0% found this document useful (0 votes)

879 views4 pagesFinancial Transaction Worksheet

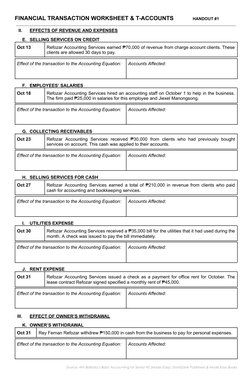

This document provides instructions and a series of financial transactions for a new accounting business. Students are asked to analyze how each transaction affects the accounting equation and identify which specific accounts are involved. The transactions include starting the business with a cash investment, purchasing equipment on credit and supplies for cash, paying a creditor, earning revenue on credit and for cash, paying expenses like salaries, utilities, and rent, collecting receivables, and an owner's withdrawal.

Uploaded by

Christian paul LaguertaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

879 views4 pagesFinancial Transaction Worksheet

This document provides instructions and a series of financial transactions for a new accounting business. Students are asked to analyze how each transaction affects the accounting equation and identify which specific accounts are involved. The transactions include starting the business with a cash investment, purchasing equipment on credit and supplies for cash, paying a creditor, earning revenue on credit and for cash, paying expenses like salaries, utilities, and rent, collecting receivables, and an owner's withdrawal.

Uploaded by

Christian paul LaguertaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Paying a Creditor: Explains the transaction effect of paying a creditor in cash on the accounts.

- Initial Transactions: Covers basic accounting transactions and their effects on assets, liabilities, and owner's equity.

- Purchasing Supplies for Cash: Discusses the effects of cash purchases of supplies on the accounting equation.

- Purchasing Equipment on Credit: Describes the accounting impact of buying equipment on credit.

- Selling Services for Cash: Explores direct cash sales and their effects on revenue accounts.

- Employees' Salaries: Accountancy of salaries paid and the impact on business expenses and liabilities.

- Rent Expense: Describes the transactions involved in paying rent and their accounting treatment.

- Collecting Receivables: Details the cash collection from receivables and its accounting impact.

- Effects of Revenue and Expenses: Analyzes how revenue and expense activities alter financial accounts and equations.

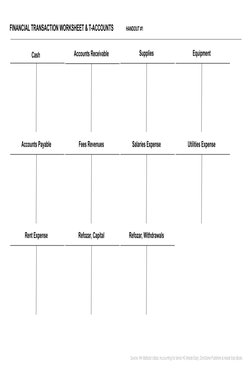

- T-Accounts Diagram: Provides a visual representation of T-accounts for various transaction categories.