Professional Documents

Culture Documents

Bab Ltd-1

Bab Ltd-1

Uploaded by

sitholeandile6100 ratings0% found this document useful (0 votes)

6 views1 pageBab Ltd's financial statements for the year show sales of R3 million, net profit of R745,500, and fixed assets of R9 million. The company is currently operating at 95% capacity, so sales and working capital are also 95% of full capacity levels. Calculations are required to determine full capacity sales, the potential sales increase, fixed assets as a percentage of full capacity sales, a pro forma income statement at full capacity, and the external financing needed to reach full capacity.

Original Description:

Work that I need to cover with this book

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBab Ltd's financial statements for the year show sales of R3 million, net profit of R745,500, and fixed assets of R9 million. The company is currently operating at 95% capacity, so sales and working capital are also 95% of full capacity levels. Calculations are required to determine full capacity sales, the potential sales increase, fixed assets as a percentage of full capacity sales, a pro forma income statement at full capacity, and the external financing needed to reach full capacity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageBab Ltd-1

Bab Ltd-1

Uploaded by

sitholeandile610Bab Ltd's financial statements for the year show sales of R3 million, net profit of R745,500, and fixed assets of R9 million. The company is currently operating at 95% capacity, so sales and working capital are also 95% of full capacity levels. Calculations are required to determine full capacity sales, the potential sales increase, fixed assets as a percentage of full capacity sales, a pro forma income statement at full capacity, and the external financing needed to reach full capacity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Bab Ltd

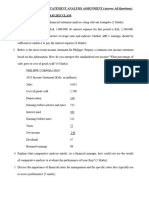

The most recent financial statements for Bab Ltd are as follows:

Bab Ltd

Income statement for the year ended

R

Sales 3 000 000

Costs (1 950 000)

Profit before tax 1 050 000

Tax expense (304 500)

Net profit 745 500

Statement of financial position

R

Equity 10 000 000

Long-term debt 4 000 000

Capital employed 14 000 000

Fixed assets 9 000 000

Net working capital 5 000 000

Net assets 14 000 000

Assume that in the above question information stays the same, except: the company is

currently operating at only 95% of its fixed asset capacity. Also assume that sales and

working capital are proportional to fixed assets.

REQUIRED:-

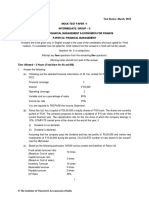

5.1 Calculate the full sales value capacity. (1)

5.2 By what percentage the current sales can increase to full capacity? (2)

5.3 Calculate fixed asset as a percentage of full capacity sales (2)

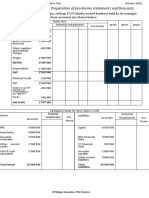

5.4 Prepare a pro-forma income statement. (4)

5.5 How much is the external financing needed? (3)

5.6 Revise your equity and liabilities section of the balance sheet after calculating the

required external finance. (3)

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Financial Planning and ForecastingDocument40 pagesFinancial Planning and ForecastingannafuentesNo ratings yet

- MAS-14 FS Analaysis With EFN (Letran)Document6 pagesMAS-14 FS Analaysis With EFN (Letran)Gio PacayraNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument4 pagesNon-Current Assets Held For Sale and Discontinued OperationsNicole Teruel100% (1)

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- Ma 2019..Document6 pagesMa 2019..Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Financial Planning and BudgetingDocument4 pagesFinancial Planning and Budgetingangelapearlr100% (1)

- Financial Forecasting Homework ProblemsDocument3 pagesFinancial Forecasting Homework ProblemsRobert IronsNo ratings yet

- Unit 5Document5 pagesUnit 5Pinaki Kumar ChakrabortyNo ratings yet

- Krystal Guile Dagatan - Activity 2Document6 pagesKrystal Guile Dagatan - Activity 2Krystal Guile DagatanNo ratings yet

- Asis 2 (CH 4) - PertanyaanDocument4 pagesAsis 2 (CH 4) - PertanyaanAndre JonathanNo ratings yet

- Exercise ResponsibiltyDocument1 pageExercise ResponsibiltyLeo Sandy Ambe CuisNo ratings yet

- Cash Flow Statement: Projected Income Statement and Balance SheetDocument14 pagesCash Flow Statement: Projected Income Statement and Balance SheetAagam SakariaNo ratings yet

- BBM 314 Assignment - Feb 2024Document1 pageBBM 314 Assignment - Feb 2024stacyrockie2030No ratings yet

