Professional Documents

Culture Documents

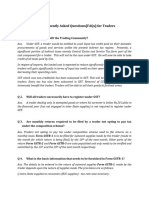

FAQ-Composition Scheme

Uploaded by

Sejal GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQ-Composition Scheme

Uploaded by

Sejal GuptaCopyright:

Available Formats

Q 1. What is exactly the concept of composition scheme under GST?

Ans. A registered taxable person (as specified) having aggregate turnover in preceding

financial year less than or equal to Rs 75 Lakhs (50 Lakhs for specified states) will have

option to pay taxes at reduced rates without availing benefit of Input tax credit. A tax payer

opting for composition levy shall not collect any tax from his customers.

Q 2. Whether the composition scheme is optional or compulsory?

Ans. Optional.

Q 3. Can a vendor opt for composition scheme for one business vertical/one state and

continue with normal scheme for GST for other verticals/other states?

Ans. A vendor has to opt for composition scheme for all business verticals across all states.

Option for availing composition scheme for one business vertical/one state & normal

scheme for other vertical/other states is not available.

Q 4. Whether the taxable person registered under the composition scheme can avail the

benefit of Input Tax Credit ?

Ans. Taxable person registered under the composition scheme can't avail any input tax

credit as he is not entitled for any tax credit under the scheme.

Q 5. Whether input tax credit of goods purchased from a vendor registered under

composition scheme is available to recipient of goods?

Ans. No, Input tax credit of goods purchased from a vendor registered under composition

scheme is not available.

Q 6. What are the conditions for opting the composition levy scheme?

Ans. The registered person shall not be eligible to opt for composition levy if he

Makes supply of Non-taxable goods

Makes Inter-State outward supplies

is a manufacturer of such goods as may be notified. Notified goods are ice cream,

Pan masala, Tobacco.

Makes supply through E-commerce

Makes supply of services other than supply of food or drinks in a restaurants

Q 7. What is the Tax Rate under the composition scheme?

Ans. Tax Rate in case of trader is 1% (0.5%-CGST & 0.5%-SGST) and for manufacturer it is 2%

(1%-CGST & 1%-SGST). If he is engaged in supply of food or drinks (other than alcoholic

liquor for human consumption), the tax rate is 5% (2.5%-CGST & 2.5%-SGST).

Q 8. Can a Composition Dealer issue Tax Invoice?

Ans. No. Since a Composition Dealer is not allowed to avail input tax credit, such a dealer

cannot issue a tax invoice as well. A buyer from composition dealer will not be able to claim

input tax on such goods.

Q 9. Which returns are required to be filed by a taxable person registered under

Composite Scheme?

Ans. The taxable person is required to furnish only one return i.e. GSTR-4 on a quarterly

basis and an annual return in FORM GSTR-9A. Quarterly return needs to be furnished by the

18th of the month succeeding the quarter. For example return in respect of supplies made

during July, 2017 to September, 2017 is required to be filed by 18th October, 2017.

Q 10. Can a Composition Dealer collect composition tax separately?

Ans. No, a Composition Dealer is not allowed to collect composition tax from the buyer.

Q 11. When will a person opting for composition levy pay tax?

Ans. A person opting for composition levy will have to pay tax on quarterly basis before 18th

of the month succeeding the quarter during which the supplies were made.

Q 12. Can a person making application for fresh registration under GST opt for

composition levy at the time of making application for registration?

Ans. Yes. Such persons can give the option to pay tax under the composition scheme in Part

B of FORM GST REG-01. This will be considered as an intimation to pay tax under the

composition scheme.

You might also like

- GST TradersDocument11 pagesGST TradersSHAIK AHMEDNo ratings yet

- Composition Scheme Under GST ExplainedDocument3 pagesComposition Scheme Under GST ExplainedrgurvareddyNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Faq Composition Levy RevisedDocument8 pagesFaq Composition Levy Revisedbharigopan8360No ratings yet

- About Composition Scheme in GSTDocument3 pagesAbout Composition Scheme in GSTArpit GuptaNo ratings yet

- Compostion SchemeDocument6 pagesCompostion SchemeK S RNo ratings yet

- Composition Scheme GSTDocument3 pagesComposition Scheme GSTUttiya BasuNo ratings yet

- GST NotesDocument39 pagesGST NotesCrick CompactNo ratings yet

- Composition Under GSTDocument12 pagesComposition Under GSTSHAMBHU DAYALNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- GST Composition SchemeDocument2 pagesGST Composition SchemeVikram AruchamyNo ratings yet

- UntitledDocument8 pagesUntitledsuyash dugarNo ratings yet

- Essay Asnwer - Income Taxation AssessmentDocument4 pagesEssay Asnwer - Income Taxation AssessmentMary Grace ChewNo ratings yet

- Transfer From Normal Dealer To Compounding DealerDocument1 pageTransfer From Normal Dealer To Compounding DealerShivanand yadavNo ratings yet

- GSTR 09 360 DegreesDocument15 pagesGSTR 09 360 Degreesarun alwaysNo ratings yet

- File Final YearDocument18 pagesFile Final YearSaurabh SinghNo ratings yet

- GST Sem Material PDFDocument6 pagesGST Sem Material PDFObaid AhmedNo ratings yet

- Department of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Document7 pagesDepartment of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Amit SharmaNo ratings yet

- Income Tax - Chap 07Document6 pagesIncome Tax - Chap 07ZainioNo ratings yet

- GST-603 Unit-3Document23 pagesGST-603 Unit-3GauharNo ratings yet

- Final - L CGST-UNIT 3Document8 pagesFinal - L CGST-UNIT 3ramNo ratings yet

- Compulsory Registration: RequirementDocument4 pagesCompulsory Registration: RequirementNur Iszyani PoadNo ratings yet

- Filing Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalDocument2 pagesFiling Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalFaizan AhmedNo ratings yet

- Casual Taxable Person Under GSTDocument3 pagesCasual Taxable Person Under GSTFiling BuddyNo ratings yet

- Unit I.4 - Levy and Collection of GSTDocument38 pagesUnit I.4 - Levy and Collection of GSTFake MailNo ratings yet

- Custom Duty in IndiaDocument29 pagesCustom Duty in IndiaKaranvir GuptaNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- A Overview of Maharashtra Value Added Tax: IndexDocument10 pagesA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarNo ratings yet

- Unit 4 - GST Liability & Input Tax CreditDocument13 pagesUnit 4 - GST Liability & Input Tax CreditPrathik PsNo ratings yet

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Document11 pagesTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyNo ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- GST - Answer 2Document9 pagesGST - Answer 2Tarun SolankiNo ratings yet

- GST Free Class: View GST Lecture at My Youtube ChannelDocument18 pagesGST Free Class: View GST Lecture at My Youtube ChannelGiri SukumarNo ratings yet

- Registration Under GSTDocument9 pagesRegistration Under GSTSaleemNo ratings yet

- Composition Scheme RulesDocument10 pagesComposition Scheme Rulesnallarahul86No ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- DT AmendmentsDocument39 pagesDT AmendmentsMurali GopalakrishnaNo ratings yet

- VAT - in IndiaDocument10 pagesVAT - in Indiasai500No ratings yet

- Advantages of VATDocument9 pagesAdvantages of VATAnkit GuptaNo ratings yet

- Taxation IiDocument60 pagesTaxation IiAnkush GuptaNo ratings yet

- CA ProjectDocument47 pagesCA Projectitaxsan198No ratings yet

- GST Unit 3Document22 pagesGST Unit 3darshansah1990No ratings yet

- Form 15G To Avoid TDS Deduction - Taxguru - inDocument4 pagesForm 15G To Avoid TDS Deduction - Taxguru - inwhitefieldNo ratings yet

- VATDocument6 pagesVATHarold ApostolNo ratings yet

- RMO No. 23-2018 DigestDocument4 pagesRMO No. 23-2018 DigestMary Joy NavajaNo ratings yet

- Value Added Tax in Maharashtra - Project Report MbaDocument72 pagesValue Added Tax in Maharashtra - Project Report Mbakamdica100% (12)

- Assignment IDocument6 pagesAssignment Imark assainNo ratings yet

- Refund Guide For Business Visitors - en - 17 09 2019Document21 pagesRefund Guide For Business Visitors - en - 17 09 2019Islam AdelNo ratings yet

- Input Tax CreditDocument5 pagesInput Tax CreditSowmya GuptaNo ratings yet

- Q. What Is Value Added Tax (VAT) ?Document8 pagesQ. What Is Value Added Tax (VAT) ?Akhilesh SinghNo ratings yet

- UntitledDocument9 pagesUntitledsuyash dugarNo ratings yet

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- TRAIN LAW Compilation From NetDocument14 pagesTRAIN LAW Compilation From NetAnne Vernadice Areña-VelascoNo ratings yet

- Tax Payment Under GSTDocument7 pagesTax Payment Under GSTAbhay GroverNo ratings yet

- Confirm Vat Audit ProjectDocument33 pagesConfirm Vat Audit ProjectkennyajayNo ratings yet

- Kingfisher Airlines Case StudyDocument30 pagesKingfisher Airlines Case StudyHarshithkmNo ratings yet

- Article On Composition Scheme With Case StudyDocument12 pagesArticle On Composition Scheme With Case StudySejal GuptaNo ratings yet

- Background Materia On GST Vol 1 Feb 2024Document1,117 pagesBackground Materia On GST Vol 1 Feb 2024Sejal GuptaNo ratings yet

- Resume Temp 3Document1 pageResume Temp 3Sejal GuptaNo ratings yet

- Resume Temp 1Document2 pagesResume Temp 1Sejal GuptaNo ratings yet

- Resume Temp 2Document2 pagesResume Temp 2Sejal GuptaNo ratings yet

- Adobe Scan 10 Feb 2023Document1 pageAdobe Scan 10 Feb 2023Sejal GuptaNo ratings yet

- French Exam FormDocument2 pagesFrench Exam FormSejal GuptaNo ratings yet

- French Exam FeeDocument1 pageFrench Exam FeeSejal GuptaNo ratings yet

- Revised ScheduleDocument2 pagesRevised ScheduleSejal GuptaNo ratings yet

- Assignment ASM 30265 PDFDocument1 pageAssignment ASM 30265 PDFSejal GuptaNo ratings yet

- Financial Management Formulas With Solution VuabidDocument13 pagesFinancial Management Formulas With Solution Vuabidsaeedsjaan100% (3)

- Invoice 1922Document1 pageInvoice 1922miroljubNo ratings yet

- Practice Exam Pool 1Document11 pagesPractice Exam Pool 1Ey ZalimNo ratings yet

- ITC SME Trade Academy - Post-Course Knowledge QuizDocument11 pagesITC SME Trade Academy - Post-Course Knowledge QuizUlul AzmiNo ratings yet

- Dissertation Report of Mutual FundsDocument71 pagesDissertation Report of Mutual FundsShailesh Bandooni50% (2)

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiNo ratings yet

- c73s1ch48 PDFDocument2 pagesc73s1ch48 PDFChandra JacksonNo ratings yet

- Amethyst - AgapeDocument6 pagesAmethyst - AgapeOntong Divine Grace E.No ratings yet

- Schedule Fees 2021 2022Document2 pagesSchedule Fees 2021 2022Marneil Daevid ArevaloNo ratings yet

- Chapter 4, 5, 6 AssignmentDocument23 pagesChapter 4, 5, 6 AssignmentSamantha Charlize VizcondeNo ratings yet

- BAC 2020 Annual ReportDocument207 pagesBAC 2020 Annual ReportLituyopNo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- Reading 24 - Equity Valuation - Applications and ProcessesDocument5 pagesReading 24 - Equity Valuation - Applications and ProcessesJuan MatiasNo ratings yet

- Asian Economic Policy Review - 2022 - Morgan - Fintech and Financial Inclusion in Southeast Asia and IndiaDocument26 pagesAsian Economic Policy Review - 2022 - Morgan - Fintech and Financial Inclusion in Southeast Asia and IndiaFelicia Wong Shing YingNo ratings yet

- AF1401 2020 Autumn Lecture 2Document38 pagesAF1401 2020 Autumn Lecture 2Dhan AnugrahNo ratings yet

- NAMEDocument6 pagesNAMEcesar canduelasNo ratings yet

- The Best Trading Time For Each Pair of CurrenciesDocument18 pagesThe Best Trading Time For Each Pair of CurrenciesGenc GashiNo ratings yet

- Ucc Collateral WestpacDocument1 pageUcc Collateral WestpacAlfred on Gaia83% (6)

- Streamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221Document4 pagesStreamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221jo220171No ratings yet

- VN Cuts From DollarDocument4 pagesVN Cuts From DollarThanh NguyenNo ratings yet

- Pubali July - 2019 - FinalDocument66 pagesPubali July - 2019 - Finalzannatul zoyaNo ratings yet

- Q2 Week 8 - ADM ModuleDocument4 pagesQ2 Week 8 - ADM ModuleCathleenbeth MorialNo ratings yet

- RRL Need To PrintDocument9 pagesRRL Need To PrintMaribeth AmitNo ratings yet

- 6EC02 01R Que 20140521 PDFDocument32 pages6EC02 01R Que 20140521 PDFJaneNo ratings yet

- Internal Business and TradeDocument23 pagesInternal Business and TradeElla Mae Botnande VillariasNo ratings yet

- RiskDocument26 pagesRiskVaibhav BanjanNo ratings yet

- Solution To Mid-Term Exam ADM4348M Winter 2011Document17 pagesSolution To Mid-Term Exam ADM4348M Winter 2011SKNo ratings yet

- Exercise 1 - Gross Domestic ProductDocument2 pagesExercise 1 - Gross Domestic ProductAl Marvin SantosNo ratings yet

- Earnest Money AgreementDocument2 pagesEarnest Money AgreementAtty. Jefferson B. YapNo ratings yet

- Valuation Practice QuizDocument6 pagesValuation Practice QuizSana KhanNo ratings yet

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet