Professional Documents

Culture Documents

Sample Audit Program - Acctg. Dept

Sample Audit Program - Acctg. Dept

Uploaded by

angelicamadscOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Audit Program - Acctg. Dept

Sample Audit Program - Acctg. Dept

Uploaded by

angelicamadscCopyright:

Available Formats

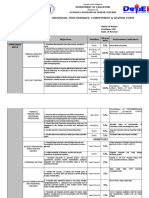

Name of Rural Bank

Audit Program Reviewed By:

Process: Approved By:

Branch/Business Unit: Audit Date:

AUDIT OBJECTIVES:

1. To ascertain compliance to prescribed policies, procedures and controls.

2. To determine whether the existing controls are appropriate and adequately mitigate risks.

3. To evaluate the effectiveness and efficiency of controls.

4. To identify value adding recommendations to improve the processes and controls.

5. To identify more risk/s within the actual processes.

RISK & CONTROL ANALYSIS & AUDIT PROCEDURES:

Risk Control Control Who Preliminary Test of Controls Procedure Time WP Performed Date

Objective Performed Evaluation Frame Ref. By

1.Incorrect or non-recording Consistency in F E 1. Obtain a copy of

of FFE may lead to booking the amount sent I F subsidiary ledger

misstated and inaccurate by HO-Accounting thru N A/S F print-out of FFE

consolidated financial IOA. A E account from A/S.

report. Check if all items N C (Note : only above

sent by HO – Accounting C T 5,000 items shall be

are completely booked. I I capitalizable)

A V 2. Check if the balance

L E of FFE account

appearing in the

subsidiary ledger is

consistent with the

balance found in

Branch’s SOC.

2.Posting overstated / Assigning of F E

understated or unrecorded Bank’s standard useful to I F 1. Obtain a copy of

depreciation for the month individual FFE. N A/S F lapsing schedule as

of bank’s asset may lead to Officer to A BM/BOO E of audit period from

incorrect financial reporting. check the lapsing schedule N C A/S.

prepared by A/S. C T 2. Observe the assigned

I I useful for each FFE

A V and take note any

L E inconsistency from

the standard bank’s

useful life.

3. Document any noted

exceptions and

discuss with the

process owner.

3.Improperly handled

branch’s SSU inventory AS should conduct F E 1. Inquire if A/S is

may invite tempted staff to physical inventory on all I A/S F conducting month-

perform fraudulent acts. SSU every month-end. N F end inventory of

Noteworthy SSUs A BOO E SSU.

should be kept inside the N C 2. Conduct physical

vault with separate C T count on all SSU

register being I I inventory and

maintained ( i.e. A V compare it with the

passbook, unissued L E per record/register

ATM cards, Cert. of maintained by the

Time Deposit, branch.

checkbook, Official 3. Note also the manner

Receipt, etc...) of safekeeping

especially for the

significant items.

(passbook,ATMcards

checkbook, etc...)

4.Un-updated reconciliation Reconciliation of the F

of Due to/from account by AS twice a I A/S 1. Ask the copy of

HO/Branches account may month. N Reconciliation report

lead to long outstanding Report prepared by AS A BM/BOO prepared by AS.

booking of floating items. to be reviewed/checked N (note: twice every

by Officer. C month )

I 2. Observe if

A reconciliation report

L is signed as

reviewed/checked by

officer.

You might also like

- Long Form Audit ReportDocument10 pagesLong Form Audit Reportchitrank10100% (3)

- Admin Assistant III IPCRFDocument4 pagesAdmin Assistant III IPCRFRhon T. Bergado100% (5)

- Test Bank For Human Resource Management 13th Edition MathisDocument33 pagesTest Bank For Human Resource Management 13th Edition MathisMitchellJohnsonktspj100% (35)

- Apollo Planning Audit Mini CaseDocument24 pagesApollo Planning Audit Mini Casepthav0% (5)

- Admin Assistant III IPCRFDocument4 pagesAdmin Assistant III IPCRFcarmena b. oris94% (17)

- Labour Law Notes LLB PDFDocument199 pagesLabour Law Notes LLB PDFjadiyappa100% (4)

- CISM 1a Information Security Governance PDFDocument4 pagesCISM 1a Information Security Governance PDFBrkNo ratings yet

- Admin Assistant III IPCRFDocument8 pagesAdmin Assistant III IPCRFJunjun Jonah JunjonNo ratings yet

- Individual Performance Commitment and Review Form (Ipcrf) : Annex FDocument2 pagesIndividual Performance Commitment and Review Form (Ipcrf) : Annex FBeverly Donato100% (2)

- Frauds in Plastic MoneyDocument60 pagesFrauds in Plastic MoneyChitra Salian0% (1)

- Individual Performance Commitment & Review Form: Department of Education Schools Division of Nueva VizcayaDocument3 pagesIndividual Performance Commitment & Review Form: Department of Education Schools Division of Nueva VizcayaMoises R Tordilla IIINo ratings yet

- Audit Program For PpeDocument5 pagesAudit Program For PpeGuiller C. Magsumbol100% (2)

- 09 - Cash and Bank BalancesDocument4 pages09 - Cash and Bank BalancesAqib SheikhNo ratings yet

- Audit Working Program - Loans PayableDocument5 pagesAudit Working Program - Loans PayableNanette Rose HaguilingNo ratings yet

- Balance Sheet Account Reconciliation SOP Apr'22Document15 pagesBalance Sheet Account Reconciliation SOP Apr'22AndyTanNo ratings yet

- Audit Program - Fixed AssetsDocument11 pagesAudit Program - Fixed Assetshamza dosani100% (3)

- CISO Roles ResponsibilitiesDocument6 pagesCISO Roles ResponsibilitiesVignesh KumarNo ratings yet

- Pagsasalin NG IdyomaDocument17 pagesPagsasalin NG IdyomaSheila Beth Galduen0% (1)

- DSWD-NCR - Audit Program - Construction in ProgressDocument5 pagesDSWD-NCR - Audit Program - Construction in ProgressAnn Marin100% (1)

- Checklist Bank Branch AuditDocument5 pagesChecklist Bank Branch AuditPratik Sankpal0% (1)

- Jurisprudence 2 NotesDocument5 pagesJurisprudence 2 NotesPaolo Vittorio Perdigueros GonzalesNo ratings yet

- SGV - E - Accounts Receivables, Trade - October 2015Document3 pagesSGV - E - Accounts Receivables, Trade - October 2015Christian Dela CruzNo ratings yet

- Property Inventory PlanDocument6 pagesProperty Inventory Planronald.aparejoNo ratings yet

- Aud. Program - Accounts PayableDocument6 pagesAud. Program - Accounts PayableRalph Christer MaderazoNo ratings yet

- Risk Statements:: Audit Program CASH IN BANK - Local CurrencyDocument3 pagesRisk Statements:: Audit Program CASH IN BANK - Local CurrencyJona De Castro - ManongdoNo ratings yet

- Investment Property - BuildingDocument1 pageInvestment Property - BuildingbeeNo ratings yet

- N-AP-1 - Accrued MarkupDocument2 pagesN-AP-1 - Accrued MarkupAung Zaw HtweNo ratings yet

- DSWD NCR - Audit Program Semi Expendable and PPEDocument4 pagesDSWD NCR - Audit Program Semi Expendable and PPEAnn MarinNo ratings yet

- Advances To SDOsDocument2 pagesAdvances To SDOsycabrera.coaNo ratings yet

- DSWD NCR Audit Program Semi ExpendablesDocument4 pagesDSWD NCR Audit Program Semi ExpendablesAnn MarinNo ratings yet

- AP - Audit of INVENTORY - Office Supplies - PRESENTATION.fDocument6 pagesAP - Audit of INVENTORY - Office Supplies - PRESENTATION.fCirilo CabadaNo ratings yet

- DSWD-NCR - Audit Program-Due From Regional Offices, Due To CODocument3 pagesDSWD-NCR - Audit Program-Due From Regional Offices, Due To COAnn MarinNo ratings yet

- CGMT Patna Ia Sept 2010Document72 pagesCGMT Patna Ia Sept 2010Chandan KumarNo ratings yet

- 19k (12-00) Develop The Audit Program - EquityDocument2 pages19k (12-00) Develop The Audit Program - EquityAnh Tuấn TrầnNo ratings yet

- 19d (12-00) Develop The Audit Program - InventoryDocument4 pages19d (12-00) Develop The Audit Program - InventoryTran AnhNo ratings yet

- LFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaDocument13 pagesLFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaJAY SHARMA100% (1)

- Saor Addalam Rhs 2018Document15 pagesSaor Addalam Rhs 2018gilbertNo ratings yet

- 2022 TOC Report - Sample ReportDocument9 pages2022 TOC Report - Sample ReportMarijune LetargoNo ratings yet

- Lead Schedule: E V C R&O P&D O M C P&DDocument4 pagesLead Schedule: E V C R&O P&D O M C P&DChristian Dela CruzNo ratings yet

- A-40 JevDocument1 pageA-40 JevErica DascoNo ratings yet

- Audit Thrusts FinalDocument4 pagesAudit Thrusts Finalangelo doceoNo ratings yet

- Local Audit ProcedureDocument17 pagesLocal Audit ProcedureKumar AshuNo ratings yet

- Aapsi 2021Document29 pagesAapsi 2021Moda ArgonaNo ratings yet

- E-AP-6 - Bills Discounted and PurchasedDocument3 pagesE-AP-6 - Bills Discounted and PurchasedAung Zaw HtweNo ratings yet

- General: Sl. No. Queries Yes No N.A. Explanatory NoteDocument83 pagesGeneral: Sl. No. Queries Yes No N.A. Explanatory Notesaradindu123No ratings yet

- Assignment # 02: 16 November 2018Document6 pagesAssignment # 02: 16 November 2018saniaNo ratings yet

- Status of Implementation of Prior Year'S Audit RecommendationsDocument15 pagesStatus of Implementation of Prior Year'S Audit RecommendationsGloria AlamilNo ratings yet

- Audit Program: Provision Against Long Term Deposits Against UtilitiesDocument4 pagesAudit Program: Provision Against Long Term Deposits Against UtilitiesAqib SheikhNo ratings yet

- Branch ReportsDocument5 pagesBranch ReportsJayakrishnaraj AJDNo ratings yet

- Due From LGUs Audit ProgramDocument2 pagesDue From LGUs Audit ProgramWilliam A. Chakas Jr.No ratings yet

- Name of Agency Audit Program CY 2016: Ap - Due To Bir Page 1 of 2Document2 pagesName of Agency Audit Program CY 2016: Ap - Due To Bir Page 1 of 2jaymark camachoNo ratings yet

- E-AP-1 - Short Term Deposits Prepayments and Other ReceivablesDocument6 pagesE-AP-1 - Short Term Deposits Prepayments and Other ReceivablesAung Zaw HtweNo ratings yet

- ACFrOgAnSoJ7XWPYGnx6EeD6VVuga1Muzpb1 UmTL1KF6SHmkaNKKUbtPMDxb4Z2AAkY1 HTo57fTE8OT uUhG7ydSy4g1jUtsEGfudlMVweTmcJ9VFgz6CHTugjAgI PDFDocument1 pageACFrOgAnSoJ7XWPYGnx6EeD6VVuga1Muzpb1 UmTL1KF6SHmkaNKKUbtPMDxb4Z2AAkY1 HTo57fTE8OT uUhG7ydSy4g1jUtsEGfudlMVweTmcJ9VFgz6CHTugjAgI PDFMarivic VeneracionNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationsDocument10 pagesStatus of Implementation of Prior Years' Audit RecommendationsJoy AcostaNo ratings yet

- Audit Observations APMT 2017Document22 pagesAudit Observations APMT 2017jaymark camachoNo ratings yet

- 100-000-Auditors Repors Financial StatementsDocument4 pages100-000-Auditors Repors Financial StatementsKris Anne SamudioNo ratings yet

- Appendix 14 - Instructions - BURSDocument1 pageAppendix 14 - Instructions - BURSthessa_starNo ratings yet

- Assets Disposal Form Has Been Prepared and ApprovedDocument4 pagesAssets Disposal Form Has Been Prepared and ApprovedChinh Lê ĐìnhNo ratings yet

- 19b (12-00) Develop The Audit Program - Accounts ReceivableDocument3 pages19b (12-00) Develop The Audit Program - Accounts ReceivableTran AnhNo ratings yet

- 19a (12-00) Develop The Audit Program - CashDocument2 pages19a (12-00) Develop The Audit Program - CashTran AnhNo ratings yet

- Ap - Cost of Goods SoldDocument2 pagesAp - Cost of Goods SoldRoby Renna EstoqueNo ratings yet

- RTS 2022 DARPO Davao CityDocument34 pagesRTS 2022 DARPO Davao CityLouie Mark lligan (COA - Louie Mark Iligan)No ratings yet

- 19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeDocument2 pages19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeTran AnhNo ratings yet

- Procedure-Internal Audits Rev 03Document7 pagesProcedure-Internal Audits Rev 03Oyungerel BattogtokhNo ratings yet

- 12-NavalWD2022 Part3-Status of PY's RecommDocument22 pages12-NavalWD2022 Part3-Status of PY's RecommKean Fernand BocaboNo ratings yet

- The Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and Auditors with CD ROMFrom EverandThe Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and Auditors with CD ROMNo ratings yet

- Vicinity MapDocument1 pageVicinity MapangelicamadscNo ratings yet

- Financial InstrumentsDocument11 pagesFinancial InstrumentsangelicamadscNo ratings yet

- Case Study - PrelimDocument3 pagesCase Study - PrelimangelicamadscNo ratings yet

- EmeDocument12 pagesEmeangelicamadscNo ratings yet

- INVESTMENTDocument3 pagesINVESTMENTangelicamadscNo ratings yet

- Insurance CompaniesDocument5 pagesInsurance CompaniesangelicamadscNo ratings yet

- Internal Audit and Contol QuestionnaireDocument8 pagesInternal Audit and Contol QuestionnaireangelicamadscNo ratings yet

- Risk Assessment CriteriaDocument5 pagesRisk Assessment CriteriaangelicamadscNo ratings yet

- Risk Assessment WorkSheetDocument29 pagesRisk Assessment WorkSheetangelicamadscNo ratings yet

- 8Document549 pages8gutenberg100% (2)

- Kids College Periodic 1 Examination (2019-20) Class: 9: Subject: English Date: Max. Marks: 50 TimeDocument4 pagesKids College Periodic 1 Examination (2019-20) Class: 9: Subject: English Date: Max. Marks: 50 TimeAbhishekNo ratings yet

- Jude Vincent B. Macalos: Career ObjectiveDocument3 pagesJude Vincent B. Macalos: Career ObjectiveJUDE VINCENT MACALOSNo ratings yet

- Narrative TextDocument5 pagesNarrative TextRizka SukmasariNo ratings yet

- Chapter 11Document16 pagesChapter 11JD0% (3)

- Rav Yitzchok Scheiner Delivers A Tough MessageDocument3 pagesRav Yitzchok Scheiner Delivers A Tough MessageyadmosheNo ratings yet

- Jewish Standard, April 1, 2016Document59 pagesJewish Standard, April 1, 2016New Jersey Jewish StandardNo ratings yet

- Moot Memo (R) of Semi-Finalist of 2nd GNLUMSIL MootDocument22 pagesMoot Memo (R) of Semi-Finalist of 2nd GNLUMSIL MootShuwakithaNo ratings yet

- Marketing Plan: Mogu MoguDocument23 pagesMarketing Plan: Mogu MoguBảo Quí TrầnNo ratings yet

- Shin Yang Group of Companies Wood ProductsDocument3 pagesShin Yang Group of Companies Wood ProductsShuk HamidNo ratings yet

- Ebay HamzaDocument2 pagesEbay Hamzaabrar zahidNo ratings yet

- Kerentanan Bangunan Terhadap TsunamiDocument13 pagesKerentanan Bangunan Terhadap TsunamiichliebeNo ratings yet

- 3238359Document164 pages3238359amal1403No ratings yet

- Wellington Tamil Christian Fellowship News Letter May 2012Document8 pagesWellington Tamil Christian Fellowship News Letter May 2012clem2kNo ratings yet

- EMZ-UAS-13 - 1031 Uen PA1 Confidentiality Agreement - Partner NameDocument6 pagesEMZ-UAS-13 - 1031 Uen PA1 Confidentiality Agreement - Partner NamekoyargaNo ratings yet

- Gabriel Humbert BEPS1 9.27.21 Part 2 - TrackDocument14 pagesGabriel Humbert BEPS1 9.27.21 Part 2 - TrackDirectMed Transcription ServicesNo ratings yet

- Group 8 Activity No. 1 Mekeni Tuki Ka Malawus Ka Pampanga 2Document10 pagesGroup 8 Activity No. 1 Mekeni Tuki Ka Malawus Ka Pampanga 2Jadon MejiaNo ratings yet

- Tapjeet Final ProjectDocument33 pagesTapjeet Final Projectggi2022.1928No ratings yet

- Form - Waagner BiroDocument3 pagesForm - Waagner BiroahmedsabercgNo ratings yet

- James Arthur (Singer)Document5 pagesJames Arthur (Singer)ancascribd00No ratings yet

- IUMI EyeDocument22 pagesIUMI EyeJackNo ratings yet

- G R No 195671 ROGELIO J GONZAGA Vs PEOPLE OF THE PHILIPPINESDocument7 pagesG R No 195671 ROGELIO J GONZAGA Vs PEOPLE OF THE PHILIPPINESRuel FernandezNo ratings yet

- I Thank God CDocument1 pageI Thank God Cjeremisam09No ratings yet