Professional Documents

Culture Documents

ACCOUNTING SCANDAL - Kraft Heinz Fined

ACCOUNTING SCANDAL - Kraft Heinz Fined

Uploaded by

Sherwin Delos Reyes DelacionOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCOUNTING SCANDAL - Kraft Heinz Fined

ACCOUNTING SCANDAL - Kraft Heinz Fined

Uploaded by

Sherwin Delos Reyes DelacionCopyright:

Available Formats

DELACION, SHERWIN D.

FINMGT 3101

FM 305

Kraft Heinz Fined $62M for Accounting Fraud

Published Sept. 3, 2021, by Matthew Heller

The Kraft Heinz Company, the world's fifth-largest food and beverage company, is the

third-largest in North America and the world's fifth-largest with eight $1 billion+ brands. As a

globally trusted producer of delicious foods, it offers high-quality, delicious, and nutritious

options for all eating occasions.

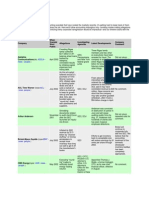

The Securities and Exchange Commission (SEC) has charged Kraft Heinz Company

with a long-running expense management scheme that resulted in the restatement of several

years of financial reporting. The company engaged in various types of accounting misconduct,

including recognizing unearned discounts from suppliers and maintaining false and misleading

supplier contracts. These improprieties improperly reduced the company's cost of goods sold

and allegedly achieved "cost savings." The accounting improprieties resulted in Kraft reporting

inflated adjusted "EBITDA," a key earnings performance metric for investors. In June 2019,

Kraft restated its financials, correcting a total of $208 million in improperly recognized cost

savings arising out of nearly 300 transactions. The SEC's order finds Kraft violated the

negligence-based anti-fraud, reporting, books and records, and internal accounting controls

provisions of the federal securities laws.

Kraft agreed to pay a civil penalty of $62 million and to cease and desist from future

violations, while former Chief Operating Officer Eduardo Pelleissone and former Chief

Procurement Officer Klaus Hofmann will pay fines of $300,000 and $100,000, respectively.

According to the SEC, the violations harmed investors, who had to bear the costs and burdens

of a restatement and delayed financial reporting.

Conclusion:

Kraft Heinz has been charged by the SEC with a long-running expense management

scheme, resulting in the restatement of financial reporting and violating federal securities laws.

The company has agreed to cease future violations and pay a civil penalty.

EBITDA measures a company's profitability before indebtedness, state-mandated payments,

and asset maintenance costs. It excludes wages, raw materials, services, borrowing costs,

lease expenses, and government obligations from revenues.

You might also like

- Test Bank For Advanced Financial Accounting 12th Edition Theodore Christensen David Cottrell Cassy BuddDocument2 pagesTest Bank For Advanced Financial Accounting 12th Edition Theodore Christensen David Cottrell Cassy BuddKay LeeNo ratings yet

- ACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDocument3 pagesACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDylan AdrianNo ratings yet

- Chapter 14Document41 pagesChapter 14wrzmstr2No ratings yet

- LEGT2741 Assignment (Week 5)Document9 pagesLEGT2741 Assignment (Week 5)Danny NgNo ratings yet

- Exercise List 1 - DCF Valuation v01Document4 pagesExercise List 1 - DCF Valuation v01Lorenzo ParenteNo ratings yet

- Practice Problems Capital Structure 25-09-2021Document17 pagesPractice Problems Capital Structure 25-09-2021BHAVYA KANDPAL 13BCE02060% (1)

- National Fabricators 1Document8 pagesNational Fabricators 1Sam Addi33% (3)

- Total Tower Case 1Document6 pagesTotal Tower Case 1Maya BoraNo ratings yet

- AUTUMN LAMPKINS v. MITRA QSR, LLC, MITRA QSR KNE, LLC, and KFC CORPORATIONDocument28 pagesAUTUMN LAMPKINS v. MITRA QSR, LLC, MITRA QSR KNE, LLC, and KFC CORPORATIONM D'Angelo100% (1)

- Key Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - InvestopediaDocument3 pagesKey Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - Investopediapolobook3782No ratings yet

- Chapter 5 - Conceptual FrameworkDocument7 pagesChapter 5 - Conceptual Frameworkvitria zhuanita100% (2)

- Krispy Kreme Financial Analysis Case StudyDocument4 pagesKrispy Kreme Financial Analysis Case StudyDaphne PerezNo ratings yet

- Chapter 3Document17 pagesChapter 3Phan Anh HaoNo ratings yet

- Accounting For Executives - Final Paper JotDocument48 pagesAccounting For Executives - Final Paper Jotapi-341396604100% (2)

- 14Document69 pages14Shoniqua Johnson100% (2)

- Chapter 09 SolutionsDocument43 pagesChapter 09 SolutionsDwightLidstromNo ratings yet

- Net Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NDocument3 pagesNet Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NMich Elle CabNo ratings yet

- Group 1 - Case 1.5Document7 pagesGroup 1 - Case 1.5lumiradut70100% (2)

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Exam 3 FINC 631 Summer 2013Document12 pagesExam 3 FINC 631 Summer 2013Sammy Ben MenahemNo ratings yet

- ACCOUNTINGDocument27 pagesACCOUNTINGUzzal HaqueNo ratings yet

- Budjet and PlannigDocument10 pagesBudjet and Plannigprakash009kNo ratings yet

- FAPDocument12 pagesFAPAnokye AdamNo ratings yet

- Auditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)Document6 pagesAuditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)sonima aroraNo ratings yet

- JEFFERY DIEFFENBACH v. GREENLEAF COMPASSIONATE CARE CENTER, INC.Document27 pagesJEFFERY DIEFFENBACH v. GREENLEAF COMPASSIONATE CARE CENTER, INC.sandydocsNo ratings yet

- Chapter 08Document26 pagesChapter 08sdnm dnkNo ratings yet

- AIG - Background HistoryDocument5 pagesAIG - Background HistoryKaren CalmaNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- The Fund of Funds: A Focus On Evidence-Asset Valuation: SynopsisDocument4 pagesThe Fund of Funds: A Focus On Evidence-Asset Valuation: SynopsisCryptic LollNo ratings yet

- Wiley - Chapter 11: Depreciation, Impairments, and DepletionDocument39 pagesWiley - Chapter 11: Depreciation, Impairments, and DepletionIvan BliminseNo ratings yet

- Amazon Stock Report $AMZNDocument7 pagesAmazon Stock Report $AMZNctringhamNo ratings yet

- Ursula Capital Partners, LP v. Crowe U.K. LLPDocument97 pagesUrsula Capital Partners, LP v. Crowe U.K. LLPBillboardNo ratings yet

- CH 01Document2 pagesCH 01Sandeep Kumar PalNo ratings yet

- Dr. Jones Case StudyDocument2 pagesDr. Jones Case StudyHaironezza AbdullahNo ratings yet

- Financial Reporting and Changing PricesDocument6 pagesFinancial Reporting and Changing PricesFia RahmaNo ratings yet

- Kirch Media (Germany) : How It Happened?Document3 pagesKirch Media (Germany) : How It Happened?Komal JosunNo ratings yet

- Collaborative Review Task M1 Enron Case StudyDocument2 pagesCollaborative Review Task M1 Enron Case StudyAbdullah AlGhamdiNo ratings yet

- Rhode Island Hospital Trust National Bank v. Swartz, Bresenoff, Yavner & Jacobs, A Virginia Partnership, 455 F.2d 847, 4th Cir. (1972)Document9 pagesRhode Island Hospital Trust National Bank v. Swartz, Bresenoff, Yavner & Jacobs, A Virginia Partnership, 455 F.2d 847, 4th Cir. (1972)Scribd Government DocsNo ratings yet

- Akl - Chap 10 - HoyleDocument10 pagesAkl - Chap 10 - Hoylelina nur hamidahNo ratings yet

- OSX FinancialAccounting ISM Ch09Document57 pagesOSX FinancialAccounting ISM Ch09Jan Mark CastilloNo ratings yet

- Chapter - 03, Process of Assurance - Planning The AssignmentDocument7 pagesChapter - 03, Process of Assurance - Planning The AssignmentSakib Ex-rccNo ratings yet

- Accounting For Airline FFPDocument20 pagesAccounting For Airline FFPPaula Andrea GarciaNo ratings yet

- Chap 006Document51 pagesChap 006kel458100% (1)

- Arthur AndersenDocument9 pagesArthur AndersenSheraz HasanNo ratings yet

- Acountancy 10Document129 pagesAcountancy 10Erfan Bhat0% (1)

- Pelzer Company Reconciled Its Bank and Book Statement Balances ofDocument2 pagesPelzer Company Reconciled Its Bank and Book Statement Balances ofAmit PandeyNo ratings yet

- IMEF Case 15 AnalysisDocument5 pagesIMEF Case 15 AnalysisHoward McCarthyNo ratings yet

- 02 How To Forecast Sales More Accurately 1Document1 page02 How To Forecast Sales More Accurately 1eduson2013No ratings yet

- Transfer and Transmission of SharesDocument2 pagesTransfer and Transmission of SharesLina KhalidaNo ratings yet

- Main ReportDocument13 pagesMain Reportehsanul1No ratings yet

- Introduction To Accounting and BusinessDocument42 pagesIntroduction To Accounting and BusinessCris LuNo ratings yet

- Kraft Heinz's Accounting Issues Raise Red Flags: A Timeline of EventsDocument2 pagesKraft Heinz's Accounting Issues Raise Red Flags: A Timeline of EventsThuong VuNo ratings yet

- The Corporate Scandal SheetDocument4 pagesThe Corporate Scandal SheetAngelo LincoNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Ifrs - IntroductionDocument28 pagesIfrs - IntroductionArockia Sagayaraj TNo ratings yet

- Motives and Consequences of Fraudulent Financial ReportingDocument8 pagesMotives and Consequences of Fraudulent Financial ReportingAndreea VioletaNo ratings yet

- Daniels Fund Ethics Initiative University of New Mexico HTTPDocument12 pagesDaniels Fund Ethics Initiative University of New Mexico HTTPMuhammad TariqNo ratings yet

- Teamsters GE LawsuitDocument31 pagesTeamsters GE LawsuitDan ShepardNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet