Professional Documents

Culture Documents

Garcia - SCM - Part 2 Assessment

Uploaded by

jaychristiangarcia18Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Garcia - SCM - Part 2 Assessment

Uploaded by

jaychristiangarcia18Copyright:

Available Formats

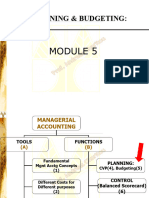

[AEAIS9]: [Strategic Cost Management]

Unit 2 - Part 2

Assessment

Jay Christian D. Garcia

Affiliation 1; jaychristiangarcia18@gmail.com

Correspondence: Janet Jardin (Classroom) • brosia459@gmail.com

Instructor: Ms. Janet Jardin

Date Submitted: 14 February 2024

Part IV – The Master Budget Exercises

Discussion Questions:

1. Define the term budget. How are budgets used in planning?

➢ A budget is a financial plan that outlines expected revenues and expenses over a specific period.

Budgets are used in planning by setting financial goals, allocating resources, forecasting future

performance, evaluating actual performance, aiding decision-making, controlling costs, and

facilitating communication within organizations. They are essential tools for managing finances

effectively and achieving strategic objectives.

2. Define control. How are budgets used to control?

➢ Control involves monitoring performance against predetermined standards and taking corrective

action when necessary. Budgets are used for control by providing benchmarks for comparison,

analyzing variances, identifying problems early on, controlling costs, and evaluating performance.

They enable organizations to manage resources effectively and ensure that goals are achieved

efficiently.

3. What is a master budget? An operating budget? A financial budget?

➢ Master Budget: Comprehensive financial plan integrating all operational and financial aspects for a

specific period.

➢ Operating Budget: Focuses on day-to-day operational activities, detailing expected revenues and

expenses.

Second Semester, A.Y. 2023-2024 Page 1 of 14

[AEAIS9]: [Strategic Cost Management]

➢ Financial Budget: Concentrates on financial aspects, including cash flow, capital expenditures, and

projected financial statements.

In summary, the master budget encompasses both operational and financial budgets, providing a

complete overview of a company's financial plan and activities.

4. All budgets depend on the sales budget. Is this true? Explain.

➢ Yes, it's true that all budgets typically depend on the sales budget. The sales budget serves as a

foundational component because it provides the initial estimate of the revenue that a company

expects to generate during a specific period. In essence, the sales budget serves as a starting

point for creating other budgets within an organization. It provides the basis for estimating revenues

and drives the allocation of resources across various departments to support sales targets and

overall business objectives.

5. Why is it important for a manager to receive frequent feedback on his or her performance?

➢ It's important for managers to receive frequent feedback on their performance because it:

a. Facilitates continuous improvement by highlighting strengths and areas for

development.

b. Ensures alignment with organizational goals and expectations.

c. Enhances employee engagement and motivation.

d. Helps identify and address problems early on.

e. Builds trust and fosters positive relationships.

f. Supports professional development and skill enhancement.

g. Boosts retention and morale within the team.

6. A budget too easily achieved will lead to diminished performance. Do you agree? Explain.

➢ An easily achievable budget can lead to diminished performance due to a lack of challenge,

potential stagnation, missed opportunities, decreased engagement, underutilization of resources,

and the development of a culture of mediocrity. Challenging yet realistic goals encourage

motivation, innovation, and a culture of high performance within the organization.

Second Semester, A.Y. 2023-2024 Page 2 of 14

[AEAIS9]: [Strategic Cost Management]

Exercises:

1. Preparing a Sales Budget

Patrick Inc. sells industrial solvents in five-gallon drums. Patrick expects the following units to be

sold in the first three months of the coming year.

January 41,000

February 38,000

March 50,000

Answer:

1 2 3 Total

Units 41,000 38,000 50,000 129,000

Unit selling price x P35 x P35 x P35 x P35

Budgeted Sales P1,435,000 P1,330,000 P1,750,000 P4,515,000

2. Preparing a Production Budget

Patrick Inc. makes industrial solvents. In the first four months of the coming year, Patrick expects the

following unit sales:

January 41,000

February 38,000

March 50,000

April 51,000

Answer:

Patrick Inc.

Production Budget

Quarter

Jan Feb Mar Quarter

Sales in units 41,000 38,000 50,000 129,000

Desired ending inventory 9,500 12,500 12,750 34,750

Total needs 50,500 50,500 62,750 163,750

Second Semester, A.Y. 2023-2024 Page 3 of 14

[AEAIS9]: [Strategic Cost Management]

Less: Beginning inventory (6,700) (9,500) (12,500) (28,400)

Units to be produced 43,800 41,000 50,250 135,350

3. Preparing a Direct Materials Purchases Budget

Patrick Inc. makes industrial solvent sold in five-gallon drums. Planned production in units for the first three months of

the coming year is:

January 43,800

February 41,000

March 50,250

Answer:

Patrick Inc.

Direct Material Purchases Budget

For the Year Ended December 31, 20

Gallons of chemical Quarter

1 2 Year

Units to be produced 43,800 41,000 84,800

Direct materials per unit x 5.5 x 5.5 x 5.5

Production needs 240,900 225,500 466,400

Desired ending inventory 33,825 41,456 75,291

Total needs 274,725 266,956 541,681

Less: Beginning inventory (36,135) (33,835) (69,970)

Direct materials to be purchased 238,590 233,131 471,721

Cost gallon of chemical x P2 x P2 x P2

Total Purchase cost plain t-shirts P477,180 P466,262 P943,442

Plastic drum 1 2 Year

Units to be produced 43,800 41,000 84,800

Direct materials per unit x1 x1 x1

Production needs 43,800 41,000 84,800

Desired ending inventory 6,150 7,538 13,688

Total needs 49,950 48,538 98,488

Less: Beginning Inventory (6,570) (6,150) (12,720)

Direct materials to be purchased 43,380 42,388 85,768

Cost per plastic drum x P1.60 x P1.60 x P1.60

Total Purchase cost of ink P69,408 P67,821 P137,229

Second Semester, A.Y. 2023-2024 Page 4 of 14

[AEAIS9]: [Strategic Cost Management]

Total direct materials purchase cost P546,588 P454,063 P1,080,671

4. Preparing a Direct Labor Budget

Patrick Inc. makes industrial solvents. Planned production in units for the first three months of the coming year is:

January 43,800

February 41,000

March 50,250

Answer:

Patrick Inc.

Direct Labor Budget

For The Year Ended December 31, 2020

Quarter

1 2 3 Total

Units to be produced 43,800 41,000 50,250 135,050

Direct labor time per unit in hours X 0.3 X 0.3 X 0.3 X 0.3

Total hours needed 13,140 12,300 15,075 40,515

Average wage per hour X P18 X P18 X P18 X P18

Total direct labor cost P236,520 P221,400 P271,350 P729,270

5. Preparing an Overhead Budget

Patrick Inc. makes industrial solvents. Budgeted direct labor hours for the first three months of the coming year are:

January 13,140

February 12,300

March 15,075

Second Semester, A.Y. 2023-2024 Page 5 of 14

[AEAIS9]: [Strategic Cost Management]

Answer:

Patrick Inc.

Overhead Budget

For the 1st Quarter

Quarter

January February March Year

Budgeted direct labor hours 13,140 12,300 15,075 40,515

Variable overhead rate X P0.70 X P0.70 X P0.70 X P0.70

Budgeted variable overhead P9,198 P8,610 P10,553 P28,361

Budgeted fixed overhead* 2,750 2,750 2,750 8,250

Total overhead P11,948 P11,360 P13,303 P36,611

6. Preparing an Ending Finished Goods Inventory Budget

Andrew Company manufactures a line of office chairs. Each chair takes P14 of direct materials and uses 1.9 direct

labor hours at P16 per direct labor hour. The variable overhead rate is P1.20 per direct labor hour and the fixed

overhead rate is P1.60 per direct labor hour. Andrews expects to have 675 chairs in the ending inventory. There is no

beginning inventory of office chairs.

Answer:

a. Direct materials P14

Direct Labor (1.9 @ P16) 30.4

Overhead:

Variable (1.9 @ P1.20) 2.28

Fixed (1.9 x P1.60) 3.04

Total Unit Cost P49.72

b. Ending Finished Goods Inventory Budget

Andrew Company

Ending Finished Goods Inventory Budget

Logo t-shirts 675

Unit Cost X P49.72

Total ending inventory P 33,561

Second Semester, A.Y. 2023-2024 Page 6 of 14

[AEAIS9]: [Strategic Cost Management]

7. Preparing a Cost of Goods Sold Budget

Andrews Company manufactures a line of office chairs. Each chair takes P14 of direct materials and uses 1.9 direct

labor hours at P16 per direct labor hour. The variable overhead rate is P1.20 per direct labor hour and the fixed

overhead rate is P1.60 per direct labor hour. Andrews expects to produce 20,000 chairs next year and expects to

have 675 chare in ending inventory. There is no beginning inventory of office chairs. Prepare a cost of goods sold

budget for Andrews Company.

Answer:

Product cost

DM - P14

DL - P30.40

VOH - 2.28

FOH - 3.04

Product Cost = P49.72

COGS = Beg + New - End = 0 + 20,000 - 675 = 19,325

Andrews Company

Cost of Goods Sold Budget

Direct materials used P280,000

Direct labor used 608,000

Overhead 106,400

Budgeted manufacturing costs P994,400

Beginning finished goods 0

Cost of goods available for sale P994,400

Less: Ending finished goods (33,561)

Budgeted cost of goods sold P960,839

8. Preparing a Selling and Administrative Expenses Budget

Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of P19,730,000. There

is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following:

Salaries P960,000

Utilities 365,000

Office space 230,000

Second Semester, A.Y. 2023-2024 Page 7 of 14

[AEAIS9]: [Strategic Cost Management]

Advertising 1,200,000

Answer:

Year

Total variable expenses P591,900

Fixed S&A expenses

Salaries P960,000

Utilities 365,000

Office space 230,000

Advertising 1,200,000

Total fixed expenses

Total S&A expenses P3,346,900

9. Preparing a Budgeted Income Statement

Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of P19,730,000. There

is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following:

Salaries P960,000

Utilities 365,000

Office space 230,000

Advertising 1,200,000

Answer:

Oliver Company

Budgeted Income Statement

For the Year Ended

Sales P1,728,000

Less: Cost of Goods Sold (1,008,000)

Gross margin P720,000

Less: Variable S&A expenses (176,000)

Fixed S&A expenses (423,000)

Income before income taxes 121,000

Less: Income taxes (121,000 x 35%) (42,350)

Second Semester, A.Y. 2023-2024 Page 8 of 14

[AEAIS9]: [Strategic Cost Management]

Net income P78,650

10. Preparing a schedule of Cash Collection on Accouonts

Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of P19,730,000. There

is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following:

Salaries P960,000

Utilities 365,000

Office space 230,000

Advertising 1,200,000

Answer:

Source August September

Receive on account from:

May

June 25,200

July 38,500 19,250

August 17,360 43,400

September 18,200

11. Preparing an Accounts Payable Schedule

Fazel Company makes and sells paper products. In the coming year, Fazel expects total sales of P19,730,000. There

is a 3% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following:

Salaries P960,000

Utilities 365,000

Office space 230,000

Advertising 1,200,000

Answer:

Source May June

Cash needed for payments:

April 299,520

May 82,240 328,960

June 83,200

Second Semester, A.Y. 2023-2024 Page 9 of 14

[AEAIS9]: [Strategic Cost Management]

Total cash needed P381,760 P412,160

12. La Famiglia Pizzeria provided the following information for the month of October:

a. Sales are budgeted to be P157,000. About 85% of sales are cash; the remainder are on account.

b. La Famiglia expects that, on average, 70% of credit sales will be paid in the month of sale, and 28 will

be paid in the following month.

c. Food and supplies purchases, all on account, are expected to be P116,000. La Famiglia pays 25% in the

month of purchase and 75% in the month following purchase.

d. Most of the work is done by the owners, who typically withdraw P6,000 a month from the business as

their salary. (Note: The P6,000 is a payment in total to the two owners, not per person.) Various

part-time workers cost P7,300 per month. They are paid for their work weekly, so on average 90% of

their wages are paid in the month incurred and the remaining 10% in the next month.

e. Utilities average P5,950 per month. Rent on the building is P4,100 per month.

f. Insurance is paid quarterly; the next payment of P1,200 is due in October.

g. September sales were P181,500 and purchases of food and supplies in September equalled P130,000.

h. The cash balance on October 1 is P2,147.

Answer:

a. Source October

Cash sales P133,450

Received on account from:

Month of sale 16,485

September 15,246

_____________

Total cash receipts P165,181

b. Cash payment P29,000 + P97,500 = P126,500

c.

Year

Beginning cash balance P2,147

Cash sales and collections on account: 165,181

Second Semester, A.Y. 2023-2024 Page 10 of 14

[AEAIS9]: [Strategic Cost Management]

Total cash available P167,328

Less disbursements

Payments for:

Raw material P(126,181)

Owner’s withdrawal (6,000)

Worker’s salary (7,300)

Utilities (5,950)

Rent (4,100)

Insurance (1,200)

Total disbursements P(150,731)

Ending cash balance P16,597

13. Select Operational Budgets

Joven Products produces coat racks. The projected sales for the first quarter of the coming year and the beginning

and ending inventory data are as follows:

Unit Sales 100,000

Unit Price P 15

Units in beginning inventory 8,000

Units in targeted ending inventory 12,000

Answer:

a. Sales

Joven Products

Sales Budget

For the First Quarter

Units 100,000

Unit Price x P15

Sales P1,500,000

b. Production Budget

Joven Products

Production Budget

For the First Quarter

Second Semester, A.Y. 2023-2024 Page 11 of 14

[AEAIS9]: [Strategic Cost Management]

Sales (in units) 100,000

Desired ending inventory 12,000

Total needs 112,100

Less: Beginning Inventory 8,000

Units to be produced 104,000

c. Direct Materials Purchase Budget

Joven Products

Direct Materials Purchases Budget

For the First Quarter

Units to be produced 104,000

Direct materials per unit (lb.) 12,000

Production needs (lb.) 416,000

Desired ending inventory (lb.) 6,000

Total needs (lb.) 422,000

Less: Beginning inventory (lb.) 4,000

Materials to be purchased (lb.) 418,000

Cost per pound X P2.50

Total purchase cost P1,045,000

d. Direct Labor Budget

Joven Products

Direct Labor Budget

For the First Quarter

Units to be produced 104,000

Labor hours per unit X 0.5

Total hours needed 52,000

Cost per hour X P9

Total direct labor cost P468,000

Second Semester, A.Y. 2023-2024 Page 12 of 14

[AEAIS9]: [Strategic Cost Management]

14. Cash Budgeting

Kylles Inc. expects to receive cash from sales of P45,000 in March. In addition, Kylles expects to sell

property worth P3,500. Payments for materials and supplies are expected to total P10,000, direct labor

payroll will be P12,500, and other expenditures are budgeted at P14,900. On March 1, the cash account

balance is P1,230.

Answer:

a.

Kylles Inc.

Cash Budget for the Month of March

Beginning cash balance 1, 230

Cash sales 45,000

Sale of property 3,500

Total cash available P49,730

Less disbursements:

Materials and supplies P10,000

Direct labor payroll 12,500

Other expenditures 14,900

Total disbursements P37,400

Ending cash balance P12,330

b. Unadjusted ending balance P12,330

Plus borrowing 3,000

Adjusted ending balance P15,330

In April, interest owed would be (1/12 x 0.12 x P3,000) = P30.

