Professional Documents

Culture Documents

SSA - Short Notes

Uploaded by

Poorani SundaresanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSA - Short Notes

Uploaded by

Poorani SundaresanCopyright:

Available Formats

Sukanya Samriddhi Account (SSA)

Interest payable, Rates, Minimum Amount for opening of account and maximum

Periodicity etc. balance that can be retained

Rate of interest 8.2% Per Annum Minimum INR. 250/-and Maximum INR. 1,50,000/- in a

(with effect from 01.01.2024), financial year. Subsequent deposit in multiple of INR 50/-

calculated on yearly basis ,Yearly Deposits can be made in lump-sum No limit on number of

compounded. deposits either in a month or in a Financial year

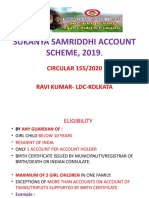

(a) Who can open account:-

• -> By the guardian in the name of girl child below the age of 10 years.

• -> Only one account can be opened in India either in Post Office or in any bank in the name

of a girl child.

• -> This account can be opened for maximum of two girls in a family. Provided in case of

twins/triplets girls birth more than two accounts can be opened.

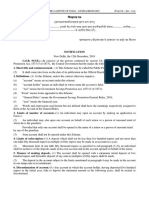

(b) Deposits:-

(i) Account can be opened with minimum initial deposit Rs. 250.

(ii) Minimum deposit in a FY is Rs. 250 and maximum deposit can be made up to Rs. 1.50 lakh

(in multiple of Rs.50) in a FY in lumpsum or in multiple instalments.

(iii) Deposit can be made maximum up to completion of 15 years from the date of opening.

(iv) If minimum deposit Rs. 250 is not deposited in a account in a FY , the account shall be

treated at defaulted account.

(v) Defaulted account can be revived before completion of 15 years from the date of opening of

account by paying minimum Rs. 250 + Rs. 50 default for each defaulted year.

(vi) Deposits qualify for deduction under section 80C of Income Tax Act.

(c) Interest:-

(i) The account will earn the prescribed rate notified by Ministry of Finance on quarterly basis.

(ii) The interest shall be calculated for the calendar month on the lowest balance in the account

between the close of the fifth day and the end of the month.

(iii) Interest shall be credited to the account at the end of each Financial year.

(iii) Interest shall be credited to the account at the end of each FY where account stands at the

end of FY. (i.e. in case of transfer of account from Bank to PO or vice versa)

(iv) Interest earned is tax free under Income Tax Act.

(d) Operation of Account:-

• -> Account will be operated by the guardian till the girl child attains the age of majority (i.e.

18 years).

(e) Withdrawal:-

(i) Withdrawal may be taken from account after girl child attains age of 18 or passed 10th

standard.

(ii) withdrawal may be taken up to 50% of balance available at the end of preceding F.Y.

(iii) withdrawal may be made in one lump sum or in installments, not exceeding one per year, for

a maximum of five years, subject to the ceiling specified and subject to actual requirement of

fee/other charges.

(f) Premature closure:-

(i) Account may be prematurely closed after 5 years of account opening on the following

conditions : -

• -> On the death of account holder. (from date of death to date of payment PO Savings Account

interest rate will be applicable).

• -> On extreme compassionate grounds

(i) Life threatening decease of a/c holder.

(ii) Death of the guardian by whom account operated.

(iii) Complete documentation and application required for such closure.

(vi) For premature closure of account submit prescribed application form along with pass book

at concerned Post Office.

(g) Closure on maturity:-

(i) After 21 years from the date of account opening.

(ii) Or at the time of marriage of girl child after attaining age of 18years.(1 month before or 3

month after date of marriage).

https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

ManuVR 9496114743

You might also like

- Pendulum Dowsing ChartsDocument8 pagesPendulum Dowsing ChartsLyn62% (13)

- (E6) Exercise For Unit 6Document2 pages(E6) Exercise For Unit 6Lê Cẩm YênNo ratings yet

- 500 Chess Exercises Special Mate in 1 MoveDocument185 pages500 Chess Exercises Special Mate in 1 MoveRégis WarisseNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- Oracle User Adoption ServicesDocument38 pagesOracle User Adoption ServicesHaitham Ezzat100% (1)

- Lean101 Train The Trainer Slides tcm36-68577Document66 pagesLean101 Train The Trainer Slides tcm36-68577zakari100% (1)

- Indian Post OfficeDocument75 pagesIndian Post OfficeEvanchalin mercyNo ratings yet

- PPF - Short NotesDocument1 pagePPF - Short NotesPoorani SundaresanNo ratings yet

- 7816 - CBS PPF - PPFDocument14 pages7816 - CBS PPF - PPFsrinu reddyNo ratings yet

- Post Office Saving SchemesDocument1 pagePost Office Saving SchemesTanuja ShirodkarNo ratings yet

- 15 Year Public Provident Fund AccountDocument1 page15 Year Public Provident Fund AccountAndRoid DeveLoPerNo ratings yet

- Public Provident Fund Scheme 1968: Salient FeaturesDocument16 pagesPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNo ratings yet

- PPF Section 80cDocument8 pagesPPF Section 80cPaymaster ServicesNo ratings yet

- Monthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument10 pagesMonthly Income Account Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodarabhanupalavarapuNo ratings yet

- NSC - Short NotesDocument1 pageNSC - Short NotesPoorani SundaresanNo ratings yet

- Public Provident Fund Scheme RulesDocument6 pagesPublic Provident Fund Scheme Rulesraj rajNo ratings yet

- Sources of finance and Post Office savings schemesDocument24 pagesSources of finance and Post Office savings schemesAnkit Sinai TalaulikarNo ratings yet

- Guide to India's Public Provident Fund SchemeDocument3 pagesGuide to India's Public Provident Fund SchemePratap Narayan SinghNo ratings yet

- SB and Jan Suraksha SchemesDocument54 pagesSB and Jan Suraksha SchemesSreemon P VNo ratings yet

- Kisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC VadodaraDocument9 pagesKisan Vikas Patra Scheme: Prepared By: Jagdish Chosala Instructor, PTC Vadodarabhanupalavarapu100% (1)

- Post Office SchemesDocument27 pagesPost Office SchemesvarshapadiharNo ratings yet

- Public Provident Fund SchemeDocument3 pagesPublic Provident Fund SchemeAshish PatilNo ratings yet

- Posb 7. NSC PDFDocument9 pagesPosb 7. NSC PDFbhanupalavarapuNo ratings yet

- Govt Schemes 3.1.23Document27 pagesGovt Schemes 3.1.23Sumit Suman ChaudharyNo ratings yet

- Untitledpdf HTCDocument1 pageUntitledpdf HTCRahulSinghNo ratings yet

- Public Provident Fund Scheme (PPF) Bod - 25112021Document5 pagesPublic Provident Fund Scheme (PPF) Bod - 25112021Priya KalraNo ratings yet

- Non-Marketable Financial Assets: Bank DepositsDocument8 pagesNon-Marketable Financial Assets: Bank DepositsDhruv MishraNo ratings yet

- 02 SCSS SchemeDocument3 pages02 SCSS Schemeరాజశేఖర్ రెడ్డి కందికొండNo ratings yet

- Post Office Savings SchemesDocument8 pagesPost Office Savings SchemesKailashnath GantiNo ratings yet

- Public Provident Fund (PPF) interest rate drops to 8.7Document5 pagesPublic Provident Fund (PPF) interest rate drops to 8.7Sumit GuptaNo ratings yet

- Post Office Monthly Income SchemeDocument7 pagesPost Office Monthly Income SchemeLaxman RathodNo ratings yet

- Invest in 7.75% RBI Savings BondsDocument2 pagesInvest in 7.75% RBI Savings BondsYash SoniNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- Mahila Samman eCircularDocument5 pagesMahila Samman eCircularரஞ்சித் குமார்.பNo ratings yet

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDocument4 pagesRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmateNo ratings yet

- Govt SchemesDocument49 pagesGovt SchemesArul pratheebNo ratings yet

- Public Provident Fund (PPF)Document3 pagesPublic Provident Fund (PPF)rupesh_kanabar1604100% (2)

- Post Office SchemesDocument10 pagesPost Office SchemesmuntaquirNo ratings yet

- Postal InsuranceDocument21 pagesPostal InsuranceMaha RasiNo ratings yet

- Customer's Account With The BankerDocument7 pagesCustomer's Account With The BankerShuktarai Nil JosnaiNo ratings yet

- Government Business Products HandbookDocument8 pagesGovernment Business Products HandbookraghuviltapuramNo ratings yet

- What Is Sukanya Samriddhi YojanaDocument7 pagesWhat Is Sukanya Samriddhi Yojanaaarja sethiNo ratings yet

- PNB Savings Account FeaturesDocument28 pagesPNB Savings Account Featuresgauravdhawan1991No ratings yet

- Public Provident Fund Scheme 2019Document11 pagesPublic Provident Fund Scheme 2019blazeramakrishnanNo ratings yet

- THE PUBLIC PROVIDENT FUND SCHEMEDocument7 pagesTHE PUBLIC PROVIDENT FUND SCHEMENILRATAN SARKARNo ratings yet

- National Savings Monthly IncomeDocument3 pagesNational Savings Monthly Incomejack sNo ratings yet

- UCO Bank's Sukanya Samriddhi Scheme GuidelinesDocument10 pagesUCO Bank's Sukanya Samriddhi Scheme Guidelinessri arjunNo ratings yet

- Mahindra Finance Fixed Deposit FAQsDocument4 pagesMahindra Finance Fixed Deposit FAQsPoonam ShardaNo ratings yet

- AB Savings AccountsDocument26 pagesAB Savings AccountsTejaswi Joshyula ChallaNo ratings yet

- PNB Fixed Deposit FormDocument6 pagesPNB Fixed Deposit FormANKITNo ratings yet

- PNB Housing: Harvest Great Returns, Assured and SafeDocument6 pagesPNB Housing: Harvest Great Returns, Assured and Safeshahid2opuNo ratings yet

- Handbook On Govt Business Products 20210818174621Document9 pagesHandbook On Govt Business Products 20210818174621omvir singhNo ratings yet

- Kisan Vikas PatraDocument16 pagesKisan Vikas PatraAnonymous aAMqLLNo ratings yet

- How To Open PPF AccountDocument6 pagesHow To Open PPF Accountnitinsharma1984No ratings yet

- STB04012018 A1Document14 pagesSTB04012018 A1Mainak MukherjeeNo ratings yet

- Pag Ibig Housing LoanDocument5 pagesPag Ibig Housing LoanHeber BacolodNo ratings yet

- SSY Account Opening FormDocument2 pagesSSY Account Opening FormKiran JupallyNo ratings yet

- I. What Is This Product About?Document5 pagesI. What Is This Product About?RevelUp :3No ratings yet

- Sarwa SOPsDocument10 pagesSarwa SOPsDanish DaniNo ratings yet

- Retail BankingDocument71 pagesRetail Bankingswati_rathourNo ratings yet

- Sukanya Samriddhi Yojana Objective Eligibility: Sl. No. Salient FeaturesDocument1 pageSukanya Samriddhi Yojana Objective Eligibility: Sl. No. Salient FeaturesPazhamalairajan KaliyaperumalNo ratings yet

- Small Saving SchemeDocument30 pagesSmall Saving SchemePallaviNo ratings yet

- GSPGR 2018Document6 pagesGSPGR 2018Online RTC NashikNo ratings yet

- Government BusinessDocument17 pagesGovernment BusinessManish AroraNo ratings yet

- Company Profile ToureziaDocument22 pagesCompany Profile ToureziaIstato HudayanaNo ratings yet

- Marketing Management Assignment On MelitaDocument17 pagesMarketing Management Assignment On MelitaarjunNo ratings yet

- Archean Mafic Rocks and Their GeochemistryDocument12 pagesArchean Mafic Rocks and Their GeochemistrygajendraNo ratings yet

- Billy: Bookcase SeriesDocument4 pagesBilly: Bookcase SeriesDImkaNo ratings yet

- Black Pepper Cultivation GuideDocument26 pagesBlack Pepper Cultivation GuideReny FranceNo ratings yet

- Nick & Sammy - Baby You Love Me (Bass Tab)Document6 pagesNick & Sammy - Baby You Love Me (Bass Tab)Martin MalenfantNo ratings yet

- Hotel Sambar Recipe - Sambar Dal Recipe - Saravana Bhavan SambarDocument2 pagesHotel Sambar Recipe - Sambar Dal Recipe - Saravana Bhavan SambarSankar SasmalNo ratings yet

- ARTS8 Q4 MOD2Document32 pagesARTS8 Q4 MOD2eoghannolascoNo ratings yet

- Rel-08 Description 20130121Document254 pagesRel-08 Description 20130121Alexandre BeckerNo ratings yet

- Describing LearnersDocument29 pagesDescribing LearnersSongül Kafa67% (3)

- Pork Hamonado: IngredientsDocument7 pagesPork Hamonado: IngredientsRosaly BontiaNo ratings yet

- Claim and Counter Claim Signal WordsDocument21 pagesClaim and Counter Claim Signal WordsYra MatiasNo ratings yet

- Substation - NoaraiDocument575 pagesSubstation - NoaraiShahriar AhmedNo ratings yet

- Bachelor ThesisDocument58 pagesBachelor ThesisGabriel RazvanNo ratings yet

- Ejercicio de Writing Formal EmailsDocument4 pagesEjercicio de Writing Formal EmailsArianna ContrerasNo ratings yet

- Directory Mepco HQ, Multan - 0Document7 pagesDirectory Mepco HQ, Multan - 0H&M TRADERS INTERNATIONALNo ratings yet

- Al Nafi Affiliate PolicyDocument12 pagesAl Nafi Affiliate PolicyIftikhar AliNo ratings yet

- International SellingDocument28 pagesInternational SellingShoaib ImtiazNo ratings yet

- Saqeeb PPT LiqueurDocument21 pagesSaqeeb PPT LiqueurSæqéëb Æl HæssåñNo ratings yet

- Olweus Research HistoryDocument2 pagesOlweus Research Historykso87100% (1)

- 4g 6 Traits Writing Rubric StudentDocument3 pages4g 6 Traits Writing Rubric Studentapi-295344358No ratings yet

- NF - Lx1 - Workbook 2023Document38 pagesNF - Lx1 - Workbook 2023Maria Carolina Vega GuardiaNo ratings yet

- Prabuddha Bharata June10Document58 pagesPrabuddha Bharata June10talk2ankitNo ratings yet

- Sharing Economy Research on Uber, Airbnb ImpactsDocument14 pagesSharing Economy Research on Uber, Airbnb ImpactsChung NguyenNo ratings yet