Professional Documents

Culture Documents

Applicable Stamp Duty On SPA

Uploaded by

yogeshshukla.ys140 ratings0% found this document useful (0 votes)

20 views1 pageApplicable Stamp Duty on SPA

Original Title

Applicable Stamp Duty on SPA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentApplicable Stamp Duty on SPA

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageApplicable Stamp Duty On SPA

Uploaded by

yogeshshukla.ys14Applicable Stamp Duty on SPA

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

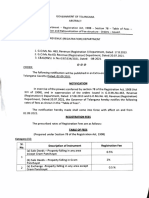

S.

Relevant Act Provision of the Act Applicable stamp duty for

No SPA

1. Uttar Pradesh Stamp Act, 2008 Article 5 (c), Schedule 50 paise for every Rs

(Noida). 1,00,000 (0.005% of the

value of shares at the time

of its sale or purchase).

2. Bombay Stamp Act, 1958 Article 5 (c), Schedule 1-A 1 Rupee for every Rs

(Mumbai). 10,000 rupee (0.1% of the

value of share at the time

of its sale or purchase).

3. Karnataka Stamp Duty Act, 1957 Article 5 (c), Schedule 1 Rupee for every Rs

(Bangalore). 1(A) 10,000 rupee (0.1% of the

value of share at the time

of its sale or purchase).

4. Tamil Nadu Stamp Act, 2019 Article 5(c), The Schedule 1 Rupee for every Rs

(Chennai). 10,000 rupee (0.1% of the

value of share at the time

of its sale or purchase).

5. The Indian Stamp (Delhi Article 5(b), Schedule 1 rupee for every Rs 10,000

Amendments) Act, 1899 (Delhi). 1(A) rupee (0.1% of the value of

share at the time of its sale

or purchase).

Applicable Stamp Duty for Share Purchase Agreement

You might also like

- Schedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)Document32 pagesSchedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)nikita karwaNo ratings yet

- Karnataka Stamp Duty Rates Updated Upto 31-07-2010Document28 pagesKarnataka Stamp Duty Rates Updated Upto 31-07-2010Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್50% (2)

- The Maharashtra Act Schedule 1 and 2Document40 pagesThe Maharashtra Act Schedule 1 and 2manish jaiswalNo ratings yet

- Stamp Duty On Transfer or Transmission of Shares Securities Statewise in IndiaDocument5 pagesStamp Duty On Transfer or Transmission of Shares Securities Statewise in IndiaAnchal RaiNo ratings yet

- Open OfferDocument9 pagesOpen OfferraghuNo ratings yet

- Duty & Fees - Stamp Duty and Registration FeeDocument5 pagesDuty & Fees - Stamp Duty and Registration FeeBoopathy RangasamyNo ratings yet

- INDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-ADocument28 pagesINDIAN STAMP ACT, 1899 Schedule I-A - SCHEDULE I-AyashNo ratings yet

- Total Land Area 2 Acres Leasable Area - Office 226,000 Assumed Rent 50 Monthly Rent 11,300,000 Annual Rent 135,600,000 (INR/ SFT/ Month)Document2 pagesTotal Land Area 2 Acres Leasable Area - Office 226,000 Assumed Rent 50 Monthly Rent 11,300,000 Annual Rent 135,600,000 (INR/ SFT/ Month)kshitij jainNo ratings yet

- 4delivery - Westlaw India PDFDocument4 pages4delivery - Westlaw India PDFsairishikeshNo ratings yet

- GO ChangeInStampDutyDocument9 pagesGO ChangeInStampDutySANTHOSH SANTHOSHNo ratings yet

- NN 4 2017 As Amended RCM On GoodsDocument3 pagesNN 4 2017 As Amended RCM On GoodsRohan KulkarniNo ratings yet

- Kerala registration rates and fees guideDocument12 pagesKerala registration rates and fees guideranjithxavierNo ratings yet

- Karnataka Stamp Act 1957 Schedule PDFDocument53 pagesKarnataka Stamp Act 1957 Schedule PDFRAJESH KUMARNo ratings yet

- Schedule I of Tamil Nadu Stamp ActDocument40 pagesSchedule I of Tamil Nadu Stamp ActYash GangwaniNo ratings yet

- Terms and ConditionsDocument15 pagesTerms and ConditionsMythri OfficersNo ratings yet

- INVESTMENT QUOTE - One City - Tower C - 503Document2 pagesINVESTMENT QUOTE - One City - Tower C - 503Aditi VishwakarmaNo ratings yet

- TN SeneiarageDocument3 pagesTN SeneiarageSadharmaSadhanaNo ratings yet

- Consumer ProtectionDocument1 pageConsumer ProtectionDeepak DasNo ratings yet

- INVESTMENT QUOTE - One City - Tower A - 2503Document3 pagesINVESTMENT QUOTE - One City - Tower A - 2503Aditi VishwakarmaNo ratings yet

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableDocument2 pagesBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzNo ratings yet

- Golden Nest Price SheetDocument2 pagesGolden Nest Price SheetRajesh KomatineniNo ratings yet

- Anti Termite BoqDocument2 pagesAnti Termite BoqAbu Mariam100% (1)

- Noti Rate Utgst 4 2017Document2 pagesNoti Rate Utgst 4 2017sridharanNo ratings yet

- Manchirevula Price Sheet - GeneralDocument1 pageManchirevula Price Sheet - GeneralGarNo ratings yet

- Revision of Rates IGRS 01-Sep-2021Document8 pagesRevision of Rates IGRS 01-Sep-2021venu4u498No ratings yet

- Payment Plan - Sukhbiri Villa - FinalDocument1 pagePayment Plan - Sukhbiri Villa - FinalPurnima YadavNo ratings yet

- Hindalco Wef 16.06.2018Document1 pageHindalco Wef 16.06.2018SanjayNo ratings yet

- Act - 30 - Tamil Nadu Minor Inams (Abolition and Conversion Into Ryotwari) Act, 1963Document26 pagesAct - 30 - Tamil Nadu Minor Inams (Abolition and Conversion Into Ryotwari) Act, 1963Girivel ThirugnanamNo ratings yet

- The Kerala Stamp Rules 1960Document11 pagesThe Kerala Stamp Rules 1960shiyas.vkNo ratings yet

- Finance Act, 2010Document10 pagesFinance Act, 2010SaddaqatNo ratings yet

- Get affordable mobile tariffs in AP starting from Rs.9Document6 pagesGet affordable mobile tariffs in AP starting from Rs.9Ibrahim KhaleelNo ratings yet

- Stamp Duty and Registration FeeDocument3 pagesStamp Duty and Registration FeeJerard francis victorNo ratings yet

- GOMS12Document3 pagesGOMS12Sanjana KakinadaNo ratings yet

- Temporary Occupation Licence (TOL)Document19 pagesTemporary Occupation Licence (TOL)Aieyda Nazri100% (3)

- Tower Stanley 3 BHK Premium PricingDocument1 pageTower Stanley 3 BHK Premium PricingMythri OfficersNo ratings yet

- Altura Price List & Payment Plan-02-11-2022Document1 pageAltura Price List & Payment Plan-02-11-2022Saurabh TewariNo ratings yet

- Andhra Court Fees Act 1958 amendment summaryDocument3 pagesAndhra Court Fees Act 1958 amendment summaryKushNo ratings yet

- Chit Fund FeesDocument5 pagesChit Fund Feesvinod kumarNo ratings yet

- Schedule I Stamp Duty ActDocument17 pagesSchedule I Stamp Duty Actvijay ostwalNo ratings yet

- YCM Price List 16.08.2023Document2 pagesYCM Price List 16.08.2023pawansagar0530No ratings yet