Professional Documents

Culture Documents

Thaai Casting Anchor Allocation Report

Uploaded by

hdubq5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thaai Casting Anchor Allocation Report

Uploaded by

hdubq5Copyright:

Available Formats

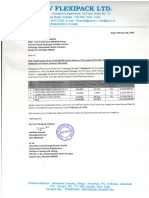

To,

Asst.Vice President

Listing Department

M/s. National Stock Exchange of India Limited

Exchange Plaza, Bandra Kurla Complex,

Bandra (E), Mumbai-400051

Dear Sir,

Sub.: Issue details for Anchor allocations of SME IPO of Thaai Casting Limited

The Board of the directors of the company at their respective meeting held on February 14, 2024, in consultation with the GYR Capital

Advisors Private Limited acting as Book Running Lead Managers to the offer, have finalized allocation of 17,34,400 Equity shares to

Anchor Investors at Anchor Investor offer price Rs. 77/- per share in the following manner:

SR Name of Anchor Investor No. of Equity No of Equity Shares allocated Bid Price

NO Shares Allocated as a % of Anchor Investor (Per Equity

Portion Share)

1. VIKASA INDIA EIF I FUND - INCUBE 14,73,600 84.96% Rs. 77/-

GLOBAL OPPORTUNITIES

2. SILVER STALLION LIMITED 2,60,800 15.04% Rs. 77/-

Total 17,34,400 100.00% -

No Mutual fund has applied through a total of Nil Schemes, scheme-wise details provided in the table below; -

SR Name of Scheme No. of Equity No of Equity Shares Bid Price

NO Shares Allocated allocated as a % of Anchor (Per Equity

Investor Portion Share)

1. NA

Total - - -

As per the SEBI (Issue of Capital and Disclosure Requirements) Regulation, 2018, as amended in case the offer price discovered through

book building process is higher than the anchor investor allocation price, Anchor investor will be required to pay the difference by the pay-

in as specified.

Please note the capitalized terms used and not defined herein shall have the respective meaning ascribed to them in the Offer Document.

We request you to make the above information public by disclosing the same on your website.

Thanking You

For,

THAAI CASTING LIMITED

Digitally signed by

ANANDAN S ANANDAN S

Date: 2024.02.14 16:06:04

+05'30'

_____________________

Mr. Anandan Sriramulu

Chairman & Managing Director

(DIN: 02354202)

You might also like

- Addictive Learning Technology Anchor AllocationDocument2 pagesAddictive Learning Technology Anchor Allocationrishabh.khandelwal361No ratings yet

- DRONE ANCHOR ListDocument2 pagesDRONE ANCHOR Listjamesdann009No ratings yet

- Anchor Intimation LetterDocument3 pagesAnchor Intimation LetterPraneethNo ratings yet

- Electro Force (India) Limited: Corporate Identification Number: U51909MH2010PLC204214Document283 pagesElectro Force (India) Limited: Corporate Identification Number: U51909MH2010PLC204214Sourav PalNo ratings yet

- Purv Flexipack Anchor Allocation ReportDocument1 pagePurv Flexipack Anchor Allocation Report62melNo ratings yet

- CyientDLMAnchor Allocation IntimationDocument3 pagesCyientDLMAnchor Allocation IntimationSaurav Kumar SinghNo ratings yet

- Honasa Consumer Limited - Anchor Allocation - Stock Exchange - 301023Document7 pagesHonasa Consumer Limited - Anchor Allocation - Stock Exchange - 301023Akshat BansalNo ratings yet

- 28a8c6d2-3211-4768-b66e-14bfb94ccff8Document2 pages28a8c6d2-3211-4768-b66e-14bfb94ccff8chhaterpal8890No ratings yet

- GPT Healthcare Limited - Anchor Intimation LetterDocument2 pagesGPT Healthcare Limited - Anchor Intimation Letterxepikej426No ratings yet

- JNK Newipo IpoDocument464 pagesJNK Newipo IpotantaraazNo ratings yet

- MedPlus Health Services Limited Anchor Intimation To Stock ExchangeDocument3 pagesMedPlus Health Services Limited Anchor Intimation To Stock ExchangeRubiks TejNo ratings yet

- Drone Destination LTD - RHPDocument382 pagesDrone Destination LTD - RHPakshayNo ratings yet

- Drone Destination LTD - DRHPDocument381 pagesDrone Destination LTD - DRHPakshayNo ratings yet

- Yatra Online Limited: (Please Scan This QR Code To View The DRHP)Document416 pagesYatra Online Limited: (Please Scan This QR Code To View The DRHP)Bhagwan BachaiNo ratings yet

- Jyoti CNC Automation Limited RHPDocument511 pagesJyoti CNC Automation Limited RHPgauravkaushikgsklNo ratings yet

- Paymate India Limited Ipo Draft Red Herring ProspectusDocument387 pagesPaymate India Limited Ipo Draft Red Herring ProspectusSandesh ShettyNo ratings yet

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNo ratings yet

- Delhivery Limited Prospectus 1 MinDocument650 pagesDelhivery Limited Prospectus 1 MinNishankNo ratings yet

- Akanksha Power and Infrastructure LTD - RHPDocument374 pagesAkanksha Power and Infrastructure LTD - RHPrahul sinhaNo ratings yet

- AddictiveLearning RHPDocument432 pagesAddictiveLearning RHPDhruvin ManekNo ratings yet

- Prospectus Final 9febDocument407 pagesProspectus Final 9febJeet GandhiNo ratings yet

- ProspectusDocument355 pagesProspectusanushari_9No ratings yet

- Inanna Fashion and Trends Limited: (Formerly Known As Frontline Business Solutions Limited)Document5 pagesInanna Fashion and Trends Limited: (Formerly Known As Frontline Business Solutions Limited)rahul sarafNo ratings yet

- Rahul Saraf - INANNA FASHION AND TRENDS LIMITEDDocument5 pagesRahul Saraf - INANNA FASHION AND TRENDS LIMITEDrahul sarafNo ratings yet

- Beaver GroupDocument397 pagesBeaver GroupmugenNo ratings yet

- 100 200 Full Board Meeting 20230222Document6 pages100 200 Full Board Meeting 20230222Contra Value BetsNo ratings yet

- Anchor Letter From Company - SE IntimationDocument4 pagesAnchor Letter From Company - SE IntimationBharat LohiyaNo ratings yet

- Cartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Document4 pagesCartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Prashant barodiyaNo ratings yet

- Financial Year Ended270820211623Document6 pagesFinancial Year Ended270820211623SOMNATH DHEMARENo ratings yet

- Offer Period - 12th Dec, 2019 - 20th Dec, 2019Document5 pagesOffer Period - 12th Dec, 2019 - 20th Dec, 2019JYOTHI D100% (1)

- EDELWISSDocument1 pageEDELWISShthn gfufNo ratings yet

- Fees and Deposits Schedule Updated July 2018 FinalDocument4 pagesFees and Deposits Schedule Updated July 2018 FinalYasir Abbas BhattiNo ratings yet

- DlfuniDocument507 pagesDlfuniauthentic786No ratings yet

- RHP Ems LimitedDocument540 pagesRHP Ems LimitedMohammed Ameen SezanNo ratings yet

- CDS - Schedule of Fees Deposits Updated July 2016Document4 pagesCDS - Schedule of Fees Deposits Updated July 2016fpaimranNo ratings yet

- RHP Hi Green CarbonDocument340 pagesRHP Hi Green CarbonAniket GaikwadNo ratings yet

- DOMS Industries LTD - RHPDocument506 pagesDOMS Industries LTD - RHPGovernment ExamsNo ratings yet

- Fees and Deposits Schedule Updated July 2020 FinalDocument5 pagesFees and Deposits Schedule Updated July 2020 Finalthe eagleNo ratings yet

- Sasseur Real Estate Investment Trust Prospectus Dated 21 March 2018Document748 pagesSasseur Real Estate Investment Trust Prospectus Dated 21 March 2018David ElefantNo ratings yet

- Sub: Disclosure Under Regulation 32 (1) of The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Document5 pagesSub: Disclosure Under Regulation 32 (1) of The SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Pritam BaralNo ratings yet

- Portfolio Holding Vs Performance (Since Inception) Sector - HoldingsDocument3 pagesPortfolio Holding Vs Performance (Since Inception) Sector - HoldingsAshok MishraNo ratings yet

- Capital SummaryDocument2 pagesCapital SummaryMayank GandhiNo ratings yet

- Sula Vineyards Limited RHPDocument483 pagesSula Vineyards Limited RHPRahul MehtaNo ratings yet

- Circular ESPS PDFDocument19 pagesCircular ESPS PDFSurabhi SaurabhNo ratings yet

- Gopal KhichadiaDocument3 pagesGopal KhichadiaAmrut BhattNo ratings yet

- WSML Ishares Msci World Small Cap Ucits Etf Fund Fact Sheet en GBDocument4 pagesWSML Ishares Msci World Small Cap Ucits Etf Fund Fact Sheet en GBfaisall.msqNo ratings yet

- Gmail - Zomato Limited - IPO - Allotment Advice Cum Refund Intimation.Document2 pagesGmail - Zomato Limited - IPO - Allotment Advice Cum Refund Intimation.Amit PandeyNo ratings yet

- PARKHOTELS pdf1706933755263413Document564 pagesPARKHOTELS pdf1706933755263413ujjvalNo ratings yet

- Anchor Data - WindlasDocument3 pagesAnchor Data - WindlasPrem SagarNo ratings yet

- RHP Spectrum Talent Management CompressedDocument312 pagesRHP Spectrum Talent Management CompressedPrateek KumarNo ratings yet

- Fund Fact Sheet As at 31 July 2021: Investment ObjectiveDocument1 pageFund Fact Sheet As at 31 July 2021: Investment ObjectiveMohd Hafizi Abdul RahmanNo ratings yet

- Tbo Tek Limited DRHPDocument451 pagesTbo Tek Limited DRHPKhushal JainNo ratings yet

- Shareholding Details January 2023Document1 pageShareholding Details January 2023Shouptik SarkarNo ratings yet

- Anchor Intimation Letter - Sula Vineyards LimitedDocument4 pagesAnchor Intimation Letter - Sula Vineyards LimitedAbdul ShaheenNo ratings yet

- Dpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148Document2 pagesDpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148AtanuMajiNo ratings yet

- Sula Vineyards Limited - ProspectusDocument464 pagesSula Vineyards Limited - Prospectussaim moosaNo ratings yet

- Kross Limited: (Please Scan This QR Code To View The Draft Red Herring Prospectus)Document426 pagesKross Limited: (Please Scan This QR Code To View The Draft Red Herring Prospectus)Suhani BansalNo ratings yet

- Account Certificate 20240214053224 20078018Document2 pagesAccount Certificate 20240214053224 20078018ArunNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet