Professional Documents

Culture Documents

MCQ On Derr......

Uploaded by

Manjula B K AI002233Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCQ On Derr......

Uploaded by

Manjula B K AI002233Copyright:

Available Formats

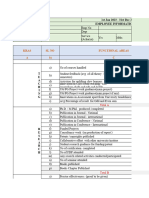

School of Distance Education

UNIVERSITY OF CALICUT

School of Distance Education

B.Com. VI Semester (2019 Admn.)

Specialisation: BC6B14 Financial Derivatives

Multiple Choice Questions

1) The payoffs for financial derivatives are linked to

(a) securities that will be issued in the future.

(b) the volatility of interest rates.

(c) previously issued securities.

(d) government regulations specifying allowable rates of return.

2) Financial derivatives include

(a) forwards (b) Options (c) futures. (d) All of these

3) Financial derivatives include

(a) stocks. (b) bonds.

(c) forward contracts. (d) both (a) and (b) are true.

4) Which of the following is not a financial derivative?

(a) Stock (b) Futures

(d) Forward contracts

(c) Options

5) By hedging a portfolio, a bank manager

(a) reduces interest rate risk. (b) increases reinvestment risk.

(c) increases exchange rate risk. (d) increases the probability of gains.

6) Which of the following is a reason to hedge a portfolio?

(a) To increase the probability of gains.

(b) To limit exposure to risk.

(c) To profit from capital gains when interest rates fall.

Financial Derivatives Page 1

School of Distance Education

(d) All of the above.

7) Hedging risk for a long position is accomplished by

(a) taking another long position.

(b) taking a short position.

(c) taking additional long and short positions in equal amounts.

(d) taking a neutral position.

8) Hedging risk for a short position is accomplished by

(a) taking a long position.

(b) taking another short position.

(c) taking additional long and short positions in equal amounts.

(d) taking a neutral position.

9) A contract that requires the investor to buy securities on a future date is called a

(a) short contract. (b) long contract.

(c) hedge. (d) cross.

10) A long contract requires that the investor

(a) sell securities in the future. (b) buy securities in the future.

(c) hedge in the future (d) close out his position in the future.

11) A person who agrees to buy an asset at a future date has gone

(a) long. (b) short. (c) back. (d) ahead.

12) A short contract requires that the investor

(a) sell securities in the future. (b) buy securities in the future.

(c) hedge in the future. (d) close out his position in the future.

13) A contract that requires the investor to sell securities on a future date is called a

(a) short contract. (b) long contract.

Financial Derivatives Page 2

School of Distance Education

(c) hedge. (d) micro hedge.

14) If a bank manager chooses to hedge his portfolio of treasury securities by selling future contracts, he

(a) gives up the opportunity for gains. (b) removes the chance of loss.

(c) increases the probability of a gain. (d) both (a) and (b) are true.

15) To say that the forward market lacks liquidity means that

(a) forward contracts usually result in losses.

(b) forward contracts cannot be turned into cash.

(c) it may be difficult to make the transaction.

(d) forward contracts cannot be sold for cash.

16) A disadvantage of a forward contract is that

(a) it may be difficult to locate a counterparty.

(b) the forward market suffers from lack of liquidity.

(c) these contracts have default risk.

(d) all of the above.

17) Forward contracts are risky because they

(a) are subject to lack of liquidity (b) are subject to default risk.

(c) hedge a portfolio. (d) both (a) and (b) are true.

18) The advantage of forward contracts over future contracts is that they

(a) are standardized. (b) have lower default risk.

(c) are more liquid. (d) none of the above.

19) The advantage of forward contracts over futures contracts is that they

(a) are standardized. (b) have lower default risk.

(c) are more flexible. (d) both (a) and (b) are true.

20) Forward contracts are of limited usefulness to financial institutions because

(a) of default risk. (b) it is impossible to hedge risk.

(c) of lack of liquidity. (d) both (a) and (c) of the above.

21) Futures contracts are regularly traded on the

(a) Chicago Board of Trade. (b) New York Stock Exchange.

(c) American Stock Exchange. (d) Chicago Board of Options Exchange.

22) Hedging in the futures market

(a) eliminates the opportunity for gains.

Financial Derivatives Page 3

School of Distance Education

(b) eliminates the opportunity for losses.

(c) increases the earnings potential of the portfolio.

(d) both (a) and (b) of the above.

23) When interest rates fall, a bank that perfectly hedges its portfolio of Treasury securities in the futures

market

(a) suffers a loss. (b) experiences a gain.

(c) has no change in its income. (d) none of the above.

24) Futures markets have grown rapidly because futures

(a) are standardized. (b) have lower default risk.

(c) are liquid. (d) all of the above.

25) On the expiration date of a futures contract, the price of the contract

(a) always equals the purchase price of the contract.

(b) always equals the average price over the life of the contract.

(c) always equals the price of the underlying asset.

(d) always equals the average of the purchase price and the price of underlying asset.

26) The price of a futures contract at the expiration date of the contract

(a) equals the price of the underlying asset.

(b) equals the price of the counterparty.

(c) equals the hedge position.

(d) equals the value of the hedged asset.

27) Elimination of riskless profit opportunities in the futures market is

(a) hedging. (b) arbitrage.

(c) speculation. (d) underwriting.

28) If you sold a short contract on financial futures you hope interest rates

(a) rise. (b) fall. (c) are stable. (d) fluctuate.

29) If you sold a short futures contract you will hope that interest rates

(a) rise. (b) fall. (c) are stable. (d) fluctuate.

30) If you bought a long contract on financial futures you hope that interest rates

Financial Derivatives Page 4

School of Distance Education

(a) rise. (b) fall. (c) are stable. (d) fluctuate.

31) If you bought a long futures contract you hope that bond prices

(a) rise. (b) fall. (c) are stable. (d) fluctuate.

32) If you sold a short futures contract you will hope that bond prices

(a) rise. (b) fall. (c) are stable. (d) fluctuate.

33) To hedge the interest rate risk on $4 million of Treasury bonds with $100,000 futures contracts, you

would need to purchase

(a) 4 contracts. (b) 20 contracts.(c) 25 contracts. (d) 40 contracts.

34) Assume you are holding Treasury securities and have sold futures to hedge against interest rate risk.

If interest rates rise

(a) the increase in the value of the securities equals the decrease in the value of the futures

contracts.

(b) the decrease in the value of the securities equals the increase in the value of the futures

contracts.

(c) the increase in the value of the securities exceeds the decrease in the values of the futures

contracts.

(d) both the securities and the futures contracts increase in value.

35) Assume you are holding Treasury securities and have sold futures to hedge against interest rate risk.

If interest rates fall

(a) the increase in the value of the securities equals the decrease in the value of the futures

contracts.

(b) the decrease in the value of the securities equals the increase in the value of the futures

contracts.

(c) the increase in the value of the securities exceeds the decrease in the values of the futures

contracts.

(d) both the securities and the futures contracts increase in value.

36) When a financial institution hedges the interest-rate risk for a specific asset, the hedge is called a

(a) macro hedge. (b) micro hedge.

(c) cross hedge. (d) futures hedge.

Financial Derivatives Page 5

School of Distance Education

37) When the financial institution is hedging interest-rate risk on its overall portfolio, then the hedge is a

(a) macro hedge. (b) micro hedge.

(c) cross hedge. (d) futures hedge.

38) The number of futures contracts outstanding is called

(a) liquidity. (b) volume.

(c) float. (d) open interest.

39) Which of the following features of futures contracts were not designed to increase liquidity?

(a) Standardized contracts (b) Traded up until maturity

(c) Not tied to one specific type of bond (d) Marked to market daily

40) Which of the following features of futures contracts were not designed to increase liquidity?

(a) Standardized contracts (b) Traded up until maturity

(c) Not tied to one specific type of bond (d) Can be closed with offsetting trade

41) Futures differ from forwards because they are

(a) used to hedge portfolios.

(b) used to hedge individual securities.

(c) used in both financial and foreign exchange markets.

(d) a standardized contract.

42) Futures differ from forwards because they are

(a) used to hedge portfolios.

(b) used to hedge individual securities.

(c) used in both financial and foreign exchange markets.

(d) marked to market daily.

43) The advantage of futures contracts relative to forward contracts is that futures contracts

(a) are standardized, making it easier to match parties, thereby increasing liquidity.

(b) specify that more than one bond is eligible for delivery, making it harder for someone to

corner the market and squeeze traders.

