building

‘Accumulated depreciation - Bldg.

Equipment

‘Accumulated depreciation - Equipment

Patent

‘Accumulated amortization - Patent

Trademark

Accounts payable

Notes payable - short term loan

Notes payable - long term loan (P50,000 due in 1 yr.)

Income tax payable

Interest payable

Salaries payable

Utilities payable

Unearned income

Provision for warranty obligation

Deferred tax liability

Share capital

Retained earnings

Revaluation surplus

33

ae eee ee

10,000,000

7,200,000

800,000

250,000

350,000

315,000

120,000

100,000

200,000

1,450,000

670,000

65,000

105,000

8,000

35,000

260,000

70,000

3,500,000

5,440,000

260,000

Cumulative translation gain - foreign operation 357,000,

Totals

20,315,000 20,315,000

Requirement: Prepare the statement of financial position.

Solution:

Scanned with CamScanner

, Chapter

4 . saicienectialtnn one

Entity A

Statement of financial position

As of December 31, 20x2

(amounts in Philippine Pesos)

[ Notes 20x2 20x1

ASSETS

Current assets

Cash and cash equivalents 6 — 2,715,000 2,800,000

Trade and other receivables 7 100,000 280,000

Inventories 200,000 180,000

Total current assets 3,015,000 3,260,000

Noncurrent assets

Property, plant and equipment 8 9,350,000 7,012,500

Intangible assets

155,000 186,000

Total noncurrent assets 9,505,000 7,198,500

Total Assets 712,520,000 P'10,458,500

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 10 313,000 200,000

Short-term borrowings 200,000 :

Current tax payable 670,000 490,000

Current portion of long-term borrowings’ 11 50,000 50,000

Provisions 260,000 :

Total current liabil

Noncurrent liabilities

1,493,000 740,000

Long-term borrowings m1 1,400,000 1,450,000

Deferred tax liability 70,000 90,000

Total noncurrent liabilities 1,470,000 1,540,000

Total Liabilities 2,963,000 2,280,000

Equity

Share capital 2 3,500,000 1,000,000

Retained earnings 5,440,000 6,684,900

Other components of equity 13___617,000 493,600

Total Equity 9,557,000 __ 8,178,500

Total Liabilities and Equit 712,520,000 _ 10,458,500

This statement should be read in conjunction with the accompanying notes.

Scanned with CamScanner

cnet of imac Ps

statement

‘The breakdowns of the line items are shown in the “Notes”

the 5c a

je, the 5" component of a complete set of financial statements) a5

follows:

Note 6: Cash and cash equivalents

This line item consists of the following:

Cash on hand : 15,000

Cash in bank to 1,900,000

Cash equivalents 800,000

Cash and cash equivalents 2,715,000

ee

Note 7: Trade and other receivables

This line item consists of the following:

Accounts receivable 122,000

‘Allowance for bad debts (30,000)

Notes receivable 8,000

Trade and other receivables P 100,000

Note 8: Property, plant and equipment

This line item consists of the following:

Land 6,000,000

Building 10,000,000

‘Accumulated depreciation - Bldg. (7,200,000)

Equiprient 800,000

Accumulated depreciation - Equipment (250,000)

Property, plant & equipment 9,350,000

Note 9: Intangible assets

This line item consists of the following:

Patent 350,000

Accumulated depreciation — Patent (315,000)

Scanned with CamScanner

Chapter

wo

Trademark

Intangible assets

120,000

155,000

———

Note 10: Trade and other payables

This line item consists ofthe following:

Accounts payable

Interest payable

Salaries payable

Utilities payable

Unearned income

Trade and other payables

100,000

65,000

105,000

8,000

35,000

313,000

Note 11: Current & Noncurrent portions of Long-term borrowings

Long-term borrowings consist of the following:

Current portion 50,000

Noncurrent portion 1,400,000

Total long-term borrowings 1,450,000

ees

Note 12: Share Capital

Share Capital consists of the following:

Shares Amounts

20x2 20x1 20x2 20x1

‘Common shares - P10 par value : =

Authorized ~ 1,000,000 shares

Issued and outstanding:

Balance at beginning of year 100,000 100,000 1,000,000 1,000,000

Issued during the year 250,000 - 2,500,000 =

Balance at end of year 350,000 100,000 _ 3,500,000 P1,000,000

On January 31, 20%2, the Company filed an application with the PSE fora listing of

additonal 250000 common shares through a stock rights offering ata price of P10 per

share, Proceeds amounting to P2,500,000 were received in December 20x2 upon

completion of the stock rights offering,

Scanned with CamScanner

statement of. Financial Position 37

Note 13: Other components of equity

This line item consists of the following:

Revaluation surplus 260,000

Cumulative translation gains on foreign operations 357,000

Total long-term borrowings P617,000

—

Chapter 1: Summa

General purpose financial statements are those statements that

cater to the common’ needs of a wide range of primary

(external) users.

The purpose of general purpose financial statements is to

provide information about the financial position, financial

performance, and cash flows of an entity that is useful to a

wide range of users in making economic decisions.

‘A complete set of financial statements consists of the following:

(1) statement of financial position, (2) statement of profit or

loss and other comprehensive income, (3) statement of

changes in equity, (4) statement of cash flows, (5) notes, (5a)

comparative information, and (6) additional statement of

financial position when an entity makes a. retrospective

application, retrospective restatement, or reclassifies items —

with material effect.

+ The statement of financial position may be presented either

showing current/non-current distinction (classified) or based

on liquidity (unclassified). PAS 1 encourages the classified

presentation.

© Current assets are those that are expected to be realized within

1 year, All other assets are noncurrent.

* Current liabilities are those that are expected to be settled

within 1 year. All other liabilities are noncurrent.

* Deferred tax assets and deferred tax liabilities are presented as

noncurrent items in a classified statement of financial position.

* PAS 1 does not prescribe the order or format iri which an

presents items.

Scanned with CamScanner

38 Chepteey

SB

PROBLEMS

PROBLEM 1: TRUE OR FALSE

1. PAS 1 Presentation of Financial Statements requires an entity to

make an explicit statement of compliance with PFRSs.

2. According to PAS 1, an entity is never allowed, in any

circumstance, to depart from a provision of a PERS.

3. According to PAS 1, material items are presented separately

on the face of the ‘financial: statements while individually

immaterial items with similar nature are aggregated and

presented under a single line item.

4, PAS 1 Presentation of Financial Statements encourages, but does

not require, the presentation of the preceding year’s financial

statements as comparative information to the current year’s

financial statements.

5. Current liabilities are obligations that are expected to be

liquidated through the use of current assets or the creation of

other current liabilities.

6. Unless there is evidence to the contrary, accounts receivable is

presented in the statement of financial position as current

asset,

7. Investments in held for trading securities are always

presented in the statement of financial position as current

assets.

8. Unless there is evidence to the contrary, investment in equity

securities measured at FVOCI is presented in the statement of

financial position as current asset.

9. Investments in associates are non-current assets.

10. Investment properties are presumed to be current assets.

PROBLEM 2: FOR CLASSROOM DISCUSSION

1. General purpose financial statements cater to what type of

needs of users?

a. common needs c.aand b

b.. specific needs 4d. loving and caring needs

Scanned with CamScanner

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)