Professional Documents

Culture Documents

AY 24-25 Computation NEW

Uploaded by

jitendra rauthan0 ratings0% found this document useful (0 votes)

8 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageAY 24-25 Computation NEW

Uploaded by

jitendra rauthanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

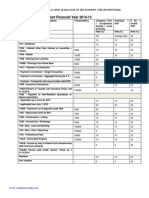

G.B.

Pant Institute of Engineering & Technology, Ghurdauri, Pauri Garhwal Employee's

Income Tax Self Declaration/Computation for the F.Y 2023-24 (A.Y 2024-25)

NEW

*Name - Designation- REGIME

PAN Number - Aadhar No. –

D.O.B. - 1 9 Mobile No. -

S.N. PARTICULAR AMOUNT (For office Use)

1 GROSS SALARY (Estimated/Actual)

Other income (specify)

(i) (+) Income from other sources (pl. mention/declare self)

(ii) (+) From Bank Interest (pl. mention/declare self)

(iii) (+) Honorarium/Remuneration etc. (pl. mention/declare self)

(iv) (+) any other (pl. mention/declare self)

GROSS TOTAL INCOME

2 Permitted Deductions (if applicable)

(i) (-) Standard Deduction (50000)

(ii) (-) U/S 80CCD(2) Employer’s contribution toward NPS (10% for

Non Central Govt. employee)

(iii) (-) any other (if any)

3 Other Deduction (if applicable)

(i)

(ii)

(iii)

(iv)

4 NET TAXABLE INCOME (1)-(2+3)

5 TAX APPLICABLE AS UNDER

Up to Rs. 300000/- NIL

Rs. 300001 to Rs. 600000/- 5%

Rs. 600001 to Rs. 900000/- 10%

Rs. 900001 to Rs. 1200000/- 15%

Rs. 1200001 to Rs. 1500000/- 20%

Above of Rs. 1500000/- 30%

Tax Calculated

(-) 87(A) (if Taxable income is 3 lac to 7 lac) (maximum Rs. 25000/-)

Tax Calculated

+ Education Cess 2%+ Secondary & higher education cess etc. 2%

Total Tax calculated

(-) Relief u/s 89 (if any)

Finally Net Tax Calculated

Particular of Calculated/Paid Income tax

Total Tax (-) Advance tax paid Remaining Tax (+) Refund

calculated for F.Y. up to Month January Due

2023-24 2024

Remark (if any) – “I declare that the above information is true and correct to the best of my

knowledge”.

* As per Pan Card Signature of employee:

You might also like

- It Sheet For DPSC2023-24Document3 pagesIt Sheet For DPSC2023-24katari.board.pry.schoolNo ratings yet

- Form PDF 696574080230622Document6 pagesForm PDF 696574080230622RUBY SHARMANo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)chandrakala telangNo ratings yet

- New Itr Forms NotifiedDocument2 pagesNew Itr Forms NotifiedmahenderreddybNo ratings yet

- Form PDF 713457630311221Document8 pagesForm PDF 713457630311221slowmotionmeeNo ratings yet

- Form PDF 736864730030722Document6 pagesForm PDF 736864730030722manuNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Form PDF 177155750160424Document11 pagesForm PDF 177155750160424dkassociate609No ratings yet

- IT - Cal - With - Form - 16 - 2011-12Document13 pagesIT - Cal - With - Form - 16 - 2011-12seeyem2000No ratings yet

- OLD Income Tax Performa-2021-22Document13 pagesOLD Income Tax Performa-2021-22Research AccountNo ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Form PDF 638711440230723Document10 pagesForm PDF 638711440230723taxindia610No ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Form PDF 468763070040922Document6 pagesForm PDF 468763070040922kxd7mknq2fNo ratings yet

- Form PDF 465757040271221Document8 pagesForm PDF 465757040271221cfaprep040No ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Aerish Paul100% (1)

- Form PDF 454963440281023Document10 pagesForm PDF 454963440281023prakashdebleyNo ratings yet

- Form PDF 831749000151121Document8 pagesForm PDF 831749000151121Steve BurnsNo ratings yet

- Form PDF 645857770010622Document9 pagesForm PDF 645857770010622GURU KRUPANo ratings yet

- Itr Form 2019-20Document10 pagesItr Form 2019-20AartiNo ratings yet

- Form PDF 720742190260723Document10 pagesForm PDF 720742190260723rishika 61No ratings yet

- Form PDF 169967860090424Document11 pagesForm PDF 169967860090424akallinonesolutionNo ratings yet

- Form PDF 130495880310723Document10 pagesForm PDF 130495880310723Rahul ChowdhuryNo ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiNo ratings yet

- Form PDF 421656360251221Document10 pagesForm PDF 421656360251221aworlda75No ratings yet

- Form PDF 429324390030921Document9 pagesForm PDF 429324390030921Good NamNo ratings yet

- Form PDF 771791780090722Document6 pagesForm PDF 771791780090722manuNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- Form PDF 284892120220923Document10 pagesForm PDF 284892120220923nishantsahab0786No ratings yet

- Form PDF 976103760240722Document6 pagesForm PDF 976103760240722Ayush KumarNo ratings yet

- Form PDF 869004400261222Document10 pagesForm PDF 869004400261222mohilNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- Form PDF 471387520080921Document6 pagesForm PDF 471387520080921PriyanshuNo ratings yet

- Form PDF 237268260290722Document9 pagesForm PDF 237268260290722cfaprep040No ratings yet