- Module 2-Topic 3Document5 pagesModule 2-Topic 3MILBERT DE GRACIANo ratings yet

- FINANCIAL MANAGEMENT April 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT April 20172016 PatternSemester IISwati DafaneNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- Profit, Profitability and Break Even AnalysisDocument16 pagesProfit, Profitability and Break Even AnalysisDr. Meghna DangiNo ratings yet

- AFN ProbDocument3 pagesAFN ProbAli The Banner MakerNo ratings yet

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- UntitledDocument6 pagesUntitledAlok TiwariNo ratings yet

- ACCA F2 FIA FMA Mock Exam 2014 15 PDFDocument11 pagesACCA F2 FIA FMA Mock Exam 2014 15 PDFBhupendra SinghNo ratings yet

- Retained Earnings and Cost of Debentures: Presented by P. Madhuri Prinkle Jain Shersti JainDocument37 pagesRetained Earnings and Cost of Debentures: Presented by P. Madhuri Prinkle Jain Shersti JainPrinkle JainNo ratings yet

- This Test Is Only For Students of MS Consultancy ManagementDocument2 pagesThis Test Is Only For Students of MS Consultancy ManagementrudypatilNo ratings yet

- Module 2-Topic 4Document5 pagesModule 2-Topic 4MILBERT DE GRACIANo ratings yet

- Homework ch4 11-4-2020Document5 pagesHomework ch4 11-4-2020Qasim MansiNo ratings yet

- True or FalseDocument4 pagesTrue or FalseMuchinNo ratings yet

- Homework of Quantitative Courses Home Work No.: 3Document3 pagesHomework of Quantitative Courses Home Work No.: 3Jasjeet SinghNo ratings yet

- Finance BE7Document23 pagesFinance BE7Yanah Zia CalachanNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Act 102 FinalsDocument5 pagesAct 102 FinalsJamii Dalidig MacarambonNo ratings yet

- Consalidated Statement of Profit and LossDocument40 pagesConsalidated Statement of Profit and LossG. DhanyaNo ratings yet

- 02 CVP Analysis PDFDocument5 pages02 CVP Analysis PDFJunZon VelascoNo ratings yet

- FINANCIAL MANAGEMENT 2016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT 2016 PatternSemester IISwati DafaneNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- DDM Practice Question QDocument1 pageDDM Practice Question QNeo HlohlongoaneNo ratings yet

- NBS Corporate Finance 2022 Assignment 2-Due-20220916Document7 pagesNBS Corporate Finance 2022 Assignment 2-Due-20220916SoblessedNo ratings yet

- Wa0035.Document5 pagesWa0035.Barack MikeNo ratings yet

- FM-I AssignmentDocument2 pagesFM-I Assignmentgwakijira006No ratings yet

- FM AssignmentDocument9 pagesFM AssignmentNikesh Shrestha100% (1)

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Chapter No.2 Capital Budgeting: Tybaf Financial Management Sem VDocument8 pagesChapter No.2 Capital Budgeting: Tybaf Financial Management Sem VAyushi PachoriNo ratings yet

- 8 LeveragesDocument14 pages8 LeveragesMedha PanditaNo ratings yet

- Nov 2001Document11 pagesNov 2001Altaf HussainNo ratings yet

- INTANGIBLE-ASSETSDocument5 pagesINTANGIBLE-ASSETSDarlianne Klyne BayerNo ratings yet

- Chapter 4Document6 pagesChapter 4Ronnel FragoNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- EP60010 - Financing New Ventures PDFDocument2 pagesEP60010 - Financing New Ventures PDFRajat AgrawalNo ratings yet

- Intermediate Accounting Chapters 4,5Document24 pagesIntermediate Accounting Chapters 4,5Jonathan NavalloNo ratings yet

- Assignment 2 Sem 6Document4 pagesAssignment 2 Sem 6Pratik ShendeNo ratings yet

- FM Assignment MMS 21-23Document4 pagesFM Assignment MMS 21-23Mandar SangleNo ratings yet

- Spring 2024 - ACC501 - 1Document3 pagesSpring 2024 - ACC501 - 1aimanshabbir017No ratings yet

- Case Study Crystal Ball Proforma and Forecasts StatementsDocument2 pagesCase Study Crystal Ball Proforma and Forecasts StatementsTingstene 13No ratings yet

- Leverage KJ PDFDocument1 pageLeverage KJ PDFDanzo ShahNo ratings yet

- Revision B326Document17 pagesRevision B326c.ronaldo.bedoNo ratings yet

- Exercise 6Document4 pagesExercise 6Tania MaharaniNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet