Professional Documents

Culture Documents

Notes

Uploaded by

Alii Zy0 ratings0% found this document useful (0 votes)

13 views2 pagesThe document discusses the fundamental principles of taxation. It defines taxation as the power by which a sovereign raises revenue through its laws to fund government expenses. Taxation has both a primary revenue purpose and secondary purposes like promoting general welfare. Some key points:

1) The power to tax is an inherent attribute of sovereignty and legislative in nature.

2) Taxation must be comprehensive, unlimited, and plenary to be effective but is not superior to other state powers.

3) Theories of taxation include that government needs revenue to function and citizens receive benefits and protection from the state in exchange.

4) A sound tax system balances fiscal adequacy, administrative feasibility, and theoretical justice.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the fundamental principles of taxation. It defines taxation as the power by which a sovereign raises revenue through its laws to fund government expenses. Taxation has both a primary revenue purpose and secondary purposes like promoting general welfare. Some key points:

1) The power to tax is an inherent attribute of sovereignty and legislative in nature.

2) Taxation must be comprehensive, unlimited, and plenary to be effective but is not superior to other state powers.

3) Theories of taxation include that government needs revenue to function and citizens receive benefits and protection from the state in exchange.

4) A sound tax system balances fiscal adequacy, administrative feasibility, and theoretical justice.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesNotes

Uploaded by

Alii ZyThe document discusses the fundamental principles of taxation. It defines taxation as the power by which a sovereign raises revenue through its laws to fund government expenses. Taxation has both a primary revenue purpose and secondary purposes like promoting general welfare. Some key points:

1) The power to tax is an inherent attribute of sovereignty and legislative in nature.

2) Taxation must be comprehensive, unlimited, and plenary to be effective but is not superior to other state powers.

3) Theories of taxation include that government needs revenue to function and citizens receive benefits and protection from the state in exchange.

4) A sound tax system balances fiscal adequacy, administrative feasibility, and theoretical justice.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

FUNDAMENTAL PRINCIPLES

Definition: Nature of taxation:

Taxation – is the power by which the sovereign, through its law-making I. Inherent Attribute of Sovereignty

body, raises revenue to defray the necessary expenses of government. It is The power to tax is an attribute of sovereignty and is inherent in the

merely a way of apportioning the costs of government among those who, in State. t does not need constitutional conferment. Constitutional

some measure, are privileged to enjoy its benefits and must bear its provisions do not give rise to the power to tax but merely impose

burdens limitations on what would otherwise be an invincible power.

2. Legislative in Character.

Tax - enforced proportional contributions or charges. It is legislative in nature since it involves the promulgation of laws.

The legislature determines the coverage, object, nature, extent and

Purpose: situs [CONES] of the tax to be imposed.

1. Primary or Revenue purpose – to raise funds or property to enable the

State to promote the general welfare and protection of the people. Characteristic of taxation:

1. Comprehensive - It covers persons, businesses, activities, professions,

2. Secondary or Non-revenue purposes / Sumptuary [PR2EP]: rights and privileges.

a. Promotion of general welfare – taxation may be used as an implement of 2. Unlimited - It is so unlimited in force and searching in extent that courts

police power to promote the general welfare of the people. scarcely venture to declare that it is subject to any restrictions.

b. Regulation of activities/industries – Taxes may also be imposed for a 3. Plenary - It is complete. Under NIRC, the BIR may avail of certain remedies

regulatory purpose as, for instance, in the rehabilitation and stabilization of to ensure the collection of taxes.

a threatened industry which is affected with public interest, like the oil 4. Supreme - It is supreme insofar as the selection of the subject of taxation

industry is concerned, but it does not mean that it is superior to the other inherent

c. Reduction of social inequality – a progressive system of taxation prevents powers of the State.

the undue concentration of wealth in the hands of few individuals.

Progressivity is based on the principle that those who are able to pay more Inherent Power to Tax:

should shoulder the bigger portion of the tax burden. a. Police Power

d. Encourage economic growth – the grant of incentives or exemptions Power of State for promoting public welfare by restricting and

encourage investment thereby stimulating economic activity. regulating the use of property and liberty.

e. Protectionism – Protective tariffs and customs duties are imposed as b. Power of Taxation

taxes in order to protect important sectors of the economy or local Power of state to raise revenue through taxation to meet

industries, as in the case of foreign importations. government needs/expenses.

c. Power of Eminent Domain

Power of State to acquire private property for public purpose upon

payment of just compensation.

Similarities between taxation, eminent domain and police power 2. Administrative feasibility

1. They are inherent powers of the State. The tax system should be capable of being effectively administered

2. All are necessary attributes of the sovereign. and enforced with the least inconvenience to the taxpayer.

3. They exist independently of the Constitution. 3. Theoretical justice

4. They constitute the three methods by which the State interferes with Must take into consideration the taxpayer’s ability to pay (Ability to

private rights and property. Pay Theory).

5. They presuppose equivalent compensation. 6. The legislature can exercise Art. VI, Sec. 28(1), 1987 Constitution mandates that the rule on

all three powers. taxation must be uniform and equitable and that the State must

evolve a progressive system of taxation.

Theory and Basis of Taxation: Scope and Limitations of Taxation

a. Lifeblood Doctrine Inherent limitations [PITIE]

Concept means that government cannot exist without taxes. It 1. Public Purpose

cannot perform its basic functions without the means of paying its 2. Inherently Legislative

expenses. 3. Territorial

b. Necessity Theory 4. International Comity

It is a necessary burden to preserve the State’s sovereignty. 5. Exemption of government entities, agencies and instrumentalities

c. Benefits-protection Theory (Doctrine of Symbiotic Relationship)

It involves the power of the State to demand and receive taxes

based on the reciprocal duties of support and protection between

the State and its citizen.

Special benefits to taxpayers are not required. A person cannot

object to or resist the payment of taxes solely because no personal

benefit to him can be pointed out arising from the tax.

d. Jurisdiction over subject and objects.

It is the country, state or sovereign that gives protection and has the

right to demand payment of taxes with which to finance activities so

it could continue to give protection.

Taxation is territorial because it is only within the confines of its

territory that a country, state or sovereign may give protection.

Principles of Sound Tax System [FAT]

1. Fiscal adequacy

Revenue raised must be sufficient to meet government/public

expenditures and other public needs.

You might also like

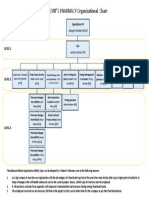

- Wilmont's Pharmacy Organizational ChartDocument1 pageWilmont's Pharmacy Organizational ChartPeter Je Dilao100% (1)

- Motorcycle Sale Agreement FormatDocument15 pagesMotorcycle Sale Agreement FormatThomas CNo ratings yet

- Income Taxation Reviewer - San BedaDocument128 pagesIncome Taxation Reviewer - San BedaJennybabe Peta100% (8)

- Tax General PrinciplesDocument54 pagesTax General Principleseunice demaclidNo ratings yet

- Basic Taxation - Aban ReviewerDocument50 pagesBasic Taxation - Aban ReviewerMariam Bautista100% (1)

- CITN Study Pack - Taxation of Specialized BusinessesDocument219 pagesCITN Study Pack - Taxation of Specialized BusinessesOguntimehin AdebisolaNo ratings yet

- Taxation of InsuranceDocument351 pagesTaxation of InsuranceJerwin DaveNo ratings yet

- General Principles of TaxationDocument12 pagesGeneral Principles of TaxationMatt Marqueses PanganibanNo ratings yet

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- Atty Aban NotesDocument52 pagesAtty Aban NotesAudrey DeguzmanNo ratings yet

- The Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomFrom EverandThe Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomNo ratings yet

- Tax ReviewerDocument52 pagesTax ReviewerevilsageNo ratings yet

- Summary of Principles of TaxationDocument8 pagesSummary of Principles of TaxationLheila MendozaNo ratings yet

- Tax Reviewer For MidtermDocument4 pagesTax Reviewer For Midtermjury jasonNo ratings yet

- Jann's Notes On TaxationDocument27 pagesJann's Notes On TaxationJANNNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDALiezl Oreilly VillanuevaNo ratings yet

- Basic PrinciplesDocument7 pagesBasic PrinciplesRodison de GuiaNo ratings yet

- Taxation Memaid (Beda)Document132 pagesTaxation Memaid (Beda)Maria Jennifer Yumul BorbonNo ratings yet

- Tax Ation San Beda College of LAW - ALABANGDocument52 pagesTax Ation San Beda College of LAW - ALABANGLaine Mongan100% (1)

- Principles of Taxation-ReviewerDocument36 pagesPrinciples of Taxation-ReviewerNikki Coleen SantinNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- Income Taxation Chapter1Document50 pagesIncome Taxation Chapter1Ja Red100% (1)

- Taxation ReviewerDocument53 pagesTaxation ReviewerDave A ValcarcelNo ratings yet

- General Principles of Taxation Definition of Taxation: This Is The So-Called "Benefits Received Principle."Document13 pagesGeneral Principles of Taxation Definition of Taxation: This Is The So-Called "Benefits Received Principle."Lyca VNo ratings yet

- Income Tax 01 General Principles of TaxationDocument11 pagesIncome Tax 01 General Principles of TaxationJade Ivy GarciaNo ratings yet

- Taxation LawDocument16 pagesTaxation LawHadjie LimNo ratings yet

- Tax Ation San Beda College of LAW - ALABANGDocument52 pagesTax Ation San Beda College of LAW - ALABANGYour Public ProfileNo ratings yet

- 02 Concept, Nature and Characteristics of Taxation and TaxesDocument4 pages02 Concept, Nature and Characteristics of Taxation and TaxesRonn Robby Rosales100% (2)

- System Development of Market Mobile Application For Sustainable Local Industry in The Philippines by Analiza v. MuñozDocument31 pagesSystem Development of Market Mobile Application For Sustainable Local Industry in The Philippines by Analiza v. MuñozmelizzeNo ratings yet

- Apple Best Fit ApproachDocument8 pagesApple Best Fit ApproachDivyamol100% (1)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewervanessa3333333No ratings yet

- General Principles in Taxation PDFDocument15 pagesGeneral Principles in Taxation PDFJewel Francine PUDESNo ratings yet

- General Principles A. Definition and Attributes of TaxationDocument10 pagesGeneral Principles A. Definition and Attributes of TaxationLei StudNo ratings yet

- Taxation 1 Lesson 1. Basic Concepts and Characteristics of TaxationDocument43 pagesTaxation 1 Lesson 1. Basic Concepts and Characteristics of Taxationjane quiambao100% (1)

- Tax Ation San Beda College of LAW - ALABANGDocument52 pagesTax Ation San Beda College of LAW - ALABANGKenneth Abarca SisonNo ratings yet

- Tax ReviewerDocument12 pagesTax Reviewerashleykate.hapeNo ratings yet

- 02 Concept, Nature and Characteristics of Taxation and TaxesDocument4 pages02 Concept, Nature and Characteristics of Taxation and TaxesRonn Robby RosalesNo ratings yet

- TAX-1801 (Basic Principles in Taxation 1)Document5 pagesTAX-1801 (Basic Principles in Taxation 1)bulasa.jefferson16No ratings yet

- Tax Reviewer MGCDocument52 pagesTax Reviewer MGCCalderón Gutiérrez Marlón PówanNo ratings yet

- TaxationDocument53 pagesTaxationDave A ValcarcelNo ratings yet

- Tax LawDocument53 pagesTax LawDave A ValcarcelNo ratings yet

- Taxation Law 1111111Document10 pagesTaxation Law 1111111SpidermanNo ratings yet

- Reviewer TaxDocument52 pagesReviewer TaxRogelio Saguinsin IIINo ratings yet

- Tax 102Document53 pagesTax 102Dave A ValcarcelNo ratings yet

- Taxpayer's Ability To PayDocument53 pagesTaxpayer's Ability To PayDave A ValcarcelNo ratings yet

- Income Taxation-Chapter 1: Tax Delegation and Tax Administration. This Is SoDocument6 pagesIncome Taxation-Chapter 1: Tax Delegation and Tax Administration. This Is SoNour Aira NaoNo ratings yet

- Tax 1 ReviewerDocument52 pagesTax 1 ReviewerDrean TubislloNo ratings yet

- Taxation Law Reviewer 2Document44 pagesTaxation Law Reviewer 2asde12ke1mNo ratings yet

- BAINCTAX Notes (REAL)Document2 pagesBAINCTAX Notes (REAL)Ashley BrevaNo ratings yet

- 2012 Bar Reviewer in TaxationDocument277 pages2012 Bar Reviewer in Taxationkent_009No ratings yet

- Income TaxationDocument3 pagesIncome Taxationclarenz alleraNo ratings yet

- TX 101Document7 pagesTX 101Pau SantosNo ratings yet

- Taxation 101Document53 pagesTaxation 101Dave A ValcarcelNo ratings yet

- Taxation LawDocument127 pagesTaxation Lawtheia28No ratings yet

- Taxation LawDocument127 pagesTaxation LawCarl MurphyNo ratings yet

- Income Taxation PrelimDocument7 pagesIncome Taxation PrelimJanella KeizyNo ratings yet

- General Principles of TaxationDocument36 pagesGeneral Principles of Taxationnicole5anne5ddddddNo ratings yet

- Basic Principles LectureDocument6 pagesBasic Principles LecturetherezzzzNo ratings yet

- St. Paul University SystemDocument9 pagesSt. Paul University SystemKeziah AliwanagNo ratings yet

- Cta 2003Document69 pagesCta 2003perlitainocencioNo ratings yet

- TAXATION-General Principles: 3. Based Ability To PayDocument11 pagesTAXATION-General Principles: 3. Based Ability To PayJudy Ann Matos DiaganNo ratings yet

- Chapter 1 Introduction To Taxation Supplementary MaterialsDocument4 pagesChapter 1 Introduction To Taxation Supplementary MaterialsAngel PaltincaNo ratings yet

- Principles of TaxationDocument8 pagesPrinciples of TaxationDC AranetaNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- NITT MBA Placement Brochure 2020Document8 pagesNITT MBA Placement Brochure 2020Tejas GNo ratings yet

- Job DesignDocument4 pagesJob DesignM RABOY,JOHN NEIL D.No ratings yet

- New Product DevelopmentDocument3 pagesNew Product Developmentविशाल गुप्ताNo ratings yet

- Qualitative Analysis Sun PharmaDocument6 pagesQualitative Analysis Sun Pharmassagr123No ratings yet

- Union Carbide CaseDocument3 pagesUnion Carbide CaseAli WaqarNo ratings yet

- QANT520 Problems 0706 CH 6Document6 pagesQANT520 Problems 0706 CH 6Rahil VermaNo ratings yet

- 7-Letter of CreditDocument16 pages7-Letter of CreditJade Palace TribezNo ratings yet

- Cma ScannerDocument17 pagesCma ScannerVivek Reddy100% (1)

- Uae Labour and Employment LawDocument4 pagesUae Labour and Employment Laws33d_2010No ratings yet

- Economic Crisis of PakistanDocument3 pagesEconomic Crisis of PakistanMaan ZaheerNo ratings yet

- c12.2023 - Rubber & Op Wage RateDocument3 pagesc12.2023 - Rubber & Op Wage RateiraNo ratings yet

- The HR Service Delivery Model Canvas (LIVE)Document2 pagesThe HR Service Delivery Model Canvas (LIVE)talentedpeopleplusNo ratings yet

- Suman Debnath by Jahin PDFDocument4 pagesSuman Debnath by Jahin PDFABDUL KHALIKNo ratings yet

- Chapter 1 Fin 2200Document7 pagesChapter 1 Fin 2200cheeseNo ratings yet

- Cost Accounting Chapter 15Document2 pagesCost Accounting Chapter 15Achmad Faizal AzmiNo ratings yet

- Accounts Chapter-Wise Test 5 (Suggested Answers)Document7 pagesAccounts Chapter-Wise Test 5 (Suggested Answers)Shweta BhadauriaNo ratings yet

- Annex B-1 RR 11-2018 - 1Document1 pageAnnex B-1 RR 11-2018 - 1Brianna MendezNo ratings yet

- Corporate ListDocument22 pagesCorporate Listsumeet sourabhNo ratings yet

- RHP of OPL Octo 27 2019 P 278Document278 pagesRHP of OPL Octo 27 2019 P 278Rumana SharifNo ratings yet

- Public RevenueDocument90 pagesPublic RevenuekhanjiNo ratings yet

- GIANAN Thesis Final Gab and Shanley JANUARY 7 2024 1Document41 pagesGIANAN Thesis Final Gab and Shanley JANUARY 7 2024 1Marco Antonio IINo ratings yet

- Cafe Coffee Day CCD A Case AnalysisDocument25 pagesCafe Coffee Day CCD A Case AnalysisKarunakar ChittigalaNo ratings yet

- Economic Impact of TourismDocument22 pagesEconomic Impact of TourismBalachandar PoopathiNo ratings yet

- CEMDocument9 pagesCEMChristineNo ratings yet