Second Semester, A.Y. 2023-2024 Page 13 of 14

[AEAIS9]: [Strategic Cost Management]

Second Semester, A.Y. 2023-2024 Page 14 of 14

You might also like

- Gonzales - Week 2 1Document10 pagesGonzales - Week 2 1Luigi Enderez BalucanNo ratings yet

- Budgeting Financial Planning1Document34 pagesBudgeting Financial Planning1GivhineNo ratings yet

- Mas 12 - Operating and Financial BudgetingDocument4 pagesMas 12 - Operating and Financial BudgetingCarl Angelo LopezNo ratings yet

- Business Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial StatementsDocument21 pagesBusiness Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial Statementsjecille magalongNo ratings yet

- LAS 3 Business-FinanceDocument12 pagesLAS 3 Business-FinanceVenus AriateNo ratings yet

- Budget (Master Planning)Document20 pagesBudget (Master Planning)krisha milloNo ratings yet

- Group Iii. Business FinanceDocument11 pagesGroup Iii. Business FinanceChristian PhilipNo ratings yet

- MAGNA COMPANY-đã chuyển đổiDocument17 pagesMAGNA COMPANY-đã chuyển đổiHiền NguyễnNo ratings yet

- Analysis Master BudgetDocument40 pagesAnalysis Master BudgetAisyahNo ratings yet

- Business Finance Note 2Document19 pagesBusiness Finance Note 2Ruth MuñozNo ratings yet

- Business Finance: Financial Planning Tools and ConceptsDocument14 pagesBusiness Finance: Financial Planning Tools and ConceptsElyzel Joy Tingson100% (1)

- Chapter 15 Budgeting Profit Sales Cost ExpensesDocument19 pagesChapter 15 Budgeting Profit Sales Cost ExpensesFarhan Khan MarwatNo ratings yet

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

- C2 - PPT Cost IIDocument94 pagesC2 - PPT Cost IINigus AyeleNo ratings yet

- Budgetary Planning and Control: 7.1 Nature and Purposes of BudgetsDocument18 pagesBudgetary Planning and Control: 7.1 Nature and Purposes of Budgetsserge folegweNo ratings yet

- Mas 9010 Operating and Financial BudgetingDocument17 pagesMas 9010 Operating and Financial BudgetingAljur Salameda100% (1)

- Profit PlanningDocument52 pagesProfit PlanningSamuel Sihombing100% (4)

- Hilton 11e Chap009PPTDocument52 pagesHilton 11e Chap009PPTNgô Khánh HòaNo ratings yet

- Comprehensive BudgetDocument50 pagesComprehensive BudgetAlfitri PuspitaNo ratings yet

- Module Code FIN 7001 Module Title: Financial ManagementDocument9 pagesModule Code FIN 7001 Module Title: Financial ManagementTitinaBangawaNo ratings yet

- Module 5 - Master BudgetDocument6 pagesModule 5 - Master BudgetFrancis Ryan PorquezNo ratings yet

- Financial Management - 2Document10 pagesFinancial Management - 2Sk jahidul IslamNo ratings yet

- Ch1 - Master BudgetDocument38 pagesCh1 - Master BudgetProf. Nisaif JasimNo ratings yet

- Functional and ActivityBased BudgetingDocument50 pagesFunctional and ActivityBased BudgetingAmanda100% (3)

- Budgeting ChapterDocument17 pagesBudgeting ChapteraasNo ratings yet

- T1 Budget For Planning S2-1718Document11 pagesT1 Budget For Planning S2-1718Faizah MKNo ratings yet

- Objectives of BudgetingDocument13 pagesObjectives of BudgetingChandanN81No ratings yet

- Abm 12 Finance q1 Clas4 Preparation-Of-budgets-And-projected-financial-statement v1 - Rhea Ann NavillaDocument23 pagesAbm 12 Finance q1 Clas4 Preparation-Of-budgets-And-projected-financial-statement v1 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Financial Planning and Analysis: The Master Budget: Mcgraw-Hill/IrwinDocument52 pagesFinancial Planning and Analysis: The Master Budget: Mcgraw-Hill/IrwinAmirah ZNo ratings yet

- Accounting 202 Chapter 9 NotesDocument15 pagesAccounting 202 Chapter 9 NotesnitinNo ratings yet

