Professional Documents

Culture Documents

Bank Loans: Rate - Period

Bank Loans: Rate - Period

Uploaded by

Hanae ElabbasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Loans: Rate - Period

Bank Loans: Rate - Period

Uploaded by

Hanae ElabbasCopyright:

Available Formats

Bank loans

1. A type of interest rate which can change during the time of the loan, is called _____variable

rate_______________

2. The amount of time to pay back a loan to a bank or lending institution is instcalled the ____repayment

period_____________ _

3. A lower rate of interest that somebody is given on a loan because they are an important customer of a

bank is a ______preferential rate______________

4. Another name for the 'small print' is the _____terms and conditions________________

5. A type of loan where you won't lose your property or assets if you can't pay is called an

______unsecured loan________________

6. The actual amount of money that a customer/borrower receives when they take out a loan is called

the ______principal________________

7. A type of interest rate which doesn't increase or decrease during the time of the loan is called

____fixed rate________________

8. The extra money/charges that you have to pay a bank for paying back a loan early are called

_______redemption penalties______________

9. The extra costs that you have to pay the bank for getting a loan are called _____fees_______________

10. The name of the extra money a customer has to pay a bank if they are late with a payment, are called

______charges________________

11. A type of loan interest rate which is a mixture of variable and fixed rates is called _____split

rate______________

12. A type of loan where you can lose your property or assets if you can't pay is called a _____secured

loan ________________

Taxes

1. A different way to say you 'don't have to' pay tax is ____exempte_____________

2. The period of time that a government uses to calculate the amount of tax that people have to pay is

called the _____tax year_______________

3. Income or earnings before tax has been removed is called _____gross salary_________________

4. A document that a company or person sends to the government, so the amount of tax they have to

pay can be calculated is called a ____tax return_________________

5. The amount of money required before you begin to pay tax is called the __thershold_____

6. When the government tells you to pay more money in tax than you have already done is called a

___tax demand________________

7. The percentage of tax that is taken from an income by the government is called the _____tax rate

8. If a tax has different tax rates, the tax rates corresponding to different income ranges is called a

____tax bracket_

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2023 Edition)From EverandThe Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2023 Edition)Rating: 4 out of 5 stars4/5 (9)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bank Loan Application LetterDocument8 pagesBank Loan Application LetterSantosh ShresthaNo ratings yet

- Credit Freeze and Data Repair StrategiesFrom EverandCredit Freeze and Data Repair StrategiesRating: 5 out of 5 stars5/5 (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Informe Corte de ObraDocument20 pagesInforme Corte de ObraMGerard Moreira100% (1)

- Calculo de La Pensión Del Imss Ley 1973Document4 pagesCalculo de La Pensión Del Imss Ley 1973Antonio TrujilloNo ratings yet

- Making Your Money Work for You: Practical Tips for Financial SuccessFrom EverandMaking Your Money Work for You: Practical Tips for Financial SuccessNo ratings yet

- Credit Booster: Helping You Enhance Your Credit & Manage Your DebtFrom EverandCredit Booster: Helping You Enhance Your Credit & Manage Your DebtRating: 5 out of 5 stars5/5 (1)

- Credit Repair Book: The Official Guide to Increase Your Credit ScoreFrom EverandCredit Repair Book: The Official Guide to Increase Your Credit ScoreNo ratings yet

- Modern Debt Management - The Most Effective Debt Management SolutionsFrom EverandModern Debt Management - The Most Effective Debt Management SolutionsNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Good Mortgage Advice: The Home Buyer's Guide to Financing a Home - A Crash Course for ConfidenceFrom EverandGood Mortgage Advice: The Home Buyer's Guide to Financing a Home - A Crash Course for ConfidenceRating: 5 out of 5 stars5/5 (1)

- Financial Freedom: Achieving Your Goals and Living Debt FreeFrom EverandFinancial Freedom: Achieving Your Goals and Living Debt FreeRating: 5 out of 5 stars5/5 (1)

- How to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesFrom EverandHow to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesRating: 3 out of 5 stars3/5 (1)

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- Credit Repair: The Ultimate Guide System On How To Remove Negative Items From Your Report And Improve Your Score With An Easy Plan; The Secrets To Rapid Restore And Fast ResultsFrom EverandCredit Repair: The Ultimate Guide System On How To Remove Negative Items From Your Report And Improve Your Score With An Easy Plan; The Secrets To Rapid Restore And Fast ResultsRating: 1 out of 5 stars1/5 (2)

- Easy Guide to Building a Good Credit Score: Personal Finance, #3From EverandEasy Guide to Building a Good Credit Score: Personal Finance, #3No ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3No ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- How Debt Generates Income: A Practical Guide to Leveraging Other People's Money - Debt Income Systems for Long-Term WealthFrom EverandHow Debt Generates Income: A Practical Guide to Leveraging Other People's Money - Debt Income Systems for Long-Term WealthNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- How to Become Financially Free in 30 Days: 10,000 Paths to ProsperityFrom EverandHow to Become Financially Free in 30 Days: 10,000 Paths to ProsperityNo ratings yet

- Personal Loans Made Easy, how to borrow money and avoid being blacklisted.From EverandPersonal Loans Made Easy, how to borrow money and avoid being blacklisted.No ratings yet

