Professional Documents

Culture Documents

FRA Based Questio

Uploaded by

abdul.fattaahbakhsh29Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRA Based Questio

Uploaded by

abdul.fattaahbakhsh29Copyright:

Available Formats

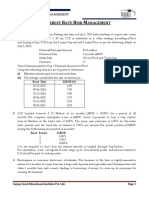

Interest rate forwards-FRA

Q.1 How the following Forward Rate Agreements will be written in FRA Style?

a) 6 months loan in 2 months

b) 1 month loan in 2 months

c) 2 months loan in 3 months

d) 3 months loan in 2 months

Q.2 A company needs money Rs.1mn in 2 months for 3 months. Company is expecting surge in interest

rates and for that reason CFO contacted to bank for Forward rate agreement. Current KIBOR rate is 6%

but bank is offering 6.5% as a forward rate for our loan requirment. CFO accepted bank offer for future

borrowing. At the time of borrowing, KIBOR Reached at 8%. CFO contacted other bank for borrowing

and borrowed 1mn at KIBOR 8%. How much will be paid and by which party when FRA will be settled?

Assume CFO borrowed from other bank at 6% as KIBOR fall to 6% at the time of borrowing then repeat

the requirement with this case?

Q.3 A company needs Rs.5mn in 3 months’ time for 6 months. The company can hedge its exposure the

risk of rise in interest rates by buying 3x9 FRA. Bank is offering 3x9 are 5.40%-5.36%. Company is fixing

rate with offering FRA Bank. Suppose at the end of 3 months, KIBOR is 6.25%. How much amount will be

settled by bank at the time of FRA expiration? Suppose at the end of 3 months, KIBOR is 4.75%, how

much amount will be settled by bank at the time of FRA Expiration?

Q.4 Compute the amount that must be repaid on a $1mn loan for 30 days if 30 day LIBOR is quoted at

6%?

Q.5 Calculate the price of FRA 1 x 4 means 90 days loan in 30 days from now. The current 30 days LIBOR

is 4% and 120 day LIBOR is 5%?

Q.6 Assume in previous question, amount is required $1mn for 90 days and rate has increased to 6% at

the time of FRA expiration which is above than FRA Rate (5.32%). Calculate the value of FRA at maturity,

which is equal to the cash payment at settlement.

Q.7 After 10 days of FRA Initiation in previous question, Find the value of FRA (Valuation at 110 TH day) if

110 day LIBOR is 5.9% and 20 day LIBOR is 5.7%.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- QuestionsDocument9 pagesQuestionsShaheer BaigNo ratings yet

- DRM-CLASSWORK - 11th JuneDocument2 pagesDRM-CLASSWORK - 11th JuneSaransh MishraNo ratings yet

- Interest Rate Risk Management PDFDocument2 pagesInterest Rate Risk Management PDFHARSHALRAVALNo ratings yet

- DRM-CLASSWORK - 14th JuneDocument4 pagesDRM-CLASSWORK - 14th JuneSaransh MishraNo ratings yet

- RE 410: Real Estate Finance: Spring 2017Document2 pagesRE 410: Real Estate Finance: Spring 2017Mohammed Al-YagoobNo ratings yet

- FD Swap 2Document6 pagesFD Swap 2Gayu RkNo ratings yet

- Midterm RevisionDocument2 pagesMidterm Revisionhoantkss181354No ratings yet

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanNo ratings yet

- Forward Rate AgreementsDocument3 pagesForward Rate AgreementssahilgeraNo ratings yet

- Forward Rate AgreementsDocument3 pagesForward Rate AgreementsNaga Mani MeruguNo ratings yet

- Week 7 Revision Exercise (Quest)Document4 pagesWeek 7 Revision Exercise (Quest)Eleanor ChengNo ratings yet

- WN 1: Computation of FRA RateDocument5 pagesWN 1: Computation of FRA RateBharat GudlaNo ratings yet

- TM - Tut 13 - Credit Derivatives - RevisionDocument5 pagesTM - Tut 13 - Credit Derivatives - RevisionTeddy AhBu0% (1)

- Handout 2Document3 pagesHandout 2Anu AmruthNo ratings yet

- Working Capital Management Exercise 3Document2 pagesWorking Capital Management Exercise 3Nikki San GabrielNo ratings yet

- FNCE 623 Financial Management: Mid Term Exam 3 June 2020 Time: 7:00 P.M. To 9:00 P.MDocument3 pagesFNCE 623 Financial Management: Mid Term Exam 3 June 2020 Time: 7:00 P.M. To 9:00 P.Mleili fallahNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- The Big Sho (R) T-Prelim 1-SRCC Business Conclave 2021Document8 pagesThe Big Sho (R) T-Prelim 1-SRCC Business Conclave 2021vishesh jainNo ratings yet

- Forward Rate Agreement NotesDocument4 pagesForward Rate Agreement NotesSangram PandaNo ratings yet

- MSE FEG 2022 QuizDocument2 pagesMSE FEG 2022 QuizPG GuidesNo ratings yet

- Assignment-I FMDocument2 pagesAssignment-I FMArnav ShresthaNo ratings yet

- MathDocument42 pagesMathMamun RashidNo ratings yet

- Forward Rate AgreementsDocument2 pagesForward Rate Agreementsajain22No ratings yet

- Interest Rate Risk Management-1Document4 pagesInterest Rate Risk Management-1tmpvd6gw8fNo ratings yet

- Fin630 GBD 2024 by Pin and MuhammadDocument4 pagesFin630 GBD 2024 by Pin and MuhammadMohammadihsan NoorNo ratings yet

- Additional Problems COE109Document10 pagesAdditional Problems COE109Kaitlyn TagleNo ratings yet

- Assignment No 1 CFDocument6 pagesAssignment No 1 CFAltaf HussainNo ratings yet

- TM Tut 13 Credit Derivatives Revision PDFDocument5 pagesTM Tut 13 Credit Derivatives Revision PDFQuynh Ngoc DangNo ratings yet

- Topic 2 Tutorial ProblemsDocument4 pagesTopic 2 Tutorial Problemsda.arts.ttNo ratings yet

- HW NongradedDocument4 pagesHW NongradedAnDy YiMNo ratings yet

- Problem Sets 15 - 401 08Document72 pagesProblem Sets 15 - 401 08Muhammad GhazzianNo ratings yet

- Simple InterestDocument19 pagesSimple InterestJohn Rhimon Abaga GelacioNo ratings yet

- Quiz MoolyankanDocument26 pagesQuiz Moolyankanapi-3754028No ratings yet

- Chapter - Security Analysis - Part 1Document7 pagesChapter - Security Analysis - Part 1adhishsirNo ratings yet

- FM II Assignment 17 W22Document2 pagesFM II Assignment 17 W22Farah ImamiNo ratings yet

- Lecture 03 PDocument3 pagesLecture 03 PalexajungNo ratings yet

- Corporate Financing Decisions, Fall 2016Document4 pagesCorporate Financing Decisions, Fall 2016Ashok BistaNo ratings yet

- 1 Fin Consider MiddletonDocument5 pages1 Fin Consider MiddletonAkshita MehtaNo ratings yet

- Assignment For BKMDocument3 pagesAssignment For BKMShankey GuptaNo ratings yet

- XYZ MidtermDocument13 pagesXYZ MidtermbooksrfunNo ratings yet

- Current Liabilities Management SOLUTIONSDocument9 pagesCurrent Liabilities Management SOLUTIONSJack Herer100% (1)

- Practices: Time Value of MoneyDocument9 pagesPractices: Time Value of MoneysovuthyNo ratings yet

- Chapter 5 ExercisesDocument2 pagesChapter 5 ExercisesTranh Meow MeowNo ratings yet

- Affin Home Flexi Plus: Product Disclosure SheetDocument6 pagesAffin Home Flexi Plus: Product Disclosure SheetPoi 3647No ratings yet

- Assignment Solution Weekend Nov18Document6 pagesAssignment Solution Weekend Nov18Lp SaiNo ratings yet

- Long Term Debt: Term LoanDocument8 pagesLong Term Debt: Term LoanSuvash KhanalNo ratings yet

- Lecture 3 - InterestRatesForwardsDocument10 pagesLecture 3 - InterestRatesForwardsscribdnewidNo ratings yet

- Derivados-Ejercicios Resueltos 1Document8 pagesDerivados-Ejercicios Resueltos 1patriciaNo ratings yet

- To Complete This Workbook, Answer The Questions On Each WorksheetDocument9 pagesTo Complete This Workbook, Answer The Questions On Each WorksheetBharat KoiralaNo ratings yet

- Tutorial Questions - Topic4Document2 pagesTutorial Questions - Topic4Thirusha balamuraliNo ratings yet

- MNGT 604 Day1 Day2 Problem Set-2Document6 pagesMNGT 604 Day1 Day2 Problem Set-2harini muthuNo ratings yet

- Documentation Needed To Apply For An Corporation Bank Home LoanDocument4 pagesDocumentation Needed To Apply For An Corporation Bank Home LoanKeerthana PadmakumarNo ratings yet

- Solution Ipa Week 9 Chapter 15Document38 pagesSolution Ipa Week 9 Chapter 15poppy seedNo ratings yet

- Answer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Document3 pagesAnswer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Irfan AzmanNo ratings yet

- Fin 4 WC FinancingDocument2 pagesFin 4 WC FinancingHumphrey OdchigueNo ratings yet

- Foundations of Finance Problem Set 9Document2 pagesFoundations of Finance Problem Set 9Richard ZhangNo ratings yet

- Interest Rate RiskDocument58 pagesInterest Rate RiskStevan PknNo ratings yet

- reprt 20x1Document25 pagesreprt 20x1abdul.fattaahbakhsh29No ratings yet

- Assignment No.2 - Tax On Salary IncomeDocument1 pageAssignment No.2 - Tax On Salary Incomeabdul.fattaahbakhsh29No ratings yet

- Excel SettingsDocument10 pagesExcel Settingsabdul.fattaahbakhsh29No ratings yet

- Class 2Document2 pagesClass 2abdul.fattaahbakhsh29No ratings yet