Professional Documents

Culture Documents

Chapter 02 Introduction

Uploaded by

Nazneen SabinaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 02 Introduction

Uploaded by

Nazneen SabinaCopyright:

Available Formats

CAMS STUDY GUIDE

Chapter Content 26%

1 Risks and Methods of Money Laundering and Terrorist Financing

25%

2 International AML/CFT Standards

28%

3 AML/CFT Compliance Programs

21%

4 Conducting and Responding to investigation

M A Islam, CDCS, CSDG, CAMS Compliance Route

CAMS STUDY GUIDE

2 International AML/CFT Standards

Financial Action Task Force

Basel Committee on Banking Supervision

European Union Directives on Money Laundering

FATF-Style Regional Bodies

Egmont Group of Financial Intelligence Units

Wolfsberg Group

World Bank and IMF

USA PATRIOT Act

Office of Foreign Assets Control

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

Financial Action Task Force

What is It?

Intergovernmental body with 35 member countries and 2

international organizations

Sets money laundering and terrorist financing standards

Important Documents

40 Recommendations on ML and TF (Last updated

February 2012)

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

Basel Committee on Banking Supervision

What is It?

Established by the central bank governors of the G-10

Promotes sound supervisory standards worldwide

Important Documents

Customer Due Diligence for Banks Paper (2001)

General Guide to Account Opening and Customer

Identification (2003, updated 2016)

Consolidated KYC Risk Management Paper (2004, updated

2016)

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

European Union

What is It?

A politico-economic union of 28 member states that are located

primarily in Europe

Issues AML/CFT directives regarding legislation that member

states must issue to prevent their domestic financial systems

being used for money laundering and terrorist financing

Important Documents

1st EU Directive (1991)

2nd EU Directive (2001)

3rd EU Directive (2005)

4th EU Directive (2015)

5th EU Directive (2018)

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

Wolfsberg Group

What is It?

Association of 13 global banks

Aims to develop standards on money laundering controls

for banks

Important Documents

AML Principles for Private Banking (2012)

The Suppression of the TF Guidelines (2002)

AML Principles for Correspondent Banking (2014)

M A Islam, CDCS, CSDG, CAMS Compliance Route

The Wolfsberg Group is an association of 13 global banks

Banco Santander Goldman Sachs

Bank of Tokyo-Mitsubishi

HSBC

Bank of America

J.P. Morgan Chase

Barclays

SCB

Citigroup

Société Générale

Credit Suisse

Deutsche Bank UBS

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

Egmont Group

What is It?

Informal networking group of financial intelligence units

international organizations Sets money laundering and

terrorist financing standards

Important Documents

Statement of Purpose (last updated 2004)

Principles for Information Exchange Between FIU for ML

Cases (2001)

Best Practices for the Exchange of Information Between

FIU (2004)

M A Islam, CDCS, CSDG, CAMS Compliance Route

International AML/CFT Standards

World Bank

International Monetary Fund

What is It?

These organizations work together and in conjunction

with FATF to encourage countries to have adequate

AML laws and to review AML laws and procedures of

FATF member countries .

Important Documents

Reference Guide to Anti-Money Laundering and

Combating the Financing of Terrorism: A Manual for

Countries to Establish and Improve Their Institutional

Framework 2002 (revised 2007)

M A Islam, CDCS, CSDG, CAMS Compliance Route

Regional AML/CFT Standards

What is It?

FATF-style regional bodies that have similar form and

functions to those of FATF

Provide input to FATF on standards and typologies

Important Documents

Typologies, etc

M A Islam, CDCS, CSDG, CAMS Compliance Route

Key US Legislative and Regulatory Initiatives

Applied to Transactions Internationally :

USA PATRIOT Act

Office of Foreign Assets Control

M A Islam, CDCS, CSDG, CAMS Compliance Route

Title III : International Money Laundering Abatement and Anti-Terrorist

Financing Act of 2001

USA PAtriot Act

Section 311 Special Measures for Primary Money Laundering Concern

Section 312 Special Due Diligence for Correspondent and Private Banking Accounts

Section 313 Prohibition on U.S. Correspondent Accounts with Foreign Shell Banks

Section 314 Cooperative Efforts to Deter Money Laundering a. FI to Law Enforcement

b. FI to FI

Section 319 Forfeiture of Funds in U.S. Interbank Accounts a. Forfeiture b. Record

M A Islam, CDCS, CSDG, CAMS Compliance Route

Legal framework : Bangladesh

Money Laundering Prevention Act, 2012 (Amendment-2015)

Anti Terrorism Act, 2009 (Amendment 2012 &2013)

Mutual Legal Assistance on Criminal Matters Act, 2012

Money Laundering Prevention Rules, 2019

Anti Terrorism Rules, 2013

Mutual Legal Assistance on Criminal Matters Rules, 2012

M A Islam, CDCS, CSDG, CAMS Compliance Route

Regulatory framework for Bank: Bangladesh

There are 18 Guidelines have already been published by BFIU

Among the guidelines, the following are most important for Bank : BFIU

Guidelines on Money Laundering & Terrorist Financing Risk Management Guidelines for

Banks -2015

Money Laundering and Terrorist Financing Risk Assessment Guidelines for Banking

Sector -

Guidelines on Implementation of The UN Security Council Resolutions Concerning

Targeted Financial Sanctions, Travel Ban, And Arms Embargo

Guidelines for Prevention of Trade Based Money Laundering-2019

Important Circular :

BFIU Circular No. 26, dated 16/06/2020 : Instructions to be followed by the schedule

banks for prevention of money laundering, terrorist financing and proliferation financing.

M A Islam, CDCS, CSDG, CAMS Compliance Route

You might also like

- E Book - Aml-Kyc and ComplianceDocument638 pagesE Book - Aml-Kyc and ComplianceGanesh Ramaiyer100% (1)

- Cash Handling Test - ConcessionsDocument5 pagesCash Handling Test - ConcessionsLizelle LasernaNo ratings yet

- Fibo Warisan 2nd Candle New v6.0Document75 pagesFibo Warisan 2nd Candle New v6.0Muhammad ZeeharzNo ratings yet

- Discrete Mathematics 10 PDF Free PDFDocument30 pagesDiscrete Mathematics 10 PDF Free PDFSamuel David Pérez BrambilaNo ratings yet

- Asynchronous Content - Managing Segments and CustomersDocument2 pagesAsynchronous Content - Managing Segments and CustomersbadtranzNo ratings yet

- Basel CommitteeDocument69 pagesBasel CommitteeNazneen SabinaNo ratings yet

- OFAC Name Matching and False Positive Reduction Techniques Codex1016 PDFDocument13 pagesOFAC Name Matching and False Positive Reduction Techniques Codex1016 PDFRakesh Raushan100% (1)

- AML LearningDocument23 pagesAML Learningstvo49100% (1)

- Trade Based Money Laundering Trends and DevelopmentsDocument66 pagesTrade Based Money Laundering Trends and Developmentsklakier2604No ratings yet

- Secp Aml CFT Guidelines Jan 2021Document63 pagesSecp Aml CFT Guidelines Jan 2021Rabab RazaNo ratings yet

- Null 063.2021.issue 003 enDocument21 pagesNull 063.2021.issue 003 enShahabas ShabuNo ratings yet

- AML Compliance Among FATF States (2018)Document18 pagesAML Compliance Among FATF States (2018)ruzainisarifNo ratings yet

- g20 Methodology For Remittance Corridor Risk Assessment PDFDocument34 pagesg20 Methodology For Remittance Corridor Risk Assessment PDFDany RomeroNo ratings yet

- A Thorough Review and Analysis of The Role of Banks in Fighting Money Laundering Through The Lenses of Regulations, Principles, and International Best PracticesDocument14 pagesA Thorough Review and Analysis of The Role of Banks in Fighting Money Laundering Through The Lenses of Regulations, Principles, and International Best PracticesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- FATF IntroductionDocument63 pagesFATF IntroductionNazneen SabinaNo ratings yet

- Proportional Risk Based AMLCFT Regimes For Mobile MoneyDocument76 pagesProportional Risk Based AMLCFT Regimes For Mobile MoneyCalvin JeremiahNo ratings yet

- FATF GAFI 2016 Guidance Correspondent Banking ServicesDocument22 pagesFATF GAFI 2016 Guidance Correspondent Banking ServicesYassine MadaniNo ratings yet

- Shadow Banking 30Document30 pagesShadow Banking 30Manuel Ramos Varela100% (1)

- A Practical Book To AML by Global AML CFT 1.0Document93 pagesA Practical Book To AML by Global AML CFT 1.0Márta dr DomoszlaiNo ratings yet

- Basilea Aml 1701905534Document55 pagesBasilea Aml 1701905534monapo.diegoNo ratings yet

- Combating Money Laundering in Malaysia: Current Practice, Challenges and SuggestionsDocument12 pagesCombating Money Laundering in Malaysia: Current Practice, Challenges and SuggestionsNur Azwa ZulaikaNo ratings yet

- Anti Money Laundering (AML) Learnings From Banks: Compliance Group-AML July 16, 2010Document23 pagesAnti Money Laundering (AML) Learnings From Banks: Compliance Group-AML July 16, 2010Mahapatra MilonNo ratings yet

- 6 KXZ 57 X JMFBPqhaple 5 NM AXAr JQ 1 XRQDH 622 M YSDDocument1 page6 KXZ 57 X JMFBPqhaple 5 NM AXAr JQ 1 XRQDH 622 M YSDমুকিমNo ratings yet

- Dissertation On Anti Money LaunderingDocument8 pagesDissertation On Anti Money LaunderingWriteMyPhilosophyPaperMilwaukee100% (1)

- De RiskingDocument9 pagesDe RiskingKerine HeronNo ratings yet

- Anti Money Laundering A Practical Guide To Reducing Organizational Risk Full ChapterDocument39 pagesAnti Money Laundering A Practical Guide To Reducing Organizational Risk Full Chapterdaniel.caster195100% (26)

- Thesis Anti Money LaunderingDocument6 pagesThesis Anti Money Launderingp0kasov1syd2100% (2)

- UNCTAD GDS 2023 1 Policy ReviewwebDocument53 pagesUNCTAD GDS 2023 1 Policy ReviewwebSudindra VRNo ratings yet

- Basel AML Index 2022 72cc668efbDocument51 pagesBasel AML Index 2022 72cc668efbXNo ratings yet

- FSRBDocument16 pagesFSRBNazneen SabinaNo ratings yet

- 3101 AmlDocument3 pages3101 AmlRizwan AhmadNo ratings yet

- 10 1108 - JMLC 07 2022 0102Document10 pages10 1108 - JMLC 07 2022 0102Sultan Ali SabanaNo ratings yet

- Money Laundering TerrorismDocument41 pagesMoney Laundering TerrorismmohankumarNo ratings yet

- Annual Report 2020 2021Document80 pagesAnnual Report 2020 2021Victor Takayama GarciaNo ratings yet

- Syllabus 3101 - Anti Money Laundering Measures and Business EthicsDocument3 pagesSyllabus 3101 - Anti Money Laundering Measures and Business EthicsAdnan MasoodNo ratings yet

- AML RiskModelsDocument7 pagesAML RiskModelsAnonymous wcqkliGtjNo ratings yet

- AML StatisticsDocument36 pagesAML StatisticsSomobrata BallabhNo ratings yet

- Bankacılık Sektörü (Basel Prensiplerine Uyumu, BCP) (8 Şubat 2017)Document249 pagesBankacılık Sektörü (Basel Prensiplerine Uyumu, BCP) (8 Şubat 2017)linaNo ratings yet

- The Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsDocument56 pagesThe Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsforcetenNo ratings yet

- OCT 22 Guidance-For-Lfis-On-Digital-Identification-For-Customer-Due-DiligenceDocument26 pagesOCT 22 Guidance-For-Lfis-On-Digital-Identification-For-Customer-Due-DiligenceSatish MenonNo ratings yet

- Full Paper 2 Shariahgovernance 230313Document20 pagesFull Paper 2 Shariahgovernance 230313rajecon543No ratings yet

- Risk Management Presentation April 22 2013Document156 pagesRisk Management Presentation April 22 2013George LekatisNo ratings yet

- Thesis Statement For Money LaunderingDocument6 pagesThesis Statement For Money Launderingnessahallhartford100% (1)

- Anti-Money Laundering/Financing Terrorism Compliance Risk RatingDocument14 pagesAnti-Money Laundering/Financing Terrorism Compliance Risk RatingBandhamneni VemuNo ratings yet

- Anti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsDocument3 pagesAnti-Money Laundering (AML) - Cases Involving Capital Market ParticipantsVia Commerce Sdn BhdNo ratings yet

- FATF Recommendations 2Document65 pagesFATF Recommendations 2sohail merchantNo ratings yet

- De-Risking and Its Impact CCMF Working PaperDocument18 pagesDe-Risking and Its Impact CCMF Working PaperJules BGNo ratings yet

- Ifc Aml ReportDocument87 pagesIfc Aml ReportDriton BinaNo ratings yet

- A Comprehensive Guide To KYC and AML Compliance in The UKDocument31 pagesA Comprehensive Guide To KYC and AML Compliance in The UKtomo Co100% (1)

- ICICI Group AML Policy April 2008 FinalDocument24 pagesICICI Group AML Policy April 2008 FinalbhaskarlalamNo ratings yet

- Please Review BSP Circular 1022 and MTPP ManualDocument26 pagesPlease Review BSP Circular 1022 and MTPP ManualAbygail GangayNo ratings yet

- AML Annual Report 2021Document12 pagesAML Annual Report 2021Kareem StaytiehNo ratings yet

- Anti-Money Laundering Disclosures and Banks' PerformanceDocument14 pagesAnti-Money Laundering Disclosures and Banks' PerformanceLondonNo ratings yet

- The Wolfsberg GroupDocument11 pagesThe Wolfsberg Groupanoobk.qNo ratings yet

- Dissertation Topics On Anti Money LaunderingDocument4 pagesDissertation Topics On Anti Money LaunderingPaySomeoneToWriteAPaperUK100% (1)

- EX AML Guidelines en 1Document376 pagesEX AML Guidelines en 11 2No ratings yet

- Topik 1 Rangka Kerja PerundanganDocument28 pagesTopik 1 Rangka Kerja PerundanganBenjamin Goo KWNo ratings yet

- Anti Money Laundering Measures Business EthicsDocument2 pagesAnti Money Laundering Measures Business EthicsRizwan AhmadNo ratings yet

- ICC Wolfsberg Trade Finance Principless 18012017Document64 pagesICC Wolfsberg Trade Finance Principless 18012017Vikram SuranaNo ratings yet

- Money Laundering Thesis ProposalDocument4 pagesMoney Laundering Thesis Proposaldwham6h1100% (2)

- Anti-Money Laundering Regimes: A Comparison Between Germany, Switzerland and The UK With A Focus On The Crypto BusinessDocument15 pagesAnti-Money Laundering Regimes: A Comparison Between Germany, Switzerland and The UK With A Focus On The Crypto Businessarief webinarNo ratings yet

- Financial Intelligence Unit 4998 Coney Drive, Belize City (501) 223-2729/223-0596Document14 pagesFinancial Intelligence Unit 4998 Coney Drive, Belize City (501) 223-2729/223-0596Om ParkashNo ratings yet

- SSRN Id882267Document32 pagesSSRN Id882267jamilsabriNo ratings yet

- Contemporary Trends in Trade-Based Money Laundering: 1st Edition, February 2024From EverandContemporary Trends in Trade-Based Money Laundering: 1st Edition, February 2024No ratings yet

- Payment MethodDocument36 pagesPayment MethodNazneen SabinaNo ratings yet

- Salution of Economics - Short Not Dec-15Document10 pagesSalution of Economics - Short Not Dec-15Nazneen SabinaNo ratings yet

- Accounting For Financial Services (AFS) - Reading Materials (Part-02)Document31 pagesAccounting For Financial Services (AFS) - Reading Materials (Part-02)Nazneen SabinaNo ratings yet

- AccountingDocument2 pagesAccountingNazneen SabinaNo ratings yet

- USA Patriot Act - 2001Document105 pagesUSA Patriot Act - 2001Nazneen SabinaNo ratings yet

- MLCA-1986 and OFACDocument30 pagesMLCA-1986 and OFACNazneen SabinaNo ratings yet

- EU DirectivesDocument67 pagesEU DirectivesNazneen SabinaNo ratings yet

- A. Theory and Process of CommunicationDocument23 pagesA. Theory and Process of CommunicationNazneen SabinaNo ratings yet

- FSRBDocument16 pagesFSRBNazneen SabinaNo ratings yet

- FATF IntroductionDocument63 pagesFATF IntroductionNazneen SabinaNo ratings yet

- 13jan2022 Portfolio 2442 DALTON079@YAHOO - COM Z232Document2 pages13jan2022 Portfolio 2442 DALTON079@YAHOO - COM Z232Nazneen SabinaNo ratings yet

