Professional Documents

Culture Documents

Quiz No. 3

Uploaded by

Jeric IsraelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz No. 3

Uploaded by

Jeric IsraelCopyright:

Available Formats

Special Journals

The General Journal is the record used to record unusual or infrequent

types of transactions. Type of entries normally made in the general journal

are depreciation entries, correcting entries, and adjusting and closing

entries.

The Cash Payments Journal is a special journal that is used to record all

cash that is paid out by a business except for payroll. Columns are set up for

types of transactions that occur frequently enough to warrant a separate

column. Some examples are Accounts Payable (Payments on Purchases and

Services Charged) and Cash Purchases.

The Cash Receipts Journal is a special journal that is used to record all

receipts of cash. Columns are set up that indicate the sources of the cash.

Two of the major sources of cash for a business are Cash Sales and

Collections of Customer Charge Sales. These and other categories that have

a lot of activity (transactions) have their own column.

The Sales Journal is a special journal where sales of services and

merchandise made on account (business's customer is allowed to charge

purchases) are recorded.

The Purchases Journal is a special journal that is used to record all

purchases and various expenses and other charges from suppliers that a

business has an open account with (supplier allows the business to charge

purchases).

The Purchase Returns & Allowances Journal is a special journal that is

used to record the returns and allowances of merchandise purchased on

account.

Instructions:

Select the appropriate Special Journal to record the following transactions:

SALES JOURNAL

PURCHASES JOURNAL

CASH RECEIPTS JOURNAL

CASH DISBURSEMENT JOURNAL

GENERAL JOURNAL

1. OWNER INVESTMENT CASH (PERSONAL CHECK) IN HIS /HER BUSINESS.

2. PURCHASE OFFICE FURNITURE WITH A CHECK.

3. SOLD PRODUCT FOR CASH

4. PURCHASED PRODUCT TO RESELL PN 30 DAY OPEN ACCOUNT (CREDIT)

5. SOLD PRODUCT TO A CUSTOMER ON ACCOUNT- 10 DAY PAYMENT TERMS.

6. RECEIVED AN INVOICE WITH 30 DAY TERM FROM SUPPLIER FOR ADVERTISING

7. CHECK WRITTEN TO OWNER FOR PERSONAL LIVING EXPENSES

8. Prepared and mailed out Purchase Order to a products supplier.

9. Received and recorded monthly phone bill with 10-day credit terms.

10. Received and paid (wrote) check for utility bill.

11. Recorded depreciation expense for the period.

12. Issued a debit memo to a supplier for some defective products

returned.

13. Received and recorded invoice with credit terms of 10 days for

gasoline purchases for the period.

14. Received an invoice and wrote check for equipment repairs.

15. Wrote checks to pay employees payroll liability.

16. Purchase of plant for business for cash.

17. Purchase of patents of credit.

18. Purchase of goods on credit.

19. Purchase of goods on credit.

20. Sale of old furniture on credit.

21. Sale of office building on cash.

TRUE OR FALSE

22. Credit purchases of goods are recorded in purchase journal.

23. Credit sales of goods are recorded in Sales journal.

24. Credit purchases of machinery are to be recorded in proper journal.

25. Cash purchases of furniture and fixture are to be recorded in purchase journal.

26. Credit note is the basis of recording purchase returns book (journal).

27. Debit note is the basis of recording sale returns book (journal).

28. Invoice is the basis for recording cash disbursement book (journal).

29. Outward invoice is the basis for recording sales journal book (journal).

30. rare transactions which do not fall within the scope of special journals are recorded in

General journal

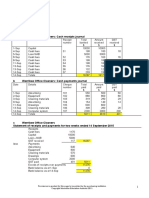

fill in the blank: DEBIT OR CREDIT

1. The total of purchases journal is posted to the ______ of purchases account.

2. The total of sales journal is posted to the ______ of sales account.

3. The total of purchases journal is posted to the ______ of purchases returns account

4. The total of sales returns journal is posted to the ______ of sales returns account.

5. The entries in the purchases journal are posted to the ______ of creditors account.

6. The entries in the sales journal are posted to the ______ of debtors account.

7. The entries in the purchases returns journal are posted to the ______ of creditors account.

8. The entries in the sales returns journal are posted to the ______ of debtors account.

You might also like

- Chapter 9Document10 pagesChapter 9Kanton FernandezNo ratings yet

- Far 6-12Document38 pagesFar 6-12Lisel SalibioNo ratings yet

- Topic 2 Special JournalsDocument6 pagesTopic 2 Special JournalsCunanan, Malakhai JeuNo ratings yet

- Special and Combination JournalsDocument8 pagesSpecial and Combination Journalsreagan blaireNo ratings yet

- 4 Special Journal UDDocument33 pages4 Special Journal UDERICK MLINGWA100% (1)

- Subsidiary BooksDocument7 pagesSubsidiary BooksADEYANJU AKEEMNo ratings yet

- Books of AccountsDocument18 pagesBooks of AccountsFrances Marie TemporalNo ratings yet

- Double Entry Recording ProcessDocument4 pagesDouble Entry Recording ProcessOlugbodi EmmanuelNo ratings yet

- CHAPTER 1. Books of Original EntryDocument10 pagesCHAPTER 1. Books of Original Entryiisjaffer100% (3)

- Ch-4 Subsidiary BooksDocument10 pagesCh-4 Subsidiary BooksRujhan KhandelwalNo ratings yet

- Computer Applications For Business 215012301297Document4 pagesComputer Applications For Business 215012301297Shobhita AgarwalNo ratings yet

- Purchase JournalDocument6 pagesPurchase JournalScarlett ReinNo ratings yet

- Unit # 9 Books of AccountsDocument81 pagesUnit # 9 Books of AccountsZaheer Ahmed SwatiNo ratings yet

- Chapter 5 - Accounting SysteDocument84 pagesChapter 5 - Accounting SysteZee waqarNo ratings yet

- EntrepDocument1 pageEntrepJho MalditahNo ratings yet

- FABM 1 - Contextualized LAS - Quarter 2 - Week 2Document7 pagesFABM 1 - Contextualized LAS - Quarter 2 - Week 2Sheila Marie Ann Magcalas-GaluraNo ratings yet

- Accounts Theory NotesDocument3 pagesAccounts Theory Notesvihaajain050209No ratings yet

- Voucher System, Special Journals, and Subsidiary LedgersDocument9 pagesVoucher System, Special Journals, and Subsidiary LedgersCatherine Calero50% (2)

- Accounting Notes On LedgersDocument3 pagesAccounting Notes On LedgersAlisha shenazNo ratings yet

- Subsidiary Book PDFDocument8 pagesSubsidiary Book PDFSwathi ShekarNo ratings yet

- Revenue and Expense RecognitionDocument27 pagesRevenue and Expense RecognitioncskNo ratings yet

- Books of Original EntriesDocument21 pagesBooks of Original EntriesMohamed Adil GibreelNo ratings yet

- 5 6172302118171443571 PDFDocument4 pages5 6172302118171443571 PDFPavan RaiNo ratings yet

- Assignment 4Document5 pagesAssignment 4Ritika ChoudharyNo ratings yet

- Lecture, Chap. 5Document5 pagesLecture, Chap. 5Moshe FarzanNo ratings yet

- Sources, Records and Books of Prime EntryDocument13 pagesSources, Records and Books of Prime EntryMuhammad Zubair Younas100% (2)

- 8 Books of Prime Entry - SaudDocument28 pages8 Books of Prime Entry - SaudMariam AhmedNo ratings yet

- Periodic PerpetualDocument25 pagesPeriodic PerpetualNunung Nurul100% (1)

- Fabm2 Q2 M4 - 4 CsefDocument20 pagesFabm2 Q2 M4 - 4 CsefZeus MalicdemNo ratings yet

- Lesson 1 - Accounting Cycle of A Merchandising BusinessDocument27 pagesLesson 1 - Accounting Cycle of A Merchandising Businessdenise andalocNo ratings yet

- Chapter 9 Lecture Notes 2Document11 pagesChapter 9 Lecture Notes 2Hannah Pauleen G. LabasaNo ratings yet

- Powerpoint Journal Ledger and Trial BalanceDocument40 pagesPowerpoint Journal Ledger and Trial BalanceChris Iero-Way100% (1)

- Special Journals Lecture No. 6Document25 pagesSpecial Journals Lecture No. 6Yuu100% (1)

- Module 11 - Accounting Cycle For Merchandising BusDocument29 pagesModule 11 - Accounting Cycle For Merchandising Busgerlie gabriel100% (1)

- Part 2 - AccDocument9 pagesPart 2 - AccSheikh Mass JahNo ratings yet

- Lecture 3.1 - Recording Events and TransactionsDocument41 pagesLecture 3.1 - Recording Events and TransactionsVivien NgNo ratings yet

- Basic Accounting Concepts: The Entity ConceptDocument56 pagesBasic Accounting Concepts: The Entity ConceptUttam Kr Patra100% (3)

- Bainte1l Quiz 3 Final Period 1trisem 2022-2023Document14 pagesBainte1l Quiz 3 Final Period 1trisem 2022-2023chen.lauriadaNo ratings yet

- Books of Original Entry-1Document3 pagesBooks of Original Entry-1Cindy LakhramNo ratings yet

- Financial Accounting (1st Year)Document18 pagesFinancial Accounting (1st Year)RohitNo ratings yet

- Dip IFR Foundation Text BookDocument59 pagesDip IFR Foundation Text Bookmay466611No ratings yet

- Accounting For Merchand ch3Document14 pagesAccounting For Merchand ch3Ealshady HoneyBee Work Force100% (1)

- Handouts Session 4Document5 pagesHandouts Session 4Allaisa Mae JacobNo ratings yet

- Books of Prime Entry: What Are They?Document6 pagesBooks of Prime Entry: What Are They?Lin Latt Wai AlexaNo ratings yet

- Principle of Accounting Notes PDFDocument22 pagesPrinciple of Accounting Notes PDFFahad Rizwan75% (4)

- Trading and Profit Loss AccountDocument8 pagesTrading and Profit Loss AccountOrange Noida100% (1)

- Books of Original EntriesDocument27 pagesBooks of Original EntriesfunnkyarulNo ratings yet

- Complete) Fundamentals of Accounting Theory and Practice 1B: Sheet1Document16 pagesComplete) Fundamentals of Accounting Theory and Practice 1B: Sheet1Wendelyn JimenezNo ratings yet

- Chapter Three Accounting Cycle For Merchandising BusinessDocument16 pagesChapter Three Accounting Cycle For Merchandising BusinessBrhane WeldegebrialNo ratings yet

- Source: 1. Sales JournalDocument3 pagesSource: 1. Sales JournalDonita SotolomboNo ratings yet

- Practice QuizDocument3 pagesPractice QuizLing lingNo ratings yet

- Books of AccountsDocument31 pagesBooks of AccountsFerly Mae ZamoraNo ratings yet

- Control AccountsDocument8 pagesControl AccountsAejaz MohamedNo ratings yet

- Accounting For Merchandising BusinessDocument20 pagesAccounting For Merchandising BusinessJen RossNo ratings yet

- Auditing Report Final AnishDocument30 pagesAuditing Report Final AnishA. SheikNo ratings yet

- AE 21 Lesson 7: Review On Special, Combination Journals and Voucher SystemDocument14 pagesAE 21 Lesson 7: Review On Special, Combination Journals and Voucher SystemGlenda LinatocNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 6 Accounting For Merchandising Businesses PDFDocument130 pagesTest Bank Accounting 25th Editon Warren Chapter 6 Accounting For Merchandising Businesses PDFAverose Bautista100% (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Marketing Strategy Term PaperDocument11 pagesMarketing Strategy Term PaperBirhanuNo ratings yet

- Installment Sales AccountingDocument9 pagesInstallment Sales AccountingCillian ReevesNo ratings yet

- Topic 4Document3 pagesTopic 4Аня Б.No ratings yet

- Pesentacion en Israel-Centro-PueblaDocument18 pagesPesentacion en Israel-Centro-PueblaGabriel HayonNo ratings yet

- PBO - Lecture 01 - Introduction To Business OperationsDocument5 pagesPBO - Lecture 01 - Introduction To Business OperationskevorkNo ratings yet

- ALL GOLD OFFERS June 2021-1-1Document15 pagesALL GOLD OFFERS June 2021-1-1Lin Chris100% (1)

- Renewables Atlas FinalDocument128 pagesRenewables Atlas FinalOrtegaYONo ratings yet

- Project Report: Recruitment and SelectionDocument34 pagesProject Report: Recruitment and SelectionGurusaran SinghNo ratings yet

- Production/Operations ManagementDocument97 pagesProduction/Operations Managementdinesh0014No ratings yet

- Eric Mugume's Egg Production EnterpriseDocument47 pagesEric Mugume's Egg Production EnterpriseInfiniteKnowledge94% (35)

- LG Quadoor Marketing PlanDocument33 pagesLG Quadoor Marketing Planzakirabbass100% (2)

- FIN533 Individual AssignmentDocument16 pagesFIN533 Individual AssignmentHasya AuniNo ratings yet

- 2022.03.03 - Toda - Murata (OP1 - SLD3 Glass) - Xoa FixDocument14 pages2022.03.03 - Toda - Murata (OP1 - SLD3 Glass) - Xoa FixHiếu NguyễnNo ratings yet

- Arabnet - KFAS - Hospitality Publication - ENDocument27 pagesArabnet - KFAS - Hospitality Publication - ENEdmond DsilvaNo ratings yet

- Gap Report 2023Document39 pagesGap Report 2023David De La CruzNo ratings yet

- Kotak Mahindra BankDocument36 pagesKotak Mahindra BankAkshat SoniNo ratings yet

- Dwnload Full Operations and Supply Chain Management For Mbas 6th Edition Meredith Test Bank PDFDocument25 pagesDwnload Full Operations and Supply Chain Management For Mbas 6th Edition Meredith Test Bank PDFavosetmercifulmww7100% (11)

- 11 Accountancy English 2020 21Document376 pages11 Accountancy English 2020 21Tanishq Bindal100% (1)

- WalletOne Franchise v7Document14 pagesWalletOne Franchise v7Marianna DereviankoNo ratings yet

- Organisational Change NotesDocument12 pagesOrganisational Change NotesKyuubiKittyNo ratings yet

- Intro To Equinix - IR - Presentation Q3 23 10.29.2023Document46 pagesIntro To Equinix - IR - Presentation Q3 23 10.29.2023alexcmorton2No ratings yet

- Work It Daily - Resume DRODocument2 pagesWork It Daily - Resume DRODan OlburNo ratings yet

- Assignment 6 RORDocument7 pagesAssignment 6 RORKHANSA DIVA NUR APRILIANo ratings yet

- My Trading PlanDocument4 pagesMy Trading PlanEdrinanimous AnandezNo ratings yet

- Enterpreneurship and Small Business DevelopmentDocument17 pagesEnterpreneurship and Small Business DevelopmentBasil AugustineNo ratings yet

- Ebook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFDocument68 pagesEbook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFShannonRussellapcx100% (13)

- IKEADocument14 pagesIKEADindz SurioNo ratings yet

- MarketingDocument29 pagesMarketingMOHAMAD FERDIANSYAH ARIFIN BIN OMER SA'AIB STUDENTNo ratings yet

- Exercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDocument9 pagesExercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDoan Chan PhongNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet