Professional Documents

Culture Documents

Strategies For Liquidity Managers

Uploaded by

fateh.fitness1230 ratings0% found this document useful (0 votes)

4 views1 pageThis document discusses three strategies for liquidity management:

1. Asset liquidity management involves storing liquid assets like treasury bills, CDs, and bonds that can easily be converted to cash when needed. However, it has opportunity costs and potential capital losses.

2. Borrowed liquidity management relies on borrowing funds as needed, allowing flexibility but uncertainty in borrowing costs and potential signals of financial difficulty.

3. A balanced strategy combines storing some liquid assets while also arranging credit lines, balancing risk, returns and flexibility between the asset and liability approaches.

Original Description:

Original Title

Strategies for Liquidity Managers

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses three strategies for liquidity management:

1. Asset liquidity management involves storing liquid assets like treasury bills, CDs, and bonds that can easily be converted to cash when needed. However, it has opportunity costs and potential capital losses.

2. Borrowed liquidity management relies on borrowing funds as needed, allowing flexibility but uncertainty in borrowing costs and potential signals of financial difficulty.

3. A balanced strategy combines storing some liquid assets while also arranging credit lines, balancing risk, returns and flexibility between the asset and liability approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageStrategies For Liquidity Managers

Uploaded by

fateh.fitness123This document discusses three strategies for liquidity management:

1. Asset liquidity management involves storing liquid assets like treasury bills, CDs, and bonds that can easily be converted to cash when needed. However, it has opportunity costs and potential capital losses.

2. Borrowed liquidity management relies on borrowing funds as needed, allowing flexibility but uncertainty in borrowing costs and potential signals of financial difficulty.

3. A balanced strategy combines storing some liquid assets while also arranging credit lines, balancing risk, returns and flexibility between the asset and liability approaches.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Strategies for Liquidity Managers

Asset Liquidity Management or Asset Conversation Strategy

The asset conversion strategy entails storing liquidity in assets, mainly in cash and

marketable securities, so that when liquidity is needed, selected assets can be easily

converted into cash to meet all demands.

Liquid assets have to have the following three characteristics:

1. It has to have a ready market, which means that it can be easily converted into cash

2. It has to have a stable price

3. It has to be reversible, which means the seller can recover his/her original principal

with little risk of loss

The most popular liquid assets include Treasury bills, federal fund loans, certificates of

deposit, municipal bonds, federal agency securities, and euro currency loans. However, a

financial firm is liquid only if it has access, at reasonable cost, to liquid funds in exactly the

amounts required at precisely the time they are needed.

This method is mainly used by smaller financial institutions, because asset liquidity

managements is a less risky approach to liquidity management, compared to borrowing.

However, it is a costly approach. There is an opportunity cost included, the loss of future

earnings on assets that must be sold. Most of the time the financial firm has to pay

commissions when the assets are sold. There is a potential for capital losses if interest rates

are raising. Moreover, selling assets to raise liquidity may weaken the appearance of the

balance sheet. Lastly, liquid assets generally have low returns.

Borrowed Liquidity (Liability) Management Strategy

Liability management strategy is an approach extensively used by the largest firms. It entails

borrowing immediately spendable funds to cover all anticipated demands for liquidity. The

primary sources of borrowed liquidity are including jumbo negotiable CDs, federal funds

borrowings, repurchase agreements, Euro currency borrowings, advances from the Federal

Home Loan Banks, and borrowings at the discount window of the country’s central bank.

There are several advantages for the financial institutions of using the borrowed liquidity

management strategy. The number one advantage of this approach is that it calls for

borrowing funds only when there is a need for funds (instead of storing liquid assets all the

time). Moreover, the volume and composition of the investment portfolio can remain

unchanged and the institution can control interest rates in order to borrow funds.

On the other hand, this method has several advantages as well. First of all, this strategy

offers the highest expected returns, but carries the highest risk due to volatility of interest

rates and possible rapid changes in credit availability. The borrowing cost is always

uncertain and borrowings can be interpreted as a signal of financial difficulties.

Balanced Liquidity Management Strategy

The balanced liquidity management strategy entails combining both asset and liability

management. It entails storing a portion of expected demands for liquidity in assets, while

backstopping other anticipated liquidity needs by advance arrangements for lines of credit

from potential suppliers of funds.

You might also like

- Financial Institutions Management - Solutions - Chap001Document10 pagesFinancial Institutions Management - Solutions - Chap001Samra AfzalNo ratings yet

- Caiib - 2 BFM Quick BookDocument124 pagesCaiib - 2 BFM Quick BookMansi Sheth100% (2)

- Principles of Money & BankingDocument3 pagesPrinciples of Money & BankingMohsin KhanNo ratings yet

- Asset Accounting ConfigurationDocument145 pagesAsset Accounting ConfigurationShaily DubeyNo ratings yet

- Treasury ManagementDocument6 pagesTreasury ManagementJanzel NuñezNo ratings yet

- List of Agricultural Companies in KenyaDocument27 pagesList of Agricultural Companies in Kenyaangie_nimmo71% (42)

- Chapter 9 - Interest Rate and Currency Swaps (Q&A)Document5 pagesChapter 9 - Interest Rate and Currency Swaps (Q&A)Nuraisyahnadhirah MohamadtaibNo ratings yet

- 2021 09 02 List of Rice ImportersDocument24 pages2021 09 02 List of Rice ImportersPhil BorNo ratings yet

- CHAPTER 1 - The Nature and Role of CreditDocument4 pagesCHAPTER 1 - The Nature and Role of Creditdoray100% (1)

- Manajemen 28-3Document8 pagesManajemen 28-3Theresiana DeboraNo ratings yet

- Chapter 12Document1 pageChapter 12Evelyn RiesNo ratings yet

- Working Cap MGTDocument53 pagesWorking Cap MGTRakibul IslamNo ratings yet

- ECON75 Lecture I. Introduction To Finnacial SytemDocument7 pagesECON75 Lecture I. Introduction To Finnacial SytemJoshua De VeraNo ratings yet

- Financial SystemDocument31 pagesFinancial SystemAdriana Del rosarioNo ratings yet

- Factors Influencing Credit PolicyDocument5 pagesFactors Influencing Credit PolicyMrDj Khan75% (4)

- Management of The ShortDocument13 pagesManagement of The ShortShivaraman ShankarNo ratings yet

- Comprehensive Activity - Financial ManagementDocument2 pagesComprehensive Activity - Financial Managementmarkconda21No ratings yet

- Financial Market and InstituionsDocument99 pagesFinancial Market and Instituionsዝምታ ተሻለNo ratings yet

- FinanceDocument108 pagesFinanceChaitanya DaraNo ratings yet

- FinanceDocument117 pagesFinancenarendraidealNo ratings yet

- Tutorial 3 Liquidity - Security PortfolioDocument12 pagesTutorial 3 Liquidity - Security PortfolioSyafiq Kamarul ZamanNo ratings yet

- Assignment # 1 POWER ECONOMICSDocument3 pagesAssignment # 1 POWER ECONOMICSkhalidNo ratings yet

- Revision OCT2018 Exams BAN2602Document9 pagesRevision OCT2018 Exams BAN2602RoelienNo ratings yet

- Retail Banking S ST WyvhdeDocument8 pagesRetail Banking S ST WyvhdeAlimo shaikhNo ratings yet

- Chapter 5 Overview of The Financial SystemDocument7 pagesChapter 5 Overview of The Financial Systemshai santiagoNo ratings yet

- Dfin402 - Treasury ManagementDocument11 pagesDfin402 - Treasury Managementjitender jangirNo ratings yet

- Chapter - 9 Investment Portfolio and Liquidity ManagementDocument16 pagesChapter - 9 Investment Portfolio and Liquidity Managementsahil ShresthaNo ratings yet

- Philippine Financial SystemDocument14 pagesPhilippine Financial SystemMarie Sheryl FernandezNo ratings yet

- Finm3404 NotesDocument20 pagesFinm3404 NotesHenry WongNo ratings yet

- Money & Banking: Capitalist EconomiesDocument7 pagesMoney & Banking: Capitalist Economiesmabvuto phiriNo ratings yet

- Role of Treasury ManagementDocument3 pagesRole of Treasury ManagementcharrygabornoNo ratings yet

- Treasury Management AssignmentDocument8 pagesTreasury Management AssignmentAnkit JugranNo ratings yet

- Managing and Pricing Deposit Services: 2.1 Types PF DepositsDocument10 pagesManaging and Pricing Deposit Services: 2.1 Types PF Depositsadela simionovNo ratings yet

- Introduction FINANCEDocument9 pagesIntroduction FINANCEBOL AKETCHNo ratings yet

- Module 1 - The Role of Financial Markets and Financial IntermediariesDocument11 pagesModule 1 - The Role of Financial Markets and Financial IntermediariesAriaga CapsuPontevedraNo ratings yet

- W C F D: Orking Apital and The Inancing EcisionDocument11 pagesW C F D: Orking Apital and The Inancing EcisionRita Redoble EspirituNo ratings yet

- FM ExamDocument13 pagesFM Examtigist abebeNo ratings yet

- Management - of - Financial - Services - Graded - Assignment KeshavDocument10 pagesManagement - of - Financial - Services - Graded - Assignment KeshavKeshav mananNo ratings yet

- Some of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowDocument3 pagesSome of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowNadir ShahNo ratings yet

- A Shortterm Fianancial Palning Noors AsimentDocument3 pagesA Shortterm Fianancial Palning Noors AsimentmahnooriftikharNo ratings yet

- Kind of RiskDocument4 pagesKind of RiskNhi Phan TúNo ratings yet

- Forecasting and Planning. The Financial Staff Must Coordinate The Planning Process. This Means They MustDocument12 pagesForecasting and Planning. The Financial Staff Must Coordinate The Planning Process. This Means They MustAssignment HelperNo ratings yet

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementDocument8 pagesUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውNo ratings yet

- Corporate LawDocument15 pagesCorporate LawLaxmi WankhedeNo ratings yet

- For Exam Bank ManagementDocument215 pagesFor Exam Bank ManagementAung phyoe Thar OoNo ratings yet

- Todays' Class of FAA & BODocument11 pagesTodays' Class of FAA & BOAmogh AroraNo ratings yet

- Planning, Organizing, Directing and Controlling: Estimation of Capital RequirementsDocument4 pagesPlanning, Organizing, Directing and Controlling: Estimation of Capital RequirementsJG ElbaNo ratings yet

- Money Market FundDocument3 pagesMoney Market FundnegosyomailNo ratings yet

- Banking ConceptsDocument19 pagesBanking ConceptsjayaNo ratings yet

- FIN 4324 Final Exam Study GuideDocument32 pagesFIN 4324 Final Exam Study GuideNicholas GiaquintoNo ratings yet

- Research On PSUDocument17 pagesResearch On PSUDevendra BhagyawantNo ratings yet

- Investments Complete Part 1 1Document65 pagesInvestments Complete Part 1 1THOTslayer 420No ratings yet

- Financial ReportingDocument74 pagesFinancial ReportingKiran A SNo ratings yet

- Working Capital Tulasi SeedsDocument22 pagesWorking Capital Tulasi SeedsVamsi SakhamuriNo ratings yet

- INSIGHT Potfolio MGNTDocument35 pagesINSIGHT Potfolio MGNTHari NairNo ratings yet

- CFI 321 Lesson 3 June 2023Document3 pagesCFI 321 Lesson 3 June 2023nyambura jacklineNo ratings yet

- What Is Asset and Liability ManagementDocument18 pagesWhat Is Asset and Liability ManagementRuhi KapoorNo ratings yet

- FME 312 - Treasury Mgt. - Big Picture A Week 1 3Document10 pagesFME 312 - Treasury Mgt. - Big Picture A Week 1 3Cheryl Diane Mae LumantasNo ratings yet

- FINANCIAL MARKETS AND INSTITUTIONS (AutoRecovered)Document8 pagesFINANCIAL MARKETS AND INSTITUTIONS (AutoRecovered)dickens omondiNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- MONDO WE INNOVATE YOU WIN Brochure 2022-EnDocument97 pagesMONDO WE INNOVATE YOU WIN Brochure 2022-Enmicky mouseNo ratings yet

- Lecture 4-Break Even and Contribution Margin AnalysisDocument13 pagesLecture 4-Break Even and Contribution Margin AnalysisFathurrahman AnwarNo ratings yet

- European Union Thesis TopicsDocument8 pagesEuropean Union Thesis Topicskelleyhunterlasvegas100% (2)

- QTi InsideDocument2 pagesQTi Insiderobertomauricio1876No ratings yet

- HSBC The World 2050 ReportDocument48 pagesHSBC The World 2050 Reporte contiNo ratings yet

- Corporate Finance - Chapter 18Document3 pagesCorporate Finance - Chapter 18Bella LsiaNo ratings yet

- Different Nationalist Approaches of Indian HistoryDocument6 pagesDifferent Nationalist Approaches of Indian HistoryLast RoninNo ratings yet

- Tutorial Ques - Personal Financial Planning-SolDocument10 pagesTutorial Ques - Personal Financial Planning-SolLaiba RazaNo ratings yet

- Cecil Notes AllDocument217 pagesCecil Notes AllCollinNo ratings yet

- Tugas 4 Tpai - Kelompok 1Document21 pagesTugas 4 Tpai - Kelompok 1Fungsional PenilaiNo ratings yet

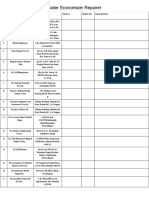

- Boiler Economizer RepairerDocument10 pagesBoiler Economizer RepairerHARSH PUNMIYANo ratings yet

- Class Activity: Answering Problem Type Questions: Ms Mwelwa BBA 170Document2 pagesClass Activity: Answering Problem Type Questions: Ms Mwelwa BBA 170Edwin Biggie MwaleNo ratings yet

- TCW Course Pack W3Document17 pagesTCW Course Pack W3Kyla Artuz Dela CruzNo ratings yet

- Villascusa, J. CIBC-Mellon CaseDocument4 pagesVillascusa, J. CIBC-Mellon CasePepe Villascusa CerezoNo ratings yet

- Limiifi: Kam in Bus Importer D.O.ODocument8 pagesLimiifi: Kam in Bus Importer D.O.OTolga KıyakNo ratings yet

- Environment Analysis-Political EnvironmentDocument2 pagesEnvironment Analysis-Political EnvironmentManokaran LosniNo ratings yet

- Risk Management: Principal Risk Specific Risk We Face Mitigation Branded and Non-Branded BusinessDocument6 pagesRisk Management: Principal Risk Specific Risk We Face Mitigation Branded and Non-Branded BusinessWilvic Jan GacitaNo ratings yet

- Amazon Vs Alibaba - One Big DifferenceDocument5 pagesAmazon Vs Alibaba - One Big DifferencebajrangkaswanNo ratings yet

- Caselet: David LTD - Budgeting-Preparation of Master BudgetDocument2 pagesCaselet: David LTD - Budgeting-Preparation of Master BudgetShubham AggarwalNo ratings yet

- ENGLISH FOR ACCOUNTING Denitto Giantoro 20.0102.0071Document2 pagesENGLISH FOR ACCOUNTING Denitto Giantoro 20.0102.0071Denitto GiantoroNo ratings yet

- Vajiram & Ravi: Prelim Test Schedule 2020 TopicsDocument2 pagesVajiram & Ravi: Prelim Test Schedule 2020 TopicsRahul KumarNo ratings yet

- Summers R., Ancient Mining 1969Document7 pagesSummers R., Ancient Mining 1969Murehwa BrewingNo ratings yet

- Bauxite Bonasika TechRep - 2008Document42 pagesBauxite Bonasika TechRep - 2008manudemNo ratings yet

- Financial Planning and StrategiesDocument5 pagesFinancial Planning and StrategiesHads LunaNo ratings yet

- Article Studi Naskah Ekonomi Syariah (English: Principles of Islamic Economics in The Light of The Holy Quran and SunnahDocument9 pagesArticle Studi Naskah Ekonomi Syariah (English: Principles of Islamic Economics in The Light of The Holy Quran and SunnahMaster statistikNo ratings yet

- Chapter 1 IntroductionDocument13 pagesChapter 1 IntroductionSarah Ud dinNo ratings yet