- Birth CertificateDocument4 pagesBirth CertificateNazneen SabinaNo ratings yet

- Short Note of Marketing-Dec-2015Document16 pagesShort Note of Marketing-Dec-2015Nazneen SabinaNo ratings yet

- Chapter 04 03Document74 pagesChapter 04 03Nazneen SabinaNo ratings yet

- 2.3STR Decission MakingDocument17 pages2.3STR Decission MakingNazneen SabinaNo ratings yet

- Chapter 04 - 1Document48 pagesChapter 04 - 1Nazneen SabinaNo ratings yet

- Chapter 04 04Document52 pagesChapter 04 04Nazneen SabinaNo ratings yet

- Md. Masud KhanDocument1 pageMd. Masud KhanNazneen SabinaNo ratings yet

- 2022 Lubrizol Sustainability ReportDocument37 pages2022 Lubrizol Sustainability Reportpatanjalipurpose010No ratings yet

- Research Titles - Group 1Document12 pagesResearch Titles - Group 1Daynalou Gaille PeñeraNo ratings yet

- 26 Spruit DragonairDocument2 pages26 Spruit DragonairW.J. ZondagNo ratings yet

- Assignment 1Document4 pagesAssignment 1Janani PriyaNo ratings yet

- Unit 1Document59 pagesUnit 1Hoàng AnhNo ratings yet

- Sample Exercise - First Steps To Freedom WebDocument12 pagesSample Exercise - First Steps To Freedom WebPatrick PilapilNo ratings yet

- 3.2 Equity Securities Hand OutDocument8 pages3.2 Equity Securities Hand OutAdyangNo ratings yet

- 2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespieNo ratings yet

- Assignment 1Document6 pagesAssignment 1aakanksha_rinniNo ratings yet

- Sequent Fy 20Document124 pagesSequent Fy 20Partha SahaNo ratings yet

- Lecture Notes On Intellectual Property LawDocument55 pagesLecture Notes On Intellectual Property LawArieza MontañoNo ratings yet

- Engineering Design Ch8Document8 pagesEngineering Design Ch8ansudasinghaNo ratings yet

- Pres 20150608 Roadshow Presentatie Electrabel Final PDFDocument8 pagesPres 20150608 Roadshow Presentatie Electrabel Final PDFfakesasoNo ratings yet

- 13 ConsumerAwarenessDocument9 pages13 ConsumerAwarenessVibha GoyalNo ratings yet

- Module 1 THC 304 Entrep SY 2021 2022 2nd SemDocument22 pagesModule 1 THC 304 Entrep SY 2021 2022 2nd Semmaryie lapecerosNo ratings yet

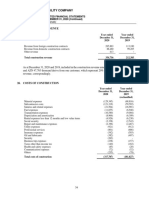

- "Azvirt" Limited Liability Company: 25. Construction RevenueDocument1 page"Azvirt" Limited Liability Company: 25. Construction RevenueŞeyxəli ŞəliyevNo ratings yet

- Entrep Mind PowerpointDocument6 pagesEntrep Mind PowerpointLgbtqia BuhiNo ratings yet

- RAP Demofest 2022 Letter of InvitationDocument2 pagesRAP Demofest 2022 Letter of InvitationRomss SyNo ratings yet

- Excel To MySQL PDFDocument12 pagesExcel To MySQL PDFsendano 0No ratings yet

- Introduction To Insurance Planning & Products: Sadique Neelgund, CFPDocument32 pagesIntroduction To Insurance Planning & Products: Sadique Neelgund, CFPPrashant ChoradiaNo ratings yet

- Report: Mean (Expected Value) of A Discrete Random Variable 100%Document2 pagesReport: Mean (Expected Value) of A Discrete Random Variable 100%abel mahendraNo ratings yet

- Remittance 11 PDFDocument2 pagesRemittance 11 PDFLoredana ValterNo ratings yet

- Project Management - Project It Charter Department 1 1Document13 pagesProject Management - Project It Charter Department 1 1api-722640149No ratings yet

- General Books - LibraryDocument74 pagesGeneral Books - LibraryVinu DNo ratings yet

- Guo 2020Document9 pagesGuo 2020gujjarashrafNo ratings yet

- Chapter 3 AssignmentDocument9 pagesChapter 3 AssignmentAnas Omar MuffarrejNo ratings yet