Financial Derivatives Page 6

School of Distance Education

(c) cannot be traded prior to the delivery date, thereby increasing market liquidity.

(d) both (a) and (b) of the above.

44) If a firm is due to be paid in deutsche marks in two months, to hedge against exchange rate risk the

firm should

(a) sell foreign exchange futures short.

(b) buy foreign exchange futures long.

(c) stay out of the exchange futures market.

(d) none of the above.

45) If a firm must pay for goods it has ordered with foreign currency, it can hedge its foreign exchange

rate risk by

(a) selling foreign exchange futures short.

(b) buying foreign exchange futures long.

(c) staying out of the exchange futures market.

(d) none of the above.

46) If a firm is due to be paid in deutsche marks in two months, to hedge against exchange rate risk the

firm should _____ foreign exchange futures _____.

(a) sell; short (b) buy; long

(c) sell; long (d) buy; short

47) If a firm must pay for goods it has ordered with foreign currency, it can hedge its foreign exchange

rate risk by _____ foreign exchange futures _____.

(a) selling; short (b) buying; long

(c) buying; short (d) selling; long

48) Options are contracts that give the purchasers the

(a) option to buy or sell an underlying asset.

(b) the obligation to buy or sell an underlying asset.

(c) the right to hold an underlying asset.

(d) the right to switch payment streams.

Financial Derivatives Page 7

School of Distance Education

49) The price specified on an option that the holder can buy or sell the underlying asset is called the

(a) premium. (b) call.

(c) strike price. (d) put.

50) The price specified on an option that the holder can buy or sell the underlying asset is called the

(a) premium. (b) strike price.

(c) exercise price. (d) both (b) and (c) are true.

51) The seller of an option has the

(a) right to buy or sell the underlying asset.

(b) the obligation to buy or sell the underlying asset.

(c) ability to reduce transaction risk.

(d) right to exchange one payment stream for another.

52) The seller of an option is ______ to buy or sell the underlying asset while the purchaser of an option

has the ______ to buy or sell the asset.

(a) obligated; right (b) right; obligation

(d) right; right

(c) obligated; obligation

53) The amount paid for an option is the

(a) strike price. (b) premium.

(c) discount. (d) commission.

54) An option that can be exercised at any time up to maturity is called a(n)

(a) swap. (b) stock option.

(c) European option. (d) American option.

55) An option that can only be exercised at maturity is called a(n)

(a) swap. (b) stock option.

(c) European option. (d) American option.

56) Options on individual stocks are referred to as

(a) stock options. (b) futures options.

(c) American options. (d) individual options.

57) Options on futures contracts are referred to as

Financial Derivatives Page 8

School of Distance Education

(a) stock options. (b) futures options.

(c) American options. (d) individual options.

Financial Derivatives Page 9

School of Distance Education

58) An option that gives the owner the right to buy a financial instrument at the exercise price within a

specified period of time is a

(a) call option. (b) put option.

(c) American option. (d) European option.

59) A call option gives the owner

(a) the right to sell the underlying security.

(b) the obligation to sell the underlying security.

(c) the right to buy the underlying security.

(d) the obligation to buy the underlying security.

60) A call option gives the seller

(a) the right to sell the underlying security.

(b) the obligation to sell the underlying security.

(c) the right to buy the underlying security.

(d) the obligation to buy the underlying security.

61) An option allowing the holder to buy an asset in the future is a

(a) put option. (b) call option.

(c) swap. (d) premium.

62) An option that gives the owner the right to sell a financial instrument at the exercise price within a

specified period of time is a

(a) call option. (b) put option.

(c) American option. (d) European option.

63) A put option gives the owner

(a) the right to sell the underlying security.

(b) the obligation to sell the underlying security.

(c) the right to buy the underlying security.

(d) the obligation to buy the underlying security.

64) A put option gives the seller

(a) the right to sell the underlying security.

Financial Derivatives Page 10

School of Distance Education

(b) the obligation to sell the underlying security.

(c) the right to buy the underlying security.

(d) the obligation to buy the underlying security.

65) An option allowing the owner to sell an asset at a future date is a

(a) put option. (b) call option. (c) swap. (d) forward contract.

66) If you buy a call option on treasury futures at 115, and at expiration the market price is 110,

(a) the call will be exercised. (b) the put will be exercised.

(c) the call will not be exercised. (d) the put will not be exercised.

67) If you buy a call option on treasury futures at 110, and at expiration the market price is 115,

(a) the call will be exercised. (b) the put will be exercised.

(c) the call will not be exercised. (d) the put will not be exercised.

68) If you buy a put option on treasury futures at 115, and at expiration the market price is 110,

(a) the call will be exercised. (b) the put will be exercised.

(c) the call will not be exercised. (d) the put will not be exercised.

69) If you buy a put option on treasury futures at 110, and at expiration the market price is 115,

(a) the call will be exercised. (b) the put will be exercised.

(c) the call will not be exercised.(d) the put will not be exercised.

70) The main advantage of using options on futures contracts rather than the futures contracts

themselves is that

(a) interest rate risk is controlled while preserving the possibility of gains.

(b) interest rate risk is controlled, while removing the possibility of losses.

(c) interest rate risk is not controlled, but the possibility of gains is preserved.

(d) interest rate risk is not controlled, but the possibility of gains is lost.

71) The main reason to buy an option on a futures contract rather than the futures contract is

(a) to reduce transaction cost. (b) to preserve the possibility for gains.

(c) to limit losses. (d) remove the possibility for gains.

Financial Derivatives Page 11

School of Distance Education

72) The main disadvantage of hedging with futures contracts as compared to options on futures

contracts is that futures

(a) remove the possibility of gains. (b) increase the transactions cost.

(c) are not as an effective a hedge. (d) do not remove the possibility of losses.

73) If a bank manager wants to protect the bank against losses that would be incurred on its portfolio of

treasury securities should interest rates rise, he could

(a) buy put options on financial futures. (b) buy call options on financial futures.

(c) sell put options on financial futures. (d) sell call options on financial futures.

74) Hedging by buying an option

(a) limits gains. (b) limits losses.

(c) limits gains and losses. (d) has no limit on option premiums.

75) All other things held constant, premiums on options will increase when the

(a) exercise price increases. (b) volatility of the underlying asset falls.

(c) term to maturity increases. (d) (a) and (c) are both true.

76) All other things held constant, premiums on call options will increase when the

(a) exercise price falls . (b) volatility of the underlying asset falls.

(c) term to maturity decreases. (d) futures price increases.

77) An increase in the exercise price, all other things held constant, will ______ the call option

premium.

(a) increase (b) decrease

(c) increase or decrease (d) Not enough information is given.

78)All other things held constant, premiums on options will increase when the

(a) exercise price increases. (b) volatility of the underlying asset increases.

(c) term to maturity decreases. (d) futures price increases.

79) An increase in the volatility of the underlying asset, all other things held constant, will ______ the

option premium.

(a) increase (b) decrease

(c) increase or decrease (d) Not enough information is given.

Financial Derivatives Page 12

School of Distance Education

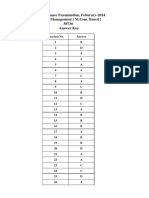

Answer Key

QN NO ANS QN NO ANS QN NO ANS QN NO ANS

1 C 21 A 41 D 61 B

2 D 22 D 42 D 62 B

3 C 23 C 43 D 63 A

4 A 24 D 44 A 64 D

5 A 25 C 45 B 65 A

6 B 26 A 46 A 66 C

7 B 27 B 47 B 67 A

8 A 28 A 48 A 68 B

9 B 29 A 49 C 69 D

10 B 30 B 50 D 70 A

11 A 31 A 51 B 71 B

12 A 32 B 52 A 72 A

13 A 33 D 53 B 73 A

14 D 34 B 54 D 74 B

15 C 35 A 55 C 75 C

16 D 36 B 56 A 76 A

17 D 37 A 57 B 77 B

18 D 38 D 58 A 78 B

19 C 39 B 59 C 79 A

20 D 40 D 60 B

Prepared By :

Rajan P, Assistant Professor on Contract,

School of Distance Education, University of

Calicut.

Financial Derivatives Page 13

You might also like

- DARVATIVE-AND-RISK-MANAGEMNT - MCQ's Answer KeyDocument16 pagesDARVATIVE-AND-RISK-MANAGEMNT - MCQ's Answer KeywaqarNo ratings yet

- Derivatives ReviewerDocument165 pagesDerivatives Reviewerjhie boterNo ratings yet

- Multiple Choice Financial DerivativesDocument14 pagesMultiple Choice Financial DerivativesAnkit BaranwalNo ratings yet

- Financial Derivatives: Multiple Choice QuestionsDocument11 pagesFinancial Derivatives: Multiple Choice Questionssid1982No ratings yet

- 1) The Payoffs For Financial Derivatives AreDocument43 pages1) The Payoffs For Financial Derivatives AreRaghavendra Kaladi33% (3)

- Derivative and Risk Management MCQ: Multiple ChoiceDocument18 pagesDerivative and Risk Management MCQ: Multiple Choicesandra kayelaNo ratings yet

- tb13 PDFDocument25 pagestb13 PDFjaiprakashNo ratings yet

- MCQ On FDDocument25 pagesMCQ On FDArun MaxwellNo ratings yet

- Objective Type Questions On DerivativesDocument5 pagesObjective Type Questions On DerivativesEknath Birari100% (1)

- FD MCQ 2Document2 pagesFD MCQ 2ruchi agrawal100% (1)

- Security Analysis and Portfolio Management: Multiple Choice QuestionsDocument2 pagesSecurity Analysis and Portfolio Management: Multiple Choice QuestionsSundarachselvan SubramanianNo ratings yet

- MCQS InvestmentDocument3 pagesMCQS Investmentaashir chNo ratings yet

- Tutorial 5Document4 pagesTutorial 5malak aymanNo ratings yet

- MB - Tutorial 5ISADocument4 pagesMB - Tutorial 5ISANouran MohamedNo ratings yet

- Kshitiz Int'L College Quiz I, Set A Sub: Financial Derivatives Semester: ViiiDocument2 pagesKshitiz Int'L College Quiz I, Set A Sub: Financial Derivatives Semester: ViiiUbraj NeupaneNo ratings yet

- Appendix A: Sample QuestionsDocument9 pagesAppendix A: Sample QuestionsYashNo ratings yet

- Ross12e Chapter25 TBDocument12 pagesRoss12e Chapter25 TBhi babyNo ratings yet

- Mock MCQ Test: Subject: International Financial Management (Ifm) Paper Code: Ms 221Document15 pagesMock MCQ Test: Subject: International Financial Management (Ifm) Paper Code: Ms 221Kiran TakaleNo ratings yet

- Chapter 4 - Q&ADocument19 pagesChapter 4 - Q&APro TenNo ratings yet

- Jaiib Sample QuestionsDocument4 pagesJaiib Sample Questionskubpyg100% (1)

- Exam1 BFDocument9 pagesExam1 BFTumaini JM100% (2)

- TYBvoc Equity & Derivatives Market University ExamDocument2 pagesTYBvoc Equity & Derivatives Market University ExamMilind PatilNo ratings yet

- FM Model Question PaperDocument10 pagesFM Model Question PaperSugandhaNo ratings yet

- Chapter 10 Review Questions NEW With SolutionsDocument5 pagesChapter 10 Review Questions NEW With SolutionschrisNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesJBNo ratings yet

- Investment Management.Document23 pagesInvestment Management.Ram IyerNo ratings yet

- MCQ2 0Document22 pagesMCQ2 0Numan AliNo ratings yet

- Chapter 9 Derivatives: Futures, Options, and Swaps: Multiple Choice QuestionsDocument34 pagesChapter 9 Derivatives: Futures, Options, and Swaps: Multiple Choice QuestionsKartikNo ratings yet

- SFM Objectives Unit 1 and 2 (MD)Document9 pagesSFM Objectives Unit 1 and 2 (MD)Anil GuptaNo ratings yet

- Financial DerivativesDocument3 pagesFinancial DerivativesUbraj NeupaneNo ratings yet

- KVVSCST, Adooor S5 Bba Investment Management Online Test PaperDocument2 pagesKVVSCST, Adooor S5 Bba Investment Management Online Test PaperTitus ClementNo ratings yet

- MCQs of Financial ManagementDocument21 pagesMCQs of Financial Managementettappan10No ratings yet

- NISM SERIES X-A Site Model PaperDocument4 pagesNISM SERIES X-A Site Model Paperssk1972100% (2)

- MCQ On International Finance MergedDocument25 pagesMCQ On International Finance MergedAjay AjayNo ratings yet

- CH 17Document0 pagesCH 17xxxthejobNo ratings yet

- NISM Equity Derivatives MCQsDocument4 pagesNISM Equity Derivatives MCQspearlksr82% (22)

- Jaiib Practice QuestionsDocument120 pagesJaiib Practice Questionsdivasg555No ratings yet

- Treasury and Investment Management Examination Sample ExaminationDocument5 pagesTreasury and Investment Management Examination Sample ExaminationQuynh Ngoc DangNo ratings yet

- International Economics, 7e (Husted/Melvin) Chapter 16 Foreign Exchange Risk, Forecasting, and International InvestmentDocument15 pagesInternational Economics, 7e (Husted/Melvin) Chapter 16 Foreign Exchange Risk, Forecasting, and International InvestmentLaraNo ratings yet

- Revised English Edition IC-34 QA - v1 3 - 8Document16 pagesRevised English Edition IC-34 QA - v1 3 - 8Rajendra UpadhyayNo ratings yet

- MCQ On International FinanceDocument13 pagesMCQ On International Financesalaf100% (3)

- Tybaf Sem 6 Sapm Sample QuestionsDocument11 pagesTybaf Sem 6 Sapm Sample QuestionsKrishna ParabNo ratings yet

- MBA 223 Financial Markets InstitutionsDocument15 pagesMBA 223 Financial Markets InstitutionsDragon BankNo ratings yet

- ISLAMIC BANKING II EXAMS For HND 1Document9 pagesISLAMIC BANKING II EXAMS For HND 1Monju GraceNo ratings yet

- Gat Subject Management Sciences Finance Mcqs1 50Document5 pagesGat Subject Management Sciences Finance Mcqs1 50Muhammad NajeebNo ratings yet

- Commercial Banking MCQsDocument8 pagesCommercial Banking MCQsaahmed459No ratings yet

- IC 38 Short Notes (2) 123Document1 pageIC 38 Short Notes (2) 123Anil KumarNo ratings yet

- Chapter Two Investment Alternatives Multiple Choice QuestionsDocument13 pagesChapter Two Investment Alternatives Multiple Choice QuestionsHashmi SutariyaNo ratings yet

- B) Karachi Stock ExchangeDocument24 pagesB) Karachi Stock Exchangeaashir chNo ratings yet

- Unit III TOPIC: - Forward and Futures Contracts: Meaning, Difference Between Forward and FuturesDocument12 pagesUnit III TOPIC: - Forward and Futures Contracts: Meaning, Difference Between Forward and FuturescammyNo ratings yet

- Sample QuestionsDocument36 pagesSample QuestionsAditya MishraNo ratings yet

- CSC Vol 1 Test 1 VB With SolutionsDocument7 pagesCSC Vol 1 Test 1 VB With Solutionschris100% (1)

- Insurance ExerciseDocument2 pagesInsurance ExerciseVeronicaGelfgren100% (3)

- Problem Set 2 - IFMPS2 (19SP) BKCDocument17 pagesProblem Set 2 - IFMPS2 (19SP) BKCLaurenNo ratings yet

- FinanceDocument13 pagesFinanceDuy Binh TranNo ratings yet

- IFS Question BankDocument2 pagesIFS Question Bankalizaidkhan1214No ratings yet

- (B) Expense RatioDocument11 pages(B) Expense RatioVirender RawatNo ratings yet

- Chapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketDocument9 pagesChapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketAsif HossainNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Florida Real Estate Exam Prep: Everything You Need to Know to PassFrom EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNo ratings yet

- Certificate of ParticipationDocument1 pageCertificate of ParticipationManjula B K AI002233No ratings yet

- Business Management (M-Com Based) - PD-33 58736Document11 pagesBusiness Management (M-Com Based) - PD-33 58736Manjula B K AI002233No ratings yet

- (M - Com - Based) BUSINESS MANAGEMENTDocument2 pages(M - Com - Based) BUSINESS MANAGEMENTManjula B K AI002233No ratings yet

- Faculty Assessemnt Form - 2023Document6 pagesFaculty Assessemnt Form - 2023Manjula B K AI002233No ratings yet

- MBA Syllabus 2020 21Document123 pagesMBA Syllabus 2020 21Manjula B K AI002233No ratings yet

- FACULTY CCEC August MonthDocument57 pagesFACULTY CCEC August MonthManjula B K AI002233No ratings yet

- ESR UG Courses 1Document1 pageESR UG Courses 1Manjula B K AI002233No ratings yet

- Unit 01 Notes (Uudd Final)Document23 pagesUnit 01 Notes (Uudd Final)Manjula B K AI002233No ratings yet

- Unit 02 Notes (Uuff Final)Document19 pagesUnit 02 Notes (Uuff Final)Manjula B K AI002233No ratings yet

- Unit 03 Notes (Uuddfinal)Document12 pagesUnit 03 Notes (Uuddfinal)Manjula B K AI002233No ratings yet

- Unit 04 Notes (Uudd Fibnal)Document5 pagesUnit 04 Notes (Uudd Fibnal)Manjula B K AI002233No ratings yet

- Mitc RupifiDocument13 pagesMitc RupifiKARTHIKEYAN K.DNo ratings yet

- Collateral Valuation and DocumentationDocument13 pagesCollateral Valuation and DocumentationWondmienehLgwNo ratings yet

- Master Circular On Investments by Primary (Urban) Co-Operative BanksDocument44 pagesMaster Circular On Investments by Primary (Urban) Co-Operative BanksNeo419No ratings yet

- Saptagiri Grameena Bank:: Head Office:: Chittoor Saptagiri Grameena Bank:: Head Office:: ChittoorDocument10 pagesSaptagiri Grameena Bank:: Head Office:: Chittoor Saptagiri Grameena Bank:: Head Office:: ChittoornanubalajagadeeshNo ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Banking Allied ServicesDocument11 pagesBanking Allied ServicesSrinivasula Reddy P100% (5)

- Mcqs 1Document2 pagesMcqs 1aashir chNo ratings yet

- Relief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationDocument1 pageRelief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationVassay KhaliliNo ratings yet

- Cfap 4 PKDocument300 pagesCfap 4 PKmuhammad osamaNo ratings yet

- FOFch 06Document175 pagesFOFch 06ferahNo ratings yet

- BPI v. Sarabia Manor1111Document3 pagesBPI v. Sarabia Manor1111Nadine Reyna CantosNo ratings yet

- Bank of AmericaDocument13 pagesBank of AmericaAnne-marie aubry83% (6)

- Ac Exam PDF For Ibps Clerk MainDocument234 pagesAc Exam PDF For Ibps Clerk MainSri KumarNo ratings yet

- Bank of BarodaDocument81 pagesBank of BarodalovelydineshNo ratings yet

- S&P500 Complete List PDFDocument3,401 pagesS&P500 Complete List PDFMacera FelipeNo ratings yet

- "Cash Management" at Indian Oil Corporation Ltd.Document49 pages"Cash Management" at Indian Oil Corporation Ltd.udpatel83% (6)

- Capital StructureDocument37 pagesCapital StructureIdd Mic-dadyNo ratings yet

- Documentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument3 pagesDocumentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested Answersrayjoshua12No ratings yet

- Statement Current yEAR KotakDocument19 pagesStatement Current yEAR KotakRikshawala 420100% (1)

- From Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeeDocument19 pagesFrom Wikipedia, The Free Encyclopedia This Article Is About The Currency. For Other Uses, See - "EUR" Redirects Here. For Other Uses, SeePrajwal AlvaNo ratings yet

- Budget at A GlanceDocument455 pagesBudget at A Glancesiddhsonu4uNo ratings yet

- Introduction To Corporate Finance 4Th Edition Booth Solutions Manual Full Chapter PDFDocument36 pagesIntroduction To Corporate Finance 4Th Edition Booth Solutions Manual Full Chapter PDFbarbara.wilkerson397100% (11)

- Giannini Final TranscriptDocument32 pagesGiannini Final Transcriptmlieb737No ratings yet

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Document39 pagesMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNo ratings yet

- Nilson ReportDocument12 pagesNilson Reporttsc databaseNo ratings yet

- Accounting Workbook Section 3 AnswersDocument30 pagesAccounting Workbook Section 3 AnswersAhmed Zeeshan83% (12)

- MBL922N 2013 6 E 1 - TestDocument16 pagesMBL922N 2013 6 E 1 - Testeugene123100% (1)

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- Palchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)Document19 pagesPalchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)SworajNo ratings yet

- FA Class SlidesDocument172 pagesFA Class Slidesjohn100% (1)