Professional Documents

Culture Documents

Salaries and Wages

Uploaded by

Lilac LucyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salaries and Wages

Uploaded by

Lilac LucyCopyright:

Available Formats

Salaries & Wages

Lesson 8

Salary Wage

A regular payment that is typically paid on a Remuneration for skilled and unskilled labor

monthly or yearly basis made by an employer to an where the payment or rates are based on

employee, usually a white-collar worker time, piece on commission basis.

Types of Wages

Pay

Salaries and Wages are considered as payments

Piece Rate

• Fixed

for the service or work done by the employee. • Differential

Hourly Rate

Daily Rate

Overtime Pay

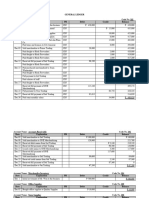

Gross Pay/ Earnings Net Pay/ Earnings Formula for Net Pay

Gross Pay for a payroll In the payroll

The total earnings of an employee deductions. Net Pay= Gross Pay - Total Deductions

for a payroll period before taxes SSS

₱xx

Philhealth & PAG-IBIG contributions

and other deductions are taken Gross Pay/Earnings

Withholding taxes

out Union Dues and other deductions

Total Deductions (xx)

This is the amount to be paid to the

employee.

Net Pay/Take-home Pay ₱xx

OVERTIME PAY

1. Ordinary Day 4. Rest Day on a Special Day

Regular Hourly Rate= Regular Hourly Rate / 8 Hourly Rate on Rest Day on a Special Day=

Overtime Rate= Regular Hourly Rate + 25% of Regular Hourly Rate Regular Hourly Rate + 50% of Regular Hourly Rate

2. Holiday Overtime Rate= Hourly Rate on Rest Day on a Special

Day + 30% of Hourly Rate on Rest Day on a Special

Holiday Hourly Rate= Regular Hourly Rate x 200%

Day

Overtime Rate= Holiday Hourly Rate + 30% of Holiday Hourly Rate

5. Rest Day on a Holiday

3. Rest Day and Special Day Hourly Rate on Rest Day on a Holiday=

Hourly Rate on Rest Day= Regular Hourly Rate + 30% of Regular Hourly Rate Regular Hourly Rate + 160% of Regular Hourly Rate

Overtime Rate= Hourly Rate on Rest Day = 30% of Hourly Rate on Rest Day

Overtime Rate= Hourly Rate on Rest Day on a Holiday

+ 30% of Hourly Rate on Rest Day on a Holiday

You might also like

- 2 Guna Fibres Ltd.Document20 pages2 Guna Fibres Ltd.Lance EstopenNo ratings yet

- Estate Planning SlidesDocument7 pagesEstate Planning SlidesVy T ToNo ratings yet

- Business Math 12Document9 pagesBusiness Math 12Scottie James Martin FaderangaNo ratings yet

- How To Compute Payroll: Michael John NatablaDocument87 pagesHow To Compute Payroll: Michael John NatablaMichael John D. Natabla100% (1)

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- What Is PayrollDocument3 pagesWhat Is PayrollAbraham Mayo MakakuaNo ratings yet

- Accounting For LaborDocument6 pagesAccounting For LaborBernard FernandezNo ratings yet

- LabourDocument67 pagesLabourRohaib MumtazNo ratings yet

- Overtime PayDocument4 pagesOvertime PayRyle Dan ClementeNo ratings yet

- Overtime PayDocument71 pagesOvertime Paychinna25689No ratings yet

- Regular Holidays Special Non Working HolidaysDocument5 pagesRegular Holidays Special Non Working HolidaysKyleTyNo ratings yet

- Credit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa CharyDocument45 pagesCredit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa Charysaumya tiwariNo ratings yet

- Activity 3B - Salary and WagesDocument6 pagesActivity 3B - Salary and WagesJesneil ZhenNo ratings yet

- Introduction To Salaries Wages Income and BenefitsDocument14 pagesIntroduction To Salaries Wages Income and BenefitsYAHIKOヤヒコYUICHIゆいちNo ratings yet

- Cost AccountingDocument9 pagesCost AccountingAmey SonarNo ratings yet

- L3 - 3.3 PayrollDocument5 pagesL3 - 3.3 PayrollLovely ParkNo ratings yet

- Fair Work Information StatementDocument2 pagesFair Work Information StatementaNo ratings yet

- Lesson 4 Wk12 4th Fundamental Operations of Mathematics As Applied in Salaries and WagesDocument15 pagesLesson 4 Wk12 4th Fundamental Operations of Mathematics As Applied in Salaries and WagesFrancine Arielle BernalesNo ratings yet

- PayrollDocument26 pagesPayrollwahidur rahmanNo ratings yet

- Payroll in The PhilippinesDocument60 pagesPayroll in The PhilippinesAr Zel ArzelNo ratings yet

- Fair Work Information StatementDocument2 pagesFair Work Information StatementAlex NguyenNo ratings yet

- Organization & Management: First Semester - Second Quarter Week - 3Document6 pagesOrganization & Management: First Semester - Second Quarter Week - 3Mira Joey AradoNo ratings yet

- Lesson 4.2Document11 pagesLesson 4.2Maricris OcampoNo ratings yet

- Lu 3Document50 pagesLu 3Vj TjizooNo ratings yet

- Salaries and WagesDocument2 pagesSalaries and WagesMisha Dela Cruz CallaNo ratings yet

- 7 - Fair-Work-Information-Statement - Nov 2021Document3 pages7 - Fair-Work-Information-Statement - Nov 2021Eza BerezzaNo ratings yet

- Bus Math-Module 5.2 Overtime PayDocument68 pagesBus Math-Module 5.2 Overtime Payaibee patatagNo ratings yet

- Matrix of Different Rates For Overtime and Premium PayDocument2 pagesMatrix of Different Rates For Overtime and Premium PayKyle DionisioNo ratings yet

- Payroll ComponentsDocument16 pagesPayroll Componentsbanerjeechiranjib637No ratings yet

- Important Information About Your Pay and ConditionsDocument2 pagesImportant Information About Your Pay and ConditionshitiliNo ratings yet

- Fair Work Information StatementDocument3 pagesFair Work Information Statementmargaux.vincartNo ratings yet

- Accounting For LaborDocument5 pagesAccounting For Laborhed-jkebengNo ratings yet

- Math ReviewerFinalsDocument17 pagesMath ReviewerFinalssamgyupNo ratings yet

- Matrix For Overtime and Premium PayDocument2 pagesMatrix For Overtime and Premium PayKyle DionisioNo ratings yet

- RSPO Guidance On Calculating Prevailing Wages - EnglishDocument10 pagesRSPO Guidance On Calculating Prevailing Wages - EnglishAndria AnriaNo ratings yet

- SalaryDocument25 pagesSalaryKylee NathanielNo ratings yet

- Unit 1 VocabularyDocument2 pagesUnit 1 VocabularyLara Rubio FernandezNo ratings yet

- California Regular Rate of Pay Calculations (JL)Document5 pagesCalifornia Regular Rate of Pay Calculations (JL)Rajat KaushikNo ratings yet

- AccountingDocument6 pagesAccountingMiselNo ratings yet

- Table of Benefits - Agent Level - Nov 2021Document5 pagesTable of Benefits - Agent Level - Nov 2021Aris SoloNo ratings yet

- Business Math 2nd Quarter Module #4Document16 pagesBusiness Math 2nd Quarter Module #4John Lloyd RegalaNo ratings yet

- Business Math 2nd Quarter Module #4Document16 pagesBusiness Math 2nd Quarter Module #4John Lloyd RegalaNo ratings yet

- Business Math Midterm Reviewer Session 8 Introduction To Salaries and WagesDocument8 pagesBusiness Math Midterm Reviewer Session 8 Introduction To Salaries and WagesJwyneth Royce DenolanNo ratings yet

- Introduction: Compensation & Benefits: The Basics - Chapter 1 by Ankush TalwarDocument7 pagesIntroduction: Compensation & Benefits: The Basics - Chapter 1 by Ankush Talwarank91181No ratings yet

- Chapter-07: Monthly Remuneration of Each of The Officers and Employees. Piece Work System & Overtime Working EtcDocument8 pagesChapter-07: Monthly Remuneration of Each of The Officers and Employees. Piece Work System & Overtime Working Etcmaheshkumar744No ratings yet

