Professional Documents

Culture Documents

Closing Entries Module 5

Uploaded by

rima rivera0 ratings0% found this document useful (0 votes)

5 views1 pageClosing entries are journal entries prepared at the end of the accounting period to transfer the balances of all nominal accounts to the capital account, bringing all nominal accounts to a zero balance. There are four groups of closing entries: 1) closing revenue/income accounts to an income and expense summary account, 2) closing all expense accounts to the income and expense summary account, 3) closing the net income to the capital account, and 4) closing the drawing account to the capital account. A post-closing trial balance is prepared to prove the equality of debits and credits after closing entries.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentClosing entries are journal entries prepared at the end of the accounting period to transfer the balances of all nominal accounts to the capital account, bringing all nominal accounts to a zero balance. There are four groups of closing entries: 1) closing revenue/income accounts to an income and expense summary account, 2) closing all expense accounts to the income and expense summary account, 3) closing the net income to the capital account, and 4) closing the drawing account to the capital account. A post-closing trial balance is prepared to prove the equality of debits and credits after closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageClosing Entries Module 5

Uploaded by

rima riveraClosing entries are journal entries prepared at the end of the accounting period to transfer the balances of all nominal accounts to the capital account, bringing all nominal accounts to a zero balance. There are four groups of closing entries: 1) closing revenue/income accounts to an income and expense summary account, 2) closing all expense accounts to the income and expense summary account, 3) closing the net income to the capital account, and 4) closing the drawing account to the capital account. A post-closing trial balance is prepared to prove the equality of debits and credits after closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

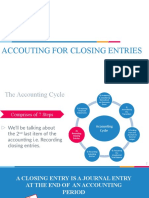

MODULE 5

Closing entries

❖ Closing Entries- are journal entries prepared at the end of the accounting period

(after adjusting entries) in order to transfer the balances of all nominal accounts to

the capital account. In other words, all nominal accounts are brought to zero

balances.

Four (4) Groups of Closing Entries:

1. To close Revenue/Sales/Income accounts to Income & Expense Summary

account.

2. To close all Expenses accounts to Income & Expense Summary account

3. To close the Net Income to Capital account.

4. To close the Drawing account to Capital account.

Income & Expense Summary – this is a temporary account created at the end of the

accounting period where Income and Expense are temporarily closed to this

accounts.

Post - Closing Trial Balances – after closing entries is prepared to proves the equality

of the debits and credit accounts. Therefore the post closing trial balances contains

all the list of the balance sheets accounts only.

You might also like

- Closing EntriesDocument1 pageClosing EntriesCharles Reginald K. HwangNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument2 pagesChapter 4 - Completing The Accounting CyclePárk Jigoo'sNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- CH4Document49 pagesCH4星喬No ratings yet

- Accounting PhaseDocument3 pagesAccounting PhaseFaithful FighterNo ratings yet

- Accounting For Closing EnteriesDocument12 pagesAccounting For Closing EnteriesIzzahIkramIllahiNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- CHAPTER 6 Completing The Accounting CycleDocument3 pagesCHAPTER 6 Completing The Accounting Cyclemojii caarrNo ratings yet

- ACTG123 (Reviewer)Document3 pagesACTG123 (Reviewer)Jenna BanganNo ratings yet

- Lesson 21Document15 pagesLesson 21Rica Mae ParamNo ratings yet

- CB Notebook 4Document1 pageCB Notebook 4iancharleseduriseulnaganNo ratings yet

- Accounting Principles: Second Canadian EditionDocument75 pagesAccounting Principles: Second Canadian EditionMuhammad AfzalNo ratings yet

- Ch3-4 Passenger VerDocument24 pagesCh3-4 Passenger Ver23006022No ratings yet

- Closing EntriesDocument4 pagesClosing EntriesAlan Christian NeisNo ratings yet

- Aira Joy S. GarciaDocument12 pagesAira Joy S. GarciaAira Joy Santos GarciaNo ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Closing EntriesDocument2 pagesClosing EntriesJotaro KujoNo ratings yet

- 2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which IncludeDocument8 pages2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which Includeapi-262218593No ratings yet

- Module7 (Activity 1) : What I Know Questions: What I Learned What Is Closing Entries?Document3 pagesModule7 (Activity 1) : What I Know Questions: What I Learned What Is Closing Entries?Mylene HeragaNo ratings yet

- Closing EntriesDocument14 pagesClosing EntriesdavilaNo ratings yet

- Lecture Week 8Document51 pagesLecture Week 8Muhammad HusseinNo ratings yet

- CH 4 Work Sheet2Document54 pagesCH 4 Work Sheet2Yasin Arafat ShuvoNo ratings yet

- Major Steps in Accounting Cycle1Document15 pagesMajor Steps in Accounting Cycle1elriatagat85No ratings yet

