Professional Documents

Culture Documents

Solution of Q.18 and Q.19-19

Uploaded by

Manjam6ri Agarwal0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document presents the trading and profit & loss account and balance sheet for a business for the year ending March 31, 2023. The trading and profit & loss account shows a net loss of Rs. 81,500 for the year. Assets include plant and machinery, debtors, furniture, land and buildings, and closing stock. Liabilities include a bank loan, creditors, and outstanding expenses. The balance sheet balances at Rs. 4,45,500.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document presents the trading and profit & loss account and balance sheet for a business for the year ending March 31, 2023. The trading and profit & loss account shows a net loss of Rs. 81,500 for the year. Assets include plant and machinery, debtors, furniture, land and buildings, and closing stock. Liabilities include a bank loan, creditors, and outstanding expenses. The balance sheet balances at Rs. 4,45,500.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesSolution of Q.18 and Q.19-19

Uploaded by

Manjam6ri AgarwalThe document presents the trading and profit & loss account and balance sheet for a business for the year ending March 31, 2023. The trading and profit & loss account shows a net loss of Rs. 81,500 for the year. Assets include plant and machinery, debtors, furniture, land and buildings, and closing stock. Liabilities include a bank loan, creditors, and outstanding expenses. The balance sheet balances at Rs. 4,45,500.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

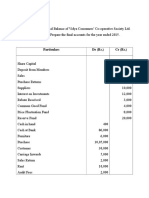

Q.

18 Solution: TRADING AND PROFIT & LOSS ACCOUNT

Dr. for the year ended 31st March, 2023 Cr.

Particulars

` Particulars `

To Opening Stock 30,000 By Sales 1,50,000

To Purchases 1,20,000 Less: Return 10,000 1,40,000

Less: Returns 20,000 1,00,000 By Closing Stock 45,000

To Gross Profit 55,000

1,85,000 1,85,000

To Depreciation on Furniture 600 By Gross Profit 55,000

To Establishment Expenses 22,000 By Commission 5,000

To Taxes and Insurance 5,000 Less: Received in Advance 1,000 4,000

Add: Outstanding 3,000 By Accrued Interest on Deposit 2,100

Less: Prepaid (500) 7,500

To Bad Debts 5,000

Add: New Provision for

Doubtful Debts 10,000

Less: Provision for

Doubtful Debts (Old) 7,000 8,000

To Outstanding Interest on Bank Loan 3,000

To Net Profit 20,000

61,100 61,100

BALANCE SHEET

as at 31st March, 2023

Liabilities

` Assets `

Bank Loan 20,000 Cash 15,000

Creditors 20,000 Debtors 50,000

Bills Payable 25,000 Less: Provision for Doubtful Debts 10,000 40,000

Outstanding Interest on Bank Loan 3,000 Deposits 40,000

Outstanding Taxes 3,000 Bills Receivable 32,000

Output IGST 2,000 Accrued Interest 2,100

Commission Received in Advance 1,000 Closing Stock 45,000

Capital 1,00,000 Prepaid Insurance 500

Less: Drawings 14,000 Furniture 6,000

Add: Net Profit 20,000 1,06,000 Less: Depreciation 600 5,400

1,80,000 1,80,000

Note: Input CGST, Input SGST is set off against Output CGST, Output SGST and Output IGST.

Working Note on GST Set-off:

IGST CGST SGST

Output GST (6,000) (8,000) (8,000)

Less: Input GST ... 10,000 10,000

Balance (6,000) 2,000 2,000

Less: Set-off 4,000 (2,000) (2,000)

Balance (2,000) ... ...

Payable

: 1

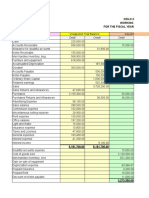

Q.19 Solution: TRADING AND PROFIT & LOSS ACCOUNT

Dr. for the year ended 31st March, 2023 Cr.

