Professional Documents

Culture Documents

It 2022 2023 2

It 2022 2023 2

Uploaded by

Rajju Rajju0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

IT-2022-2023-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesIt 2022 2023 2

It 2022 2023 2

Uploaded by

Rajju RajjuCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

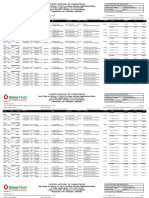

TeamLease Services Limited

BMTC Commercial Complex, 6th Floor, 80 ft Road, Koramangala, Bangalore - 560095

Income Tax Computation for the Financial Year 2022-2023

Employee KOLIMI ABDUL RAJAK - 2598732 Date of Joining 03 Oct 2022

Pan No. FMLPR1768A Gender M

A) Taxable Income

Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar

Pay Items 2022 2022 2022 2022 2022 2022 2022 2022 2022 2023 2023 2023

Total

(i) Monthly Income

ADV AGAINST ANNUAL 0.00 0.00 0.00 0.00 0.00 0.00 788.00 0.00 0.00 0.00 0.00 0.00 788.00

STAT BONUS

BASIC 0.00 0.00 0.00 0.00 0.00 0.00 6,310.00 0.00 0.00 0.00 0.00 0.00 6,310.00

HOUSE RENT 0.00 0.00 0.00 0.00 0.00 0.00 3,145.00 0.00 0.00 0.00 0.00 0.00 3,145.00

ALLOWANC E

Total 0.00 0.00 0.00 0.00 0.00 0.00 10,243.00 0.00 0.00 0.00 0.00 0.00 10,243.00

Sub Total 10,243.00

B) Other Items

PF 0.00 0.00 0.00 0.00 0.00 0.00 757.00 0.00 0.00 0.00 0.00 0.00 757.00

Income Tax

C) Perquisites 0.00

D) Gross Salary (A+C) 10,243.00

E) Less Exemption Under Section 10

House Rent Allowance : Sec.10(13A) 0.00

Total Rent Paid p.a 0.00

HRA Received 3,145.00

40% of Salary 2,524.00

Rent paid >10% of Salary 0.00

Leave Travel Assistance : Sec. 10(5) 0.00

Petrol Reimbursement : Sec. 10 0.00

Driver Reimbursement : Sec. 10 0.00

Telephone Reimbursement : Sec. 10 0.00

Books And Periodicals Reimbursement : Sec. 10 0.00

Education Reimbursement : Sec. 10 0.00

Vehicle Maintenance and Run Exp Reimbursement : Sec. 0.00

10

Leave Encashment: Sec. 10 0.00

Gratuity : Sec. 10 0.00

Total Exemption 0.00

F) Income from previous employer

Total Income 0.00

Income Tax Deducted by Previous Employer 0.00

G) Income after exemption (D-E+F) 10,243.00

H) Less Deduction under Section 16

Tax on Employment : Sec 16(iii) 0.00

Standard Deduction 50000

Sub Total 50,000.00

I) Income chargeable under the head salaries (G - H) 0.00

J) Add any other income declared by the employee 0.00

K) Interest paid for House Loan 0.00

L) Gross Total Income (I + J - K) 0.00

M) Deductions under section 80C

Investment Section Gross Qualifying Deductible

PF 80C 757.00 757.00 757.00

Sub Total 757.00 757.00 757.00

N) Deductions under chapter VIA

Details Section Gross Qualifying Deductible

Sub Total 0.00 0.00 0.00

O) Taxable Income 0.00

P) Round off to nearest 10 rupees 0.00

Q) Total Tax to be Paid

Actual Tax Tax Rebate Tax Surcharge Edu. C ess Total

0.00 0.00 0.00 0.00 0.00 0.00

R) Paid Till Date

Tax Surcharge Edu. C ess Total

Deduction Through Payroll 0.00 0.00 0.00 0.00

Direct TDS 0.00 0.00 0.00 0.00

Previous Employment 0.00 0.00 0.00 0.00

Total 0.00 0.00 0.00 0.00

S) Balance Tax 0.00 0.00 0.00 0.00

Payable

T) Monthly Tax to be 0.00 0.00 0.00 0.00

paid

U) Balance Payable (in 0 Installments) - Income Tax 0.00

@ Rs.0/- p.m.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MYOB Payslip TemplateDocument1 pageMYOB Payslip Templatejack smith100% (1)

- La Ciencia de La Finanzas PúblicasDocument4 pagesLa Ciencia de La Finanzas PúblicasRuth_Gerardine_7326100% (3)

- RecapDocument3 pagesRecapEKEKE BenoitNo ratings yet

- April 2019Document1 pageApril 2019mahesh ilagNo ratings yet

- Brbmath ExercisesDocument2 pagesBrbmath ExercisesMarcos DmitriNo ratings yet

- LohiDocument3 pagesLohiyusuf mohammadNo ratings yet

- Pension Slip PDFDocument2 pagesPension Slip PDFRamniwas TetarwalNo ratings yet

- Taxpack 2004: To Help You Prepare and Lodge Your Tax ReturnDocument132 pagesTaxpack 2004: To Help You Prepare and Lodge Your Tax ReturnRanji SoulNo ratings yet

- Solution Partnership OperationsDocument3 pagesSolution Partnership OperationsStella SabaoanNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- FORMULARIO 410 ItDocument3 pagesFORMULARIO 410 ItRosalva ZabalaNo ratings yet

- Anexa3 101Document3 pagesAnexa3 101elenaNo ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- Tax System in Pakistan.Document20 pagesTax System in Pakistan.Hashir KhanNo ratings yet

- Declaracion Abril 2023Document12 pagesDeclaracion Abril 2023Karla Ramirez MartinezNo ratings yet

- PART I - 50% Unless Otherwise Indicated, Each of The Following Questions Is Worth 2%Document3 pagesPART I - 50% Unless Otherwise Indicated, Each of The Following Questions Is Worth 2%Roxanne Datuin UsonNo ratings yet

- Fiche de Paye - CadreDocument1 pageFiche de Paye - CadreEllerNo ratings yet

- Taxation Law II Prelim Exam 2021Document2 pagesTaxation Law II Prelim Exam 2021Aure ReidNo ratings yet

- RMC 35-2011 IaetDocument2 pagesRMC 35-2011 IaetDyan de la FuenteNo ratings yet

- Control Integral de Combustibles: PrecioDocument8 pagesControl Integral de Combustibles: PrecioMARIA JOSE CEN MEZANo ratings yet

- Direct Taxes Ready Reckoner 2012Document2 pagesDirect Taxes Ready Reckoner 2012Veerkumar PuttaNo ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- RechnungDocument1 pageRechnungfelipe avariaNo ratings yet

- Chữa bài tập VATDocument4 pagesChữa bài tập VATchiukhohockhongsocucnhocNo ratings yet

- Tax Obligation of A Permanent Establishment - FDD 11 3 16Document2 pagesTax Obligation of A Permanent Establishment - FDD 11 3 16pierremartinreyesNo ratings yet

- LPC - of - L.T. Lalrinmawia April-2023Document2 pagesLPC - of - L.T. Lalrinmawia April-2023David ZD ChawngthuNo ratings yet

- Module 5. Preferential TaxationDocument6 pagesModule 5. Preferential TaxationYolly DiazNo ratings yet

- Ca Final Nov23 AmendmentsDocument31 pagesCa Final Nov23 Amendmentsswati dubeyNo ratings yet

- Nalabothula Pavani BZYPN6603G: Data Marshall Private LimitedDocument1 pageNalabothula Pavani BZYPN6603G: Data Marshall Private LimitedRamana ReddyNo ratings yet

- Arun Store GST (1) June 2022 (4) (2) DisplyaDocument3 pagesArun Store GST (1) June 2022 (4) (2) DisplyaNRP maranNo ratings yet