Professional Documents

Culture Documents

TAX-902 (Gross Income - Exclusions)

TAX-902 (Gross Income - Exclusions)

Uploaded by

MABI ESPENIDOCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX-902 (Gross Income - Exclusions)

TAX-902 (Gross Income - Exclusions)

Uploaded by

MABI ESPENIDOCopyright:

Available Formats

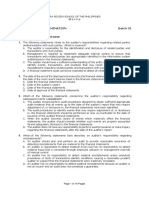

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 45 May 2023 CPA Licensure Examination

TAX-902

TAXATION A. TAMAYO E. BUEN G. CAIGA C. LIM K. MANUEL

GROSS INCOME – EXCLUSIONS

1. Exclusions defined: The term “exclusions” refers to items that are not included in the determination of gross income

either because:

a) they represent return of capital or are not income, gain or profit; or

b) they are subject to another kind of internal revenue tax; or

c) they are income, gain, or profit that are expressly exempt from income tax under the constitution, tax treaty, Tax

Code, or general or special law.

2. Sec.32 (B) Exclusions from Gross Income – The following items shall not be included in gross income and shall be

exempt from taxation:

a. Exclusions from gross income 1) Proceeds of life insurance;

2) Amount received by insured as returns of premium;

3) Gifts, bequests and devises;

4) Compensation for injuries or sickness;

5) Income exempt under treaty;

6) Retirement benefits, pensions, gratuities, etc.;

7) Miscellaneous items.

a) Income derived by foreign government;

b) Income derived by the government or its political subdivision;

c) Prizes and awards;

d) Prizes and awards in sports competition;

e) 13th month pay and other benefits;

f) GSIS, SSS, Philhealth and other contributions;

g) Gains from the sale of bonds, debenture or other certificate of indebtedness

with maturity of more than 5 years;

h) Gains from redemption of shares in mutual fund.

b. Used to be excluded but now 1) Interest on government securities (now subject to 20% final tax)

subject to final tax 2) Income derived as informer’s reward to persons instrumental in the discovery

of violations of the NIRC and in the discovery and seizure of smuggled goods

(now subject to 10% final tax based on 10% of the revenues, surcharges or

fees recovered and/or fine or penalty imposed or P1,000,000 per case

whichever is lower.)

3. Exclusions from Gross Income Explained

a. Life Insurance

Life insurance The proceeds of life insurance policies paid to the heirs or beneficiaries upon the

death of the insured, whether in a single sum or otherwise, but if such amounts

are held by the insurer under an agreement to pay interest thereon, the interest

payments shall be included in gross income.

b. Amount received by insured as return of premium

Return of premium The amount received by the insured, as a return of premiums paid by him under

life insurance, endowment, or annuity contracts, either during the term or at the

maturity of the term mentioned in the contract or upon surrender of the contract.

If the amounts, when added to amounts received before the taxable year under

such contract, exceed the aggregate premium paid, whether or not paid during

the taxable year, then the excess shall be included in gross income

In the case of a transfer for a valuable consideration by assignment or otherwise,

of a life insurance, endowment or annuity contract or any interest therein, only

the actual value of such consideration and the amount of the premiums and the

sums subsequently paid by the transferee are exempt from taxation.

Participating dividends are not income to the insured. They are treated as return

of capital.

Exercise: (CPA Exam) Mr. J. Cruz insured his life with his estate as beneficiary. In 2018, after Mr. Cruz had paid P65,000 in

premiums, he assigned the policy to Mr. S. Santos for P60,000, and Mr. Santos collected the total proceeds of P200,000.

Mr. Santos, after the assignment, and before Mr. Cruz’s death, paid total premiums of P80,000.

Compute for the: a) exempted amount;

b) the taxable amount.

Page 1 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

GROSS INCOME - EXCLUSIONS TAX-902

c. Gifts, bequests and devises

Gifts, bequests and devices The value of property acquired by gift, bequest, devise, or descent.

Gifts, bequests and devises are subject to transfer taxes (estate tax or donor’s

tax.)

Income from such property, as well as gift, bequest, devise or descent of income

from any property, in cases of transfers of divided interest, shall be included in

gross income

Alimony or an allowance based on a separation agreement is not taxable income.

d. Compensation for injuries or sickness

Compensation for injuries or Amounts received, through Accident or Health Insurance or under Workmen's

sickness Compensation Acts, as compensation for personal injuries or sickness, plus the

amounts of any damages received, whether by suit or agreement, on account of

such injuries or sickness.

Recoveries of damages, representing compensation for personal injuries arising

from libel, defamation, slander, breach of promise to marry, alienation of

affection are not subject to income tax and shall not be included in gross

income.

e. Income exempt under treaty

1) Income exempt under treaty Income of any kind to the extent required by any treaty obligation binding upon

the Government of the Philippines

Examples of income exempt under treaty:

1) Salaries of officials of the United Nations assigned in the Philippines if paid by

the United Nations and certified by the Secretary General of the United

Nations;

2) Salaries, allowances, fees, or wages received by citizens of the United States

of America working in consular offices in the Philippines are exempt from all

taxes;

3) Salaries of diplomatic officials and agents.

As a general rule, the provisions of the Philippine Tax Code (domestic law) shall

apply on the income, gain or profit of any person liable to income tax.

In case of conflict between the provisions of a tax treaty and domestic law, the

provisions of the tax treaty generally prevail over the provisions of the domestic

law.

Where the rate of tax imposed under the domestic law is lower than the rate

imposed under the tax treaty, the lower tax rate under the domestic law shall

prevail.

f. Retirement benefits

1) Retirement benefits received a) Retirement benefits received under Republic Act No. 7641 and those received

under R.A No. 7641 and those by officials and employees of private firms, whether individual or corporate, in

received by officials and accordance with a reasonable private benefit plan maintained by the employer.

employees of private firms with b) The retiring official or employee has been in the service of the same employer

reasonable private pension plan for at least ten (10) years and is not less than fifty (50) years of age at the

time of his retirement.

c) The benefits granted shall be availed of by an official or employee only once.

D) The term 'reasonable private benefit plan' means:

(1) a pension, gratuity, stock bonus or profit-sharing plan maintained by an

employer for the benefit of some or all of his officials or employees,

(2) wherein contributions are made by such employer for the officials or

employees, or both, for the purpose of distributing to such officials and

employees the earnings and principal of the fund thus accumulated, and

(3) wherein it is provided in said plan that at no time shall any part of the

corpus or income of the fund be used for, or be diverted to, any purpose

other than for the exclusive benefit of the said officials and employees.

2) Retirement benefits under R.A. In order to avail of the exemption of the retirement benefits under R.A. 7641

7641 from private employers from private employers without any retirement plans, the retiring employee has

without any retirement plans served at least five (5) years and is not less than sixty (60) years of age but not

more than sixty-five (65) declared as the compulsory retirement age, among

other conditions.

Page 2 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

GROSS INCOME - EXCLUSIONS TAX-902

3) Any amount received by Any amount received by an official or employee or by his heirs from the employer

an official or employee as a consequence of separation of such official or employee from the service of

as a consequence of the employer because of death, sickness or other physical disability or for any

separation cause beyond the control of the said official or employee.

The disease or illness should be of type which would affect the performance of

duties and endanger the life of the employee if he/she continues working. (RMO

No. 25-91)

4) Social security benefits, The provisions of any existing law to the contrary notwithstanding, social security

retirement gratuities, pensions benefits, retirement gratuities, pensions and other similar benefits received by

and other similar benefits resident or nonresident citizens of the Philippines or aliens who come to reside

received from foreign permanently in the Philippines from foreign government agencies and other

government agencies and other institutions, private or public.

institutions, private or public

5) United States Veterans Payments of benefits due or to become due to any person residing in the

Administration benefits Philippines under the laws of the United States administered by the United States

Veterans Administration.

6) Social Security System (SSS) Benefits received from or enjoyed under the Social Security System (SSS)

benefits

7) Government Service Insurance Benefits received from the GSIS including retirement gratuity received by

System (GSIS) benefits government officials and employees.

g. Miscellaneous items

Income derived by Foreign Income derived from investments in the Philippines in loans, stocks, bonds or other

Governments domestic securities, or from interest on deposits in banks in the Philippines by:

(i) foreign governments,

(ii) financing institutions owned, controlled, or enjoying refinancing from foreign

governments, and

(iii) international or regional financial institutions established by foreign governments.

Income Derived by the Income derived from any public utility or from the exercise of any essential governmental

Government or its Political function accruing to the Government of the Philippines or to any political subdivision

Subdivisions thereof.

Prizes and awards Prizes and awards made primarily in recognition of religious, charitable, scientific,

educational, artistic, literary, or civic achievement but only if:

(i) The recipient was selected without any action on his part to enter the contest or

proceeding; and

(ii) The recipient is not required to render substantial future services as a condition to

receiving the prize or award.

Prizes and Awards in All prizes and awards granted to athletes in local and international sports competitions and

Sports Competition tournaments whether held in the Philippines or abroad and sanctioned by their national

sports associations.

13th month and other Thirteenth month pay equivalent to the mandatory one (1) month basic salary of official

benefits and employees of the government (whether national or local), including government-

owned or controlled corporations, and/or private offices received after the twelfth month

pay

Other benefits such as Christmas bonus, productivity incentives, loyalty award, gift in

cash or in kind, and other benefits of similar nature actually received by officials and

employees of both government and private offices, including the Additional Compensation

Allowance (ACA) granted and paid to all officials and employees of the National Government

Agencies (NGAs) including State Universities and Colleges (SUCs), Government-Owned

and/or Controlled Corporations (GOCCs), Government Financial Institutions (GFIs) and

Local Government Units (LGUs).

The above stated exclusions shall cover benefits paid or accrued during the year,

provided that the total amount shall not exceed ninety thousand pesos (₱ 90,000),

The exclusion shall not apply to other compensation received by an employee under an

employer-employee relationship such as basic salary and other allowances.

The exclusion from gross income is not applicable to self-employed individuals and income

generated from business. (R.A. 10653 as implemented under RR 3-2015 dated March 9,

2015)

GSIS, SSS, Medicare GSIS, SSS, Philhealth, Pag-ibig contributions and union dues of individuals

(Philhealth) and other

contributions Any contribution in excess of the mandatory GSIS, SSS, Philhealth and Pag-IBIG or Home

Development Mutual Fund contributions are not excludible from gross income of the

individual taxpayer and, therefore, are subject to income tax and the consequently, to

withholding tax (RMC No. 27-2011).

Page 3 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

GROSS INCOME - EXCLUSIONS TAX-902

Gains from the Sale of Gains realized from the sale or exchange or retirement of bonds, debentures or other

Bonds, Debentures or certificate of indebtedness with a maturity of more than five (5) years.

Other Certificate of

Indebtedness

Gains from Redemption of Gains realized by the investor upon redemption of shares of stock in a mutual fund

Shares in Mutual Fund company.

Note: Mutual fund company is an open-end and close-end investment company.

6) Exercises

a. Compute the tax-exempt and the taxable benefits: A rank and file employee of a GOCC received the following benefits

from his employer:

13th month pay P40,000

14th month pay 40,000

Christmas bonus 22,000

Loyalty award 15,000

Additional Compensation Allowance (ACA) 20,000

Total 13th month and other benefits P137,000

b. The following were received by a resident citizen employee, married, and with four (4) qualified dependent children for

the year 2021:

Salary, net of P20,000 withholding tax; P6,000 SSS contribution

(mandatory SSS contribution is P3,000); P2,000 union dues P600,000

13th month pay 50,000

14th month pay 50,000

How much was the taxable compensation income?

c. Based on the following current year data compute the tax-exempt 13th month and other benefits and contributions of an

employee:

Salary, gross of withholding tax P 480,000

Allowance 20,000

Thirteenth month pay 40,000

Christmas bonus 40,000

Reimbursement for transportation expenses 5,000

Payroll deductions:

SSS contributions (mandatory contribution is P4,000) 6,000

Philhealth contributions (mandatory contribution is P3,000) 5,000

Pag-IBIG contributions (mandatory contribution is P2,400) 3,400

Charitable contributions by the employee to the employer’s outreach program 5,000

Loan payment 20,000

h. Other tax-exempt items

1) Compensation income including holiday pay, overtime pay, night shift differential pay, and hazard pay earned by minimum

wage earner, who has no other reportable income

2) Salaries and stipends in dollars received by non-Filipino citizens serving as staff of the International Rice Research Institute

and the Ford Foundation

3) Allowances paid to military personnel

4) Compensation for casual employment like house helper/maid, not connected in the conduct of business of the employer

5) Interest on the price of land covered by Comprehensive Agrarian Reform Program (CARP)

6) Compensation of Statutory Minimum Wage Earner

7) Income generated from commercial sale of the invention for 10-year period which starts from the date of the first

commercial sale

8) Income of registered Barangay Micro Business Enterprise (BMBE) (total assets not more than P3,000,000 exclusive of the

land on which the particular business entity’s office, plant and equipment are situated)

9) Income of duly registered cooperatives dealing/transacting business with members only

i. Income of registered Barangay Micro Business Enterprise (BMBE)

Definition BMBE refers to any business entity or enterprise engaged in the production, processing or manufacturing of

products or commodities, including agro-processing, trading and services, whose total assets including those

arising from loans but exclusive of the land on which the particular business entity's office, plant and

equipment are situated, shall not be more than Three Million Pesos (P3,000,000.00).

Place of The Office of the Treasurer of each city or municipality shall register BMBEs and issue a Certificate of

registration Authority (CA) to enable the BMBE to avail of incentives under the Act.

Only one Certificate of Authority shall be issued for each BMBE and only by the Office of the Treasurer of the

city or municipality that has jurisdiction over the principal place of business of BMBE. (Section 3, IRR of

BMBE)

Who are Any person, natural or juridical, such as partnership, corporation, association and cooperative, having the

eligible to qualifications and none of the disqualifications shall be eligible to register as BMBEs. (Sec. 4, IRR of BMBE as

register amended)

“Services" shall exclude those rendered by any one, who is duly licensed by the government after having

passed a government licensure examination, in connection with the exercise of one's profession. (Section 2,

IRR of BMBE)

Page 4 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

GROSS INCOME - EXCLUSIONS TAX-902

Incentives 1) Exemption from income tax for income arising from the operations of the enterprise.

and benefits 2) Reduction of or exemption from local taxes, fees and charges

granted to 3) Exemption from the coverage of the Minimum Wage Law

BMBEs 4) Availment of credit services from government financing institutions

5) Availment of technology transfer, production, management training programs and marketing assistance

from government entities

6) Availment of Development Fund from GOCCs

7) Access to Trade and Investment Promotion

8) Access to One-Stop Business Registration Center

j. Integrative Cases

1. A resident citizen, widower, with a dependent minor brother, had the following data on income and expenses for 2018:

Gross sales P1,500,000

Cost of sales 1,000,000

Business expenses 200,000

Interest from savings deposit, BPI-Makati, Philippines 50,000

Prize in a literary contest he joined 100,000

Prize received for achievement in literature (did not join the contest) 10,000

Gain from sale of bonds (maturity is 6 years) 5,000

Separation pay from his former job (resigned) 250,000

Cash he inherited from his uncle 300,000

Proceeds of his wife’s life insurance (irrevocable beneficiary) 1,000,000

Amount received as return of premium (premium paid, P150,000) 200,000

Tax Informer’s Reward 500,000

Philippine Charity Sweepstakes winnings 10,000

Interest income from Government bonds 20,000

Winnings from illegal gambling 10,000

Question 1 - How much was the total amount of excluded or exempted income?

2 - How much was the total final tax from certain income?

3 – The taxpayer failed to indicate in his first quarter return the option to be taxed at 8%:

a) How much was the income tax due if he uses itemized deductions?

b) How much was the percentage tax, if any?

4 – The taxpayer indicated in his first quarter return that he was opting for the 8% income tax rate.

a) How much was the income tax due?

b) How much was the percentage tax, if any?

5 – The taxpayer opted for the optional standard deduction (OSD).

a) Can he avail of the 8% income tax rate?

b) How much was the income tax due?

c) How much is the percentage tax, if any?

2. A resident citizen, 50 years old, married, with three (3) qualified dependent children asks you to assist him in

computing his taxable net income for the year 2021. He presented to you his Statement of Income and Expenses for the

year ended 2021.

Gross professional income (subjected to 15% withholding tax) P10,000,000

Less: Cost of services 3,500,000

Gross income 6,500,000

Less: Professional expenses 3,000,000

Operating income 3,500,000

Add: Non-operating income

Retirement benefits received from his previous employer 250,000

Lump sum benefits received from SSS 200,000

Prize in a sports tournament sponsored by a group of businessmen

promoting health products 50,000

Yield from short-term bonds 20,000

Interest on long term deposits with maturity period of 5 years 30,000

Philippine Lotto winnings 500,000

Share in the net income of a business partnership 100,000 1,150,000

Net income P4,650,000

REQ: a. Compute the following:

1)Total amount excluded or exempted from income tax

2) Total final withholding taxes

b. Prepare reconciliation of net income per books against taxable income

Page 5 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

GROSS INCOME - EXCLUSIONS TAX-902

Answers:

1) Total amount excluded or exempted from income tax

Retirement benefits received from his previous employer that maintained P 250,000

Lump sum benefits received from SSS 200,000

Interest on long term deposits with maturity period of 5 years 30,000

Total P 480,000

2) Total final withholding taxes

Prize in a sports tournament sponsored by a group of businessmen promoting health products (50,000 x 20%) P10,000

Yield from short-term bonds (20,000 x 20%) 4,000

Philippine Lotto winnings (500,000 x 20%) 100,000

Share in the net income of a business partnership (100,000 x 10%) 10,000

Total P124,000

b. Prepare reconciliation of net income per books against taxable income

Net income per books P4,650,000

Add: Non-Deductible Expenses/Taxable Other Income -

Total 4,650,000

Less: A) Non-Taxable Income and Income Subject to Final Tax

Retirement benefits received from his previous employer that maintained 250,000

Lump sum benefits received from SSS 200,000

Interest on long term deposits with maturity period of 5 years 30,000

Prize in a sports tournament sponsored by a group of businessmen promoting health 50,000

products

Yield from short-term bonds 20,000

Philippine Lotto winnings 500,000

Share in net income of business partnership 100,000

B) Special/Other Allowable Deductions

Total 1,150,000

Net Taxable Income (Loss) P3,500,000

Alternative computation

Gross professional income (subjected to 15% withholding tax) P10,000,000

Less: Cost of services 3,500,000

Gross income 6,500,000

Less: Professional expenses 3,000,000

Operating income 3,500,000

Add: Non-operating income -

Taxable income P3,500,000

END

“We find meaning when we serve other people and think less of ourselves.” - Tamthewise

Page 6 of 6 0915-2303213 www.resacpareview.com

You might also like

- TAX-701 (Income Taxes - Corporations)Document10 pagesTAX-701 (Income Taxes - Corporations)lyndon delfinNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)MABI ESPENIDONo ratings yet

- TAX-1801 (Basic Principles in Taxation 1)Document5 pagesTAX-1801 (Basic Principles in Taxation 1)bulasa.jefferson16No ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- TAX-304 (VAT Compliance Requirements)Document5 pagesTAX-304 (VAT Compliance Requirements)Edith DalidaNo ratings yet

- TAX-1101: Capital Assets, Capital Gains & Losses: - T R S ADocument3 pagesTAX-1101: Capital Assets, Capital Gains & Losses: - T R S AVaughn TheoNo ratings yet

- Cup - Regulatory Framework For Business TransactionDocument6 pagesCup - Regulatory Framework For Business TransactionJerauld BucolNo ratings yet

- Reviewer-Finals On TaxDocument7 pagesReviewer-Finals On TaxKaren Grace LucobNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsEstudyante100% (2)

- Sales Finals ReviewerDocument30 pagesSales Finals ReviewermonchievaleraNo ratings yet

- Pamela Galang Bsa 2 IA3 Quiz - Cash Flows True or FalseDocument10 pagesPamela Galang Bsa 2 IA3 Quiz - Cash Flows True or FalseYukiNo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- Module 3 - Donors Tax PDFDocument5 pagesModule 3 - Donors Tax PDFIo AyaNo ratings yet

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaNo ratings yet

- DocxDocument8 pagesDocxGuinevereNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- TAX L002 Individual TaxationDocument18 pagesTAX L002 Individual TaxationYuri CaguioaNo ratings yet

- FAR-4214 (Bonds - Other Long-Term Liabilities)Document4 pagesFAR-4214 (Bonds - Other Long-Term Liabilities)saligumba mikeNo ratings yet

- Liabilities Part 2Document4 pagesLiabilities Part 2Jay LloydNo ratings yet

- TaxationDocument1,917 pagesTaxationConteza EliasNo ratings yet

- 7084 Multiple Choice Small Entities Lecture Notes and SolutionDocument4 pages7084 Multiple Choice Small Entities Lecture Notes and SolutionpompomNo ratings yet

- Week 15 - Data Privacy ActDocument5 pagesWeek 15 - Data Privacy ActJevanie CastroverdeNo ratings yet

- Risk and Return: Sample ProblemsDocument14 pagesRisk and Return: Sample ProblemsRynette FloresNo ratings yet

- FinaleDocument22 pagesFinaleJolina ManceraNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- Letter and Symbol Series Questions and AnswersDocument11 pagesLetter and Symbol Series Questions and AnswersJofen Ann Hisoler TangpuzNo ratings yet

- RFBT Final Preboard 94 QuestionnaireDocument16 pagesRFBT Final Preboard 94 QuestionnaireJunmar AMITNo ratings yet

- HEHEDocument22 pagesHEHEKenNo ratings yet

- RFBT Answer Key Final PreboardDocument1 pageRFBT Answer Key Final PreboardjoyhhazelNo ratings yet

- TaxDocument20 pagesTaxMae AstovezaNo ratings yet

- 89 07 Gross IncomeDocument9 pages89 07 Gross IncomeNah HamzaNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Estate Tax MCQSDocument43 pagesEstate Tax MCQSpdmallari12No ratings yet

- CPAR General Principles (Batch 93) - HandoutDocument12 pagesCPAR General Principles (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- Afar 09Document14 pagesAfar 09RENZEL MAGBITANGNo ratings yet

- Auditing First Preboard SolutionsDocument2 pagesAuditing First Preboard SolutionslorenzNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsJeric RebandaNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Business and Transfer Reviewer CompressDocument11 pagesBusiness and Transfer Reviewer CompressMarko JerichoNo ratings yet

- Chapter V Audit Prepaid ExpenseDocument4 pagesChapter V Audit Prepaid ExpenseHanju DanielNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- Midterm Exam - Specialized IndustryDocument11 pagesMidterm Exam - Specialized IndustryChristinejoy MoralesNo ratings yet

- Afar Merged PFD Cuties ClubDocument51 pagesAfar Merged PFD Cuties ClubKittenNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Investment in Associates ProblemsDocument4 pagesInvestment in Associates ProblemsLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- Philippine Accountancy Act of 2004Document6 pagesPhilippine Accountancy Act of 2004jeromyNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- ICARE - AT - PreWeek - Batch 4Document19 pagesICARE - AT - PreWeek - Batch 4john paulNo ratings yet

- Auditing - Final ExaminationDocument7 pagesAuditing - Final ExaminationFrancis MateosNo ratings yet

- FAR 2 Finals Cheat SheetDocument8 pagesFAR 2 Finals Cheat SheetILOVE MATURED FANSNo ratings yet

- May 09 Final Pre-Board (At)Document13 pagesMay 09 Final Pre-Board (At)Ashley Levy San PedroNo ratings yet

- Practical Accounting 2Document14 pagesPractical Accounting 2Yumi koshaNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- AFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Document24 pagesAFAR B41 First Pre-Board Exams (Questions, Answers & Solutions) .Prances ObiasNo ratings yet

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdNo ratings yet

- Long Test No. 1 Part I - 1202 - ACTTAX1 - C31 TAXATION 1Document9 pagesLong Test No. 1 Part I - 1202 - ACTTAX1 - C31 TAXATION 1mlaNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)MABI ESPENIDONo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- RFBT-16 (Financial Rehabilitation - Insolvency Act)Document8 pagesRFBT-16 (Financial Rehabilitation - Insolvency Act)MABI ESPENIDONo ratings yet

- RFBT-15 (E-Commerce, Data Privacy - Ease of Doing Business)Document22 pagesRFBT-15 (E-Commerce, Data Privacy - Ease of Doing Business)MABI ESPENIDONo ratings yet

- Chap 9 When Technology and Humanity CrossDocument8 pagesChap 9 When Technology and Humanity CrossPrincess Mary NobNo ratings yet

- Gec 17 Chapter 13 Biodiversity and The Healthy SocietyDocument9 pagesGec 17 Chapter 13 Biodiversity and The Healthy SocietyMABI ESPENIDONo ratings yet

- Chap 11 NanotechnologyDocument10 pagesChap 11 NanotechnologyPrincess Mary NobNo ratings yet

- AFAR Final Preboard QuestionaireDocument15 pagesAFAR Final Preboard QuestionaireMABI ESPENIDONo ratings yet

- At Final Preboard QuestionaireDocument7 pagesAt Final Preboard QuestionaireMABI ESPENIDONo ratings yet

- AFAR Answer Key Final PreboardDocument1 pageAFAR Answer Key Final PreboardMABI ESPENIDONo ratings yet