- Asha Itr 4Document11 pagesAsha Itr 4Niraj JaiswalNo ratings yet

- Form PDF 606473310030522Document9 pagesForm PDF 606473310030522mahayogiconsultancyNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Form PDF 588379620210723Document10 pagesForm PDF 588379620210723govindadv75No ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- Form PDF 751794940060722Document7 pagesForm PDF 751794940060722AWANEENDRA DUBEYNo ratings yet

- Form PDF 265417800300722Document9 pagesForm PDF 265417800300722prashanthlekkalaNo ratings yet

- Form PDF 992301420310723Document10 pagesForm PDF 992301420310723tax advisorNo ratings yet

- Form PDF 494190400281221Document8 pagesForm PDF 494190400281221Suprava MishraNo ratings yet

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesNo ratings yet

- Itr4 PreviewDocument8 pagesItr4 PreviewMrinal PandeyNo ratings yet

- Form PDF 160159480020823Document10 pagesForm PDF 160159480020823SanthoshRajNo ratings yet

- Form PDF 676646680170622Document7 pagesForm PDF 676646680170622CE30 Sanket BadadeNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Dhar RakulNo ratings yet

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pavani MsrNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Yogesh SharmaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)rafeekmek31No ratings yet

- 4045 Form PDF 295945460300722Document9 pages4045 Form PDF 295945460300722Manoranjan MoharanaNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Semester Reporting Form Even Semester 2023 24 1Document1 pageSemester Reporting Form Even Semester 2023 24 1jitendra rauthanNo ratings yet

- Final ReviewDocument5 pagesFinal Reviewjitendra rauthanNo ratings yet

- Recitation5 SolnsDocument21 pagesRecitation5 Solnsjitendra rauthanNo ratings yet

- Advertisement Guest Faculty - 2Document2 pagesAdvertisement Guest Faculty - 2jitendra rauthanNo ratings yet

- Counting StepsDocument8 pagesCounting Stepsjitendra rauthanNo ratings yet

- Guidelines For Promotion of Faculty Under CAS - 2018Document67 pagesGuidelines For Promotion of Faculty Under CAS - 2018jitendra rauthanNo ratings yet

- 165958979562eb54a3a459e PDFDocument12 pages165958979562eb54a3a459e PDFjitendra rauthanNo ratings yet

- GBPEC MOA Rules and ByelawsDocument25 pagesGBPEC MOA Rules and Byelawsjitendra rauthanNo ratings yet

- SP07 cs188 Lecture 8 - Logical Agents 1Document50 pagesSP07 cs188 Lecture 8 - Logical Agents 1jitendra rauthanNo ratings yet

- Artificial Intelligence 4. Knowledge Representation: Course V231 Department of Computing Imperial College, LondonDocument26 pagesArtificial Intelligence 4. Knowledge Representation: Course V231 Department of Computing Imperial College, LondonSagar ManeNo ratings yet

- 2099set 2Document1 page2099set 2jitendra rauthanNo ratings yet

- GBPEC Leave RegulationsDocument7 pagesGBPEC Leave Regulationsjitendra rauthanNo ratings yet

- Chapter7 2Document39 pagesChapter7 2jitendra rauthanNo ratings yet

- ADocument3 pagesAKrishna RajNo ratings yet

- Departmental PEODocument1 pageDepartmental PEOjitendra rauthanNo ratings yet

- 9699457926machine Learning LabDocument52 pages9699457926machine Learning Labjitendra rauthanNo ratings yet

- HKRHZ Fokkiu La0 & 131@424 @Dq0Dk0@2023 Fnukad: 22 Qjojh 2023Document20 pagesHKRHZ Fokkiu La0 & 131@424 @Dq0Dk0@2023 Fnukad: 22 Qjojh 2023jitendra rauthanNo ratings yet

- Syllabus 874Document2 pagesSyllabus 874jitendra rauthanNo ratings yet

- NotesDocument723 pagesNotesjitendra rauthanNo ratings yet

- Tentative Examination Schedule For Even Semester Special Back Papers B.Tech. Bio Chemical EngineeringDocument9 pagesTentative Examination Schedule For Even Semester Special Back Papers B.Tech. Bio Chemical Engineeringjitendra rauthanNo ratings yet

- FoT Lesson Plan-Artificial IntelligenceDocument17 pagesFoT Lesson Plan-Artificial Intelligencejitendra rauthanNo ratings yet

- Ijaerv13n5 88Document10 pagesIjaerv13n5 88jitendra rauthanNo ratings yet

- Details Teaching PostsDocument3 pagesDetails Teaching Postsjitendra rauthanNo ratings yet

- National Institute of Technology, UttarakhandDocument1 pageNational Institute of Technology, Uttarakhandjitendra rauthanNo ratings yet

- AdvertisementDocument2 pagesAdvertisementjitendra rauthanNo ratings yet

- Detailed Teaching AdvtDocument2 pagesDetailed Teaching Advtjitendra rauthanNo ratings yet

- State/ District-Dehradun, Uttarakhand Year 2016-17Document20 pagesState/ District-Dehradun, Uttarakhand Year 2016-17jitendra rauthanNo ratings yet

- BE IT 3rd and 4th SemDocument84 pagesBE IT 3rd and 4th Semjitendra rauthanNo ratings yet

- 16-17 3semlesson PlanDocument95 pages16-17 3semlesson Planjitendra rauthanNo ratings yet