- A21 Ntry LTD 2019 QPDocument8 pagesA21 Ntry LTD 2019 QPr7kssbgxfnNo ratings yet

- Q1 LAS Business Finance 12 Week 3-4Document11 pagesQ1 LAS Business Finance 12 Week 3-4Flare ColterizoNo ratings yet

- Q1 LAS Business Finance 12 Week 3-4Document11 pagesQ1 LAS Business Finance 12 Week 3-4Gerlie BorneaNo ratings yet

- Chapter 8Document41 pagesChapter 8umer khanNo ratings yet

- (Do Not Distribute) SCM - Budgeting Part 1Document13 pages(Do Not Distribute) SCM - Budgeting Part 1James CantorneNo ratings yet

- Lecture Note Part IIDocument29 pagesLecture Note Part IIErit AhmedNo ratings yet

- MAS-06 Operational BudgetingDocument7 pagesMAS-06 Operational BudgetingKrizza MaeNo ratings yet

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaDocument42 pagesBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXNo ratings yet

- Orca Share Media1490192687898Document4 pagesOrca Share Media1490192687898NaddieNo ratings yet

- Operational BudgetingDocument7 pagesOperational BudgetingDave AlereNo ratings yet

- Pma3143 Chapter 4 Budgeting 0422Document23 pagesPma3143 Chapter 4 Budgeting 0422SYIMINNo ratings yet

- Discussion AnswersDocument9 pagesDiscussion AnswersChin FiguraNo ratings yet

- MBA 7001 Accounting For Decision Makers AssignmentDocument8 pagesMBA 7001 Accounting For Decision Makers AssignmentSupun25% (4)

- Profit Planning: Mcgraw-Hill /irwinDocument89 pagesProfit Planning: Mcgraw-Hill /irwinraina mattNo ratings yet

- 28560550Document29 pages28560550Hanabusa Kawaii IdouNo ratings yet

- Chapter 9 SolutionsDocument49 pagesChapter 9 SolutionsMasha LankNo ratings yet

- Budgets: Trefor Mcelroy September/October 2017Document35 pagesBudgets: Trefor Mcelroy September/October 2017Nguyễn Hạnh LinhNo ratings yet

- GGCGCDocument5 pagesGGCGCTri HaNo ratings yet

- Chapter 9 - Master Budget and Responsibility AccountingDocument66 pagesChapter 9 - Master Budget and Responsibility AccountingroyaltystorezNo ratings yet

- Ch09 PDFDocument37 pagesCh09 PDFAsh1No ratings yet

- CH7 BudgetingDocument51 pagesCH7 BudgetingYMNo ratings yet

- MOD 05 Planning & Budgeting (2023)Document53 pagesMOD 05 Planning & Budgeting (2023)georgiana.ioannouNo ratings yet

- Team PRTC May 2023 1st PBDocument46 pagesTeam PRTC May 2023 1st PBEpfie SanchesNo ratings yet

- Hilton 11e Chap009PPTDocument51 pagesHilton 11e Chap009PPTNgọc ĐỗNo ratings yet

- Bchcr410 CIADocument4 pagesBchcr410 CIA15Nabil ImtiazNo ratings yet

- Budgeting.3rd EdDocument25 pagesBudgeting.3rd EduncleloncoNo ratings yet

- Assignment A2: Managing Financial Resources and DecisionsDocument9 pagesAssignment A2: Managing Financial Resources and DecisionsBảo OliverNo ratings yet

- Chapter 9 Review - UpdatedDocument10 pagesChapter 9 Review - UpdatedTamerat FikaduNo ratings yet

- Purposely Profitable: Embedding Sustainability into the DNA of Food Processing and other BusinessesFrom EverandPurposely Profitable: Embedding Sustainability into the DNA of Food Processing and other BusinessesNo ratings yet

- The Spread of Yield Management PracticesDocument159 pagesThe Spread of Yield Management PracticesLaufer BariNo ratings yet

- Senior 12 Business Finance Q1 - M3 For PrintingDocument36 pagesSenior 12 Business Finance Q1 - M3 For PrintingRomnick SarmientoNo ratings yet

- Budgeting 1Document53 pagesBudgeting 1MRIDUL GOELNo ratings yet

- Question Bank On SALES & DISTRIBUTION MANAGEMENTDocument27 pagesQuestion Bank On SALES & DISTRIBUTION MANAGEMENTganeshNo ratings yet

- Revenue Management of Food and Beverages Services Group 7 ReportingDocument29 pagesRevenue Management of Food and Beverages Services Group 7 ReportingAnthony Flores100% (1)

- Ebs Ecc Quick Start Guide PDFDocument4 pagesEbs Ecc Quick Start Guide PDFMax ReedNo ratings yet

- TREVES de BONFILI - GIORG - Dynamic Pricing in The Airline Industry - Treves de Bonfili 198461Document44 pagesTREVES de BONFILI - GIORG - Dynamic Pricing in The Airline Industry - Treves de Bonfili 198461Apaar SinghNo ratings yet

- Profitability Analytcis FrameworkDocument26 pagesProfitability Analytcis Frameworkbefn35No ratings yet

- Sip Project HarshadaDocument51 pagesSip Project HarshadaAkshada GodseNo ratings yet

- Hotel Management Application.Document28 pagesHotel Management Application.Cheeze Fly Funny moments & montage67% (3)

- Smart Pricing PDFDocument10 pagesSmart Pricing PDFAkshaya LakshminarasimhanNo ratings yet

- Budgetary Planning: Assignment Classification TableDocument64 pagesBudgetary Planning: Assignment Classification TableISLAM KHALED ZSCNo ratings yet

- FILE TÓM TẮT SÁCH QTCCU - TIẾNG ANHDocument132 pagesFILE TÓM TẮT SÁCH QTCCU - TIẾNG ANHVit BeNo ratings yet

- Dynamic Pricing SoftwareDocument12 pagesDynamic Pricing SoftwaremuhammadNo ratings yet

- RM Group 7Document5 pagesRM Group 7Ravi KamaniNo ratings yet

- MA-06 (Budgeting With Probability Analysis)Document10 pagesMA-06 (Budgeting With Probability Analysis)Kristel Anne RunasNo ratings yet

- CH - 2 For TeacherDocument11 pagesCH - 2 For TeacherEbsa AdemeNo ratings yet

- Oracle Communication StrategyDocument42 pagesOracle Communication Strategyravi.janakiraman9693100% (1)

- Approaches For Restaurant Revenue ManagementDocument21 pagesApproaches For Restaurant Revenue ManagementJustin BasiNo ratings yet

- Spreadsheet Information Systems Are Essential To BusinessDocument39 pagesSpreadsheet Information Systems Are Essential To BusinessSameh Ahmed HassanNo ratings yet

- Ecornell Brochure EmailDocument7 pagesEcornell Brochure EmailTunggalNo ratings yet

- What Is Oracle Revenue Management CloudDocument4 pagesWhat Is Oracle Revenue Management CloudSriram KalidossNo ratings yet

- Covid 19 Hotel Recovery Strategy EbookDocument68 pagesCovid 19 Hotel Recovery Strategy EbookLuisAlhodaSilvaNo ratings yet

- Chapter 10 PDFDocument3 pagesChapter 10 PDFGajanan Shirke AuthorNo ratings yet

- GAD MicroprojectDocument31 pagesGAD Microprojectᴠɪɢʜɴᴇꜱʜ ɴᴀʀᴀᴡᴀᴅᴇ.No ratings yet

- Ecommerce For TVET 10 162Document153 pagesEcommerce For TVET 10 162nasNo ratings yet

- Restaurant Revenue StudyDocument37 pagesRestaurant Revenue Studyyiannis pogasNo ratings yet

- Emirates CrapDocument11 pagesEmirates CrapAnoop PrasadNo ratings yet

- M04MKT-Etihad V6Document53 pagesM04MKT-Etihad V6ytudak100% (1)

- TOPIC 5-Budgetary PlanningDocument73 pagesTOPIC 5-Budgetary PlanningDashania GregoryNo ratings yet