Professional Documents

Culture Documents

Accounts Top Q PDF

Uploaded by

Kashish GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Top Q PDF

Uploaded by

Kashish GuptaCopyright:

Available Formats

•ACCOUNTANCY

(Top Questions)

Chap-1 [Accounting for partnership firm]

2 MARK

Q.1 Write the definition of partnership

as per the partnership act, 1932?

Q.2 What is the rights of a partner? Write any two.

Q.3 What is meant by divisible profit?

Q.4 Specify any two rules applicable in the absence of partnership.

Q.5 Discuss the following definitions of partners.

4 MARKS

Q.1 Differences between Fixed and fluctuating capital.

Q.2 Explain characteristics of partnership? (Any-4)

Q.3 Discuss the points apply in the partnership deed.

Q.4 Write main objectives of preparing profit and loss appropriation a/c.

Q.5 How to interest calculate on drawing under Profit method?

UNIT-II

3 MARKS

(Chapter-2=Reconstitution of partnership firm)

Q.1 What is the nature & characteristics of goodwill?

Q.2 Write the

differences between sacrificing and gaining ratio.

Q.4 Distinguish between Normal or Super profit.

Q.5 Explain the legal status of new partner.

(Chapter-3=Admission of a new partner)

Q.1 Explain different methods of valuation of goodwill.

Q.2 Explain the

causes of admission of a new partner.

Q.3 What are main

rights required by a new partner?

Q.4 Discuss the

needs or condition of admission of new partner.

Q.5 What is meant by change in Profit sharing ratio by old partner.

UNIT-III

(Chapter-4= Retirement or death of partner)

2 Mark

Q.1 What is

meant by Settlement on retirement of partner?

Q.2 Under what circumference can a

partner retire from the firm?

Q.3 Explain the legal status of the retiring partners.

Q.4 Write causes of retirement of partner.

Q.5 Define:- •Annuity •Internal reserves

4 Marks

Q.1 Explain in detail

Treatment of goodwill on retirement.

Q.2 How due amount to retiring partner calculated?

Q.3 Under which conditions

a partner retire from a partnership firm.

Q.4 Write the adjustment of capital account on retirement of partner.

Q.5 State differences between retirement and death of a partner.

•BONUS QUESTIONS

Q.1 Explain the procedure of determining the amount payable to a retiring partner.

Q.2 Describe the Calculation of profit on time and Sale basis.

Q.3 Explain the various methods of Payments for the final claims to the outgoing or retired partner.

(Chapter-5=Dissolution of partnership firm)

Q.1 What is compulsory dissolution?

Q.2 What do you understand by dissolution of partnership?

Q.3 Name the Accounts which are not allowed to transfer realisation account on dissolution of firm.

Q.4 What do you mean by dissolution by agreement?

Q.5 Define:- •Realisation Account •Revaluation Account

Q.6 Explain dissolution of partnership firm.

Q.7 Show the transfer of assets and liabilities of dissolution of firm.

Q.8 Specify the dissolution by notice.

Q.9 Write the Reasons or conditions of dissolution of partnership firm.

Q.10 Write any two circumstances for dissolution by court.

UNIT-IV

(Chapter-6=Accounting for Share capital)

2 Mark

Q.1 What is company According to Indian company act 2013?

Q.2 What do you mean by forfeiture of shares.

Q.3 Explain private company.

Q.4 Write the uses of Securities premium reserves.

Q.5 Explain: •Calls in advance •Calls in arrears.

Q.6 Define Premium.

Q.7 What do you understand by shares?

Q.8 Why shareholders surrender of shares?

Q.9 Explain Share and Stock.

Q.10 Specify: •Under subscription •Over subscription

4 Marks

Q.1 Differences between

Equity share and preferences share.

Q.2 Discuss different kinds or types of preference shares.

Q.3 Discuss the characteristics of company.

Q.4 Explain the Types of capital of a company.

Q.5 Differences between Memorandum and Article of association.

Q.6 Write valid reasons for forfeiture of shares.

Q.7 State differences between Authorised capital and issued capital.

Q.8 Differences between Shares and Stocks.

Q.9 Explain main objectives of prospectus.

Q.10 Write procedures and effects of forfeiture of shares.

(Chapter-7=Issue of debentures)

2 Mark

Q.1 Explain meaning of Debenture.

Q.2 What is the procedures of debenture issue.

Q.3 What is unsecured debenture.

Q.4 Discuss the legal status of debenture holders.

Q.5 Give definitions: •Registered debenture •Nacked Debenture

BONUS QUESTIONS

Q.1 Explain the Issue of debentures at premium.

Q.2 Write the main objectives of issue of debentures.

Q.3 What is the features or characteristics of Debenture.

3 Marks

Q.1 Differentiate between Share and debentures.

Q.2 Distinguish between Shareholders and debentureholder.

Q.3 Give types of debenture on the basis of security.

Q.4 .Write utility of debentures.

Q.5 Show different types of debentures on the basis of conversation.

BONUS QUESTIONS

Q.1 Mentioned types of debenture on the basis of ownership?

Q.2 Describe the different types of debentures.

UNIT-V

Chap-8 [Financial statements of a company]

Q.1 Explain main objects of financial statement.

Q.2 Explain main utilities of financial statement of a company.

Q.3 Explain in details financial statement.

Q.4 Write the importance of financial statement.

Q.5 Write the limitations of financial statement.

CHAPTER-9

•Analysis of financial statements

3 MARKS

Q.1 Explain main objects of Analysis of financial statement.

Q.2 Name the tools of analysis of financial statement.

Q.3 Write significance or importance of analysis of financial statement.

Q.4 What do you mean by analysis of financial statement.

Q.5 Discuss limitations of analysis of financial statement.

CHAPTER-10

(Accounting Ratio)

2 Mark

Q.1 What do you mean by Ratio analysis.

Q.2 Give the names of current liabilities.

Q.3 What is meant by liquidity Ratio.

Q.4 How would you calculated cost of goods sold?

Q.5 Write advantages or limitations of accounting ratio.

BONUS QUESTIONS

Q.1 What is meant by shareholder funds?

Q.2 Write the names of activities ratio.

Q.3 Explain Solvency ratio.

Q.4 What do you understand by long term loans?

Q.5 Discuss:

•Current liabilities & assets •Quick & Net profit Ratio.

UNIT-VI

CHAPTER-11

(Cash flow statement)

2 Mark

Q.1 What is cash flow statement?

Q.2 What is the meaning of Operating Activities?

Q.3 Write the definition of investing activities.

Q.4 How many methods are for preparation of cash flow.

Q.5 Explain:

•Cash equivalents •Cash inflow & outflow

BONUS QUESTIONS

Q.1 Write examples of cash flow from operating activities.

Q.2 State cash and cash equivalents.

Q.3 Write the Characteristics of cash flow statement.

4 MARKS

Q.1 Discuss the Limitations of cash flow statement.

Q.2 Explain the Direct method of cash flow.

Q.3 Distinguish between Cash flow and cash budget.

Q.4 Explain the classification of Cash flow’s activity.

Q.5 Show the Process of preparing cash flow Statement.

BONUS QUESTIONS

Q.1 Describe the uses of cash flow statement.

Q.2 Explain the various source of cash flow statement.

Q.3 Differences between funds flow statement & Cash flow statement.

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Book Keeping & AccountingDocument3 pagesBook Keeping & Accountingkunjap0% (1)

- Bob's BarloneyDocument4 pagesBob's BarloneyRafael Martinez Figueroa0% (2)

- Accounting Changes and Error AnalysisDocument39 pagesAccounting Changes and Error AnalysisIrwan Januar100% (1)

- Mergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketFrom EverandMergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketRating: 1 out of 5 stars1/5 (1)

- The Singapore Variable Capital Companies (VCC) at A GlanceDocument8 pagesThe Singapore Variable Capital Companies (VCC) at A GlanceMinal SequeiraNo ratings yet

- Important Question B.com IiDocument1 pageImportant Question B.com Iisubba1995333333No ratings yet

- 2nd Year Principles of Accounting Guess Paper 2023 Zahid NotesDocument5 pages2nd Year Principles of Accounting Guess Paper 2023 Zahid Notesashfaq4985No ratings yet

- ACC 324 Bankruptcy and InsolvencyDocument39 pagesACC 324 Bankruptcy and InsolvencyStephen YigaNo ratings yet

- Module For Fundamentals of AccountingDocument9 pagesModule For Fundamentals of AccountingJohn Rey Bantay Rodriguez50% (2)

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- Chap 12Document44 pagesChap 12Jehad Selawe100% (1)

- Assignment Lab 7Document2 pagesAssignment Lab 7Rin ZhafiraaNo ratings yet

- Institute of Actuaries of India: Subject CT2 - Finance and Financial ReportingDocument6 pagesInstitute of Actuaries of India: Subject CT2 - Finance and Financial ReportingVignesh Srinivasan0% (1)

- Assignment QuestionsDocument2 pagesAssignment QuestionsPankaj GoplaniNo ratings yet

- Assignment-2 MAXIMUM MARKS-68 Date of Given Assignment-23-02-2019 NO. OF QUESTIONS-28 Date of Submission Assignment-05-03-2019 UNIT-1Document2 pagesAssignment-2 MAXIMUM MARKS-68 Date of Given Assignment-23-02-2019 NO. OF QUESTIONS-28 Date of Submission Assignment-05-03-2019 UNIT-1manjeetNo ratings yet

- Revision Tutorial Written QuestionsDocument1 pageRevision Tutorial Written QuestionsChandran PachapanNo ratings yet

- Atoz Financial Accounting Bba (Semester-1) : V. Question BankDocument2 pagesAtoz Financial Accounting Bba (Semester-1) : V. Question BankmahendrabpatelNo ratings yet

- Level 1 Certificate in Book-Keeping: SyllabusDocument20 pagesLevel 1 Certificate in Book-Keeping: Syllabusvincentho2k100% (1)

- Sap Fico Q&aDocument18 pagesSap Fico Q&aAbhishek PawarNo ratings yet

- Learning Objectives: Slide 4-1Document43 pagesLearning Objectives: Slide 4-1Jadeja OdleNo ratings yet

- Question BankDocument2 pagesQuestion BankMrugesh MahetaNo ratings yet

- Statement of Changes in Equity SCE - 20230928 - 050345 - 0000Document21 pagesStatement of Changes in Equity SCE - 20230928 - 050345 - 0000Loraine JubeleaNo ratings yet

- Core and Principle of Corporate FinanceDocument12 pagesCore and Principle of Corporate FinancePermata Ayu WidyasariNo ratings yet

- CH 15Document58 pagesCH 15Natya NindyagitayaNo ratings yet

- MB41Document5 pagesMB41Prajeesh Kumar KmNo ratings yet

- Important Questions of FMDocument2 pagesImportant Questions of FMCharchit RawalNo ratings yet

- Sap Tan - CodesDocument2 pagesSap Tan - CodeskocherlakotapavanNo ratings yet

- Homework T2 - FSDocument3 pagesHomework T2 - FSCrayZeeAlexNo ratings yet

- Kap 1 5th Workbook Se CH 3Document20 pagesKap 1 5th Workbook Se CH 3DakshNo ratings yet

- Finance For NonfinanceDocument35 pagesFinance For Nonfinancelasyboy20No ratings yet

- FICO-Course Curriculum - FinalDocument10 pagesFICO-Course Curriculum - FinalAnuj SinghNo ratings yet

- CH 12Document53 pagesCH 12indahmuliasariNo ratings yet

- Imp. Q. F. A. BBA For External JANDocument7 pagesImp. Q. F. A. BBA For External JANgarvbarrejaNo ratings yet

- Practice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsDocument15 pagesPractice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsRahulNo ratings yet

- Corporate Finance 4th Edition by Berk DeMarzo ISBN 013408327X Solution ManualDocument6 pagesCorporate Finance 4th Edition by Berk DeMarzo ISBN 013408327X Solution Manualdavid100% (20)

- Solution Manual For Corporate Finance 4Th Edition by Berk Demarzo Isbn 013408327X 9780134083278 Full Chapter PDFDocument27 pagesSolution Manual For Corporate Finance 4Th Edition by Berk Demarzo Isbn 013408327X 9780134083278 Full Chapter PDFkatherine.serrano725100% (10)

- Chapter 23 - SCF - Aug 2012Document11 pagesChapter 23 - SCF - Aug 2012bebo3usaNo ratings yet

- L7 Financial Accounting Dec12Document5 pagesL7 Financial Accounting Dec12S.L.L.CNo ratings yet

- Chapter 2 Financial Statements and Accounting Concepts and PrinciplesDocument57 pagesChapter 2 Financial Statements and Accounting Concepts and Principlesbrendon laverNo ratings yet

- EDM - Practice QuetionsDocument4 pagesEDM - Practice Quetionsomshirdhankar30No ratings yet

- Bcoc - 131 ImpDocument16 pagesBcoc - 131 Impstudy with rajput bawaNo ratings yet

- 11 Accountany II Goalias BlogspotDocument296 pages11 Accountany II Goalias BlogspotRanbir Singh JamwalNo ratings yet

- HDJJDDocument15 pagesHDJJDjustin maharlikaNo ratings yet

- Account Sylabus Pu 2Document7 pagesAccount Sylabus Pu 2bhasunagaNo ratings yet

- Company CodeDocument8 pagesCompany CodeAleks KoporgeNo ratings yet

- Cfa SyallbusDocument24 pagesCfa SyallbusSushil MundelNo ratings yet

- Participant Instructions: Occupational CategoryDocument6 pagesParticipant Instructions: Occupational CategorypoonyorkNo ratings yet

- ch23 Statement of Cash FlowsDocument90 pagesch23 Statement of Cash FlowsIma ListyaningrumNo ratings yet

- Cash Flow vs. Profits Lesson 1Document6 pagesCash Flow vs. Profits Lesson 1Jeet ShahNo ratings yet

- Concepts Rev Iew and Critical Thinking QuestionsDocument8 pagesConcepts Rev Iew and Critical Thinking Questionsdt0035620No ratings yet

- Cpa SyllabusDocument150 pagesCpa Syllabusathancox5837100% (1)

- Understanding Financial StatementsDocument25 pagesUnderstanding Financial StatementsFarah AtikahNo ratings yet

- Must Do Content Accountancy Class XiiDocument45 pagesMust Do Content Accountancy Class XiiPratham Malhotra0% (1)

- Question Bank - CL-RevisedDocument1 pageQuestion Bank - CL-RevisedAditya KulkarniNo ratings yet

- Introduction Cash FlowDocument10 pagesIntroduction Cash FlowAmrit TejaniNo ratings yet

- 23 P1 (1) .1y ch22 PDFDocument20 pages23 P1 (1) .1y ch22 PDFAdrian NutaNo ratings yet

- The Bookkeeping Process and Transaction AnalysisDocument54 pagesThe Bookkeeping Process and Transaction AnalysisdanterozaNo ratings yet

- The Statement of Cash FlowsDocument18 pagesThe Statement of Cash FlowsfahadNo ratings yet

- Secretarial Practices: Important QuestionsDocument3 pagesSecretarial Practices: Important QuestionsdisushahNo ratings yet

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- Ros69749 ch19Document9 pagesRos69749 ch19arzoo26No ratings yet

- PLS - FRIA SyllabusDocument8 pagesPLS - FRIA SyllabusRalph Ryan TooNo ratings yet

- Accounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDocument3 pagesAccounting Concepts: A. Write The Letter of Your Answer Before Each Number or ItemDail Xymere YamioNo ratings yet

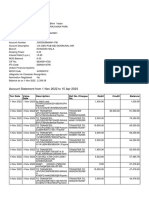

- Account Statement From 1 Nov 2022 To 15 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Nov 2022 To 15 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAyush yadavNo ratings yet

- Contents of TaxmannDocument2 pagesContents of TaxmannMohammed Umer0% (1)

- ACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationDocument9 pagesACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationRaju Raj RajNo ratings yet

- OlaDocument2 pagesOlaanderspeh.realestateNo ratings yet

- Your Company Name: Balance Sheet Projection Fiscal Year End DateDocument5 pagesYour Company Name: Balance Sheet Projection Fiscal Year End DateBohdan KozarNo ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Press Release Tereos 2022 23 Annual ResultsDocument12 pagesPress Release Tereos 2022 23 Annual ResultsPerico EldelospalotesNo ratings yet

- A Test of Graham's Stock Selection CriteriaDocument10 pagesA Test of Graham's Stock Selection CriteriaiamnitinNo ratings yet

- Acis 5194Document2 pagesAcis 5194steveNo ratings yet

- New or Revised Interpretations.: Intended Learning Outcomes (Ilos)Document3 pagesNew or Revised Interpretations.: Intended Learning Outcomes (Ilos)Mon RamNo ratings yet

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- 3.CFA财报分析 Financial Statement AnalysisDocument408 pages3.CFA财报分析 Financial Statement AnalysisliujinxinljxNo ratings yet

- Financial Statement Analysis Chapter One ExamplesDocument4 pagesFinancial Statement Analysis Chapter One ExamplesRichard ScripterNo ratings yet

- Class 12th Accounts Unsolved Sample Paper 1Document9 pagesClass 12th Accounts Unsolved Sample Paper 1Vikrant NainNo ratings yet

- Capital Allocation To Risky Assets: Investments - Bodie, Kane, MarcusDocument22 pagesCapital Allocation To Risky Assets: Investments - Bodie, Kane, MarcussaharNo ratings yet

- Unit Iii: Cost of CapitalDocument109 pagesUnit Iii: Cost of CapitalMehak SinghNo ratings yet

- Chapter 8Document41 pagesChapter 8umer khanNo ratings yet

- Handout Investment in Debt SecuritiesDocument28 pagesHandout Investment in Debt SecuritiesTsukishima KeiNo ratings yet

- Transaction June'2017-REPORTDocument1,734 pagesTransaction June'2017-REPORTIndranilGhoshNo ratings yet

- Assignment 10Document2 pagesAssignment 10Kristina KittyNo ratings yet

- Financial ModelingDocument5 pagesFinancial ModelingQuang Hữu TrầnNo ratings yet

- Pre Reading Material For Session 17 FA (Cash Flow)Document10 pagesPre Reading Material For Session 17 FA (Cash Flow)Rohit Roy100% (1)

- This Study Resource Was: Partnership LiquidationDocument3 pagesThis Study Resource Was: Partnership LiquidationKez MaxNo ratings yet

- Questions - Financial ReportingDocument3 pagesQuestions - Financial ReportingMo HachimNo ratings yet

- Clemente Ronaliza Auditing ProblemsDocument9 pagesClemente Ronaliza Auditing ProblemsEsse ValdezNo ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet