Professional Documents

Culture Documents

Group Assignment Fin202

Uploaded by

Bé GiangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group Assignment Fin202

Uploaded by

Bé GiangCopyright:

Available Formats

Group Assignment FIN202

Corporate Finance (Trường Đại học FPT)

Scan to open on Studocu

Studocu is not sponsored or endorsed by any college or university

Downloaded by Giang Mai (yoonamai468@gmail.com)

Group Assignment – FIN202

Members of Group 1

Dương Quốc Nhật Quỳnh CS171511

Lê Hoàng Cẩm Vy CA171167

Lê Ngọc Nhi CS160051

Nguyễn Thị Tuyết Trinh CS160518

Nguyễn Thành Nhân CS170836

Lê Trung Nguyên CE160764

Downloaded by Giang Mai (yoonamai468@gmail.com)

I. Introduction:

1. What about Dat Bike?

2. The company’s project.

II. Summary Of Project Data:

1. Operating assumption.

2. Sales revenue.

3. Costs/Revenue.

4. Opportunity costs.

5. Initial outlay.

6. Salvage value.

7. NWC requirement.

III. Capital Asset Pricing Model (CAPM).

IV. Calculate Project Cash Flows:

1. Estimate the yearly cash flows of the project.

2. Apply NPV, IRR, and payback period rule to determine whether we should take

the project to improve the value of your startup.

V. Evaluate the project through 3 methods NPV, IRR,

and Payback:

1. Identify your assumption on the nature of real options embedded in your project.

2. Re-estimate the yearly cash flows of the project. (good - bad)

VI. Project Risk Analysis.

VII. Conclusion.

VIII. Recommendations.

IX. References:

Downloaded by Giang Mai (yoonamai468@gmail.com)

I. Introduction:

1. What about Dat Bike?

Dat Bike is a Vietnamese electric motorcycle manufacturing company, founded in 2019

by Mr. Nguyen Ba Canh Son - a talented software engineer who has won many national

and international awards in the field of technology. Son realized that the image of

motorbikes is associated with Vietnamese people. The number of motorbikes is so much

that it "plows" the atmosphere, causing serious environmental pollution. If the market

appears motorcycles using non-fossil fuels with the same powerful capabilities as

gasoline cars, consumers can both meet their needs and form a modern green lifestyle.

2. The company’s project:

Most electric vehicles on the market have low capacity and speed, not meeting the usage

habits of Vietnamese people. Canh Son once shared that when he was still in the US,

Tesla had a foothold in the electric car market, but electric motorbike startups often

failed and closed after the first round of funding because there was no market, not even a

market. there is a market. Although the problem of technology has been solved.

Because we want to expand the mass production process to increase productivity and

reduce the selling price of the car to about 25 million VND, an affordable price for easy

access to consumers, Dat Bike company wants to call for more investors. The project's

capital is 900 billion VND, of which fixed capital is VND 600 billion and working

capital is 300 billion VND. The maximum capacity of the house is expected to be 2000

motorcycles per year with the main products being electric motorcycles, components for

electric vehicles, and replacement batteries for vehicles.

II. Summary Of Project Data:

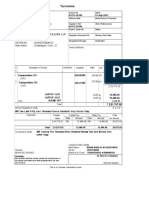

1. Operating assumption:

Downloaded by Giang Mai (yoonamai468@gmail.com)

2. Sale revenue:

Sales revenue is the income a business generates from the sale of goods or services.

According to the operating assumption, sales revenue is 267,568,241,596 Dong.

3. Costs / Revenue:

Cost of revenue is the total of all costs incurred directly in producing, marketing, and

distributing the products and services of a company to customers.

Formula: Costs of revenue = Total cost / Total revenue (%)

Applying the formula:

Total cost = 39,867,463,582; Total revenue = 267,568,241,596

=> Costs of revenue = 39,867,463,582 / 267,568,241,596 = 15%

4. Opportunity costs:

Opportunity cost is defined as the lost benefit of the best choice missed. In any decision,

there is an opportunity cost because by choosing that decision you will forgo the other

option.

Formula: Opportunity cost = Total revenue - Total cost

Applying the formula:

Total cost = 39,867,463,582; Total revenue = 267,568,241,596

=> Opportunity cost = 267,568,241,596 - 39,867,463,582 = 227,700,778,014 (Dong)

5. Initial outlay:

The initial outlay is 900 billion VND, of which fixed capital is VND 600 billion and

working capital is 300 billion VND.

Downloaded by Giang Mai (yoonamai468@gmail.com)

The maximum capacity of the house is expected to be 2000 motorcycles per year with the

main products being electric motorcycles, components for electric vehicles, and

replacement batteries for vehicles.

6. Salvage value:

Salvage value is calculated according to THE STRAIGHT-LINE METHOD: The annual

depreciation = (Cost of an asset – Residual value) / Expected useful life of the asset.

The production line is assumed by the company to have an Expected useful life of 80

years. So, the annual depreciation is 500/80 = 6,25 billion VND.

After 5 years, the salvage value is 468,75 billion VND.

7. NWC requirement:

Working capital assets are project cash and inventories and accounts receivable. It is

calculated as 13% Summary of Operating Assumptions.

CAPM evolved as a way to measure this systematic risk. It is widely used throughout

finance for pricing risky securities and generating expected returns for assets, given the

risk of those assets and the cost of capital.

Applying the formula:

Risk-free rate = 10%

Expected return on the market = 15%

Beta of the investment = 1.5

Market risk premium = expected return on the market – risk-free rate = 15% - 10% = 5%

=> Expected return of investment = 10% + (15% - 10%) * 1.5 = 17,50%

III. Calculate Project Cash Flows:

Downloaded by Giang Mai (yoonamai468@gmail.com)

1. Estimate the yearly cash flows of the project:

As expected, in 2023 the project will have a revenue of 267,568,241,596 VND and

continuously increase by 7% over the years, until 2027, the revenue will reach

1,268,459,367,572 VND. Total Operating costs year by year will be equal to Operating

costs plus Total Costs of Revenue and will increase year by year from 49,567,463,582

VND in 2023 to 68,270,153,430 VND in 2027. The amortization for this project is fixed

year by year at 5,000,000,000 VND. From those data, we calculate that the Net income in

2023 is 174,400,622,411 VND and gradually increases by 2027 is 960,151,371,314 VND.

Next, in the Cash Flows table, Operating Cash Flow is calculated by net income in each

year plus depreciation, then the Operating Cash Flow in 2023 is 179,400,622,411 VND

and the same calculation in years. CAPEX only available in 2022 is 700,000,000,000

VND, next we calculate NWC equal to 13% of revenue per year and subtract the

following year's NWC from the previous year's NWC to get the result of Chg. Print

NWC.

Finally, the result of Total Cash Flow is - 700,000,000,000 VND in the first year, and in

the second year, Total Cash Flow is 144,616,751,003.72 VND, increasing gradually until

2027 reaching 1,382,383,531,974 VND.

2. Apply NPV, IRR, and payback period rule to determine whether we

should take the project to improve the value of your startup:

- NPV=1,228,846,664,127 > 0: This project is selected, as a profitable, worthwhile

project, that has economic return.

- Payback Period = 2.729 years shows that this project has the ability to pay back

after more than 2 years should be selected.

Downloaded by Giang Mai (yoonamai468@gmail.com)

- IRR = 45,69% > Cost of capital so accept the project. The expected IRR of this one

project is higher than the cost of capital making the net cash flow into the company

higher. Hence the project looks profitable and the management should proceed with

it.

IV. Evaluate the project through 3 methods NPV, IRR,

and Payback:

1. Identify your assumption on the nature of real options embedded in

your project:

Assume that there are:

- There are 20% sales revenue is $63,155,076,512 VND in year 1 and will increase

next year.

- There are 20% sales revenue is $42,103,384,342 VND in year 1 and will decrease

next year.

2. Re-estimate the yearly cash flows of the project. (good - bad)

Product Electric Vehicle Income Statement & Cash

Flow

Downloaded by Giang Mai (yoonamai468@gmail.com)

- NPV = 1,487,700,557,361 > 0: This project is a selected, profitable, worthwhile project,

and has economic return.

- Payback Period = 2,61 years shows that this project has the ability to pay back after

more than 2 years should be selected.

- IRR = 53% > Cost of capital so accept the project. The expected IRR of this project is

much higher than the cost price, which makes the net cash flow into the company high

and strong. Therefore, the project looks very profitable and the management should

proceed with it.

- Through the changing structure of data and indexes in the context of positive economic

growth, the project's free cash flow grew with a strong fluctuation within 5 years of

operation.

Product Electric Vehicle Income Statement & Cash Flow

- NPV= 803,585,856,313 > 0: This project is selected, a profitable, worthwhile project,

and has economic return.

- Payback Period = 3,156 years shows that this project has the ability to pay back

after more than 2 years should be selected.

- IRR = 35% > Cost of capital so accept the project. The expected IRR of this one

project is higher than the cost of capital making the net cash flow into the company

higher.

In the context of the downturn economy, the investment for the Electric Vehicle project

will be able to create returns and profitability. Furthermore, the payback period is

determined at 3,156, this index proved repayable ability, at least within 3 years. Finally,

Downloaded by Giang Mai (yoonamai468@gmail.com)

the indicators NPV, IRR, and Payback Period represent that in an economic downturn,

Electric Vehicle is worth investing in.

V. Project Risk Analysis:

1. Capital Asset Pricing Model (CAPM):

CAPM evolved as a way to measure this systematic risk. It is widely used throughout

finance for pricing risky securities and generating expected returns for assets, given the

risk of those assets and the cost of capital.

Applying the formula:

Risk-free rate = 10%

Expected return on the market = 15%

Beta of the investment = 1.5

Market risk premium = expected return on the market – risk-free rate = 15% - 10% = 5%

=> Expected return of investment = 10% + (15% - 10%) * 1.5 = 17,50%

2. Risk Analysis:

With a growth rate of about 10%/year and sales of up to millions of units, the electric

motorcycle market is very fertile also because electric cars are increasingly interesting to

consumers. Besides, many organizations and individuals have smuggled and

counterfeited this item for profit. The company will likely face the problem of electric

vehicles and components being counterfeited and released into the market. Many

consumers who do not research carefully will not be able to detect which is a pirated car,

and which is a genuine car, leading to damage to the company's reputation and profits.

This is a risk that jeopardizes the profitability of the project. Another production risk is

that if the production process of electric scooters and components is not careful, it will

lead to poor product quality, potentially endangering users. In the world today, there have

been recorded cases where the firing process caused a fire on electric vehicles while the

vehicle was charging, causing certain dangers to people and surrounding environmental

conditions. However, these risks are within the control of the company. The project has

been put into operation and plans and solutions have been prepared to control the above

Downloaded by Giang Mai (yoonamai468@gmail.com)

risks. Avoiding the above risks is possible, the economic efficiency and profit of the

project will still be the same as the original calculation.

VI. Conclusion:

The implementation of a business project of electric motorcycles, electric vehicle

components, and replacement batteries is a good choice. Demand for these products has

increased significantly over the past few years and is expected to continue to do so for the

foreseeable future. We applied the NPV, IRR, and payback rules to determine if a project

should be implemented to improve start-up value, and the results are very feasible.

Production costs have also been kept low, making these products affordable for

customers and also providing substantial profits for the company. This project will allow

the company to remain competitive in the market while providing customers with quality

products at affordable prices. Overall, this business venture will succeed in providing

consumers with a more efficient means of transportation while also reducing their overall

costs. With the growing demand for electric vehicles, it is expected that this business

project will continue to grow in the future. We can conclude that this business venture

will be a great success and will be more and more successful in the years to come.

VII. Recommendations:

Investing in a motorcycle and electric vehicle component trading project is a great way to

capitalize on the growing trend of electric vehicles. The key to success in this project is to

develop appropriate recommendations for investments and operations. Although electric

motorbikes have outstanding advantages in terms of environmental friendliness and fuel

economy, there are still limitations in speed, the ability to travel not far, and the charging

time is quite long. Priority should be given to the development of the TCVN and QCVN

systems of charging stations, fast charging systems, battery exchange stations, etc. to be

able to put technical and safety requirements of devices and charging stations into

management. management, reduce risks and improve the efficiency of electrical safety in

the process of putting electric vehicles into public operation. Find ways to maximize

profits, reduce costs, and ensure product quality control. Next, it is necessary to

strengthen the coordination of manufacturers, importers, and distributors with media

units and relevant state agencies to promote propaganda and popularisation of the TCVN

and QCVN systems. came to the community to bring the standards and standards into

reality and promote the application of TCVN, and QCVN in harmony with the

international standard system. Finally, there is a need to explore ways to use new

technologies such as AI and machine learning to optimize operations and increase

customer satisfaction.

Downloaded by Giang Mai (yoonamai468@gmail.com)

VIII. References:

Xe Máy Điện | Dat Bike

Dat Bike gọi vốn thành công 5,3 triệu USD - VnExpress Kinh doanh

Dat Bike: Từng bị Shark Bình chê thẳng mặt, giờ đây sản xuất không kịp bán, founder

được quỹ đầu tư kỳ vọng là Elon Musk trong mảng 2 bánh của ĐNÁ (vnfinance.vn)

Dat Bike: Startup xe điện từng lên sóng Shark Tank vừa gọi thành công 5,3 triệu USD

vốn đầu tư (cafebiz.vn)

What Is the Capital Asset Pricing Model (CAPM)? (investopedia.com)

Downloaded by Giang Mai (yoonamai468@gmail.com)

You might also like

- Final Review Questions SolutionsDocument5 pagesFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Free Trade AgreementDocument26 pagesFree Trade AgreementRohitnanda Sharma ThongratabamNo ratings yet

- Wire Transfer FormDocument1 pageWire Transfer FormMaissa MejdoubNo ratings yet

- Capital Budgeting MethodsDocument62 pagesCapital Budgeting MethodsAnna100% (3)

- Hotel Booking PDFDocument2 pagesHotel Booking PDFferuzbekNo ratings yet

- Basic Capital BudgetingDocument42 pagesBasic Capital BudgetingMay Abia100% (2)

- IT Governance MCQDocument3 pagesIT Governance MCQHazraphine Linso63% (8)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Double EntryDocument15 pagesDouble Entryapi-207179647No ratings yet

- Vanraj Smart Task 2Document4 pagesVanraj Smart Task 2Vanraj MakwanaNo ratings yet

- RiteDocument91 pagesRiteRahul VermaNo ratings yet

- Meaning of Capital BudgetingDocument7 pagesMeaning of Capital BudgetingSaswat MishraNo ratings yet

- EM302 Exam Style Questions To Practice On Curtin UniDocument5 pagesEM302 Exam Style Questions To Practice On Curtin UniDerekVunNo ratings yet

- Vce Smart Task2Document4 pagesVce Smart Task2Bhumika AdlakNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Amazing Chemicals - Case StudyDocument11 pagesAmazing Chemicals - Case StudyKrishna HarshitaNo ratings yet

- Lecture 7 NotesDocument6 pagesLecture 7 NotesAna-Maria GhNo ratings yet

- SDG 8Document10 pagesSDG 8hassan anwerNo ratings yet

- Bài Thuyết Trình CSR Tiếng AnhDocument12 pagesBài Thuyết Trình CSR Tiếng AnhNguyễn NhiNo ratings yet

- Smart Task 2Document4 pagesSmart Task 2Ruchira ParwandaNo ratings yet

- State Bank of IndiaDocument30 pagesState Bank of IndiaSahil ChhibberNo ratings yet

- Mba026 Corporate Finance - 895727188Document2 pagesMba026 Corporate Finance - 895727188Bhupendra SoniNo ratings yet

- Corporate Finance Report AnalysisDocument64 pagesCorporate Finance Report AnalysisabhdonNo ratings yet

- Task-2 Financial Modeling and AnalysisDocument3 pagesTask-2 Financial Modeling and AnalysisPampana Bala Sai Saroj RamNo ratings yet

- WINSEM2020-21 SWE2028 TH VL2020210503406 Reference Material I 01-Apr-2021 5.5 VTOP - Cost-Benefit AnalysisDocument8 pagesWINSEM2020-21 SWE2028 TH VL2020210503406 Reference Material I 01-Apr-2021 5.5 VTOP - Cost-Benefit AnalysisGangadhar VijayNo ratings yet

- Smart Task 3Document5 pagesSmart Task 3Utkarsh ChaturvediNo ratings yet

- Nico Andre M. Sevillena BSBA MA 4-2 CS13-Information Management and Control CaseDocument2 pagesNico Andre M. Sevillena BSBA MA 4-2 CS13-Information Management and Control CaseNico Andre SevillenaNo ratings yet

- Nptel6 PDFDocument23 pagesNptel6 PDFSaurabh Kumar SharmaNo ratings yet

- Project Work Notice - Sem 6Document3 pagesProject Work Notice - Sem 6Mintu MondalNo ratings yet

- Part A Answer All The Question 4 1 4Document3 pagesPart A Answer All The Question 4 1 4jeyappradhaNo ratings yet

- Multiple Choice Theory: Choose The Best Answer. 1 Point EachDocument9 pagesMultiple Choice Theory: Choose The Best Answer. 1 Point EachPao SalvadorNo ratings yet

- The Appraisal of Capital Projects: C. G. LewinDocument28 pagesThe Appraisal of Capital Projects: C. G. LewinBhuvana ArasuNo ratings yet

- Plagiarism Checker X Originality Report: Similarity Found: 3%Document8 pagesPlagiarism Checker X Originality Report: Similarity Found: 3%Bicycle ThiefNo ratings yet

- Corporate Finance, Term-II, 2021-23Document2 pagesCorporate Finance, Term-II, 2021-23keshav kumarNo ratings yet

- Ae 313 Prelims ExamDocument7 pagesAe 313 Prelims ExamNicole ViernesNo ratings yet

- A Project On Feasibility Study of Photo Studio: Submitted byDocument16 pagesA Project On Feasibility Study of Photo Studio: Submitted bysandeep_yadav_11No ratings yet

- Ae 313 - Prelim Exam: TheoryDocument7 pagesAe 313 - Prelim Exam: TheoryNicole ViernesNo ratings yet

- Financial Management AssignmDocument14 pagesFinancial Management AssignmAmenti ErenaNo ratings yet

- Re Submit Nadda Appendix 4 Temaplate BSBMGT517 Manage Operational Plan PDFDocument4 pagesRe Submit Nadda Appendix 4 Temaplate BSBMGT517 Manage Operational Plan PDFNicolas EscobarNo ratings yet

- CF ReportDocument11 pagesCF ReportRajib AliNo ratings yet

- Software Project Management CH2 5-11Document38 pagesSoftware Project Management CH2 5-11Ramyasai MunnangiNo ratings yet

- CE1 Exercises - 2020Document6 pagesCE1 Exercises - 2020Vũ KhangNo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- AE24 Lesson 6: Analysis of Capital Investment DecisionsDocument17 pagesAE24 Lesson 6: Analysis of Capital Investment DecisionsMajoy BantocNo ratings yet

- VCE Summer Internship Program 2021: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2021: Smart Task Submission FormatKetan PandeyNo ratings yet

- Project Appraisal - Capital Budgeting MethodsDocument55 pagesProject Appraisal - Capital Budgeting Methodsmanju09535No ratings yet

- Ae23 Capital Budgeting 2Document2 pagesAe23 Capital Budgeting 2Hanielyn TagupaNo ratings yet

- Chapter 6 2021 RevisionDocument20 pagesChapter 6 2021 RevisionAri LosNo ratings yet

- Vietjet Aviation Joint Stock Company: Scope ofDocument10 pagesVietjet Aviation Joint Stock Company: Scope ofThaoNo ratings yet

- PPAC AssignDocument13 pagesPPAC AssignTs'epo MochekeleNo ratings yet

- Strategic Finance Section B & C MBAD 1B FinalDocument4 pagesStrategic Finance Section B & C MBAD 1B FinalSumama IkhlasNo ratings yet

- Project Evaluation & SelectionDocument19 pagesProject Evaluation & SelectionAlokKumarNo ratings yet

- Project Finance Question PaperDocument3 pagesProject Finance Question PaperBhavna0% (1)

- Corporate Finance - IIDocument18 pagesCorporate Finance - IIMadhuram SharmaNo ratings yet

- fm2 mq1Document4 pagesfm2 mq1Ramon Jonathan SapalaranNo ratings yet

- Impact Evaluation of Prime Minister's Employment Generation ProgramDocument39 pagesImpact Evaluation of Prime Minister's Employment Generation ProgramDhruv JainNo ratings yet

- Project Profile On Bicycle RimsDocument9 pagesProject Profile On Bicycle RimshaqNo ratings yet

- Course Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DateDocument59 pagesCourse Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DatePubgnewstate keliyeNo ratings yet

- Case StudyDocument21 pagesCase StudyAmarinder Singh Sandhu100% (1)

- Lsbf.p4 Mock QuesDocument21 pagesLsbf.p4 Mock Quesjunaid-chandio-458No ratings yet

- Introduction Part of Envoy TextileDocument4 pagesIntroduction Part of Envoy Textileshaiqua TashbihNo ratings yet

- Solution To Test 4 of 2022Document10 pagesSolution To Test 4 of 2022mavuso.kt97No ratings yet

- Handbook for Developing Joint Crediting Mechanism ProjectsFrom EverandHandbook for Developing Joint Crediting Mechanism ProjectsNo ratings yet

- Power in Teams and Groups (Chap 11)Document1 pagePower in Teams and Groups (Chap 11)Bé GiangNo ratings yet

- LONGDocument2 pagesLONGBé GiangNo ratings yet

- Individual 3 2Document16 pagesIndividual 3 2Bé GiangNo ratings yet

- Conflict and Negotiation (Chap 14)Document1 pageConflict and Negotiation (Chap 14)Bé GiangNo ratings yet

- PDF Sales Midterm Reviewer by Article 1530 1593pdfDocument43 pagesPDF Sales Midterm Reviewer by Article 1530 1593pdfsoyoung kimNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceᴘᴇᴀᴄᴏᴄᴋNo ratings yet

- Seminar On Total Productive MaintenanceDocument16 pagesSeminar On Total Productive Maintenancesrihitha tumulaNo ratings yet

- Sree Susheel Oil IndustriesDocument27 pagesSree Susheel Oil IndustriesDeekshith NNo ratings yet

- Cirrus (Interbank Network) - WikipediaDocument2 pagesCirrus (Interbank Network) - WikipediaSamNo ratings yet

- The Indonesian Economy From The Colonial Extraction Period Until The Post-New Order Period: A Review of Thee Kian Wie's Major WorksDocument12 pagesThe Indonesian Economy From The Colonial Extraction Period Until The Post-New Order Period: A Review of Thee Kian Wie's Major WorksKhairul SaniNo ratings yet

- Finman Asnwer KeyDocument6 pagesFinman Asnwer KeyLopez, Azzia M.No ratings yet

- Chapter 15 - Purchase and Purchase Returns Day BooksDocument13 pagesChapter 15 - Purchase and Purchase Returns Day Booksshemida100% (2)

- 2022acc Compart 1Document10 pages2022acc Compart 1Jabez JeenaNo ratings yet

- Bos 59504Document48 pagesBos 59504swati dubeyNo ratings yet

- Keywords: Small Business, Sustainability, Customer Retention, CRM, Relationship ManagementDocument25 pagesKeywords: Small Business, Sustainability, Customer Retention, CRM, Relationship ManagementFranklyn ChamindaNo ratings yet

- Week 3 - Chapter 7 Process ManagementDocument68 pagesWeek 3 - Chapter 7 Process Managementarthaprabawa2005No ratings yet

- Income Tax Quiz 3 and Quiz 4 Answers PDFDocument32 pagesIncome Tax Quiz 3 and Quiz 4 Answers PDFJeda UsonNo ratings yet

- Budget Statement 2024 FinalDocument250 pagesBudget Statement 2024 FinalAshley MasiyakurimaNo ratings yet

- Lbex DocidDocument65 pagesLbex DocidEmperor MinatiNo ratings yet

- 04 IntroFinancialModel PPA BoonrodDocument15 pages04 IntroFinancialModel PPA BoonrodAgus SupriyonoNo ratings yet

- Seminar Analysis 8 Key Elements of Shopee E-Commerce: University of Economics & Finance TP - HCMDocument17 pagesSeminar Analysis 8 Key Elements of Shopee E-Commerce: University of Economics & Finance TP - HCMHiền LêNo ratings yet

- Amagram May PDFDocument24 pagesAmagram May PDFKhaja MOHIDEEN .M.ANo ratings yet

- VSPD EpfDocument115 pagesVSPD EpfDIPAK VINAYAK SHIRBHATENo ratings yet

- Gopal Vashistha 200992105067 - Asian Paints STPR PDFDocument101 pagesGopal Vashistha 200992105067 - Asian Paints STPR PDFSumitNo ratings yet

- Theme 2 Technology and The Geo-Economy - FinalDocument57 pagesTheme 2 Technology and The Geo-Economy - Finalreginaamondi133No ratings yet

- Derivatives and Risk ManagementDocument5 pagesDerivatives and Risk ManagementPuneet GargNo ratings yet

- 1701 Jan 2018 Final With RatesDocument4 pages1701 Jan 2018 Final With RatesexquisiteNo ratings yet

- Guesstimates: by ICON-Consulting Club of IIM-BDocument9 pagesGuesstimates: by ICON-Consulting Club of IIM-BPratyush GoelNo ratings yet

- Amway - The Role of StakeholdersDocument5 pagesAmway - The Role of StakeholdersLukman PatelNo ratings yet

- The Specific and General External Environmental FactorsDocument3 pagesThe Specific and General External Environmental FactorsMishkatul FerdousNo ratings yet