- Credit Repair Secrets Learn Proven Steps To Fix And Boost Your Credit Score To 100 Points in 30 days Or LessFrom EverandCredit Repair Secrets Learn Proven Steps To Fix And Boost Your Credit Score To 100 Points in 30 days Or LessNo ratings yet

- The Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1From EverandThe Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1No ratings yet

- From Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsFrom EverandFrom Bad to Good Credit: A Practical Guide for Individuals with Charge-Offs and CollectionsNo ratings yet

- Credit Score Mastery: A Step-by-Step Guide to Financial FreedomFrom EverandCredit Score Mastery: A Step-by-Step Guide to Financial FreedomNo ratings yet

- How to Raise Your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 1From EverandHow to Raise Your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 1No ratings yet

- Steps Academics Can Take Now to Protect and Grow Their PortfoliosFrom EverandSteps Academics Can Take Now to Protect and Grow Their PortfoliosNo ratings yet

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet

- How to Fix Your Terrible Credit Score: Getting Out of Debt the Easy Way!From EverandHow to Fix Your Terrible Credit Score: Getting Out of Debt the Easy Way!No ratings yet

- Smart Home Tips: Credit, Money, Budget, Debt, Payday LoansFrom EverandSmart Home Tips: Credit, Money, Budget, Debt, Payday LoansRating: 5 out of 5 stars5/5 (1)

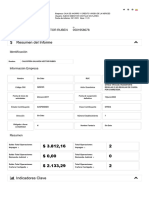

- Mes12 (2022)Document11 pagesMes12 (2022)Bruna BarrosNo ratings yet

- Finance CrosswordDocument1 pageFinance CrosswordAnalía ScozzariNo ratings yet

- July To 9Document11 pagesJuly To 9wphuang86No ratings yet

- 1 Actividad - Ejercicio Presupuesto Fijo y VariableDocument13 pages1 Actividad - Ejercicio Presupuesto Fijo y VariableCrash OfficialNo ratings yet

- Planilla de Remuneraciones CTS, Vacaciones TruncasDocument9 pagesPlanilla de Remuneraciones CTS, Vacaciones TruncasJose Tejada CondoriNo ratings yet

- Bank Interview QuestionsDocument2 pagesBank Interview Questionsrithiksuman57No ratings yet

- Analis de Costos Unitarios EstructurasDocument18 pagesAnalis de Costos Unitarios EstructurasAlbertNo ratings yet

- Actividad 8 PresupuestoDocument4 pagesActividad 8 PresupuestoCarlos LandazuryNo ratings yet

- Apu Mobiliario y Equip PDFDocument9 pagesApu Mobiliario y Equip PDFBrandoon LamNo ratings yet

- BP 205Document2 pagesBP 205Ma Lea100% (3)

- Unidad 4 Practica 1-Wilmer D.Document5 pagesUnidad 4 Practica 1-Wilmer D.Wilmer Duverge OlivoNo ratings yet

- Ec 1248488 5101Document2 pagesEc 1248488 5101Jared KbreraNo ratings yet

- Planilha Controle de Cartão de Crédito 4.0Document78 pagesPlanilha Controle de Cartão de Crédito 4.0AllanNo ratings yet

- Libro de FiscalizacionTributaria-TomoI-ELIZABETH NINADocument4 pagesLibro de FiscalizacionTributaria-TomoI-ELIZABETH NINAximenaNo ratings yet

- GT - Lista de Precios Nutricionales 2022 PblicoDocument1 pageGT - Lista de Precios Nutricionales 2022 PblicoNichitaNo ratings yet

- Presupuesto Maestro 2Document6 pagesPresupuesto Maestro 2José Villarreal GilNo ratings yet

- Real Estate Finance and Investments 15th Edition Brueggeman Fisher 007337735X Test BankDocument6 pagesReal Estate Finance and Investments 15th Edition Brueggeman Fisher 007337735X Test Bankmatthew100% (20)

- Business Account StatementDocument2 pagesBusiness Account StatementRamesh NatarajanNo ratings yet

- Sesion 3 - S10Document39 pagesSesion 3 - S10AndyNo ratings yet

- Detalles de TarjetaDocument5 pagesDetalles de TarjetaJorGe Junior SantanaNo ratings yet

- Evidencia 6 - Ejercicio Práctico "Presupuestos para La Empresa LPQ Maderas de Colombia"Document16 pagesEvidencia 6 - Ejercicio Práctico "Presupuestos para La Empresa LPQ Maderas de Colombia"Edwin Suarez67% (6)

- Sahar Shahzadi (2020-2024) - 1Document1 pageSahar Shahzadi (2020-2024) - 1Burhan composingNo ratings yet

- Account Statement 15-02-2023T18 26 39Document2 pagesAccount Statement 15-02-2023T18 26 39Younas KhanNo ratings yet

- João Pedro Cantele Viana CentrapeDocument4 pagesJoão Pedro Cantele Viana CentrapeLPMTXNo ratings yet

- Calvopiña Galarza Hector RubenDocument9 pagesCalvopiña Galarza Hector RubenSebastianCastilloNo ratings yet

- Trabajo de Presupuesto Terminado - 2-03-2022.fDocument12 pagesTrabajo de Presupuesto Terminado - 2-03-2022.fLuis Aguas GuerraNo ratings yet

- Parcial - Semana 4 COSTOS GRUPO4 EsquivelDocument16 pagesParcial - Semana 4 COSTOS GRUPO4 Esquivelalexis infanteNo ratings yet