Professional Documents

Culture Documents

AFAR-13 (Joint Arrangements)

Uploaded by

MABI ESPENIDOCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR-13 (Joint Arrangements)

Uploaded by

MABI ESPENIDOCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 45 May 2023 CPA Licensure Examination

AFAR-13

ADVANCED FINANCIAL ACCOUNTING & REPORTING (AFAR) A. DAYAG A. CRUZ

JOINT ARRANGEMENTS

I. Definitions

Joint arrangement An arrangement of which two or more parties have joint control

The contractually agreed sharing of control of an arrangement, which exists only when

Joint control decisions about the relevant activities require the unanimous consent of the parties sharing

control

A joint arrangement whereby the parties that have joint control of the arrangement have

Joint operation

rights to the assets, and obligations for the liabilities, relating to the arrangement

A joint arrangement whereby the parties that have joint control of the arrangement have

Joint venture

rights to the net assets of the arrangement

Joint venture A party to a joint venture that has joint control of that joint venture

Party to a joint An entity that participates in a joint arrangement, regardless of whether that entity has joint

arrangement control of the arrangement

A separately identifiable financial structure, including separate legal entities or entities

Separate vehicle

recognized by statute, regardless of whether those entities have a legal personality

II. The Concept of Joint Control

A joint arrangement is an arrangement of which two or more parties have joint control.

A joint arrangement has the following characteristics:

• the parties are bound by a contractual arrangement, and

• the contractual arrangement gives two or more of those parties joint control of the arrangement.

Joint control

Joint control is the contractually agreed sharing of control of an arrangement, which exists only when decisions

about the relevant activities require the unanimous consent of the parties sharing control.

Before assessing whether an entity has joint control over an arrangement, an entity first assesses whether the

parties, or a group of the parties, control the arrangement (in accordance with the definition of control in PFRS 10

Consolidated Financial Statements).

After concluding that all the parties, or a group of the parties, controls the arrangement collectively, an entity shall

assess whether it has joint control of the arrangement. Joint control exists only when decisions about the relevant

activities require the unanimous consent of the parties that collectively control the arrangement.

The requirement for unanimous consent means that any party with joint control of the arrangement can prevent

any of the other parties, or a group of the parties, from making unilateral decisions (about the relevant activities)

without its consent.

A joint arrangement is either a joint operation or a joint venture.

III. Types of Joint Arrangements

Joint arrangements are either joint operations or joint ventures:

• A joint operation is a joint arrangement whereby the parties that have joint control of the arrangement have

rights to the assets, and obligations for the liabilities, relating to the arrangement. Those parties are called joint

operators.

• A joint venture is a joint arrangement whereby the parties that have joint control of the arrangement have

rights to the net assets of the arrangement. Those parties are called joint venturers.

Correlation of PFRSs 9, 10, 11, 12 and PAS 28

Control alone?

yes no

Consolidation in Joint Control?

accordance with PFRS 10

yes no

Disclosures in accordance

with PFRS 12

Define type of joint

arrangement in Significant

accordance with PFRS 11 influence?

Joint Operations Yes - Associate no

Joint Venture

Account for assets, liabilities, Investment in accordance

PFRS 9

revenues and expenses with PAS 28 – equity method

Disclosures in accordance Disclosures in accordance

with PFRS 12 with PFRS 12

Page 1 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

JOINT ARRANGEMENTS AFAR-13

IV. Classifying joint arrangements

The classification of a joint arrangement as a joint operation or a joint venture depends upon the rights and

obligations of the parties to the arrangement. An entity determines the type of joint arrangement in which it is

involved by considering the structure and form of the arrangement, the terms agreed by the parties in the

contractual arrangement and other facts and circumstances.

Regardless of the purpose, structure or form of the arrangement, the classification of joint arrangements depends

upon the parties' rights and obligations arising from the arrangement.

A joint arrangement in which the assets and liabilities relating to the arrangement are held in a separate vehicle

can be either a joint venture or a joint operation.

A joint arrangement that is not structured through a separate vehicle is a joint operation. In such cases, the

contractual arrangement establishes the parties' rights to the assets, and obligations for the liabilities, relating to

the arrangement, and the parties' rights to the corresponding revenues and obligations for the corresponding

expenses.

V. Financial Statements of Parties to a Joint Arrangement

A. Joint Operations

A joint operator recognizes in relation to its interest in a joint operation:

• its assets, including its share of any assets held jointly;

• its liabilities, including its share of any liabilities incurred jointly;

• its revenue from the sale of its share of the output of the joint operation;

• its share of the revenue from the sale of the output by the joint operation; and

• its expenses, including its share of any expenses incurred jointly.

A joint operator accounts for the assets, liabilities, revenues and expenses relating to its involvement in a joint

operation in accordance with the relevant PFRSs.

A party that participates in, but does not have joint control of, a joint operation shall also account for its

interest in the arrangement in accordance with the above if that party has rights to the assets, and

obligations for the liabilities, relating to the joint operation.

Accounting for Joint Operations – Partnership in Nature

It involves the computation of the following data:

1. Joint Operations Profit or Loss

a. Completed Joint Operation

b. Uncompleted Joint Operation

2. Cash settlement to participants

Joint Operation Profit or Loss

The Joint Operation account is debited for all costs and expenses and is credited for all incomes recognized.

The following should be considered in computing profit or loss:

1. If the joint venture is completed, the balance of the Joint Operation account represents the profit or loss.

A credit balance represents profit and a debit balance represents loss.

2. If Joint Operation is uncompleted, meaning there is still unsold merchandise, the profit or loss is squeeze

figure between the balance of the Joint Operation account and the profit distribution and the cost of the

unsold merchandise (the required debit balance of the Joint Venture account after profit or loss

distribution).

Cash Settlement

This is the cash due or from the participant upon completion of the Joint Operation undertaking. The following

should be observed:

1. The participants’ balances are initially determined.

2. If there is a credit balance in the participants’ account, he/she will receive cash equal to his/her credit

balance.

3. If there is a debit balance in the participant’s account, he/she will pay cash equal to his/her debit balance

B. Joint Ventures – refer to Equity method in Financial Accounting and Reporting (Pract. 1) for problems

A joint venturer recognizes its interest in a joint venture as an investment and shall account for that investment

using the equity method in accordance with PAS 28 Investments in Associates and Joint Ventures unless the

entity is exempted from applying the equity method as specified in that standard.

A party that participates in, but does not have joint control of, a joint venture accounts for its interest in the

arrangement in accordance with PFRS 9 Financial Instruments unless it has significant influence over the joint

venture, in which case it accounts for it in accordance with PAS 28 (as amended in 2011).

Page 2 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

JOINT ARRANGEMENTS AFAR-13

Accounting for Joint Operations – Partnership in Nature

I – Completed Joint Operations

K and L form a joint arrangement for the sale of certain merchandise. The joint operators agree to the

following: K shall be allowed a commission of 10% on his net purchases; the joint operators shall be allowed

commissions of 25% on their respective sales; and K and L shall divide the profit or loss 60% and 40%,

respectively. Joint arrangements transactions follow:

Dec. 1: K make cash purchase of P57,000.

3: L pays joint arrangement expenses of P9,000.

5: Sales are as follows: K, P48,000; L,P36,000. The operators keep their own cash receipts.

7: K returns unsold merchandise and receives P15,000 cash.

15: The operators make cash settlement.

Required:

1. In the distribution of the balance in net profit of the joint arrangement, the shares of K and L:

K L K L___

a. P 4,260 P 3,230 c. P4,820 P 3,430

b. 4,680 3,120 d. 4,840 4,230

2. In the final cash settlement, L would pay K the amount of:

a. P14,100 c. P15,100

b. P14,880 d. P15,890

II

The joint operations accounts in the books of the operators, X, Y and Z, show the balances below, upon

termination of the joint arrangement and distribution of the profits:

Accounts X Y Z

with Dr(Cr) Dr(Cr) Dr(Cr)

X - P 2,500 P2,500

Y P 4,000 - 4,000

Z (6,500) (6,500) -

Final settlement of the joint operations will require payments as follows:

a. X pays P2,500 to Z, and Y pays P4,000 to Z c. Y pays P6,500 to X, and Z pays P2,500 to Y

b. Z pays P2,500 to X, and P4,000 to Y d. None of these

III – Completed Joint Operations

The following information is available:

Investment in Joint Operations

20x8

Nov. 6 Merchandise –Jose P 8,500 Nov .20 Cash Sales – Ampon P20,400

8 Merchandise –Deyro 7,000 12 Cash Sales – Ampon 4,200

10 Freight paid –Ampon 200 28 Merchandise – Deyro 1,210

12 Advertising –Ampon 150

Dec. 8 Purchase –Ampon 3,500

14 Selling expense –Ampon 400

The joint arrangement provided for the division of gains and losses among Jose, Deyro and Ampon in the

ratio of 2:3:5. The arrangement was to close as of December 31, 20x8.

Required:

1. The total gain from the joint arrangement amounted to:

a. P 6,060 c. P18,180

b. P12,120 d. None

2. As final settlement, Jose received in cash:

c. P 6,060 c. P8,080

d. P 7,608 d. P9,712

IV – Uncompleted Joint Operations

Soriente, Santos, and Salazar formed a joint operations, Soriente has been designated as manager of the

arrangements, for which he is to receive a bonus of 15% of the profit after deduction of the bonus as an

expense. The net profit, after bonus, has been agreed to be divided as follows: Soriente, 25%; Santos, 40%;

and Salazar, 35%.

After 5 months, the joint arrangement is terminated as of May 31, 2019. On this date, the trial balance kept

by Soriente contains the following balances:

Debit Credit

Investment in Joint Arrangement P9,000

Santos P 500

Salazar P2,000

Page 3 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

JOINT ARRANGEMENTS AFAR-13

The joint operations has still some undisposed merchandise, which Soriente agreed to purchase at its cost

of P2,500. The bonus of Soriente has not yet been taken up.

Required:

1. The net profit of the joint arrangement, after bonus to Soriente is:

a. P 1,500 c. P10,000

b. P 9,000 d. P11,500

2. The share of Santos in the joint arrangement is:

a. P 3,500 c. P4,000

b. P 3,600 d. P4,600

3. The cash settlement received by Santos and Salazar is:

a. Santos – P4,000; Salazar – P3,500 c. Santos – P4,000; Salazar – P6,500

b. Santos – P3,500; Salazar – P3,500 d. Santos – P3,500; Salazar – P5,500

V – Uncompleted Joint Arrangement

On July 1, 20x9, Andres, Bantug and Carlos formed a joint arrangement for the sale of the merchandise,

Andres was designated as the managing joint operator. Profits or losses are to be divided as follows: Andres

50%; Bantug 25%; and Carlos 25%. On October 1, 20x9, though the joint arrangement was still uncompleted,

the operators agreed to recognize profits or loss on the venture to date. The cost of inventory on hand was

determined at P25,000. The joint arrangement account has a debit balance of P15,000 before distribution

of profit and loss. No separate book is maintained for the joint arrangement and the joint operators record

in their individual books all joint arrangement transactions.

Required:

1. The joint arrangement profit or loss on October 1, 20x9 is:

a. P10,000 profit c. P15,000 loss

b. P25,000 profit d. No profit or loss

2. The distribution of the arrangement profit or (loss) on October 1, 20x9 to the operators shall be as

follows:

a. Andres P5,000; Bantug P2,500; and Carlos P2,500

b. Andres P12,500; Bantug P6,250 and Carlos P6,250

c. Andres P7,500; Bantug (P3,750) and Carlos (P3,750)

d. No distribution yet because venture is uncompleted

VI – Uncompleted Joint Arrangement

Reyes and Santos formed a joint arrangement to acquire and sell a particular lot of merchandise. Reyes

was to manage the arrangement and to furnish the capital, and the operators were to share equal in any

gain or loss. On June 10, 20x9, Santos sent Reyes P10,000 cash, which was immediately used to purchase

merchandise which cost P10,000. Reyes paid freight of P240 on the merchandise purchased. On June 24,

one half of the merchandise was sold for P7,200 cash. Reyes paid the cost of delivering merchandise to

customers, which amounted to P260. No further transactions occurred on June 30, 20x9.

Required:

1. The profit (loss) of the arrangement s for the period June 10 – June 30, 20x9 is:

a. P1,820 c. P(1,700)

b. b. P1,950 d. Some other answer

2. On June 30, 20x9 after recognizing the profit (loss) on the uncompleted joint arrangement the

account of Santos on the books of Reyes will show a debit (credit) balance of:

a. (P10,910) c. P10,850

b. (P10,975) d. some other answer

VII – Joint Venture

Ace Company purchases 40% of Basket Company on January 1 for P500,000 that carry voting rights at a

general meeting of shareholders of Basket Company. Ace Company and Blake Company immediately

agreed to share control (wherein unanimous consent is needed to all the parties involved) over Basket

Company. Basket reports assets on that date of P1,400,000 with liabilities of P500,000. One building with a

seven-year life is undervalued on Basket’s books by P140,000. Also Basket’s book value for its trademark (10-

year life) is undervalued by P210,000. During the year, Basket reports net income of P90,000, while paying

dividends of P30,000.

Required:

1. What is the Investment in Basket Company balance (equity method) in Ace’s financial records as of

December 31?

a. P504,000 c. P513,900

b. P507,600 d. P516,000

2. The Income from Investment in Basket Company in Ace’s financial records as of December 31?

a. P36,000 c. P12,000

b. P19,600 d. P 7,600

Page 4 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

JOINT ARRANGEMENTS AFAR-13

VIII – Joint Venture or Associate?

Goldman Company reports net income of P140,000 each year and pays an annual cash dividend of

P50,000. The company holds net assets of P1,200,000 on January 1, 2019. On that date, Wallace Company

purchases 40 percent of the outstanding stock for P600,000, which gives it the ability to have joint control

with Zimmerman Company over Goldman. At the purchase date, the excess of Wallace’s cost over its

proportionate share of Goldman’s book value was assigned to goodwill.

Required:

1. On December 31, 2021, what is the investment in Goldman Company balance (equity method) in

Wallace’s financial records?

a. P600,000 c. P690,000

b. P660,000 d. P708,000

2. Assuming that Goldman Company’s ownership structure is as follows:

75% is needed to direct relevant activities;

50% ownership of Wallace Company;

30% ownership of Zimmerman Company; and

20% ownership of American Company

What is the amount of Income from the Income from Investment in Goldman’s Company in Wallace

financial records as of December 31, 2021?

a. P168,000 c. P70,000

b. P108,000 d. P56,000

3. Assuming that Goldman Company’s ownership structure is as follows:

75% is needed to direct relevant activities;

50% ownership of Wallace Company;

25% ownership of Zimmerman Company; and

25% ownership of American Company

What is the amount of Income from the Income from Investment in Goldman’s Company in Wallace

financial records as of December 31, 2021?

a. P168,000 c. P70,000

b. P108,000 d. P56,000

4. Assuming that Goldman Company’s ownership structure is as follows:

Majority vote to direct relevant activities;

35% ownership of Wallace Company;

35% ownership of Zimmerman Company; and

Not applicable – ownership of American Company

Widely dispersed – other companies

What is the amount of Income from the Income from Investment in Goldman’s Company in Wallace

financial records as of December 31, 2021?

a. P168,000 c. P70,000

b. P108,000 d. P49,000

Examples of Joint Arrangements under PFRS 11

Example 1 – Construction services

A and B (the parties) are two companies whose businesses are the provision of many types of

public and private construction services. They set up a contractual arrangement to work together

for the purpose of fulfilling a contract with a government for the design and construction of a

road between two cities. The contractual arrangement determines the participation shares of A

and B and establishes joint control of the arrangement, the subject matter of which is the

delivery of the road.

The parties set up a separate vehicle (entity Z) through which to conduct the arrangement. Entity

Z, on behalf of A and B, enters into the contract with the government. In addition, the assets

and liabilities relating to the arrangement are held in entity Z. The main feature of entity Z’s

legal form is that the parties, not entity Z, have rights to the assets, and obligations for the

liabilities, of the entity.

Analysis

The joint arrangement is carried out through a separate vehicle whose legal form does not confer

separation between the parties and the separate vehicle (i.e. the assets and liabilities held

in entity Z are the parties’ assets and liabilities). This is reinforced by the terms agreed by

the parties in their contractual arrangement, which state that A and B have rights to the assets,

and obligations for the liabilities, relating to the arrangement that is conducted through entity

Z. The joint arrangement is a joint operation.

Page 5 of 6 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

JOINT ARRANGEMENTS AFAR-13

Example 2 – Shopping centre operated jointly

Two real estate companies (the parties) set up a separate vehicle (entity X) for the purpose of

acquiring and operating a shopping centre. The contractual arrangement between the parties

establishes joint control of the activities that are conducted in entity X. The main feature of

entity X’s legal form is that the entity, not the parties, has rights to the assets, and

obligations for the liabilities, relating to the arrangement. These activities include the rental

of the retail units, managing the car park, maintaining the centre and its equipment, such as

lifts, and building the reputation and customer base for the centre as a whole.

Analysis

The joint arrangement is carried out through a separate vehicle whose legal form causes the

separate vehicle to be considered in its own right (ie the assets and liabilities held in the

separate vehicle are the assets and liabilities of the separate vehicle and not the assets and

liabilities of the parties). In addition, the terms of the contractual arrangement do not specify

that the parties have rights to the assets, or obligations for the liabilities, relating to the

arrangement. Instead, the terms of the contractual arrangement establish that the parties have

rights to the net assets of entity X. The joint arrangement is a joint venture. The parties

recognize their rights to the net assets of entity X as investments and account for them using

the equity method.

Example 3 – Joint manufacturing and distribution of a product

Companies A and B (the parties) have set up a strategic and operating agreement (the framework

agreement) in which they have agreed the terms according to which they will conduct the

manufacturing and distribution of a product (product P) in different markets.

Analysis

The framework agreement sets up the terms under which parties A and B conduct the manufacturing

and distribution of product P. These activities are undertaken through joint arrangements whose

purpose is either the manufacturing or the distribution of product P.

The parties carry out the manufacturing arrangement through entity M whose legal form confers

separation between the parties and the entity. In addition, neither the framework agreement nor

the contractual arrangement dealing with the manufacturing activity specifies that the parties

have rights to the assets, and obligations for the liabilities, relating to the manufacturing

activity. However, when considering the following facts and circumstances the parties have

concluded that the manufacturing arrangement is a joint operation.

Example 4 – Bank operated jointly

Banks A and B (the parties) agreed to combine their corporate, investment banking, asset

management and services activities by establishing a separate vehicle (bank C). Both parties

expect the arrangement to benefit them in different ways. Bank A believes that the arrangement

could enable it to achieve its strategic plans to increase its size, offering an opportunity to

exploit its full potential for organic growth through an enlarged offering of products and

services. Bank B expects the arrangement to reinforce its offering in financial savings and

market products.

Analysis

The joint arrangement is carried out through a separate vehicle whose legal form confers

separation between the parties and the separate vehicle. The terms of the contractual arrangement

do not specify that the parties have rights to the assets, or obligations for the liabilities,

of bank C, but it establishes that the parties have rights to the net assets of bank C. The

commitment by the parties to provide support if bank C is not able to comply with the applicable

legislation and banking regulations is not by itself a determinant that the parties have an

obligation for the liabilities of bank C. There are no other facts and circumstances that

indicate that the parties have rights to substantially all the economic benefits of the assets

of bank C and that the parties have an obligation for the liabilities of bank C. The joint

arrangement is a joint venture.

**Success does not depend on what you achieved but on how you achieved it.**

**Sail through the sands of the present time and savor present reality and pray the best in life will happen in the future.**

**We definitely reach new heights in conquering certain fears that hinders us from becoming battle-tested individuals, enough to

survive the wheels of life.

**Your mind was framed to succeed, Your hand was armed with skill,

Your face was the mould of great faith and courage, and your HEART with the throne of will.**

**It is the habit of a mind which attaches to abstractions with passion which gives vast results.**

**There are storms to be considered, problems to be reckoned with, crisis to be encountered, high seas to contend with, unfateful events

that should be hurdled and they are phenomenon to be shunned with great faith and courage.**

**We definitely reached new heights in conquering certain fears that hinders us from becoming battle-tested individuals, enough to survive

the wheels of life.**

**We tend to forget that life is a gift to be enjoyed to the fullest and not a burden**

**A DREAM UNREALIZED IS A DREAM IMPRISONED BY THAT ENEMY OF ALL ENEMIES THE FEAR OF FAILURE. SET THAT DREAM FREE BY

DETERMINING THAT YOU WILL MAKE IT HAPPEN

**Every great success was at the beginning impossible.**

**Opportunities are usually disguised as hard work, so most people don’t recognize them.**

**The only thing that stands between a man and what he wants from life is often merely the will to try it and the faith to believe that it is

possible.**

**A goal is nothing more than a dream with a time limit.**

****God’s LOVE is like a river that keeps on flowing…****

Page 6 of 6 0915-2303213 www.resacpareview.com

You might also like

- Practical Accounting 2 - Joint ArrangementDocument37 pagesPractical Accounting 2 - Joint ArrangementJeane Bongalan82% (17)

- Accounting for joint arrangements under PFRSDocument13 pagesAccounting for joint arrangements under PFRSPam G.No ratings yet

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- Fin TechDocument3 pagesFin TechDiana PerezNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- Practical Accounting 2 Joint ArrangementDocument70 pagesPractical Accounting 2 Joint ArrangementMary Jescho Vidal AmpilNo ratings yet

- Accounting for Joint Arrangements under PFRS 11Document8 pagesAccounting for Joint Arrangements under PFRS 11Darlene Faye Cabral RosalesNo ratings yet

- Module 7Document5 pagesModule 7trixie maeNo ratings yet

- Module 2 - Joint ArrangementsDocument9 pagesModule 2 - Joint ArrangementsRodelLaborNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- IFRS 11 SummaryDocument4 pagesIFRS 11 SummaryJoshua Capa Fronda100% (1)

- Joint ArrangementsDocument19 pagesJoint ArrangementsAndyvergys Aldrin MistulaNo ratings yet

- As-27 (Financial Reporting of Interests in Joint Ventures)Document10 pagesAs-27 (Financial Reporting of Interests in Joint Ventures)api-3828505No ratings yet

- IFRS 11 Joint ArrangementsDocument3 pagesIFRS 11 Joint ArrangementsPrinceNo ratings yet

- General de Jesus CollegeDocument16 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- JOINT ARRANGEMENTSDocument3 pagesJOINT ARRANGEMENTSfrondagericaNo ratings yet

- Joint ArrangementsDocument88 pagesJoint ArrangementsJustine Kate Ferrer BascoNo ratings yet

- Joint Arrangements Accounting GuideDocument14 pagesJoint Arrangements Accounting GuidemixxNo ratings yet

- Joint Arrangement: Ifrs 11Document3 pagesJoint Arrangement: Ifrs 11Aira Nhaira MecateNo ratings yet

- PFRS 11 SummaryDocument2 pagesPFRS 11 SummaryHakdog SadNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument14 pagesAfar01 Joint Arrangements ReviewerstheresaazuresNo ratings yet

- CMPC 131 04 Module 02Document7 pagesCMPC 131 04 Module 02Fernando III PerezNo ratings yet

- Joint Arrangements: International Financial Reporting Standard 11Document24 pagesJoint Arrangements: International Financial Reporting Standard 11Obet LimNo ratings yet

- Item 71721Document17 pagesItem 71721Seanie ReyesNo ratings yet

- Deegan5e SM Ch34Document6 pagesDeegan5e SM Ch34Rachel TannerNo ratings yet

- AFAR01 Joint Arrangements Reviewers AFAR01 Joint Arrangements ReviewersDocument14 pagesAFAR01 Joint Arrangements Reviewers AFAR01 Joint Arrangements ReviewersMarco Louis Duval UyNo ratings yet

- Ind AS 31 Joint Ventures ExplainedDocument16 pagesInd AS 31 Joint Ventures ExplainedsatishNo ratings yet

- Lesson 13Document9 pagesLesson 13Jamaica bunielNo ratings yet

- Joint Arrangement AccountingDocument4 pagesJoint Arrangement AccountingJasmine Marie Ng CheongNo ratings yet

- IFRS 11 Joint Arrangement GuideDocument4 pagesIFRS 11 Joint Arrangement GuideMariette Alex Agbanlog100% (1)

- Joint ArrangementsDocument4 pagesJoint ArrangementsgeexellNo ratings yet

- Joint Arrangements: International Financial Reporting Standard 11Document19 pagesJoint Arrangements: International Financial Reporting Standard 11Tanvir PrantoNo ratings yet

- Course Module - Chapter 9 - Interest in Joint VenturesDocument9 pagesCourse Module - Chapter 9 - Interest in Joint VenturesMarianne DadullaNo ratings yet

- Chapter6 - Interest - in - Join - Ventures - IAS31 (Compatibility Mode)Document9 pagesChapter6 - Interest - in - Join - Ventures - IAS31 (Compatibility Mode)Chi Nguyễn Thị KimNo ratings yet

- Module 3 Joint ArrangementsDocument19 pagesModule 3 Joint ArrangementsNiki DimaanoNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- Joint Arrangements: International Financial Reporting Standard 11Document28 pagesJoint Arrangements: International Financial Reporting Standard 11Cryptic LollNo ratings yet

- SPECIAL TRANSACTION CHAP 6Document9 pagesSPECIAL TRANSACTION CHAP 6balidleahluna20No ratings yet

- Joint ArrrangementsDocument5 pagesJoint ArrrangementsGIGI BODONo ratings yet

- Sri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesDocument17 pagesSri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesMaithri Vidana KariyakaranageNo ratings yet

- Pfrs 11Document25 pagesPfrs 11rena chavezNo ratings yet

- .IFRS 11 Joint ArrangementDocument28 pages.IFRS 11 Joint ArrangementNeil Antoni MirasNo ratings yet

- IFRS 11 Joint Arrangements ClassificationDocument11 pagesIFRS 11 Joint Arrangements ClassificationJohn Rey LabasanNo ratings yet

- 3 Joint Arrange. Ifrs 11Document6 pages3 Joint Arrange. Ifrs 11DM BuenconsejoNo ratings yet

- Chapter 2 Joint ArrangementsDocument3 pagesChapter 2 Joint ArrangementsAngelica B. MartinNo ratings yet

- IFRS 11 (Revised)Document28 pagesIFRS 11 (Revised)Cryptic LollNo ratings yet

- 0000000585246131Document23 pages0000000585246131Phuong TaNo ratings yet

- Chapter 1Document18 pagesChapter 1Nigusu TadeseNo ratings yet

- Kashifadeel - IFRS 11Document2 pagesKashifadeel - IFRS 11zahidsiddiqui75No ratings yet

- Joint Arrangements by Antonio DayagDocument5 pagesJoint Arrangements by Antonio DayagbrookeNo ratings yet

- Adv Fa I CH 1Document30 pagesAdv Fa I CH 1Addi Såïñt GeorgeNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- 11 Ind as 111 Joint ArrangementsDocument29 pages11 Ind as 111 Joint Arrangementsadipawar2824No ratings yet

- Other Consolidation Reporting Issues: © 2019 Mcgraw-Hill EducationDocument20 pagesOther Consolidation Reporting Issues: © 2019 Mcgraw-Hill EducationNeha SainiNo ratings yet

- International Financial Reporting Standard 11 International Financial Reporting Standard 11Document4 pagesInternational Financial Reporting Standard 11 International Financial Reporting Standard 11Harmony Clement-ebereNo ratings yet

- Module 4 PFRS 11 Joint ArrangementDocument30 pagesModule 4 PFRS 11 Joint Arrangementjulia4razoNo ratings yet

- 8925 Joint Arrangements Lecture NotesDocument18 pages8925 Joint Arrangements Lecture NotesBabyrose Pelobello GnayasgaNo ratings yet

- AC511Document3 pagesAC511Kimkim EdilloNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Resa Law On SalesDocument16 pagesResa Law On SalesArielle D.No ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)MABI ESPENIDONo ratings yet

- RFBT-17 (Anti-Bouncing Checks Law)Document2 pagesRFBT-17 (Anti-Bouncing Checks Law)reynanciacatherinemaeNo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- RFBT-15 (E-Commerce, Data Privacy - Ease of Doing Business)Document22 pagesRFBT-15 (E-Commerce, Data Privacy - Ease of Doing Business)MABI ESPENIDONo ratings yet

- RFBT-16 (Financial Rehabilitation - Insolvency Act)Document8 pagesRFBT-16 (Financial Rehabilitation - Insolvency Act)MABI ESPENIDONo ratings yet

- Gec 17 Chapter 13 Biodiversity and The Healthy SocietyDocument9 pagesGec 17 Chapter 13 Biodiversity and The Healthy SocietyMABI ESPENIDONo ratings yet

- Gene Therapy Ready For BooksDocument9 pagesGene Therapy Ready For BooksJENEUSE JADE TAGANASNo ratings yet

- Resa PARTNERSHIPDocument12 pagesResa PARTNERSHIPArielle D.No ratings yet

- Chap 10 Why Does The Future Not Need UsDocument10 pagesChap 10 Why Does The Future Not Need UsPrincess Mary NobNo ratings yet

- Chap 11 NanotechnologyDocument10 pagesChap 11 NanotechnologyPrincess Mary NobNo ratings yet

- Chap 9 When Technology and Humanity CrossDocument8 pagesChap 9 When Technology and Humanity CrossPrincess Mary NobNo ratings yet

- AFAR Final Preboard QuestionaireDocument15 pagesAFAR Final Preboard QuestionaireMABI ESPENIDONo ratings yet

- Chap 8 Good LifeDocument3 pagesChap 8 Good LifePrincess Mary NobNo ratings yet

- TAXATION Final Preboard Questionaires With AnswerDocument10 pagesTAXATION Final Preboard Questionaires With AnswerChristina Fe GalacinaoNo ratings yet

- Chapter 5 - Health Insurance SchemesDocument0 pagesChapter 5 - Health Insurance SchemesJonathon CabreraNo ratings yet

- General Principles & National Income Taxation Lecture Atty RizalinaDocument242 pagesGeneral Principles & National Income Taxation Lecture Atty RizalinaJoyce LapuzNo ratings yet

- Role of Commercial Banks in The Economic Development of IndiaDocument5 pagesRole of Commercial Banks in The Economic Development of IndiaGargstudy PointNo ratings yet

- ConsignmentDocument6 pagesConsignmentendouusaNo ratings yet

- Module 5 Statement of Cash FlowsDocument11 pagesModule 5 Statement of Cash FlowsGAZA MARY ANGELINENo ratings yet

- Role of State Bank of Pakistan in EconomicDocument20 pagesRole of State Bank of Pakistan in Economiclaiba faizNo ratings yet

- IMS Internal Audit ScheduleDocument1 pageIMS Internal Audit ScheduleAkd DeshmukhNo ratings yet

- E Newspaper 9 - 15 July 2020Document12 pagesE Newspaper 9 - 15 July 2020raphaelmashapaNo ratings yet

- Invoice 26Document2 pagesInvoice 26asim khanNo ratings yet

- Unit-1 Potential RevenueDocument5 pagesUnit-1 Potential RevenueYash RajNo ratings yet

- Dynamic Asset AllocationDocument7 pagesDynamic Asset AllocationdraknoirrdNo ratings yet

- Application and Analysis Exercises 28.1 and 28.2Document8 pagesApplication and Analysis Exercises 28.1 and 28.2Peper12345No ratings yet

- Lec1 - Introduction To AccountingDocument47 pagesLec1 - Introduction To AccountingDylan Rabin PereiraNo ratings yet

- NISM Series VIII - Equity Derivatives Certification Examination Workbook - May 2023Document204 pagesNISM Series VIII - Equity Derivatives Certification Examination Workbook - May 2023kamali varNo ratings yet

- Chapter 9 Accounting Cycle of A Service BusinessDocument59 pagesChapter 9 Accounting Cycle of A Service BusinessArlyn Ragudos BSA1No ratings yet

- EBAN. Statistics Compendium 2014Document17 pagesEBAN. Statistics Compendium 2014mhldcnNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- NYC HDC M2 Mixed Middle-Income Housing TermsheetDocument6 pagesNYC HDC M2 Mixed Middle-Income Housing TermsheetNorman OderNo ratings yet

- 16.internal Reconstruction PDFDocument7 pages16.internal Reconstruction PDFkamal_potter1707100% (2)

- FAS 166/167 and FSP FAS 115-2Document21 pagesFAS 166/167 and FSP FAS 115-2Cairo AnubissNo ratings yet

- US - JOURNAL - EJAE - 2020 - Vol 17 No 1Document153 pagesUS - JOURNAL - EJAE - 2020 - Vol 17 No 1kophNo ratings yet

- Debre Markos University College of Business and Economics Department of EconomicsDocument484 pagesDebre Markos University College of Business and Economics Department of EconomicsYeshiwas EwinetuNo ratings yet

- Develop Business Plan Market PotentialDocument5 pagesDevelop Business Plan Market PotentialShunuan HuangNo ratings yet

- Pitchbook - Trading Business: BSE LTDDocument34 pagesPitchbook - Trading Business: BSE LTDVenu MadhavNo ratings yet

- Portfolio Performance Evaluation of Selected Sector Index of BSEDocument12 pagesPortfolio Performance Evaluation of Selected Sector Index of BSEDavid RiveraNo ratings yet

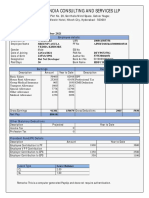

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- UBS & CS Merger PresentationDocument12 pagesUBS & CS Merger PresentationBilly LeeNo ratings yet

- AttachmentDocument95 pagesAttachmentSyed InamNo ratings yet

- NismDocument17 pagesNismRohit Shet50% (2)