Professional Documents

Culture Documents

PARTNERHIP

Uploaded by

rosojanice080 ratings0% found this document useful (0 votes)

3 views2 pagesAnswer key

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnswer key

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesPARTNERHIP

Uploaded by

rosojanice08Answer key

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

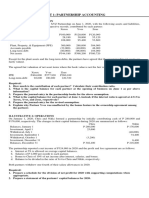

Apol, Bepol, and Cepol formed the ABC Partnership on Haidee and Irma are partners sharing profits

profits and losses

August 30, 2022, with the following assets measured at in the ratio of 60% and 40%, respectively. The

book values in their respective records, contributed by partnership balance sheet at August 30, 2018 foliows:

each partner:

Cash 9,720 Accounts payable 10,800

Apol Bepol Cepol Other assets 95,760 Haidee, Loan 4,680

Irma, Loan 7,200 Haidee, Capital 64,800

Cash 259,200.00 86,400.00 103,680.00

Irma, capital 32,400

Inventory 58,464.00 75,200.00 Total 112,680 112,680

At this date, Jessa was admitted as a partner for a

PPE 1,296,000.00 240,000.00 consideration of P35,100 cash for a 30% interest in

Totals 1,613,664.00 326,400.00 178,880.00 capital and in profits.

5. Assume Jessa is admitted by purchase of 30% each

of the original partners’ interest, determine how

A part of Apol’s cash contribution, P172,800, comes from the P35,100 will be apportioned to Haidee and

personal borrowings. Also, the PPE of Apol and Bepol are Irma, respectively.

mortgaged with the bank for P777,600 and P57,600,

respectively. The partnership is to assume responsibility 6. Assume Jessa is admitted by investing the P35,100

for these PPE mortgages. The fair value of the inventories to the partnership, determine the effects of any

contributed by Cepol is P73,440 while the PPE bonus over the capital balances of the original

contributed by Bepol at this date is P272,160. The partners:

partners have agreed to share profits and losses on a

5:2:3 ratio, to Apol, Bepol, and Cepol, respectively.

The following balances as at October 31, 2018 for the

1. What is the capital balance for each partner at the Partnership of Kiks, Leila, and Mimi were as follows:

opening of business on August 30, 2022?

2. What is the capital balance for each partner at Cash 50,000.00 Liabilities 15,000.00

August 30, 2022, instead, if the interest ration is Leila, Loan 15,000.00 Kiks, loan 22,500.00

given at 5:2:3 to Apol, Bepol, and Cepol, Non-cash assets 400,000.00 Kiks, capital 105,000.00

respectively? Leila, capital 97,500.00

Mimi,cap 225,000.00

Totals 465,000.00 465,000.00

On January 1, 2022, Eneru and Farah formed a

partnership by contributing cash of P324,000 and Kiks has decided to retire from the partnership on

P216,000, respectively. On February 1, 2022, Partner October 31. Partners agreed to adjust the non-cash

Eneru contributed an additional P108,000 cash to the assets to their fair market value of P490,000. The

partnership and on August 1, 2022 Partner Eneru made a estimated profit to October 31 is P100,000. Kiks will be

permanent withdrawal of P54,000. On May 1, 2022, paid P173,000 for her partnership interest inclusive of

Partner Farah contributed machinery with a fair market her loan which is repaid in full. Their profit and loss ratio

value of P72,000 and a net book value of P60,000 when is 3:3:4 to Kiks, Leila, and Mimi, respectively.

contributed. On November 1, 2022, Partner Farah

contributed an additional P36,000 cash to the 7. What will be the balance of Leila’s capital account

partnership. Both partners withdrew one-fourth of their after the retirement of Kiks.

salary allowances in 2022. The accounts of the partnership of XYZ at December 31,

The partnership reported a net income of P205,920 in 2022 are as follows:

2022 and the profit and loss agreement are as follows:

a. Interest at 6% is allowed on average capital balances: Cash 59,400.00 Liabilities 45,000.00

b. Salaries of P2,160 per month to each partner; Non-cash assets 524,700.00 Loan from Y 14,400.00

c. Bonus to Eneru of 10% net income after interest, Loan to X 10,800.00 X, Capital 148,500.00

salaries, and bonus; and Y, Capital 263,700.00

d. Balance to be divided in the ratio of 6:4 to Eneru and Z, Capital 123,300.00

Farah, respectively. Totals 594,900.00 594,900.00

They divide profit and losses 3:5:2 to X, Y, and Z,

3. Determine how the net income will be allocated to

respectively. They have decided to liquidate the

the partners.

partnership at this date.

4. Determine the capital balances of the partners at

December 31, 2022. 8. Determine the amount Partner X and Partner Y

would have received by the time Partner Z would

have received a cumulative amount of P32,400.

MARS and PAUTANG partnership’s balance sheet at

December 31, 2017, reported the following:

Total assets P 100,000

Total liabilities 20,000

Mars, capital 40,000

Pautang, capital 40,000

On January 2, 2018, MARS and PAUTANG dissolved their

partnership and transferred all assets and liabilities to a

newly formed corporation. At the date of incorporation,

the fair value of the net assets was P12,000 more than

the carrying amount on the partnership’s books. Of

which P7,000 was assigned to tangible assets and PS,000

was assigned to patent. MARS and PAUTANG were each

issued 5,000 shares of the corporation’s P1 par common

stock.

9. Immediately following incorporation, additional

paid-in Capital in excess of par should be credited

for ____________________.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Partnership Dissolution QuizDocument8 pagesPartnership Dissolution QuizLee SuarezNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Partnership-Accounting NotesDocument30 pagesPartnership-Accounting NotesCarl Dhaniel Garcia SalenNo ratings yet

- Partnership DrillDocument4 pagesPartnership DrillCelestiaNo ratings yet

- Prelim Exam - Special TopicsDocument9 pagesPrelim Exam - Special TopicsCaelah Jamie TubleNo ratings yet

- Pre Midterm AFAR PDFDocument12 pagesPre Midterm AFAR PDFDanielle Nicole Marquez100% (1)

- Reviewer From Prelim To FinalsDocument324 pagesReviewer From Prelim To FinalsRina Mae Sismar Lawi-an100% (1)

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- 15Qs-Partnership-Corporate Liquidation - 052406Document8 pages15Qs-Partnership-Corporate Liquidation - 052406Daniboy BalinawaNo ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Partnership Dissolution: QuizDocument5 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- MIDTERM EXAM SpecTransDocument7 pagesMIDTERM EXAM SpecTransEidel PantaleonNo ratings yet

- Acc114 H1Document4 pagesAcc114 H1EDELYN PoblacionNo ratings yet

- AFAR 1st Monthly AssessmentDocument6 pagesAFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Partnership Formation Problems SolvedDocument13 pagesPartnership Formation Problems Solvedmaria evangelistaNo ratings yet

- AFAR 1st Monhtly AssessmentDocument5 pagesAFAR 1st Monhtly AssessmentCriza MayNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Afar - Partnership, Corporate Liquadation & Home Office and BranchDocument31 pagesAfar - Partnership, Corporate Liquadation & Home Office and BranchMitch MinglanaNo ratings yet

- 1-Formation-1Document7 pages1-Formation-1martinfaith958No ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- Partnership Liquidation and Capital Account DistributionsDocument7 pagesPartnership Liquidation and Capital Account DistributionsMaria Beatriz Munda0% (1)

- AFAR Assessment October 2020Document8 pagesAFAR Assessment October 2020FelixNo ratings yet

- AFAR Summary Lecture (10 May 2021)Document30 pagesAFAR Summary Lecture (10 May 2021)Joanna MalubayNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- Partnership Liquidation and Capital Account CalculationsDocument4 pagesPartnership Liquidation and Capital Account Calculationskat kaleNo ratings yet

- Accounting Ae2023Document2 pagesAccounting Ae2023elsana philipNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDocument11 pagesPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Partnership FormationDocument9 pagesPartnership FormationRujean Salar AltejarNo ratings yet

- 1 - PDFsam - 01 Partnership - RetirementxxDocument9 pages1 - PDFsam - 01 Partnership - RetirementxxnashNo ratings yet

- ARTS CPA Review Multiple Choice ProblemsDocument3 pagesARTS CPA Review Multiple Choice ProblemsRuffa Mae MaldoNo ratings yet

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- 1st Yr Review Questions Parcor 1Document6 pages1st Yr Review Questions Parcor 1Rogen Dane GeneblazaNo ratings yet

- Partnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesDocument2 pagesPartnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesJohn BryanNo ratings yet

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- Partnership Dissolution & LiquidationDocument15 pagesPartnership Dissolution & LiquidationJean Ysrael Marquez50% (4)

- Joint arrangement profit calculation and settlementDocument3 pagesJoint arrangement profit calculation and settlementMaurice AgbayaniNo ratings yet

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- Week 6 NotesDocument7 pagesWeek 6 NotescalebNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Еduсаtiоn of Patriotism in the Russian Lаnguаgе Lеssоns in Pеdаgоgiсаl UniversitiesDocument4 pagesЕduсаtiоn of Patriotism in the Russian Lаnguаgе Lеssоns in Pеdаgоgiсаl UniversitiesResearch ParkNo ratings yet

- Santiago V SantiagoDocument6 pagesSantiago V SantiagoKenmar NoganNo ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormYCMOUNo ratings yet

- Non Individual REKYCDocument15 pagesNon Individual REKYCDeepankar SinghNo ratings yet

- 4 - Security Transactions - Guranty - SuretyDocument16 pages4 - Security Transactions - Guranty - SuretyAlexandraSoledadNo ratings yet

- Hire Purchase AgreementDocument16 pagesHire Purchase AgreementKweku JnrNo ratings yet

- Sagrado vs. NacocoDocument5 pagesSagrado vs. NacocoMark PeruNo ratings yet

- Herminio de Guzman v. Tabangao Realty IncorpDocument2 pagesHerminio de Guzman v. Tabangao Realty IncorpKara Russanne Dawang AlawasNo ratings yet

- in Re Alvarado v. Gaviola, JR., G.R. No. 74695, (September 14, 1993) )Document7 pagesin Re Alvarado v. Gaviola, JR., G.R. No. 74695, (September 14, 1993) )yasuren2No ratings yet

- International Chamber of Commerce (I.C.C.) Non-Circumvention, Non-Disclosure Working AgreementDocument2 pagesInternational Chamber of Commerce (I.C.C.) Non-Circumvention, Non-Disclosure Working Agreementfabrizio ballesiNo ratings yet

- Contract of Gift HibaDocument11 pagesContract of Gift Hibahina ranaNo ratings yet

- Eastern Shipping Lines Presumption of Death CaseDocument10 pagesEastern Shipping Lines Presumption of Death Caseshookt panboiNo ratings yet

- Lapuz-Sy vs. EufemioDocument5 pagesLapuz-Sy vs. EufemioAnna BautistaNo ratings yet

- Blackstone BREIT Notice To StockholdersDocument3 pagesBlackstone BREIT Notice To StockholdersZerohedgeNo ratings yet

- FIDIC Forms of Contract See Major Changes in 2017 White Book EditionDocument14 pagesFIDIC Forms of Contract See Major Changes in 2017 White Book EditionGopalakrishnan SekharanNo ratings yet

- Valuation Support Services (VSS) Appraiser Panel AgreementDocument10 pagesValuation Support Services (VSS) Appraiser Panel AgreementFrank GregoireNo ratings yet

- The Motor Vehicles Act, 1988 (Contd.) : (Section 140 To 217-A)Document66 pagesThe Motor Vehicles Act, 1988 (Contd.) : (Section 140 To 217-A)Matto MNo ratings yet

- Yellow Book 4ed 2013Document122 pagesYellow Book 4ed 2013Hari Singh100% (2)

- Agent To Agent Agreement Form IDocument3 pagesAgent To Agent Agreement Form IAhmedNadeemNo ratings yet

- Summary Dato JagindarDocument2 pagesSummary Dato Jagindarlaiyyeen75% (8)

- Brook Robertson 39 S Essentials - Boom-Chick Fingerstyle EtudesDocument52 pagesBrook Robertson 39 S Essentials - Boom-Chick Fingerstyle Etudestopotara palu100% (2)

- Application For Payment of Gratuity (In Case of Death)Document2 pagesApplication For Payment of Gratuity (In Case of Death)Tahir SajjadNo ratings yet

- Dela Merced v. Dela MercedDocument2 pagesDela Merced v. Dela MercedKaren Ryl Lozada Brito100% (1)

- Labour Court CasesDocument10 pagesLabour Court Casest bhavanaNo ratings yet

- Documents During Car Sale1Document11 pagesDocuments During Car Sale1Paras ShardaNo ratings yet

- DEED OF SALE OF MOTOR VEHICLE - TemplateDocument1 pageDEED OF SALE OF MOTOR VEHICLE - Templatepuroy kempisNo ratings yet

- Ubiquitous Listening Affect Attention and Distributed SubjectivityDocument20 pagesUbiquitous Listening Affect Attention and Distributed SubjectivityErnesto FreieNo ratings yet

- Differences of Remedies For Breach of Contract in Cisg and VN LawDocument6 pagesDifferences of Remedies For Breach of Contract in Cisg and VN LawCu Thi Hong NhungNo ratings yet

- Cundy V LindsayDocument2 pagesCundy V LindsayNguyễn HuyềnNo ratings yet

- Materi 13 Patents Intellectual Property UlrichDocument22 pagesMateri 13 Patents Intellectual Property UlrichDiza AmeliaNo ratings yet