Professional Documents

Culture Documents

NIL Memorize

Uploaded by

jessica cruz0 ratings0% found this document useful (0 votes)

5 views2 pagesThis document outlines the requirements for an instrument to be considered negotiable under the law. It defines that an instrument must be in writing and signed, contain an unconditional promise to pay a sum certain, and be payable either on demand or at a fixed time. The document further specifies what constitutes a determinable future time and conditions under which an instrument would be considered payable to order or to bearer. It concludes by defining what qualifies someone as a holder in due course of a negotiable instrument.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the requirements for an instrument to be considered negotiable under the law. It defines that an instrument must be in writing and signed, contain an unconditional promise to pay a sum certain, and be payable either on demand or at a fixed time. The document further specifies what constitutes a determinable future time and conditions under which an instrument would be considered payable to order or to bearer. It concludes by defining what qualifies someone as a holder in due course of a negotiable instrument.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesNIL Memorize

Uploaded by

jessica cruzThis document outlines the requirements for an instrument to be considered negotiable under the law. It defines that an instrument must be in writing and signed, contain an unconditional promise to pay a sum certain, and be payable either on demand or at a fixed time. The document further specifies what constitutes a determinable future time and conditions under which an instrument would be considered payable to order or to bearer. It concludes by defining what qualifies someone as a holder in due course of a negotiable instrument.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

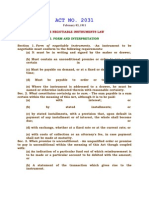

SECTION 1. Form of negotiable instrument.

—An instrument to be negotiable must

conform to the following requirements:

(a) It must be in writing and signed by the maker or drawer;

(b) Must contain an unconditional promise or order to pay a sum certain in money;

(c) Must be payable on demand, or at a fixed or determinable future time;

(d) Must be payable to order or to bearer; and

(e) Where the instrument is addressed to a drawee, he must be named or

otherwise indicated therein with reasonable certainty.

SEC. 2. Certainly as to sum ; what constitutes.—The sum payable sum is a sum

certain within the meaning of this Act, although it is to be paid—

(a) With interest; or

(b) By stated installments^ or

(c) By stated installments, with a provision that upon default in payment of any

installment or of interest the whole shall become due; or

(d) With exchange, whether at a fixed rate or at the current rate; or

(e) With costs of collection or an attorney's fee, in case payment shall not be made

at maturity.

SEC. 3. When promise is unconditional.—An unqualified order or promise to pay is

unconditional within the meaning of this Act, though coupled with—

(a) An indication of a particular fund out of which reimbursement is to be made, or

a particular account to be debited with the amount; or

(b) A statement of the transaction which gives rise to the instrument.

But an order or promise to pay out of a particular fund is not unconditional.

SEC. 4. Determinable future time; what constitutes.—An instrument is payable at a

determinable future time, within the meaning of this Act, which is expressed to be

payable—

(a) At a fixed period after date or sight; or

(b) On or before a fixed or determinable future time specified therein; or

(c) On or at a fixed period after the occurrence of a specified event, which is certain

to happen, though the time of happening be uncertain.

An instrument payable upon a contingency is not negotiable, and the happening of

the event does not cure the defect.

SEC. 7. When payable on demand.—An instrument is payable on demand—

(a) Where it is expressed to be payable on demand, or at sight, or on presentation;

or

(b) In which no time for payment is expressed.

Where an instrument is issued, accepted, or indorsed when overdue, it is, as

regards the person so issuing, accepting, or indorsing it, payable on demand.

SEC. 8. When payable to order.—The instrument is payable to order where it is

drawn payable to the order of a specified person or to him or his order. It may be

drawn payable to the order of—

(a) A payee who is not maker, drawer, or drawee; or

(b) The drawer or maker; or

(c) The drawee; or

(d) Two or more payees jointly; or

(e) One or some of several payees; or

(f) The holder of an office for the time being.

Where the instrument is payable to order the payee must be named or otherwise

indicated therein with reasonable certainty.

SEC. 9. When payable to bearer.—The instrument is payable to bearer—

(a) When it is expressed to be so payable; or

(b) When it is payable to a person named therein or bearer; or

(c) When it is payable to the order of a fictitious or person, and such fact was

known to the person making it so payable; or

(d) When the name of the payee does not purport to be the name of any person;

or

(e) When the only or last indorsement is an indorsement in blank, sufficient terms.

SEC. 52. What constitutes a holder in due course.— A holder in due course is a

holder who has taken the instrument under the following conditions:

(a) That it is complete and regular upon its face;

(b) That he became the holder of it before it was overdue, and without notice that

it had been previously dishonored, if such was the fact;

(c) That he took it in good faith and for value;

(d) That at the time it was negotiated to him he had no notice of any infirmity in

the instrument or defect in the title of the person negotiating it.

You might also like

- Oracle Procurement Cloud Release 9 Whats NewDocument84 pagesOracle Procurement Cloud Release 9 Whats Newbaluanne100% (1)

- Quiz StratmanDocument12 pagesQuiz StratmanJohn Patrick Anyayahan100% (1)

- Negotiable Instrument - Lecture in UstDocument2 pagesNegotiable Instrument - Lecture in UstRaymondBelgicaNo ratings yet

- Negotiable Instruments Law Sec 1-10Document4 pagesNegotiable Instruments Law Sec 1-10endingcooperNo ratings yet

- The Negotiable Instruments Law: I. Form and InterpretationDocument4 pagesThe Negotiable Instruments Law: I. Form and InterpretationJoanna AbañoNo ratings yet

- Negotiable InstrumentsDocument3 pagesNegotiable InstrumentsMorgana BlackhawkNo ratings yet

- Law On Negotiable Instruments: Colegio San Agustin - BacolodDocument15 pagesLaw On Negotiable Instruments: Colegio San Agustin - BacolodGabriel SincoNo ratings yet

- Law On Negotiable Instruments Sections 1-10Document3 pagesLaw On Negotiable Instruments Sections 1-10Santi ArroyoNo ratings yet

- Act No. 2031 The Negotiable Instruments LawDocument1 pageAct No. 2031 The Negotiable Instruments LawxxhoneyxxNo ratings yet

- Constitutes. - An Instrument Is Payable at ADocument2 pagesConstitutes. - An Instrument Is Payable at AazizNo ratings yet

- N.I. (Sec. 1 - 14)Document4 pagesN.I. (Sec. 1 - 14)Jade BelenNo ratings yet

- THE NEGOTIABLE INSTRUMENTS LAW - Codal ProvDocument2 pagesTHE NEGOTIABLE INSTRUMENTS LAW - Codal Provluis capulongNo ratings yet

- Instrument.-An Instrument To Be What Constitutes.-An InstrumentDocument25 pagesInstrument.-An Instrument To Be What Constitutes.-An InstrumentAnna Marie DayanghirangNo ratings yet

- Regulatory Framework AND Legal Issues IN Business: Cristine G. Policarpio Bsais 3-BDocument33 pagesRegulatory Framework AND Legal Issues IN Business: Cristine G. Policarpio Bsais 3-BApril Joy SevillaNo ratings yet

- Nego Sec 1 - 52 Print!!Document4 pagesNego Sec 1 - 52 Print!!azizNo ratings yet

- The Negotiable Instruments LawDocument22 pagesThe Negotiable Instruments LawJaime PinuguNo ratings yet

- Act 2031Document32 pagesAct 2031popbiloNo ratings yet

- The Negotiable Instruments LawDocument25 pagesThe Negotiable Instruments LawSMNo ratings yet

- The Negotiable Instruments LawDocument3 pagesThe Negotiable Instruments LawMheryza De Castro PabustanNo ratings yet

- The Negotiable Instruments LawDocument18 pagesThe Negotiable Instruments Lawcode4sale100% (1)

- Sec. 1-9Document2 pagesSec. 1-9Julienne GayondatoNo ratings yet

- The Negotiable Instruments LawDocument5 pagesThe Negotiable Instruments LawEmman RiveraNo ratings yet

- Law On Negotiable Instruments Section 1 10Document4 pagesLaw On Negotiable Instruments Section 1 10Nepnep VascoNo ratings yet

- CODAL - Negotiable InstrumentsDocument30 pagesCODAL - Negotiable InstrumentsMiguel BerguNo ratings yet

- Act 2031 Negotiable InstrumentsDocument33 pagesAct 2031 Negotiable InstrumentsArman GubatNo ratings yet

- Law On Negotiable Instruments Section 1-10Document4 pagesLaw On Negotiable Instruments Section 1-10Miguel GrayNo ratings yet

- The Negotiable Instruments LawDocument6 pagesThe Negotiable Instruments LawHerbert JavierNo ratings yet

- Negotiable InstrumentsDocument21 pagesNegotiable InstrumentsPrincess Trisha Joy UyNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsAngel Alejo AcobaNo ratings yet

- Nego Law CodalDocument26 pagesNego Law CodalMark JosephNo ratings yet

- Nil Codal ProvisionsDocument18 pagesNil Codal ProvisionsLemuel Angelo M. EleccionNo ratings yet

- Negotiable Instruments LawDocument18 pagesNegotiable Instruments LawJemNo ratings yet

- The Negotiable Instruments Law: Constitutes. - An Instrument Is Payable at ADocument6 pagesThe Negotiable Instruments Law: Constitutes. - An Instrument Is Payable at AGeremy Justine BonifacioNo ratings yet

- Act No 2031Document20 pagesAct No 2031Andrea RioNo ratings yet

- Act No 2031 NILDocument30 pagesAct No 2031 NILHp AmpsNo ratings yet

- Act No 2031Document15 pagesAct No 2031GrayNo ratings yet

- The Negotiable Instruments Law IDocument6 pagesThe Negotiable Instruments Law IMarcial Gerald Suarez IIINo ratings yet

- Form of Negotiable Instruments. - An Instrument TobeDocument2 pagesForm of Negotiable Instruments. - An Instrument TobeGielsie CruzatNo ratings yet

- Act No 2031Document18 pagesAct No 2031Denise CruzNo ratings yet

- Nego Codal Provisions PrintDocument16 pagesNego Codal Provisions PrintJoanna Paula P. SollanoNo ratings yet

- Negotiable Instruments DefinedDocument2 pagesNegotiable Instruments DefinedJoice Camelle PinosNo ratings yet

- In Addition To The Payment of Money Is Not Negotiable. ButDocument14 pagesIn Addition To The Payment of Money Is Not Negotiable. ButUriko LabradorNo ratings yet

- Law and Negotiable 1-29Document5 pagesLaw and Negotiable 1-29James Cedrick NuasNo ratings yet

- The Negotiable Instuments Law - Act No. 2031 - CodalDocument28 pagesThe Negotiable Instuments Law - Act No. 2031 - CodalMichelle Escudero FilartNo ratings yet

- Chapter 1 NegoDocument27 pagesChapter 1 Negojhaeus enaj100% (1)

- Nego SylabusDocument44 pagesNego SylabusRose Mae GullaNo ratings yet

- The Negotiable Instruments Law CodalDocument12 pagesThe Negotiable Instruments Law CodalAleezah Gertrude RaymundoNo ratings yet

- NIL ProvisionsDocument4 pagesNIL ProvisionsTsuuundereeNo ratings yet

- NIL CodalDocument17 pagesNIL Codalblue_blue_blue_blue_blueNo ratings yet

- Negotiability. - An Instrument Which Contains AnDocument18 pagesNegotiability. - An Instrument Which Contains AnmichaellaNo ratings yet

- The Negotiable Instruments LawDocument15 pagesThe Negotiable Instruments LawHello KittyNo ratings yet

- Act No. 2031Document25 pagesAct No. 2031Jannina Pinson RanceNo ratings yet

- Negotiable Instruments MaterialDocument13 pagesNegotiable Instruments MaterialMiks EnriquezNo ratings yet

- ACT NO. 2031 February 03, 1911 The Negotiable Instruments LawDocument14 pagesACT NO. 2031 February 03, 1911 The Negotiable Instruments LawRichel Dean SolisNo ratings yet

- Negotiable Instruments LawDocument16 pagesNegotiable Instruments LawTokie Toki100% (1)

- I. Form and Interpretation: Act No. 2031 Philippine Legislature 3 February 1911Document7 pagesI. Form and Interpretation: Act No. 2031 Philippine Legislature 3 February 1911Leo GuillermoNo ratings yet

- The Negotiable Instruments LawDocument5 pagesThe Negotiable Instruments LawJohn Alex Del RosarioNo ratings yet

- ACT NO. 2031 February 03, 1911 The Negotiable Instruments Law I. Form and InterpretationDocument19 pagesACT NO. 2031 February 03, 1911 The Negotiable Instruments Law I. Form and InterpretationELaine Nadera-SarmientoNo ratings yet

- ACT NO. 2031 - The Negotiable Instruments Law - Form and InterpretationDocument13 pagesACT NO. 2031 - The Negotiable Instruments Law - Form and Interpretationmendel28No ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Supply Chain IntroductionDocument13 pagesSupply Chain IntroductionSiddhant MadvariyaNo ratings yet

- O Agreement (Meeting of The Mind) Resulting From An Offer and Acceptance O Consideration O Competent Parties or Mutual Obligation O A Lawful PurposeDocument3 pagesO Agreement (Meeting of The Mind) Resulting From An Offer and Acceptance O Consideration O Competent Parties or Mutual Obligation O A Lawful PurposeMaelyn PinedaNo ratings yet

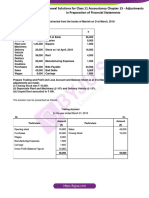

- Ts Grewal Solutions For Class 11 Account Chapter 15 MinDocument36 pagesTs Grewal Solutions For Class 11 Account Chapter 15 Minrocking toxtricityNo ratings yet

- Baye 9e Chapter 08Document48 pagesBaye 9e Chapter 08nita sugiarta wijayaNo ratings yet

- Ch.8-Planning Work Activities-1Document24 pagesCh.8-Planning Work Activities-1Taha MadniNo ratings yet

- Arnav - Mulge - 122Document1 pageArnav - Mulge - 122Anirudh PrakashNo ratings yet

- General Counsel in New York NY Resume Adele FreedmanDocument3 pagesGeneral Counsel in New York NY Resume Adele FreedmanAdeleFreedmanNo ratings yet

- File-31 (1) Ms PipeDocument14 pagesFile-31 (1) Ms PipeSudip LamsalNo ratings yet

- Construction Manager or Project Manager or Electrical EngineerinDocument7 pagesConstruction Manager or Project Manager or Electrical Engineerinapi-121297457No ratings yet

- MPU 2232 Chapter 4-Business PlanDocument21 pagesMPU 2232 Chapter 4-Business Plandina azmanNo ratings yet

- Personnel Administration: (Meaning, Definitions, Objectives, Types A Significance, and Challenges and Issues)Document45 pagesPersonnel Administration: (Meaning, Definitions, Objectives, Types A Significance, and Challenges and Issues)Charlene RodriguezNo ratings yet

- Instructions: Answer Minimum Five Out of Seven Questions. All Questions Carry Equal Marks (5 10 50)Document4 pagesInstructions: Answer Minimum Five Out of Seven Questions. All Questions Carry Equal Marks (5 10 50)Abhishek RaghavNo ratings yet

- Amazon Business Model CanvasDocument1 pageAmazon Business Model CanvasMehran SavadkouhiNo ratings yet

- MGT401 PaperDocument10 pagesMGT401 PaperQaiser WaseemNo ratings yet

- ACC 113 Mid Term Examination Sept 30 2021Document11 pagesACC 113 Mid Term Examination Sept 30 2021yhygyug0% (1)

- Performance Appraisal QuestionnaireDocument3 pagesPerformance Appraisal QuestionnaireSUKUMAR88% (51)

- Salesforce: Proxy Statement SupplementDocument18 pagesSalesforce: Proxy Statement SupplementjjruttiNo ratings yet

- Punjab Oil Mills LimitedDocument9 pagesPunjab Oil Mills LimitedMuhammadAli AbidNo ratings yet

- GEOJITDocument18 pagesGEOJITAnsu BabyNo ratings yet

- ImranDocument2 pagesImranImran LaghariNo ratings yet

- Plant MaintenanceDocument10 pagesPlant MaintenanceGatut SulianaNo ratings yet

- Business ProcessDocument34 pagesBusiness ProcessSyrell NaborNo ratings yet

- GSMA Mobile Operators Start Ups in Emerging MarketsDocument14 pagesGSMA Mobile Operators Start Ups in Emerging MarketsTharindu K JayasinghaNo ratings yet

- CB Insights Corporate Innovation Labs Finance NurtureDocument47 pagesCB Insights Corporate Innovation Labs Finance Nurturedrestadyumna ChilspiderNo ratings yet

- Rwakobo Rock Rates From 15th December 2018 Until 15th December 2020Document2 pagesRwakobo Rock Rates From 15th December 2018 Until 15th December 2020Ronnie WilliamNo ratings yet

- PP27 - Knowledge Management at WiproDocument21 pagesPP27 - Knowledge Management at WiproSubodh SharmaNo ratings yet

- Cash Management TechniquesDocument6 pagesCash Management Techniquessakshi srivastavaNo ratings yet

- Land, Building, and MachineryDocument6 pagesLand, Building, and MachineryPaula Rodalyn MateoNo ratings yet