Professional Documents

Culture Documents

Ally Bank Direct Deposit Form

Ally Bank Direct Deposit Form

Uploaded by

kelsey.frost0 ratings0% found this document useful (0 votes)

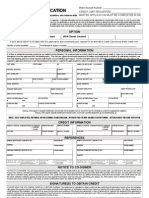

44 views1 pageThis document is a direct deposit form that provides instructions for setting up or switching direct deposit with an employer. It requests the employee's information as well as their Ally checking and savings account information if they want their paycheck deposited into multiple accounts. The employee authorizes their employer to deposit their earnings into their Ally accounts based on the specified amounts or percentages. It should take 1-2 payment cycles for direct deposit to be set up.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a direct deposit form that provides instructions for setting up or switching direct deposit with an employer. It requests the employee's information as well as their Ally checking and savings account information if they want their paycheck deposited into multiple accounts. The employee authorizes their employer to deposit their earnings into their Ally accounts based on the specified amounts or percentages. It should take 1-2 payment cycles for direct deposit to be set up.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views1 pageAlly Bank Direct Deposit Form

Ally Bank Direct Deposit Form

Uploaded by

kelsey.frostThis document is a direct deposit form that provides instructions for setting up or switching direct deposit with an employer. It requests the employee's information as well as their Ally checking and savings account information if they want their paycheck deposited into multiple accounts. The employee authorizes their employer to deposit their earnings into their Ally accounts based on the specified amounts or percentages. It should take 1-2 payment cycles for direct deposit to be set up.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

DIRECT DEPOSIT FORM

Here’s the information you’ll need to set up or switch your direct deposit. Check with your employer to see if they

have a direct deposit form. If they don’t, you can fill out this form and give it to your employer.

Plan ahead: It should take 1-2 payment cycles to set up your deposit.

Deposit split: Consider planning for future savings by splitting your direct deposit between savings and checking.

Employee Information

NAME

EMPLOYEE ID

ADDRESS

PHONE

Ally Account Information

Ally Checking Account Ally Savings Account

ACCOUNT NUMBER ACCOUNT NUMBER

ROUTING / TRANSIT NUMBER ROUTING / TRANSIT NUMBER

124003116 124003116

Amount to Deposit Amount to Deposit

PERCENTAGE DOLLAR AMOUNT PERCENTAGE DOLLAR AMOUNT

% OR $ % OR $

Account Agreement

ACCEPTANCE OF TERMS AND CONDITIONS

I authorize _______________________________ to initiate automatic credit entries to my account(s), listed above,

at Ally Bank. I also authorize _______________________________ to initiate debit entries from my account(s), if

necessary, in the event a credit entry is made in error. Any previous authorization is replaced by this authorization,

which will remain in full force and effect until ____________________________ receives a written cancellation notice

from me or Ally Bank, in such time to provide both the company and depository a reasonable opportunity to act.

SIGNATURE DATE

Ally Bank, Member FDIC

Questions? Call 1-877-247-2559 or visit ally.com

UPDATED 10/2021

You might also like

- Account Opening DisclosuresDocument7 pagesAccount Opening Disclosures4cydfngkt9No ratings yet

- Account Opening DisclosuresDocument9 pagesAccount Opening DisclosuresEAZY CHARNo ratings yet

- Dave Banking Direct Deposit Enrollment FormDocument1 pageDave Banking Direct Deposit Enrollment FormDavid HannaganNo ratings yet

- Account Opening DisclosuresDocument8 pagesAccount Opening Disclosuresitsadozie2No ratings yet

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday Checkingbaga ibakNo ratings yet

- Direct DepositsDocument1 pageDirect Depositsken frostNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormRogers KevinnNo ratings yet

- Edna Unzueta: Direct Deposit Enrollment FormDocument1 pageEdna Unzueta: Direct Deposit Enrollment FormAll Result BD 2019No ratings yet

- Wells Fargo Clear Access BankingDocument4 pagesWells Fargo Clear Access Bankingiimoadi333No ratings yet

- Bank Verification: This Section To Be Completed by Financial InstitutionDocument2 pagesBank Verification: This Section To Be Completed by Financial InstitutionKierbien Kile GarciaNo ratings yet

- 真实的富国账单 020722 WellsFargoDocument3 pages真实的富国账单 020722 WellsFargoZheng YangNo ratings yet

- StatementDocument4 pagesStatementVortax IncNo ratings yet

- WellsFargo StatementDocument4 pagesWellsFargo StatementVõ Quốc CôngNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Wells Fargo Everyday Checking: Important Account InformationDocument3 pagesWells Fargo Everyday Checking: Important Account InformationbridenstinenildaNo ratings yet

- Direct Deposit Download Form - WSFCSDocument1 pageDirect Deposit Download Form - WSFCSemily.fellinnNo ratings yet

- Checking and Savings ApplicationDocument15 pagesChecking and Savings Applicationolatunjioluwatobi66No ratings yet

- Direct Deposit FormDocument3 pagesDirect Deposit FormSreenivas RaoNo ratings yet

- Document PDFDocument3 pagesDocument PDFsawadogojustinNo ratings yet

- Direct Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositDocument1 pageDirect Deposit of Other Income: Please Establish Direct Deposit or Change Account Used For Direct DepositXquisiteNo ratings yet

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Document2 pagesAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit Formandrewdallas948No ratings yet

- Pass 114232 Mg-DirectdebitDocument2 pagesPass 114232 Mg-DirectdebitJoseph GetachewNo ratings yet

- IRA Contribution and RolloverDocument4 pagesIRA Contribution and Rolloverja leeNo ratings yet

- What You Need To Know About Overdrafts and Overdraft FeesDocument1 pageWhat You Need To Know About Overdrafts and Overdraft Feesmetreus30No ratings yet

- Easy Checking SnapshotDocument2 pagesEasy Checking SnapshotsupportNo ratings yet

- Info: Your Loan Status and Repayment ScheduleDocument3 pagesInfo: Your Loan Status and Repayment ScheduleFrank RoseNo ratings yet

- Overdraft Protection Service Request: P.O. Box 15966, Sacramento, CA 95826-0966Document1 pageOverdraft Protection Service Request: P.O. Box 15966, Sacramento, CA 95826-0966lucy.martinez800500No ratings yet

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- Nahwu at - Tatbiiqiy. TcsDocument2 pagesNahwu at - Tatbiiqiy. TcsBest channelNo ratings yet

- 01 Co Maker StatementDocument1 page01 Co Maker Statementdjem38No ratings yet

- 06-2010 VISA Application 06-2010Document2 pages06-2010 VISA Application 06-2010tredway01100% (2)

- Loan Restructuring App FormDocument3 pagesLoan Restructuring App FormLilibeth Allosada LapathaNo ratings yet

- Danta Health Bank Statement 04.30.10Document3 pagesDanta Health Bank Statement 04.30.10Prasenjit SahaNo ratings yet

- Direct Deposit Enrollment FormDocument2 pagesDirect Deposit Enrollment Formmirza.adeelNo ratings yet

- Nach ECS Direct Debit Mandate Instruction FormDocument2 pagesNach ECS Direct Debit Mandate Instruction Formsiva nunnaNo ratings yet

- Scan Doc0005Document1 pageScan Doc0005chikenbone420No ratings yet

- Latoya BradfordDocument1 pageLatoya Bradfordalexandresamantha84No ratings yet

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocument4 pagesCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNo ratings yet

- Chapter 7 - Bank Reconciliation StatementDocument24 pagesChapter 7 - Bank Reconciliation StatementNoor MahmoodNo ratings yet

- DirectDepositEnrollmentForm-April112022 23322760Document1 pageDirectDepositEnrollmentForm-April112022 23322760Derrick MorrisonNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- Calsia AccDocument12 pagesCalsia AccThabang MafiriNo ratings yet

- Direct Deposit / Automatic Payment: Set-Up GuideDocument2 pagesDirect Deposit / Automatic Payment: Set-Up GuideMaykol MorenoNo ratings yet

- Ada Form DownloadDocument1 pageAda Form DownloadDona DolorzoNo ratings yet

- Document 2Document5 pagesDocument 2Alessandra CecíliaNo ratings yet

- KPF Direct-Deposit-Form v2Document1 pageKPF Direct-Deposit-Form v2Jacqueline O'ConnellNo ratings yet

- Metrobank ADA Form PDFDocument1 pageMetrobank ADA Form PDFMichelle FelloneNo ratings yet

- Understanding A Check and Balancing A Checkbook - MyCreditUnion - GovDocument3 pagesUnderstanding A Check and Balancing A Checkbook - MyCreditUnion - GovCidália FonsecaNo ratings yet

- Cardmember Agreement Rates and Fees TableDocument15 pagesCardmember Agreement Rates and Fees TableMatt D FNo ratings yet

- Payment Schedule Homecredit Copy: Loan Account Number: 3802605743Document2 pagesPayment Schedule Homecredit Copy: Loan Account Number: 3802605743ablaza abigailNo ratings yet

- Business Credit App 0Document12 pagesBusiness Credit App 0Kent WhiteNo ratings yet

- PayOptionsDirectDeposit (E1993) PDFDocument1 pagePayOptionsDirectDeposit (E1993) PDFBrenda DeeNo ratings yet

- eyJpdiI6ImlURytlY2w5N3h0VXB3RVowM0pTeWc9PSIsInZhbHVlIjoiVXVQTnErUlFKUjFKOEVZZEFRN21KQT09IiwibWFjIjoiYmE1MTdmZmYyNzQ4OTgwZWZlOWIwY2ExNTBhMmRiMDliMTA3YzIwOTZlZTZjMzNiMTQ3N2ViZmVhM2E3MGUzNSJ9Document2 pageseyJpdiI6ImlURytlY2w5N3h0VXB3RVowM0pTeWc9PSIsInZhbHVlIjoiVXVQTnErUlFKUjFKOEVZZEFRN21KQT09IiwibWFjIjoiYmE1MTdmZmYyNzQ4OTgwZWZlOWIwY2ExNTBhMmRiMDliMTA3YzIwOTZlZTZjMzNiMTQ3N2ViZmVhM2E3MGUzNSJ9GlendaNo ratings yet

- Installment Loan Agreement: Itemization of Amount FinancedDocument1 pageInstallment Loan Agreement: Itemization of Amount FinancedaaNo ratings yet

- Interest Rates and Interest Charges: Important DisclosuresDocument5 pagesInterest Rates and Interest Charges: Important DisclosuresataraNo ratings yet

- DDformDocument1 pageDDformardipunk49No ratings yet

- Generic Form Preview DocumentDocument1 pageGeneric Form Preview Documentelena.69.mxNo ratings yet