Professional Documents

Culture Documents

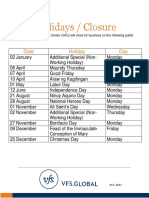

2024 Regular Holidays

Uploaded by

jinkysuzykaye0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 page2024 Regular Holidays

Uploaded by

jinkysuzykayeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

2024 Regular Holidays

January 1 Monday New Year’s Day

March 28 Thursday Maundy Thursday

March 29 Friday Good Friday

April 9 Tuesday Day of Valor (Araw ng Kagitingan)

May 1 Wednesday Labor Day

June 12 Wednesday Independence Day

August 26 Monday National Heroes Day

November 30 Saturday Bonifacio Day

December 25 Wednesday Christmas Day

December 30 Monday Rizal Day

2024 Special Non-Working Holidays

February 10 Saturday Chinese New Year

March 30 Black Saturday Black Saturday

August 21 Wednesday Ninoy Aquino Day

November 1 Friday All Saints’ Day

November 2 Saturday All Souls’ Day

December 8 Sunday Feast of the Immaculate Conception of Mary

December 24 Tuesday Christmas Eve

December 31 Tuesday Last Day of the Year

Computation for Employees Who Worked for 8 Hours on a special non-

working holiday:

(Basic Wage x 130%) + COLA [cost of living allowance]

If your daily rate is ₱1,000 (no COLA), your holiday pay is computed as follows:

₱1,000 x 1.30 = ₱1,300

Computation for Employees Who Worked Overtime on a special non-working

holiday:

Hourly rate of the basic wage x 130% x 130% x number of hours worked

With an hourly rate of ₱125 and two hours of overtime work, here's how to calculate your pay during

a special non-working day:

₱125 x 1.30 x 1.30 x 10 hours = ₱2,112.50

Computation for Employees Who Worked on a special non-working holiday

which is also their rest day:

(Daily rate × 150%) + COLA

For a daily rate of ₱1,000 (no COLA), your holiday pay is computed as follows:

₱1,000 x 1.50 = ₱1,500

Computation for Employees Who Worked OT on a special non-working

holiday which is also their rest day:

Hourly rate of the basic wage x 150% x 130% x number of hours worked

Here's how to compute your holiday rest day pay with overtime of two hours:

₱125 x 1.50 x 1.30 x 10 hours = ₱2,437.50

You might also like

- 2020 Holiday Schedule - US FINALDocument1 page2020 Holiday Schedule - US FINALDavy TongNo ratings yet

- 2022 HolidaysDocument1 page2022 Holidaysnicole samianoNo ratings yet

- Uk Bank Holidays - Gov - UkDocument4 pagesUk Bank Holidays - Gov - UkJmMcmknaol.comNo ratings yet

- HolidaysDocument1 pageHolidaysEm Bi CalizoNo ratings yet

- HolidaysDocument1 pageHolidaysEm Bi CalizoNo ratings yet

- Philippine Holidays in 2023Document2 pagesPhilippine Holidays in 2023Lyn TNo ratings yet

- Holiday CalendarDocument22 pagesHoliday CalendarRamesh RathodNo ratings yet

- 2023 HolidaysDocument1 page2023 HolidaysJhoy AnzNo ratings yet

- 2022 US Holiday ScheduleDocument1 page2022 US Holiday ScheduleAnonymous OFwyjaMyNo ratings yet

- HolidaysDocument2 pagesHolidaysMelonie JallorinaNo ratings yet

- Holidays and Observances in Philippines in 2022Document2 pagesHolidays and Observances in Philippines in 2022Charmie Fuentes AmpalayohanNo ratings yet

- Philippines 2020 Holidays and Special Non-Working Days CalendarDocument2 pagesPhilippines 2020 Holidays and Special Non-Working Days Calendarjon_macasaetNo ratings yet

- Wärtsilä U.S.: 2018 Holiday ScheduleDocument1 pageWärtsilä U.S.: 2018 Holiday ScheduleAna MariaNo ratings yet

- 2017 Legal HolidaysDocument1 page2017 Legal HolidaysJustin Paul LuminariasNo ratings yet

- Overseas Public HolidayDocument8 pagesOverseas Public Holidaynptj2xcbwrNo ratings yet

- 2022 HolidaysDocument2 pages2022 Holidaysmaria ruby diazNo ratings yet

- Office of Human Resources Holiday Calendar 2020 - 2025: Applies To: Faculty and StaffDocument3 pagesOffice of Human Resources Holiday Calendar 2020 - 2025: Applies To: Faculty and StaffJohn CocumelliNo ratings yet

- 2019 Calendar HolidaysDocument2 pages2019 Calendar HolidaysAnonymous xmSG3eHSNo ratings yet

- 2018 Philippine HolidayDocument2 pages2018 Philippine HolidayCagas Shalee GayNo ratings yet

- Employee-IndustrialRelations Holidays 2016Document1 pageEmployee-IndustrialRelations Holidays 2016LharkNo ratings yet

- Long weekends in 2023: Philippine holidays guideDocument1 pageLong weekends in 2023: Philippine holidays guideHarsha AlamoNo ratings yet

- DclaredHolidays2024Document1 pageDclaredHolidays2024Dionne Philip AmparoNo ratings yet

- Public - Holiday Philippines 2023 ENDocument1 pagePublic - Holiday Philippines 2023 ENpink jennieNo ratings yet

- Holiday Schedule 2022Document1 pageHoliday Schedule 2022Tom BondalicNo ratings yet

- CalendarDocument1 pageCalendarRuby HocsonNo ratings yet

- SS&C Eze 2019 Global Holiday CalendarDocument2 pagesSS&C Eze 2019 Global Holiday CalendarThumu srinivasa reddyNo ratings yet

- Public Holidays For 2011Document1 pagePublic Holidays For 2011alexretifNo ratings yet

- NYSE Holidays and Trading HoursDocument1 pageNYSE Holidays and Trading HoursMaqsoodNo ratings yet

- List Holiday Country 2023Document13 pagesList Holiday Country 2023Cecilia Harjanto HONo ratings yet

- Holiday List 2019Document6 pagesHoliday List 2019Ruchit KapadiaNo ratings yet

- Tuesday Nov 5 Muslim, Common Local HolidaysDocument2 pagesTuesday Nov 5 Muslim, Common Local Holidaysfraye_1No ratings yet

- Holidays and Observances in Philippines in 2021Document2 pagesHolidays and Observances in Philippines in 2021Marivic AtilloNo ratings yet

- Regular HolidaysDocument1 pageRegular HolidaysJhon Rey LaycoNo ratings yet

- Holiday List 2022Document20 pagesHoliday List 2022Shabbir KNo ratings yet

- Payroll NotesDocument1 pagePayroll NotesJL CHRISTINE UZARRAGANo ratings yet

- Nationwide Holidays: Event DateDocument1 pageNationwide Holidays: Event DateCarl VonNo ratings yet

- Holidays 2023Document1 pageHolidays 2023Millete MNo ratings yet

- 2023 Bulacan Holidays Rev.2Document2 pages2023 Bulacan Holidays Rev.2Martin Del MundoNo ratings yet

- Philippine Holiday 2010Document1 pagePhilippine Holiday 2010Kenneth E. Dela CruzNo ratings yet

- Holiday ListDocument26 pagesHoliday ListKalyan.adaviNo ratings yet

- Philippines 2019 Holidays CalendarDocument1 pagePhilippines 2019 Holidays CalendarRalp Anthony AustriaNo ratings yet

- Philippines 2021 Holidays CalendarDocument2 pagesPhilippines 2021 Holidays CalendarRey-j GumbanNo ratings yet

- Public Holidays in Philippines in 2017: AdvertisementsDocument2 pagesPublic Holidays in Philippines in 2017: AdvertisementsjayzweetNo ratings yet

- Holiday List 2023Document2 pagesHoliday List 2023Dipty SharmaNo ratings yet

- 201 Public HolidaysDocument2 pages201 Public Holidaysrahulshinde2007@gmail.comNo ratings yet

- Holiday Schedule 2024Document1 pageHoliday Schedule 2024Nathan PachecoNo ratings yet

- Philippine HolidaysDocument3 pagesPhilippine HolidaysWifi Uy AbNo ratings yet

- 2022 Holiday CalendarDocument1 page2022 Holiday CalendarKhanithaNo ratings yet

- 2012 Holidays by Location1Document3 pages2012 Holidays by Location1rudolfpeterssonNo ratings yet

- Philippine HolidaysDocument1 pagePhilippine HolidaysEdward TalamanNo ratings yet

- Holiday List 2022Document1 pageHoliday List 2022Vamsi krishnaNo ratings yet

- ACT Public Holidays 2024Document1 pageACT Public Holidays 2024Oliver HoughNo ratings yet

- Holiday List - 2021Document5 pagesHoliday List - 2021swati jenaNo ratings yet

- Calender 2021 East TimorDocument1 pageCalender 2021 East Timorserena freitasNo ratings yet

- Philippines 2021 Holidays and Observances GuideDocument2 pagesPhilippines 2021 Holidays and Observances GuideJaya DmngNo ratings yet

- Holidays in Philippines 2018Document1 pageHolidays in Philippines 2018Narette SolanoyNo ratings yet

- Holiday List 2020: New South Wales, AustraliaDocument17 pagesHoliday List 2020: New South Wales, AustraliaAnkush BagleyNo ratings yet

- List of Holidays 2024: Holiday Date Month Day RemarksDocument1 pageList of Holidays 2024: Holiday Date Month Day RemarksbutterflysforestNo ratings yet

- Holidays 2023Document1 pageHolidays 2023Millete MNo ratings yet

- The Festive Teacher: Multicultural Activities for Your CurriculumFrom EverandThe Festive Teacher: Multicultural Activities for Your CurriculumRating: 5 out of 5 stars5/5 (1)

- Report On Health and Safety Organization Form (DOLE - BWC - OHSD - IP-5)Document2 pagesReport On Health and Safety Organization Form (DOLE - BWC - OHSD - IP-5)jinkysuzykayeNo ratings yet

- Part Time Employment AgreementDocument4 pagesPart Time Employment AgreementjinkysuzykayeNo ratings yet

- Employment Agreement SummaryDocument6 pagesEmployment Agreement Summarydemelyn dargantesNo ratings yet

- Juki HZL-FDocument35 pagesJuki HZL-FjinkysuzykayeNo ratings yet