Professional Documents

Culture Documents

Practie-Test-For-Econ-121-Final-Exam 1

Practie-Test-For-Econ-121-Final-Exam 1

Uploaded by

mehdi karamiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practie-Test-For-Econ-121-Final-Exam 1

Practie-Test-For-Econ-121-Final-Exam 1

Uploaded by

mehdi karamiCopyright:

Available Formats

224) Lowery Food Market owns refrigeration equipment that cost $10,000 and has accumulated 224)

depreciation of $8,500. The company exchanges the equipment for new equipment worth $12,000.

In addition to the old equipment, the company pays $10,000 for the new equipment. Which of the

following is the correct entry to record the transaction?

A) Refrigeration equipment 12,000

Accumulated depreciation 8,500

Gain on exchange of equipment 500

Cash 10,000

Refrigeration equipment 10,000

B) Refrigeration equipment 11,000

Accumulated depreciation 8,500

Loss on exchange of equipment 500

Cash 10,000

Refrigeration equipment 10,000

C) Refrigeration equipment 11,500

Accumulated depreciation 8,500

Cash 10,000

Refrigeration equipment 10,000

D) None of the above

29

You might also like

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Task 5Document9 pagesTask 5Honey TolentinoNo ratings yet

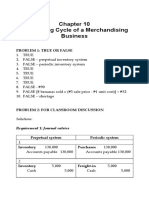

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Acctg. Equation Puring CompanyDocument8 pagesAcctg. Equation Puring CompanyAngelNo ratings yet

- Accounting EquationDocument2 pagesAccounting EquationSebastianNo ratings yet

- Ex 5Document9 pagesEx 5farahamin359No ratings yet

- Accounting Assigment 01 IndividualDocument2 pagesAccounting Assigment 01 IndividualOmari MaugaNo ratings yet

- Trial Balance Questions Chap 4 SolDocument8 pagesTrial Balance Questions Chap 4 Solgameppass22No ratings yet

- Ac Cost AccDocument4 pagesAc Cost AccAngelica Vera L. GuevaraNo ratings yet

- Homework Chapter 9Document15 pagesHomework Chapter 9Trung Kiên Nguyễn100% (1)

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument37 pagesChapter 10 Accounting Cycle of A Merchandising BusinessArlyn Ragudos BSA1No ratings yet

- Journal Entries: To Record The Sale of Land and BuildingDocument2 pagesJournal Entries: To Record The Sale of Land and BuildingJoshua FrondaNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Solution Job Order CostingDocument1 pageSolution Job Order Costingaiza eroyNo ratings yet

- Solution.: ST ND RD THDocument4 pagesSolution.: ST ND RD THhaggaiNo ratings yet

- Daf1201 Cost Accounting CatDocument3 pagesDaf1201 Cost Accounting CathaggaiNo ratings yet

- BE Chap 10Document4 pagesBE Chap 10TIÊN NGUYỄN LÊ MỸNo ratings yet

- Initial Cost of EquipmentDocument10 pagesInitial Cost of EquipmentRamin AminNo ratings yet

- Problem 7Document1 pageProblem 7Yixing XingNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- Any 20 Transactions of A Company (PGPMX2022-24, Batch 1, Avinash Sharma)Document7 pagesAny 20 Transactions of A Company (PGPMX2022-24, Batch 1, Avinash Sharma)Gaurav HiraniNo ratings yet

- Accounting Chap 9 - Sheet1Document4 pagesAccounting Chap 9 - Sheet1Nguyễn Ngọc MaiNo ratings yet

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- Integrated Accounting Assignment - Docx.1Document5 pagesIntegrated Accounting Assignment - Docx.1justinmajok8No ratings yet

- AdvDocument2 pagesAdvJhaNo ratings yet

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument40 pagesChapter 10 Accounting Cycle of A Merchandising BusinessOmelkhair YahyaNo ratings yet

- Additional Practical Problems-5Document3 pagesAdditional Practical Problems-5Ayush Kumar XIth classNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument5 pagesAcquisition and Disposition of Property, Plant, and Equipmenthosnearanaznin07No ratings yet

- Waltham Oil Solution Journal EntriesDocument4 pagesWaltham Oil Solution Journal EntriesVinayak SinglaNo ratings yet

- Chapter 7 Interm 1a Sol Man Millan (2019)Document20 pagesChapter 7 Interm 1a Sol Man Millan (2019)5555-899341No ratings yet

- 61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument17 pages61oq678rf - CD - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNo ratings yet

- 61oq678rf - CD - CHAPTER 10 - ACCTG CYCLE OF A MERCHANDISING BUSINESSDocument17 pages61oq678rf - CD - CHAPTER 10 - ACCTG CYCLE OF A MERCHANDISING BUSINESSLyra Mae De BotonNo ratings yet

- Accounts Sample Paper 04 0253b13ec1bb2Document48 pagesAccounts Sample Paper 04 0253b13ec1bb2opNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Profit and LossDocument5 pagesProfit and Losssudhi ravindranNo ratings yet

- ACC 101 - Financial Accounting and Reporting 1Document14 pagesACC 101 - Financial Accounting and Reporting 1Rc RocafortNo ratings yet

- Illustrative Example - Cash Flow StatementDocument6 pagesIllustrative Example - Cash Flow StatementNausheenNo ratings yet

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoNo ratings yet

- Integrated Accounting AssignmentDocument4 pagesIntegrated Accounting Assignmentjustinmajok8No ratings yet

- Final Output Cabiltes, Joielyn B SC199 053850Document8 pagesFinal Output Cabiltes, Joielyn B SC199 053850Joielyn CabiltesNo ratings yet

- FAR1 Solution ManualDocument4 pagesFAR1 Solution ManualChristian OliverosNo ratings yet

- I-11.03 StudentDocument4 pagesI-11.03 StudentDavid GuerraNo ratings yet

- 8 - Nonmonetary Transactions Problems With SolutionsDocument9 pages8 - Nonmonetary Transactions Problems With Solutionsbusiness docNo ratings yet

- HW Chap 9Document10 pagesHW Chap 9uong huonglyNo ratings yet

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- Accounting Equation (Practical Questions)Document5 pagesAccounting Equation (Practical Questions)AbhipsaNo ratings yet

- Problem Solving - Statement of Cash FlowDocument7 pagesProblem Solving - Statement of Cash FlowHossain AlmasNo ratings yet

- CostingDocument30 pagesCostingSanjana SharmaNo ratings yet

- Classification of CostsDocument6 pagesClassification of CostsKate Crystel reyesNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Accounting EquationsDocument3 pagesAccounting Equationsamitabhkumar1979No ratings yet

- JoneDocument2 pagesJoneMa. Joan ApolinarNo ratings yet

- Date Particulars DR CRDocument6 pagesDate Particulars DR CRRyll BedasNo ratings yet

- Chapter 12 AnsDocument31 pagesChapter 12 Ansdlne sarausNo ratings yet

- Case1: Exercise Number 1Document8 pagesCase1: Exercise Number 1Pearl Isabelle SudarioNo ratings yet

- GA 04042022 - QuestionDocument3 pagesGA 04042022 - QuestionSakamoto HiyoriNo ratings yet

- BoardPaper 2019 SolutionsDocument7 pagesBoardPaper 2019 Solutionskartik 011No ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- 1 The University of Texas at DallasDocument2 pages1 The University of Texas at Dallasmehdi karamiNo ratings yet