Professional Documents

Culture Documents

Ir Variable

Uploaded by

Ronmel Ariel López RamírezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ir Variable

Uploaded by

Ronmel Ariel López RamírezCopyright:

Available Formats

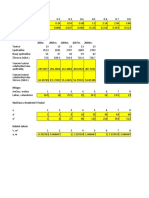

TABLA DE SALARIOS VARIABLES

PERIODO DEL 01 DE ENERO AL 31 DE DICIEMBRE DE 2021

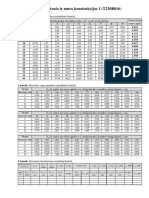

Sueldo Seguro Sueldo Sueldo Meses Sueldo Meses Expectativa Impuesto Entre 12 Por Meses Total Retención Retención Neto Neto Retención Retención

Mes U$ T/C Mensual Social Mensual Acumulado Transcu- Promedio del Anual Anual Coeficiente Laborados Acumulada del a a 1Q 2Q

Acumulado rridos Mensual Año Mes Recibir C$ Recibir U$

Enero 8,000.00 - 0.00 0.00 0.00 0.00 1 0.00 12 0.00 0.00 0.00 12 0.00 0.00 0.00 - - - -

Febrero 8,000.00 1.0000 8,000.00 560.00 7,440.00 7,440.00 2 3,720.00 12 44,640.00 0.00 0.00 11 0.00 0.00 0.00 7,440.00 7,440.00 - -

Marzo 8,098.00 1.0000 8,098.00 566.86 7,531.14 14,971.14 3 4,990.38 12 59,884.56 0.00 0.00 10 0.00 0.00 0.00 7,531.14 7,531.14 - -

Abril 8,098.00 1.0000 8,098.00 566.86 7,531.14 22,502.28 4 5,625.57 12 67,506.84 0.00 0.00 9 0.00 0.00 0.00 7,531.14 7,531.14 - -

Mayo 8,098.00 1.0000 8,098.00 566.86 7,531.14 30,033.42 5 6,006.68 12 72,080.21 0.00 0.00 8 0.00 0.00 0.00 7,531.14 7,531.14 - -

Junio 10,276.65 1.0000 10,276.65 719.37 9,557.28 39,590.70 6 6,598.45 12 79,181.41 0.00 0.00 7 0.00 0.00 0.00 9,557.28 9,557.28 - -

Julio 23,403.86 1.0000 23,403.86 1,638.27 21,765.59 61,356.29 7 8,765.18 12 105,182.22 777.33 64.78 6 388.67 0.00 388.67 21,376.92 21,376.92 - 388.67

Agosto 25,113.65 1.0000 25,113.65 1,757.96 23,355.69 84,711.99 8 10,589.00 12 127,067.98 4,060.20 338.35 5 1,691.75 388.67 1,303.08 22,052.61 22,052.61 - 1,303.08

Septiembre 25,113.65 1.0000 25,113.65 1,757.96 23,355.69 108,067.68 9 12,007.52 12 144,090.24 6,613.54 551.13 4 2,204.51 1,691.75 512.76 22,842.93 22,842.93 - 512.76

Octubre 25,113.65 1.0000 25,113.65 1,757.96 23,355.69 131,423.38 10 13,142.34 12 157,708.05 8,656.21 721.35 3 2,164.05 2,204.51 -40.46 23,396.15 23,396.15 - (40.46)

Noviembre 25,113.65 1.0000 25,113.65 1,757.96 23,355.69 154,779.07 11 14,070.82 12 168,849.90 10,327.48 860.62 2 1,721.25 2,164.05 -442.80 23,798.50 23,798.50 - (442.80)

Diciembre 25,113.65 1.0000 25,113.65 1,757.96 23,355.69 178,134.77 12 14,844.56 12 178,134.77 11,720.21 976.68 1 976.68 1,721.25 -744.56 24,100.26 24,100.26 - (744.56)

191,542.76 13,407.99 178,134.77 - 976.68

15,305.86

23,403.86

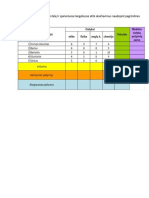

Impuesto Porcentaje sobre exceso

base aplicable de

0.01 100,000.00 - 0% -

100,000.01 200,000.00 - 15% 100,000.00

200,000.01 350,000.00 15,000.00 20% 200,000.00

350,000.01 500,000.00 45,000.00 25% 350,000.00

500,000.01 + 82,500.00 30% 500,000.00

You might also like

- RepaymentPlan - 2Document1 pageRepaymentPlan - 2nalivaikaiterNo ratings yet

- STR 2.05.08-2005 PriedaiDocument23 pagesSTR 2.05.08-2005 PriedaiVytautas ŠulskisNo ratings yet

- Cuotas INFONAVIT-IMSSDocument3 pagesCuotas INFONAVIT-IMSSjoseP88No ratings yet

- Mokestinis Pranešimas2028351Document1 pageMokestinis Pranešimas2028351Vajne DNo ratings yet

- 7 UžduotisDocument11 pages7 UžduotisModesta KivyliutėNo ratings yet

- Fact UrasDocument4 pagesFact UrasaldairNo ratings yet

- Verslo-Statistika - Užduotis JURGISDocument20 pagesVerslo-Statistika - Užduotis JURGISnereikalinga paskyraNo ratings yet

- Financiera Glox de Pagos FijosDocument3 pagesFinanciera Glox de Pagos FijosIsrael Flores100% (1)

- GB LentelėsDocument1 pageGB LentelėsFau ddNo ratings yet

- Įmonės Gaminių SąrašasDocument2 pagesĮmonės Gaminių SąrašasDaiva ValienėNo ratings yet

- Jis FlangeDocument10 pagesJis FlangejakkyntoNo ratings yet

- Jis FlangeDocument10 pagesJis Flangetiepnh.ameccNo ratings yet

- Turtas Ilgalaikis Turtas: 2017 2018 2019 Palyginimas Eur. Eur. Eur. Eur. 2018/2017 2019/2018Document23 pagesTurtas Ilgalaikis Turtas: 2017 2018 2019 Palyginimas Eur. Eur. Eur. Eur. 2018/2017 2019/2018Jūratė MikoleikaitėNo ratings yet

- Fact UrasDocument3 pagesFact UrasStudioNo ratings yet

- Huella Ecologica 3Document3 pagesHuella Ecologica 3Gaston GutierrezNo ratings yet

- Diagram OsDocument6 pagesDiagram OsLėja VaitiekutėNo ratings yet

- FormulesDocument4 pagesFormulesEdvinas MižutavičiusNo ratings yet

- ProcentaiDocument4 pagesProcentaiVesta RacevičiūtėNo ratings yet

- 2 UžduotisDocument13 pages2 UžduotisNojusNo ratings yet

- Rita Kryžiokienė: Tiekėjas Mokėtojo Kodas Mokėti, MokėsiuDocument4 pagesRita Kryžiokienė: Tiekėjas Mokėtojo Kodas Mokėti, MokėsiuMindaugas KryziokasNo ratings yet

- Medžių Tūrio Struktūros LentelėsDocument21 pagesMedžių Tūrio Struktūros Lentelėszim511No ratings yet

- Uzduotis Us AbsDocument10 pagesUzduotis Us AbsDeividas BugysNo ratings yet

- Normalna DistribucijaDocument1 pageNormalna DistribucijaFrane MladarNo ratings yet

- Trigonometrinės FunkcijosDocument4 pagesTrigonometrinės FunkcijosDeividas BugysNo ratings yet

- Įmonės Ekonomikos Tarpinis AtsiskaitymasDocument6 pagesĮmonės Ekonomikos Tarpinis AtsiskaitymasArnasNo ratings yet

- 2028 - ECOSPAR OpcijaDocument2 pages2028 - ECOSPAR OpcijaNenadStojicNo ratings yet

- Elektros Pavaros: 2 Laboratorinio Darbo AtaskaitaDocument5 pagesElektros Pavaros: 2 Laboratorinio Darbo Ataskaitadeividasp321No ratings yet

- Novaturas ISf-19 2 Pataisytas2022Document16 pagesNovaturas ISf-19 2 Pataisytas2022Konrad AvdejevNo ratings yet

- GSW Jis 3537 PDFDocument2 pagesGSW Jis 3537 PDFAdhi Ne CutcakrowoNo ratings yet

- BIBA31550397154209015480/ : Mokant Būtina Nurodyti Mokėtojo Ir Įmokos KodąDocument1 pageBIBA31550397154209015480/ : Mokant Būtina Nurodyti Mokėtojo Ir Įmokos KodąTomas MigilinskasNo ratings yet

- ŽurnalasDocument2 pagesŽurnalasMatas SakNo ratings yet

- Aukse Spejeraite VVM21Document5 pagesAukse Spejeraite VVM21Aukse Spejeraite100% (1)

- JuliusDocument16 pagesJuliusJulius LamanauskasNo ratings yet

- Elektros Pavaros: Kauno Technologijos UniversitetasDocument6 pagesElektros Pavaros: Kauno Technologijos Universitetasdeividasp321No ratings yet

- Transporto Ekonomikos UzdaviniaDocument2 pagesTransporto Ekonomikos UzdaviniaArmandas ČepasNo ratings yet

- Produkto Vadybininkas: Sandra Sliesoraitienė +370 693 27738 Sandra@serfas - LTDocument2 pagesProdukto Vadybininkas: Sandra Sliesoraitienė +370 693 27738 Sandra@serfas - LTRamūnas KriščiūnasNo ratings yet

- 1 LabfinalDocument6 pages1 Labfinaldeividasp321No ratings yet

- KRAITĖKasos-knyga Laikotarpiui 2Document4 pagesKRAITĖKasos-knyga Laikotarpiui 2Ramintaaa AndrijauskaitėėėNo ratings yet

- KRAITĖKasos-knyga Laikotarpiui 2Document4 pagesKRAITĖKasos-knyga Laikotarpiui 2Ramintaaa AndrijauskaitėėėNo ratings yet

- 3Uhnlǐludusdvodxjǐdsudã/Pdv: Nr. Mato Vnt. Kiekis Kaina Be PVM PVM % Suma Be PVM SumaDocument1 page3Uhnlǐludusdvodxjǐdsudã/Pdv: Nr. Mato Vnt. Kiekis Kaina Be PVM PVM % Suma Be PVM SumaptolkaciovNo ratings yet

- Ataskaita 12122Document1 pageAtaskaita 12122Jordanas ZalNo ratings yet

- Es PM FW0016Document5 pagesEs PM FW0016Reginaldo SantosNo ratings yet

- Zinuciu Lango Suvestine 2023-11-24Document1 pageZinuciu Lango Suvestine 2023-11-24egaigaloviciuteNo ratings yet

- JIS SectionDocument17 pagesJIS Sectionaltaf_h5No ratings yet

- IT UžduotysDocument13 pagesIT UžduotysDeimantėNo ratings yet

- ApvalinimasDocument14 pagesApvalinimassaugos darbasNo ratings yet

- Jis TableDocument17 pagesJis TableDicky PramonoNo ratings yet

- Dokumentas NeklauskDocument1 pageDokumentas NeklauskUgne Nereikia ŽinotiNo ratings yet

- KV. VamzdDocument2 pagesKV. VamzdRamūnas KriščiūnasNo ratings yet

- Jis G3466 PDFDocument3 pagesJis G3466 PDFabdulloh_99No ratings yet

- Pirma KnygagsddsgDocument5 pagesPirma KnygagsddsgMartinas DainiusNo ratings yet

- Ld1A. Optinių Sistemų TyrimasDocument48 pagesLd1A. Optinių Sistemų TyrimasMantas LiudvinaitisNo ratings yet

- TABLEAU RojausDocument6 pagesTABLEAU Rojauspaysera249No ratings yet

- PL SGPDocument1,319 pagesPL SGPhendro weiNo ratings yet

- Gali 1Document18 pagesGali 1hanifharuskuatNo ratings yet

- Gali 2Document18 pagesGali 2hanifharuskuatNo ratings yet

- 3 FormulirfunkcDocument12 pages3 FormulirfunkcVitas ValiukasNo ratings yet

- 2 - ND Veleno Stiprumo SkaiciavimasDocument1 page2 - ND Veleno Stiprumo Skaiciavimasvilius slikasNo ratings yet

- LentelesDocument7 pagesLentelesDeividas BugysNo ratings yet