Professional Documents

Culture Documents

BusLaw - 1 Law On Partnerships - General Provisions (Art 1767-1783)

Uploaded by

jona0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document discusses key provisions of Philippine law regarding partnerships. It defines a partnership as when two or more persons agree to contribute money, property, or skills to a common fund with the intention of sharing profits. A partnership must have a lawful purpose. If unlawful, any profits will be confiscated by the state. A partnership is a separate legal entity from its partners. For partnerships with capital over PHP 3,000, the agreement must be in a public instrument recorded with the SEC. Different types of partnerships are defined based on what is contributed, such as universal partnerships where all present property and future profits are jointly owned.

Original Description:

Original Title

BusLaw - 1 Law on Partnerships_General Provisions (Art 1767-1783)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key provisions of Philippine law regarding partnerships. It defines a partnership as when two or more persons agree to contribute money, property, or skills to a common fund with the intention of sharing profits. A partnership must have a lawful purpose. If unlawful, any profits will be confiscated by the state. A partnership is a separate legal entity from its partners. For partnerships with capital over PHP 3,000, the agreement must be in a public instrument recorded with the SEC. Different types of partnerships are defined based on what is contributed, such as universal partnerships where all present property and future profits are jointly owned.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesBusLaw - 1 Law On Partnerships - General Provisions (Art 1767-1783)

Uploaded by

jonaThe document discusses key provisions of Philippine law regarding partnerships. It defines a partnership as when two or more persons agree to contribute money, property, or skills to a common fund with the intention of sharing profits. A partnership must have a lawful purpose. If unlawful, any profits will be confiscated by the state. A partnership is a separate legal entity from its partners. For partnerships with capital over PHP 3,000, the agreement must be in a public instrument recorded with the SEC. Different types of partnerships are defined based on what is contributed, such as universal partnerships where all present property and future profits are jointly owned.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

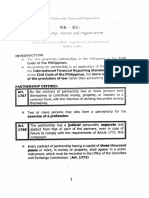

Business Law and Regulations e.

As the consideration for the sale of a In case of partnership insolvency, creditors

goodwill of a business or other property can go to the general partners for payment

Law on Partnerships by installments otherwise. of liabilities by their own assets.

Limited partners cannot be chased for

ARTICLE 1770 - A partnership must have a personal assets in case of insolvency.

lawful object or purpose, and must be Liability is only limited to one’s

GENERAL PROVISIONS ON

established for the common benefit or interest of contribution.

PARTNERSHIPS

the partners.

There should be a minimum of one general

ARTICLE 1767 – By the contract of partner in all partnerships.

When an unlawful partnership is dissolved by a

partnership, two or more persons bind

judicial decree, the profits shall be confiscated

themselves to contribute money, property, or ARTICLE 1777 – A universal partnership may

in favor of the State, without prejudice to the

industry (capital) to a common fund, with the refer to all the present property or to all the

provisions of the Penal Code governing the

intention of dividing the profits among profits.

confiscation of the instruments and effects of a

themselves.

crime.

All present

Universal property

Two or more persons may also form a Types of

If object or purpose of the partnership is Partnership as to

partnership for the exercise of a profession. Object

illegal, it is void. All profits

(General Professional Partnership) Particular (contribution)

All profits will be confiscated if unlawful

Contract of partnership must be consensual partnership is dissolved by the government.

and doesn’t need to be in writing (general ARTICLE 1778 – A partnership of all present

ARTICLE 1771 – A partnership may be property is that in which the partners contribute

rule).

constituted in any form, except where all the property which actually belongs to them

ARTICLE 1768 – The partnership has a immovable property or real rights are to a common fund, with the intention of dividing

juridical personality separate and distinct from contributed thereto, in which case a public the same among themselves, as well as all the

that of each of the partners, even in case of instrument shall be necessary. profits which they may acquire therewith.

failure to comply with the requirements of

If owners contributed real properties, it Partners contribute all property that belongs

Article 1772, first paragraph.

should be written in a public instrument. to them to the common fund of the

Two Kinds of Persons under the Law: (notarized) partnership. Ownership will also be passed.

o Natural – living beings

ARTICLE 1772 – Every contract of partnership ARTICLE 1779 – In a universal partnership of

o Juridical - Cooperatives, Corporations

having a capital of three thousand pesos or all present property, the property which

and Partnerships; separate assets and

more, in money or property, shall appear in a belonged to each of the partners at the time of

liabilities from the owners itself

public instrument, which must be recorded in the constitution of the partnership, becomes the

Doesn’t need to be in writing (public the Office of the Securities and Exchange

instrument) if capital does not exceed common property of all the partners, as well as

Commission. all the profits which they may acquire therewith.

P3,000 (Art. 1772)

(continuation of preceding article)

Even if not in writing, it is still a juridical Failure to comply with the requirements of the

person. preceding paragraph shall not affect the liability A stipulation for the common enjoyment of any

of the partnership and the members thereof to other profits (profits not made by the

ARTICLE 1769 – In determining whether a third persons. partnership) may also be made; but the property

partnership exists, these rules shall apply:

which the partners may acquire subsequently by

ARTICLE 1773 – A contract of partnership is

(1) Except as provided by Article 1825, persons inheritance, legacy, or donation cannot be

void, whenever immovable property is

who are not partners as to each other are not included in such stipulation, except the fruits

contributed thereto, if an inventory of said

partners as to third persons; thereof.

property is not made, signed by the parties, and

attached to the public instrument.

Principle of Estoppel: There is Other profits can be contributed to the

misrepresentation and reliance in good faith in partnership if stipulated by the parties.

Kailangan gumawa ng inventory of the

the 3rd person’s part. Properties acquired by inheritance and such,

properties, including its details, signed and

attached to the public instrument (articles of AFTER the constitution of the partnership,

(2) Co-ownership or co-possession does not of CANNOT be included in the stipulation,

the partnership).

itself establish a partnership, whether such except its fruits (interest, profit)

co-owners or co-possessors do or do not If not followed, the partnership is void.

share any profits made by the use of the ARTICLE 1780 – A universal partnership of

ARTICLE 1774 – Any immovable property or

property; profits comprises all that the partners may

an interest therein may be acquired in the

acquire by their industry or work during the

partnership name. Title so acquired can be

(3) The sharing of gross returns (sales, not existence of the partnership.

conveyed only in the partnership name.

profit) does not of itself establish a

partnership, whether or not the persons Movable or immovable property which earn of

Partnership have separate judicial

sharing them have a joint or common right or the partners may possess at the time of the

personality so any acquired property should

interest in any property from which the celebration of the contract shall continue to

be under the name of the partnership.

returns are derived; (e.g., may debt yung pertain exclusively, only the usufruct passing to

business or supplier niya and ang form of ARTICLE 1775 – Associations and societies, the partnership. (Usufruct – the right to use and

payment ay 20% ng sales) whose articles are kept secret among the acquire the fruits of a property)

members and wherein any one of the members

Profits or properties acquired in their own

(4) The receipt by a person of a share of the may contract in his own name with third

industry or work AFTER the constitution or

profits (Net Income) of a business is prima persons, shall have no juridical personality, and

DURING the partnership can be added in

facie (will give rise to the presumption) shall be governed by the provisions relating to

the common fund.

evidence that he is a partner in the business, co-ownership.

but no such inference shall be drawn if such Properties before the constitution of the

profits were received in payment… Partnerships are fiduciary in nature – partnership will remain separate from the

relationship built on trust and confidence. partnership. Fruits of said properties can be

a. As a debt by installments or otherwise Members keep in secret will break the passed to the partnership.

(creditor); fiduciary nature and will not be considered

ARTICLE 1781 – Articles of universal

b. As wages o an employee or rent to a as partnership.

partnership, entered into without specification of

landlord;

ARTICLE 1776 – As to its object, a partnership its nature, only constitute a universal partnership

c. As annuity to a widow or representative

is either universal or particular. of profits.

of a deceased partner (pension based on

agreement); If partners signed a universal partnership

As regards to liability of the partners, a

d. As interest on a loan, though the amount without specifying whether it is all present

partnership may be general or limited.

of payment vary with the profits of the property or all profits, it constitutes a

business; universal partnership of profits.

ARTICLE 1782 - Persons who are prohibited

from giving each other any donation or

advantage cannot enter into universal

partnership.

Husband and wife; those guilty of adultery

and concubinage (kabit); guilty of offense;

public officers

ARTICLE 1783 – A particular partnership has

for its object determinate things, their use or

fruits, or a specific undertaking, or the exercise

of a profession or vocation.

Particular Partnership - Partners

identify/specify what personal assets to

contribute to the common fund.

You might also like

- QN - PartneshipDocument19 pagesQN - PartneshipJovy Norriete dela CruzNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Partnership-3 0Document5 pagesPartnership-3 0Rhea Jane ParconNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- Summary Notes (GP)Document12 pagesSummary Notes (GP)Jenmae Dacullo MansiguinNo ratings yet

- Partnership Batungbakal Reviewer PDFDocument15 pagesPartnership Batungbakal Reviewer PDFGloriette Marie AbundoNo ratings yet

- Intellectual Property Securitization: Intellectual Property SecuritiesFrom EverandIntellectual Property Securitization: Intellectual Property SecuritiesRating: 5 out of 5 stars5/5 (1)

- Partnership-Case Digests and CodalDocument16 pagesPartnership-Case Digests and CodalaliahNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- PARTNERSHIP Review NotesDocument33 pagesPARTNERSHIP Review Notescelynah.rheudeNo ratings yet

- Article 1767-1816Document3 pagesArticle 1767-1816ChaNo ratings yet

- Law On Partnership and CorporationDocument7 pagesLaw On Partnership and CorporationYeontanNo ratings yet

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Chapter 2 - Partnership Basic Concept and FormationDocument6 pagesChapter 2 - Partnership Basic Concept and FormationKennethEdiza100% (3)

- Partnership PDFDocument33 pagesPartnership PDFGeodetic Engineering FilesNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Partnership: Civil LawDocument33 pagesPartnership: Civil LawAnna VeluzNo ratings yet

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsFrom EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsRating: 3 out of 5 stars3/5 (1)

- BALAWREX ReviewerDocument14 pagesBALAWREX Reviewerhervasirishmae01No ratings yet

- Convention on International Civil Aviation: A CommentaryFrom EverandConvention on International Civil Aviation: A CommentaryNo ratings yet

- Partnership LectureDocument3 pagesPartnership LectureherraENo ratings yet

- Partnership: - Yes, Under The Revised Corporation Code! (Sec. 10, RA 11232) oDocument21 pagesPartnership: - Yes, Under The Revised Corporation Code! (Sec. 10, RA 11232) omarizenocNo ratings yet

- Law On PartnershipsDocument57 pagesLaw On Partnershipsdmjong2002No ratings yet

- PartnershipDocument20 pagesPartnershipLm RicasioNo ratings yet

- BUSLAWDocument53 pagesBUSLAWwinterhotdog29No ratings yet

- Partnership ReviewDocument32 pagesPartnership ReviewAnthony YapNo ratings yet

- Coblaw2 Finals ReviewerDocument7 pagesCoblaw2 Finals ReviewerluisamariepandoNo ratings yet

- (Partnerships) Post-Midterms ReviewerDocument34 pages(Partnerships) Post-Midterms ReviewerAlecParafinaNo ratings yet

- The Law On PartnershipDocument22 pagesThe Law On PartnershipLorjyll Shyne Luberanes TomarongNo ratings yet

- Agency and Partnership - UST Civil Law NotesDocument67 pagesAgency and Partnership - UST Civil Law NotesREINE JULIA SORIANO MADRIAGANo ratings yet

- PARTNERSHIPDocument41 pagesPARTNERSHIPalyNo ratings yet

- Partnership and CorporationDocument44 pagesPartnership and CorporationWed Cornel0% (1)

- Law On Partnership and CorporationDocument7 pagesLaw On Partnership and CorporationAda RiegoNo ratings yet

- Art 1769-1783Document16 pagesArt 1769-1783Agatha JenellaNo ratings yet

- Law On Partnership Reviewer Law On Partnership ReviewerDocument16 pagesLaw On Partnership Reviewer Law On Partnership ReviewerYatar, JolinaNo ratings yet

- Blaw Prelims ReviewerDocument17 pagesBlaw Prelims ReviewerVanessa dela Torre0% (1)

- ARTICLE 1767. by The Contract of Partnership, Two or More Persons Bind Themselves ToDocument5 pagesARTICLE 1767. by The Contract of Partnership, Two or More Persons Bind Themselves ToTrisha Anne Aica RiveraNo ratings yet

- A. Partnerships: 1. General ProvisionsDocument33 pagesA. Partnerships: 1. General ProvisionsRubierosseNo ratings yet

- Chapter 1 General Provisions: Creation Juridical PersonalityDocument22 pagesChapter 1 General Provisions: Creation Juridical PersonalityMark CalimlimNo ratings yet

- Chapter 1Document2 pagesChapter 1Jojemar EncisoNo ratings yet

- Commercial LawDocument183 pagesCommercial LawWarly PabloNo ratings yet

- Parcor ReviewerDocument202 pagesParcor ReviewerAnjilla RubiaNo ratings yet

- Laws On PartnershipDocument17 pagesLaws On PartnershipCGNo ratings yet

- Partnership NotesDocument16 pagesPartnership NotesMarc GelacioNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- Partnership (Introduction To Formation)Document14 pagesPartnership (Introduction To Formation)hinata shoyoNo ratings yet

- A. Kinds of PartnershipDocument16 pagesA. Kinds of PartnershipHanna Liia GeniloNo ratings yet

- Law ReviewerDocument5 pagesLaw Revieweralbert cumabigNo ratings yet

- Exam Reviewieer NotesDocument12 pagesExam Reviewieer NotesRose Lynn VelascoNo ratings yet

- Article 1767-1783Document7 pagesArticle 1767-1783kt. rznNo ratings yet

- Partnership Review NotesDocument3 pagesPartnership Review NotesNoel Krish ZacalNo ratings yet

- PAT ReviewerDocument7 pagesPAT ReviewerJewel CantileroNo ratings yet

- Law On Partnership, Corporation, and CooperativeDocument16 pagesLaw On Partnership, Corporation, and Cooperativebusganonicole554No ratings yet

- Ateneo Central Bar Operations 2007 Civil Law Summer ReviewerDocument15 pagesAteneo Central Bar Operations 2007 Civil Law Summer ReviewerMiGay Tan-Pelaez85% (13)

- ILS-TrustLaw - (1) - ITA-Object Concept and Kinds of TrustDocument6 pagesILS-TrustLaw - (1) - ITA-Object Concept and Kinds of Trustoo7No ratings yet

- Tax Remedies Chapter 2 ReportDocument69 pagesTax Remedies Chapter 2 ReportVinz G. VizNo ratings yet

- Contoh CV ProfesionalDocument1 pageContoh CV ProfesionalSulistyo WasonoNo ratings yet

- Transkrip BM (Provisional) Pelajar 01DKA15F1058 PDFDocument2 pagesTranskrip BM (Provisional) Pelajar 01DKA15F1058 PDFMohd ShafiqNo ratings yet

- 75 - Misterio V Cebu State College of Science and TechnologyDocument2 pages75 - Misterio V Cebu State College of Science and TechnologyChristine Joy Angat100% (3)

- Power of Attorney TemplateDocument3 pagesPower of Attorney TemplateClaire T100% (32)

- IsmailJafferAlibhai NandlalHarjivanKariaDocument46 pagesIsmailJafferAlibhai NandlalHarjivanKariaReal Trekstar80% (5)

- Order Imperial Vs Cayetano (DBB)Document5 pagesOrder Imperial Vs Cayetano (DBB)DianneBalizaBisoñaNo ratings yet

- Sean P. Callan, EsqDocument32 pagesSean P. Callan, EsqImran ShaNo ratings yet

- For TarpDocument40 pagesFor TarpRumylo AgustinNo ratings yet

- Printable Florida Residential Lease Agreement Fillable-1Document10 pagesPrintable Florida Residential Lease Agreement Fillable-1danNo ratings yet

- G.R. No. L-26278 Case DigestDocument1 pageG.R. No. L-26278 Case DigestRaym TrabajoNo ratings yet

- Future InterestsDocument1 pageFuture InterestsBrat WurstNo ratings yet

- Agtarap v. Agtarap 651 SCRA June 2011Document11 pagesAgtarap v. Agtarap 651 SCRA June 2011Emerson NunezNo ratings yet

- Chua Guan Vs MagsasakaDocument2 pagesChua Guan Vs MagsasakaGeorge HabaconNo ratings yet

- MCIAA Vs LAPU LAPU CITYDocument5 pagesMCIAA Vs LAPU LAPU CITYJep Echon TilosNo ratings yet

- SBQ 4424 Task 1Document50 pagesSBQ 4424 Task 1masrydaerliwati abduhNo ratings yet

- Commercial Lease For EpcDocument4 pagesCommercial Lease For Epchamza tariqNo ratings yet

- JPC Corporate ProfileDocument3 pagesJPC Corporate ProfileJoburg Property Company50% (2)

- RC Property Transfers 3-30 To 4-5Document1 pageRC Property Transfers 3-30 To 4-5augustapressNo ratings yet

- John LockeDocument179 pagesJohn LockeEli Moreira100% (3)

- City Council First-Read Ordinances, 07/14/2010 - Jersey CityDocument92 pagesCity Council First-Read Ordinances, 07/14/2010 - Jersey CityThe Jersey City IndependentNo ratings yet

- Property de Leon Notes PDFDocument3 pagesProperty de Leon Notes PDFTrick San Antonio100% (2)

- Dir. of Lands and Dir. Forest Development Vs CA, 129 SCRA 689Document3 pagesDir. of Lands and Dir. Forest Development Vs CA, 129 SCRA 689Jaymar DonozoNo ratings yet

- Beneficial OwnerDocument53 pagesBeneficial Ownermlo356100% (1)

- LTDDocument13 pagesLTDJanet ChanNo ratings yet

- Cruz vs. Secretary of DENRDocument4 pagesCruz vs. Secretary of DENRAphrNo ratings yet

- 09.13.16 PC FINAL PACKET - Items 42-103 PDFDocument1,143 pages09.13.16 PC FINAL PACKET - Items 42-103 PDFPlanningCommissionNo ratings yet

- AST Tenancy Agreement - TDS - Landlord RentDocument42 pagesAST Tenancy Agreement - TDS - Landlord RentGareth McKnightNo ratings yet

- Purdah and Status of Women in IslamDocument142 pagesPurdah and Status of Women in IslamAnas Muhamad PauziNo ratings yet