- Learning Activity Sheets in Fundamental of Accountancy, Business, and Management 1Document27 pagesLearning Activity Sheets in Fundamental of Accountancy, Business, and Management 1Rheyjhen Cadawas40% (5)

- Quiz-2 Financial Acctg & ReportingDocument3 pagesQuiz-2 Financial Acctg & ReportingDanica Saraus DomughoNo ratings yet

- Partnership and Corporation - Chapter 4Document2 pagesPartnership and Corporation - Chapter 4Aeris StrongNo ratings yet

- Module 006 Week002-Finacct3 Review of The Accounting ProcessDocument4 pagesModule 006 Week002-Finacct3 Review of The Accounting Processman ibeNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting Cycleliesly buticNo ratings yet

- ACTG121LEC (Reviewer)Document3 pagesACTG121LEC (Reviewer)Jenna BanganNo ratings yet

- Welcome To The Period End Closing TopicDocument25 pagesWelcome To The Period End Closing TopicFernandoNo ratings yet

- Management PresentationDocument61 pagesManagement Presentationiffat.stu2018No ratings yet

- CH2 Principles of Acc P3Document16 pagesCH2 Principles of Acc P3saed cabdiNo ratings yet

- Class 20Document4 pagesClass 20Majid IqbalNo ratings yet

- Completing The Accounting CycleDocument17 pagesCompleting The Accounting CycleAudity PaulNo ratings yet

- Supplementary Material Module 5Document10 pagesSupplementary Material Module 5Darwin Dionisio ClementeNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documentracc wooyoNo ratings yet

- Introduction: The Accounting Process Is A Series of Activities That BeginsDocument20 pagesIntroduction: The Accounting Process Is A Series of Activities That BeginsMiton AlamNo ratings yet

- Accounting CycleDocument3 pagesAccounting CyclefranciscalinjeNo ratings yet

- Part 1: Charles Hwang, CPA Tutorial ServicesDocument1 pagePart 1: Charles Hwang, CPA Tutorial ServicesAlyssa GervacioNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Chapter 4 ReviewDocument8 pagesChapter 4 ReviewKim Ngan TranNo ratings yet

- 课堂练习-Chapter 4Document2 pages课堂练习-Chapter 4timNo ratings yet

- Accounting Cycle StepsDocument3 pagesAccounting Cycle Stepsjewelmir100% (1)

- Period Close Processing Checklist - R12 General LedgerDocument5 pagesPeriod Close Processing Checklist - R12 General LedgerSureshNo ratings yet

- CH 4Document59 pagesCH 4ad_jebbNo ratings yet

- The Accounting Cycle: 9-Step Accounting Process InshareDocument3 pagesThe Accounting Cycle: 9-Step Accounting Process InshareBTS ARMYNo ratings yet

- AccountingDocument1 pageAccountingRya MarianoNo ratings yet

- 00 - Notes On Accounting ProcessDocument7 pages00 - Notes On Accounting ProcessLalaine ReyesNo ratings yet

- Ch04 - Completing The Accounting CycleDocument26 pagesCh04 - Completing The Accounting CycleBảo DươngNo ratings yet

- The Accounting CycleDocument3 pagesThe Accounting CyclekyncjsNo ratings yet

- Q4 Fabm1 ReviewerDocument7 pagesQ4 Fabm1 ReviewerAira MoscosaNo ratings yet

- Completion of The Accounting PDFDocument10 pagesCompletion of The Accounting PDFZairah HamanaNo ratings yet

- Accounting Process CycleDocument12 pagesAccounting Process Cyclechandra sekhar Tippreddy100% (1)

- Accounting Process 2Document2 pagesAccounting Process 2Lala ArdilaNo ratings yet

- Completing The Accounting CycleDocument7 pagesCompleting The Accounting CycleDe Vera PatrickNo ratings yet

- Steps in The Accounting Process Assignment AISDocument2 pagesSteps in The Accounting Process Assignment AISKathlene BalicoNo ratings yet

- Closing Entries: 1. Close Revenue To Income SummaryDocument3 pagesClosing Entries: 1. Close Revenue To Income Summarymuhammadtaimoorkhan100% (2)

- Chapter 5. Closing Entries and The Post-Closing Trial BalanceDocument26 pagesChapter 5. Closing Entries and The Post-Closing Trial BalanceNguyen Dac ThichNo ratings yet

- Statement of Cash Flows Module 6Document3 pagesStatement of Cash Flows Module 6rima riveraNo ratings yet

- Rules of Debit and Credit Module 3Document12 pagesRules of Debit and Credit Module 3rima riveraNo ratings yet

- Basic Accounting Module 1Document6 pagesBasic Accounting Module 1rima riveraNo ratings yet

- Activity 3 Service ConcernDocument1 pageActivity 3 Service Concernrima riveraNo ratings yet