Professional Documents

Culture Documents

KK Stores Is A Retail Business Operating in Madadeni Selling and Buying Goods On Credit

KK Stores Is A Retail Business Operating in Madadeni Selling and Buying Goods On Credit

Uploaded by

Uuh Awarh RsaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KK Stores Is A Retail Business Operating in Madadeni Selling and Buying Goods On Credit

KK Stores Is A Retail Business Operating in Madadeni Selling and Buying Goods On Credit

Uploaded by

Uuh Awarh RsaCopyright:

Available Formats

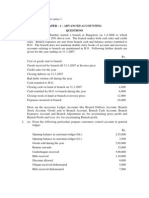

1 KK Stores is a retail business operating in Madadeni selling and buying goods on credit.

They

have recently appointed an inexperienced clerk who is unfamiliar with recording of

transactions to various journals. You have been requested to assist in the following aspects.

• Cash Payments Journal (Bank, Trading stock, wages, creditors control [payments], and Discount

received).

• Creditors Journal (Creditors control, Trading stock, stationery, equipment)

• Creditors Allowances Journal (Creditors control, Trading stock, stationery)

Transactions: January 2024

1 Bought merchandise on account according to invoice no. 1 from BB suppliers, R10 000.

4 An equipment to the value of R 5 000 was purchased on account from Boss Equip.

10 An order for merchandise from JJ wholesalers was received and EFT 20 for R12 000 was

issued after receiving 4% trade discount.

12 Bought stationery on account from PJ stationers, R500.

15 Withdrew cash to pay wages, R4 500.

17 Returned merchandise purchased on credit from BB Suppliers, R1500. Debit note 1 was

issued.

22 An EFT for R3 000 was forwarded to BB Suppliers in part payment of our account.

25 Purchased the computer on account, R6 000 for owner’s son.

28 Stationery for R200 purchased from PJ Stationers was returned back to the supplier as per

debit note 2.

30 Paid R10 000 to BB suppliers in settlement of our account, an EFT was issued.

31 Paid 50% of our outstanding debt to Boss Equip, EFT was issued

2 Post the above transactions to the Creditors ledger of KK stores in respect of the following

creditors:

• BB Suppliers (opening balance on 1 January 2024 (R 5000)

• Boss Equip (opening balance on 1 January 2024 (1500)

• PJ Suppliers (opening balance on 1 January 2024 (R500)

e.g

Date Details Fol Debit Credit balance

3 Post the above journals to the following ledger account

• Creditors control

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Osborne Books Answer Sheet PDFDocument37 pagesOsborne Books Answer Sheet PDFBarışEgeUysalNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Receivables Handouts PDFDocument8 pagesReceivables Handouts PDFKian BarredoNo ratings yet

- Online Lecture Questions 11 - AugDocument3 pagesOnline Lecture Questions 11 - AugAbdullah SalieNo ratings yet

- ACCE 112 Analysis Reservior Stores QPDocument2 pagesACCE 112 Analysis Reservior Stores QPnazmirakaderNo ratings yet

- Fin Rep & Analysis Unit 1 ActivitiesDocument1 pageFin Rep & Analysis Unit 1 Activitiessiphesihlem629No ratings yet

- Classification of AccountsDocument53 pagesClassification of AccountsSathish BabuNo ratings yet

- T1 CAT Pilot PaperDocument12 pagesT1 CAT Pilot PaperSalim ShirzaiNo ratings yet

- Problem 1: RequiredDocument3 pagesProblem 1: RequiredKim PunayNo ratings yet

- Accounting Exercise (Y10) - 9 - 1 - 23Document4 pagesAccounting Exercise (Y10) - 9 - 1 - 23gaiyun209No ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Boss Naik Accounti NG Series: ReceivablesDocument8 pagesBoss Naik Accounti NG Series: ReceivablesKian BarredoNo ratings yet

- Accounting Equation and General JournalDocument3 pagesAccounting Equation and General JournalWaqar AhmadNo ratings yet

- Exercise 3Document2 pagesExercise 3Ju Ing GanNo ratings yet

- Lecture 2Document2 pagesLecture 2AD Music & LyricsNo ratings yet

- Tutorial 2Document2 pagesTutorial 2maizatul aisyahNo ratings yet

- Presentation 3 - Dealing With Vatable Disbursements - Agency and Principal MethodsDocument14 pagesPresentation 3 - Dealing With Vatable Disbursements - Agency and Principal Methodsvyysbfxvg2No ratings yet

- Journal & LedgerDocument9 pagesJournal & Ledgeranushka100% (1)

- Fa2 Mock 2 Question - 1Document18 pagesFa2 Mock 2 Question - 1sameerjameel678No ratings yet

- Hacp130 1 Jul Dec2021 Fa1 GT V3 02082021Document8 pagesHacp130 1 Jul Dec2021 Fa1 GT V3 02082021vanessa.ryder15No ratings yet

- Introduction To Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesIntroduction To Financial Accounting: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Cash and Cash EquivalentsDocument23 pagesCash and Cash EquivalentsOCAMPO Julia ConereeNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- 2023 COALA1 Week 5 Transfer Procedures & Correspondent AccountsDocument44 pages2023 COALA1 Week 5 Transfer Procedures & Correspondent Accountsnandinhlapo96No ratings yet

- AE 111 Midterm Departmental AssessmentDocument8 pagesAE 111 Midterm Departmental AssessmentDjunah ArellanoNo ratings yet

- Chapter Four - Books of Original EntryDocument5 pagesChapter Four - Books of Original EntryHezel GreationNo ratings yet

- Journal Ledger Trial BalanceDocument8 pagesJournal Ledger Trial BalancejessNo ratings yet

- 2021 18-March Part-4 FinalDocument4 pages2021 18-March Part-4 FinalLucky NetshamutavhaNo ratings yet

- RP - Working Capital Audit 2Document2 pagesRP - Working Capital Audit 2Viky Rose EballeNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- ACC 1100 Day 10 Cash and Bank AccountDocument17 pagesACC 1100 Day 10 Cash and Bank AccountMai Anh ĐàoNo ratings yet

- Debtors and Creditors GuideDocument6 pagesDebtors and Creditors Guidesammie celeNo ratings yet

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Recording of Financial TransactionsDocument8 pagesRecording of Financial TransactionsbarakaNo ratings yet

- Books of Prime Entry and LedgersDocument10 pagesBooks of Prime Entry and LedgersLOW YAN QINNo ratings yet

- Question Bank (Accounting Problems)Document11 pagesQuestion Bank (Accounting Problems)Abhishek MohantyNo ratings yet

- Fundamentals of Accounting (1A&B) - Sample ProblemDocument4 pagesFundamentals of Accounting (1A&B) - Sample Problemalaina_alfaroNo ratings yet

- Delhi Pubic School, Nacharam Accountancy - Xi Question BankDocument9 pagesDelhi Pubic School, Nacharam Accountancy - Xi Question BanklasyaNo ratings yet

- Branch Class PuzzleDocument26 pagesBranch Class PuzzleDainika ShettyNo ratings yet

- MG T 101 Short Notes Lectures 2345Document29 pagesMG T 101 Short Notes Lectures 2345Abdul wadoodNo ratings yet

- Module4 AccountsReceivablePartIDocument6 pagesModule4 AccountsReceivablePartIGab OdonioNo ratings yet

- Journal 2Document28 pagesJournal 2vkvivekkm163No ratings yet

- A1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsDocument27 pagesA1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsGaurav AnandNo ratings yet

- Act1 - Eco1Document2 pagesAct1 - Eco1cedricdimaligalig51No ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- G9-Recording Transactions in The Ledger Unit 10Document8 pagesG9-Recording Transactions in The Ledger Unit 10liamlouis982No ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- Cash and Cash EquivalentsDocument38 pagesCash and Cash EquivalentschristianallenmlagosNo ratings yet

- ReceivablesDocument58 pagesReceivablesHannah OrosNo ratings yet

- Branch Home PuzzleDocument12 pagesBranch Home PuzzleDainika ShettyNo ratings yet

- WorkbookDocument84 pagesWorkbookTheinfiniteroarNo ratings yet

- Lpam Practical Exercises 2024 - 1Document9 pagesLpam Practical Exercises 2024 - 1simoneeaveningNo ratings yet

- FA1 Source Documents and Books of Prime Entry Week 2Document18 pagesFA1 Source Documents and Books of Prime Entry Week 2Sebastian FeuersteinNo ratings yet

- Review QuestionsDocument9 pagesReview QuestionsGamaya EmmanuelNo ratings yet

- VU Accounting Lesson 27Document5 pagesVU Accounting Lesson 27ranawaseemNo ratings yet

- FINL101-Last Year Paper and MemoDocument6 pagesFINL101-Last Year Paper and MemoNcediswaNo ratings yet

- Gr9EMST2L2 SlidesDocument16 pagesGr9EMST2L2 SlidesadoliveiraNo ratings yet

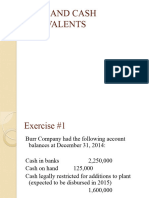

- As 1 Cash and Cash EquivalentsDocument2 pagesAs 1 Cash and Cash EquivalentsRodlyn LajonNo ratings yet