Professional Documents

Culture Documents

Doraswami Services 202402

Doraswami Services 202402

Uploaded by

bronnaf80Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Doraswami Services 202402

Doraswami Services 202402

Uploaded by

bronnaf80Copyright:

Available Formats

Please submit the original return and retain a copy for your records.

This return contains existing data

printed in pink. To correct or update information, write over the pink text in black ink and capital letters.

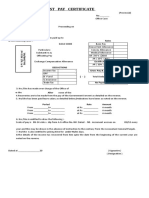

Return for Payment of Provisional Tax

Company /

Type: Individual Trust CC IRP6

Particulars of Taxpayer CMPTE01

Year of Period: First Second Taxpayer Registered

assessment 2 0 2 4 Reference Number 9 8 3 4 7 7 5 1 7 4 no. 2 0 2 0 / 8 8 3 0 8 5 / 0 7

Registered

name D O R A S W A M I S E R V I C E S

Taxpayer Estimate Unusual/infrequent amounts included in the estimated taxable income (eg. CGT, Lump sums)

Gross Income (sales/turnover plus other income) R 2 0 7 0 0 0 ., 0 0 Amount included in estimated taxable income that relates to unusual/infrequent events

R 0 ., 0 0

Estimated taxable income R 1 0 7 1 9 3 ., 0 0

Tax on estimated taxable R Historical Information

income 0 ., 0 0

Less: Rebates - Primary, secondary and tertiary Year last assessed 2 0 2 2

(for individuals only) R ,

- Medical scheme fees tax credit R Taxable income for that year R 0 ., 0 0

,

- Additional medical expenses R Basic amount R 0 ., 0 0

tax credit ,

Tax for the full year Payment Detail

R 0 ., 0 0

Payment ref no. (PRN) 9 8 3 4 7 7 5 1 7 4 P 0 0 0 2 2 0 2 4

Less: Employees’ tax for this period (12 months) R 0 ., 0 0

Beneficiary ID / Account no. S A R S - P R O V

Less: Foreign tax credits for this period (12 months) R 0 ., 0 0

Payment reference numbers and payment allocation:

Less: Provisional tax paid for 1st period R Always quote the unique PRN when making payment. Payment allocations to provisional tax periods are based on specific

0 ., 0 0 allocation rules which are linked to the unique PRN used on each provisional tax period return filed. If you wish to make a

payment relating to a previous period, please use the PRN specified on the previous provisional tax period return. Payments

Tax payable for this period R 0 ., 0 0 will be allocated to your account by provisional tax period in the following manner: 1st Penalties, 2nd Interest, 3rd Provisional

Tax declared. Please contact SARS when you wish to re-allocate a payment to the correct period.

Add: Penalty outstanding from 1st period R 0 ., 0 0 Electronic payments are recommended. SARS does not accept cheques exceeding R50 000.

Add: Interest outstanding from 1st period R 0 ., 0 0

Declaration

Amount payable R 0 ., 0 0

I declare that the information furnished in this return is true and

Add: Penalty on late payment R 0 ., 0 0 correct in every respect.

xxxxxxxxxxxxxxxxxxxxxxxxx

Date xxxxxxxxxxxxxxxxxxxxxxxxx

Add: Interest on late payment R 0 ., 0 0 For enquiries go to

(CCYYMMDD) 2 0 2 4 0 2 1 2 www.sars.gov.za or call

0800 00 SARS (7277)

Please ensure you sign over

Total Amount Payable R 0 ., 0 0 the 2 lines of “X”s above

IRP6 L 2 FV 2021.01.00 SV 1601 CT 03 NO 9834775174

P 02

Y 2024

b97c-121-0a17-4a26-a09w-d5980eb532db 001/001

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- BIR Form No. 1701Document4 pagesBIR Form No. 1701blesypNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- Manual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFDocument40 pagesManual - Intro To Financial Analytics by Kaizen Analytic LLP (Free Webinar) PDFBabar Ali100% (1)

- BMATH Week11-20Document33 pagesBMATH Week11-20Jaydine DavisNo ratings yet

- Bir Form 1702-RtDocument8 pagesBir Form 1702-RtJonalyn Lapidario100% (2)

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Print HTML5 FormDocument1 pagePrint HTML5 FormTeffo MathewsNo ratings yet

- UYLC Income Tax Return For 2022 (1702RT 2018C) - DraftDocument4 pagesUYLC Income Tax Return For 2022 (1702RT 2018C) - DraftVirgelio AbarquezNo ratings yet

- Income Decleration PDFDocument2 pagesIncome Decleration PDFvijay dabhiNo ratings yet

- 20992NAP Payment Form ReDocument1 page20992NAP Payment Form ReTzuyu TchaikovskyNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- BIR Form No. 1600Document2 pagesBIR Form No. 1600Lorraine Steffany BanguisNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- Quarterly Remittance Return of Final Income Taxes Withheld: Background InformationDocument2 pagesQuarterly Remittance Return of Final Income Taxes Withheld: Background InformationVincent John RigorNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- Form RR1: High-Income Individuals: Limitation On Use of Reliefs 2016Document8 pagesForm RR1: High-Income Individuals: Limitation On Use of Reliefs 2016Mil GustosNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- Lecture Three 2024Document20 pagesLecture Three 2024Khulekani SbonokuhleNo ratings yet

- Note On Budget Proposals-2020Document7 pagesNote On Budget Proposals-2020Mayur VartakNo ratings yet

- LAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsDocument2 pagesLAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsSyed Jalil abbas100% (1)

- Lwci Bir 1702 RT - 2023Document4 pagesLwci Bir 1702 RT - 2023Kevin BesaNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Document9 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertNo ratings yet

- Financial Assessment Income and ExpenditureDocument1 pageFinancial Assessment Income and ExpenditureThabo KholoaneNo ratings yet

- 1601C Final Jan 2018 With DPA Comp 2Document2 pages1601C Final Jan 2018 With DPA Comp 2Donjoe JoejoejoejoeNo ratings yet

- All in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Document24 pagesAll in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Pranab BanerjeeNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- BIR Form 1702-RTDocument4 pagesBIR Form 1702-RTAljohn Sechico BacolodNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3Document2 pages2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)JEREMY WILLIAM COZENS-HARDYNo ratings yet

- ESS Guidance - DocDocument5 pagesESS Guidance - DocEr Sundeep RachakondaNo ratings yet

- Group 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnDocument4 pagesGroup 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnVan Joshua NunezNo ratings yet

- Taxation of PartnershipDocument14 pagesTaxation of PartnershipJoy ConsigeneNo ratings yet

- Tax Rebate Calculator of Salaried Class Indviduals 2013-14Document4 pagesTax Rebate Calculator of Salaried Class Indviduals 2013-14waheedNo ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- Final File FY 20-21Document4 pagesFinal File FY 20-21Piyush LanjewarNo ratings yet

- Far Eastern University - Manila Income Taxation TAX1101 PartnershipDocument3 pagesFar Eastern University - Manila Income Taxation TAX1101 PartnershipRyan Christian BalanquitNo ratings yet

- Paper4 Taxation RTP All Attempts May23Document304 pagesPaper4 Taxation RTP All Attempts May23viji1957147No ratings yet

- PLBC FY2022 AmendedDocument4 pagesPLBC FY2022 AmendedstillwinmsNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationDeebees Marie Erazo TumulakNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- 1pg Itr SMIIDocument2 pages1pg Itr SMIIRic Dela CruzNo ratings yet

- BIR Form 0605 - Annual Registration FeeDocument2 pagesBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- BIR Form 1702-RT 2018Document8 pagesBIR Form 1702-RT 2018Krisha Pioco TabanaoNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- BIRForm1701 Old FormDocument6 pagesBIRForm1701 Old FormKristine VelardeNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Quarterly Percentage Tax Return: 12 - December 059Document2 pagesQuarterly Percentage Tax Return: 12 - December 059Abby UmipigNo ratings yet

- OSD 2nd QuarterDocument2 pagesOSD 2nd QuarterMariela MirandaNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationJonNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- 0619-E Jan 2018 Rev Final-1-1-1Document2 pages0619-E Jan 2018 Rev Final-1-1-1cahiligjoyceNo ratings yet

- Acknowledgement Niket Panjiier Army LucknowDocument1 pageAcknowledgement Niket Panjiier Army Lucknowbeauty kumariNo ratings yet

- Nirmal Singh Ack2Document1 pageNirmal Singh Ack2ca.lakshaykhannaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- ACC2054 Tutorial 3Document3 pagesACC2054 Tutorial 3Euvan KumarNo ratings yet

- Accounting Neri & LoiDocument120 pagesAccounting Neri & Loinerissa lopeNo ratings yet

- Week 6 Module 5 Analysis and Interpretation of Financial StatementsDocument31 pagesWeek 6 Module 5 Analysis and Interpretation of Financial StatementsZed Mercy86% (14)

- Law On Taxation Review.-Chapter 1Document17 pagesLaw On Taxation Review.-Chapter 1GeeanNo ratings yet

- LP 8 TaxationDocument2 pagesLP 8 TaxationJames CorpuzNo ratings yet

- ABM 12 FABM2 q1 CLAS7 Analysis and Interpretation of Financial Statement2 v2 RHEA ANN NAVILLADocument19 pagesABM 12 FABM2 q1 CLAS7 Analysis and Interpretation of Financial Statement2 v2 RHEA ANN NAVILLAGlecerie Ann Lizbeth PaanoNo ratings yet

- Prof 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedDocument22 pagesProf 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedTifanny MallariNo ratings yet

- 1 - Shrout Indictment December 15, 2015Document5 pages1 - Shrout Indictment December 15, 2015Freeman LawyerNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularhannah drew ovejasNo ratings yet

- LAPD-Gen-G01 - Taxation in South Africa - External GuideDocument91 pagesLAPD-Gen-G01 - Taxation in South Africa - External GuideUrvashi KhedooNo ratings yet

- CHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Document6 pagesCHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Maurice AgbayaniNo ratings yet

- Supply Chain Management: Dell & LenovoDocument7 pagesSupply Chain Management: Dell & LenovoRohanMohapatraNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- TAX.3401 General Principles in Taxation PDFDocument19 pagesTAX.3401 General Principles in Taxation PDFDestiny Lim CalambaNo ratings yet

- Strategic Tax Management Notes - CMA ReviewerDocument10 pagesStrategic Tax Management Notes - CMA ReviewerAngelly EsguerraNo ratings yet

- Tax Final CasesDocument14 pagesTax Final Casesjade123_129No ratings yet

- ACC100 Midterm - Winter 2012 - FINAL SOLUTION - StudentDocument7 pagesACC100 Midterm - Winter 2012 - FINAL SOLUTION - Studentseville240% (1)

- TAX Final Preboard SolutionDocument25 pagesTAX Final Preboard SolutionLaika Mae D. CariñoNo ratings yet

- Establishment of Jackfruit Meat Gourmet Manufactoring Business in Siniloan LagunaDocument14 pagesEstablishment of Jackfruit Meat Gourmet Manufactoring Business in Siniloan LagunaAPJAET JournalNo ratings yet

- Tax Review NotesDocument11 pagesTax Review NotesShayne AgustinNo ratings yet

- Explanatory Notes NIRC 1-30 Part 1 Aug2018Document23 pagesExplanatory Notes NIRC 1-30 Part 1 Aug2018Anonymous MikI28PkJcNo ratings yet

- Manila Memorial Park Inc v. Secretary of DSWD - G.R. No. 175356Document16 pagesManila Memorial Park Inc v. Secretary of DSWD - G.R. No. 175356Charmaine Valientes CayabanNo ratings yet

- 2021-490-Amendment-PCIC (Final)Document11 pages2021-490-Amendment-PCIC (Final)virliebenitez77No ratings yet

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- Microsoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Document9 pagesMicrosoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Erika Jamine SantosNo ratings yet

- Chapter8 TaxationonindividualsDocument12 pagesChapter8 TaxationonindividualsChristine Joy Rapi MarsoNo ratings yet