Particulars

` Particulars `

To Opening Stock 70,000 By Sales 4,00,000

To Purchases 2,60,000 Less: Return 8,000 3,92,000

Less: Returns 7,000 By Closing Stock 35,000

Less: Addition to Machinery 10,000 2,43,000

To Wages 50,000

Add: Outstanding 6,000 56,000

To Carriage 5,000

To Gross Profit 53,000

4,27,000 4,27,000

To Bad Debts 2,000 By Gross Profit 53,000

Add: Provision for Doubtful Debts 4,800 6,800 By Discount Received 6,000

To Commission 15,000 By Provision for Doubtful Debts 13,000

To Discount Allowed 7,000 By Net Loss 81,500

To Interest on Bank Loan 12,000

To Salaries 45,000

Add: Outstanding 5,000 50,000

To Advertisement 15,000

To Rent and Taxes 13,000

To Depreciation:

Plant and Machinery 21,000

Furniture 8,250

Land and Building 2,450 31,700

To Outstanding Interest on Bank Loan 3,000

1,53,500 1,53,500

BALANCE SHEET as at 31st March, 2023

Liabilities

` Assets `

Capital 3,50,000 Plant and Machinery 2,05,000

Less: Drawings 15,000 Add: Addition to Machinery 10,000

Net Loss 81,500 2,53,500 Less: Depreciation 21,000 1,94,000

10% Bank Loan 1,50,000 Debtors 50,000

Creditors 28,000 Less: Bad Debt 2,000

Outstanding Wages 6,000 Provision for Doubtful Debts 4,800 43,200

Outstanding Salaries 5,000 Furniture 55,000

Outstanding Interest on Loan 3,000 Less: Depreciation 8,250 46,750

Land and Building 98,000

Less: Depreciation 2,450 95,550

Input SGST 3,000

Closing Stock 35,000

Cash in Hand 8,000

Cash at Bank 20,000

4,45,500 4,45,500

Note: Input CGST, Input SGST is set off against Output IGST.

You might also like

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Date Adjusting Entries Dec.31Document18 pagesDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNo ratings yet

- From The Following Trial Balance, Prepare Trading and Profit & Loss AccountDocument2 pagesFrom The Following Trial Balance, Prepare Trading and Profit & Loss Accountyuvraj singhNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- 4.6 Final AcoountsDocument2 pages4.6 Final AcoountsSarath kumar CNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- Sole Trading Final AccountDocument5 pagesSole Trading Final AccountARJIT KULSHRESTHA100% (1)

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- Persfin 5&6Document3 pagesPersfin 5&6Vicente BerdanNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Accounts QuestionDocument8 pagesAccounts QuestionMaitri SaraswatNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- Accounts CIADocument4 pagesAccounts CIATanmay AroraNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Lembar Jawaban Jurnal U.anakDocument38 pagesLembar Jawaban Jurnal U.anakjohannahtheresiaNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- 4.2 Final AccountsDocument2 pages4.2 Final AccountsSarath kumar CNo ratings yet

- Accounting Assignment #3 - Jonah KelaryDocument2 pagesAccounting Assignment #3 - Jonah KelaryJerad KotiNo ratings yet

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- Audit of Receivables and Sales SolutionsDocument16 pagesAudit of Receivables and Sales SolutionsNICELLE TAGLENo ratings yet

- Stage 1 Ffa3Document3 pagesStage 1 Ffa3Khalid AzizNo ratings yet

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Sanjay Industries: Final AccountsDocument16 pagesSanjay Industries: Final AccountsNickNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Local Media479648801608356881Document8 pagesLocal Media479648801608356881Joeven DinawanaoNo ratings yet

- Profit and LossDocument5 pagesProfit and Losssudhi ravindranNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- AFM Solution SumitDocument4 pagesAFM Solution SumitSumitNo ratings yet

- Npo AnswersDocument25 pagesNpo Answersjabav44728No ratings yet

- Menyusun Laporan KeuanganDocument18 pagesMenyusun Laporan KeuanganAngelaNo ratings yet

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- CAPI Suggested June 2014Document25 pagesCAPI Suggested June 2014Meghraj AryalNo ratings yet

- Statement of Cash Flows: RequiredDocument50 pagesStatement of Cash Flows: RequiredLouise91% (22)

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Ia3 22 23Document5 pagesIa3 22 23Gabriel Trinidad SonielNo ratings yet

- Computation For Exercise 1Document10 pagesComputation For Exercise 1Xyzra AlfonsoNo ratings yet

- 2 Numericals of Schedule 3 For PracticeDocument3 pages2 Numericals of Schedule 3 For PracticeAchyut AwasthiNo ratings yet

- Answer Illustration 6Document4 pagesAnswer Illustration 6apokelloNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Retail BankingDocument46 pagesRetail BankingNeelanjan MitraNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Financial Management Handbook 1704942604Document45 pagesFinancial Management Handbook 1704942604alenNo ratings yet

- Department of Accountancy: Holy Angel University Intermediate Accounting 1Document9 pagesDepartment of Accountancy: Holy Angel University Intermediate Accounting 1Shania LiwanagNo ratings yet

- FAR Final Preboard QuestionaireDocument18 pagesFAR Final Preboard Questionaireyzhlansang.studentNo ratings yet

- Case Citation:: PLM JD 3-3 (2021-2022) Please Do Not CirculateDocument3 pagesCase Citation:: PLM JD 3-3 (2021-2022) Please Do Not CirculateJoyceNo ratings yet

- Trusts L6 Exam 2020 BDocument4 pagesTrusts L6 Exam 2020 BFahmida M RahmanNo ratings yet

- 172 Fernandez Hermanos, Inc. v. CIR (Uy)Document4 pages172 Fernandez Hermanos, Inc. v. CIR (Uy)Avie UyNo ratings yet

- Prelim Exam Accounting 2Document3 pagesPrelim Exam Accounting 2JM Singco Canoy100% (1)

- The National Bursary PolicyDocument20 pagesThe National Bursary PolicyCrazyCrafterYTNo ratings yet

- Public Group Term PaperDocument21 pagesPublic Group Term Paperrami assefaNo ratings yet

- Public DebtDocument9 pagesPublic DebtSamiksha SinghNo ratings yet

- Ap 300q Quizzer Audit of Liabilities QuestionsDocument14 pagesAp 300q Quizzer Audit of Liabilities QuestionsLeinell Sta. MariaNo ratings yet

- Lecture 4.1 - The Cash Book and Petty Cash BookDocument26 pagesLecture 4.1 - The Cash Book and Petty Cash BookVivien NgNo ratings yet

- Bookkeeping To Trial Balance 10Document15 pagesBookkeeping To Trial Balance 10elelwaniNo ratings yet

- Lesson 1.1 Simple Interest Visual AidDocument13 pagesLesson 1.1 Simple Interest Visual AidJerald SamsonNo ratings yet

- Unit-4 Liquidity DecisionsDocument35 pagesUnit-4 Liquidity DecisionsGrubber grubNo ratings yet

- Bailment & PledgeDocument11 pagesBailment & Pledgewelcome2jungleNo ratings yet

- Lead From The OutsideDocument10 pagesLead From The Outsideelmraksi30No ratings yet

- Dusty R BouthilletteDocument16 pagesDusty R Bouthillettedanw5646No ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Unit 1 Practice QuestionsDocument4 pagesUnit 1 Practice QuestionsWing Chit LamNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Leases, Debt and ValueDocument57 pagesLeases, Debt and ValueGaurav ThakurNo ratings yet

- Question Banl XII ACC 2021 - 2022Document12 pagesQuestion Banl XII ACC 2021 - 2022aes event100% (1)

- Plagiarism Scan Report: Plagiarism Unique Plagiarized Sentences Unique SentencesDocument8 pagesPlagiarism Scan Report: Plagiarism Unique Plagiarized Sentences Unique SentencesPrachi ParabNo ratings yet

- DBM 611 Question Papers 2022Document3 pagesDBM 611 Question Papers 2022julierienyeNo ratings yet

- Discharging Debt "The Administrative Way"Document5 pagesDischarging Debt "The Administrative Way"politically incorrect96% (25)

- 4 - Change in Capital StructureDocument18 pages4 - Change in Capital Structurelou-924No ratings yet

- CMPC 131 3-Partnership-DissltnDocument13 pagesCMPC 131 3-Partnership-DissltnGab IgnacioNo ratings yet