- Labor ElDocument4 pagesLabor ElRachelle CasimiroNo ratings yet

- BBA - Management AccountingDocument17 pagesBBA - Management AccountingMohamaad SihatthNo ratings yet

- Fair Work Information StatementDocument3 pagesFair Work Information StatementAlisonNo ratings yet

- Payroll in Hong Kong It Adp ComDocument8 pagesPayroll in Hong Kong It Adp ComdongmingNo ratings yet

- Working Out Your Wages 1 2Document10 pagesWorking Out Your Wages 1 213593678No ratings yet

- Business Math G12 - Week9 Employee Compensation Payroll Deductions PPTX 1Document16 pagesBusiness Math G12 - Week9 Employee Compensation Payroll Deductions PPTX 1KeiNo ratings yet

- Chapter Four Payroll in ETHDocument11 pagesChapter Four Payroll in ETHMiki AberaNo ratings yet

- Bus Math-M6Document3 pagesBus Math-M6Caslenia IvyNo ratings yet

- Acca Accounting For LabourDocument54 pagesAcca Accounting For LabourKiri chrisNo ratings yet

- Computing Overtime:: 13th Month PayDocument4 pagesComputing Overtime:: 13th Month PayAra Princess OlamitNo ratings yet

- Xcostcon Chapter 9Document16 pagesXcostcon Chapter 9abrylle opinianoNo ratings yet

- Final Reviewer 2ndmid BMDocument1 pageFinal Reviewer 2ndmid BMRawr rawrNo ratings yet

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Payroll 101Document26 pagesPayroll 101RENz TUBALNo ratings yet

- Week 3 - Salary, WageDocument21 pagesWeek 3 - Salary, WageKristiane Joie MicoNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- 20221224-CITIC-Giant Biogene 2367.HK Initiation Exploring A Second Growth CurveDocument6 pages20221224-CITIC-Giant Biogene 2367.HK Initiation Exploring A Second Growth CurvejsbcpersonalNo ratings yet

- Chapter 31Document9 pagesChapter 31narasimhaNo ratings yet

- Dr. Felipe Medalla Financial SectorDocument104 pagesDr. Felipe Medalla Financial SectorLianne Carmeli B. Fronteras100% (1)

- Background To IPSAS Implementation in NigeriaDocument28 pagesBackground To IPSAS Implementation in NigeriaAkinmulewo Ayodele67% (3)

- Chapter 14aDocument25 pagesChapter 14aKhadiza Tul Kobra BornaNo ratings yet

- Lecture - Interest Rate SwapDocument26 pagesLecture - Interest Rate SwapKamran AbdullahNo ratings yet

- Pearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1Document8 pagesPearson Btec Level 4 HND Diploma in Business Unit 2 Managing Financial Resources and Decision Assignment 1beautyrubbyNo ratings yet

- Past PaperDocument17 pagesPast Paperwanangwa nyasuluNo ratings yet

- PFM 4 DimensionsDocument10 pagesPFM 4 DimensionsSentayehu GebeyehuNo ratings yet

- Home Loans Project ReportDocument105 pagesHome Loans Project Reportkaushal2442No ratings yet

- Insurance MRPDocument30 pagesInsurance MRPritesh0201100% (1)

- BH - eFM3 - PPT - ch05 - Part 1Document19 pagesBH - eFM3 - PPT - ch05 - Part 1LIM HUI YI / UPMNo ratings yet

- Chapter 7 Chap SevenDocument11 pagesChapter 7 Chap SevenRanShibasaki50% (2)

- VAT MathDocument3 pagesVAT Mathtisha10rahman50% (4)

- Self Test Questions-PROVISIDocument2 pagesSelf Test Questions-PROVISIWilna PurenNo ratings yet

- Audit of BanksDocument92 pagesAudit of BanksDebbie Grace Latiban LinazaNo ratings yet

- Ifsfm M2Document98 pagesIfsfm M2Cally CallisterNo ratings yet

- PitchBook 4Q 2019 Analyst Note Overview of Tech Focused PE FundsDocument16 pagesPitchBook 4Q 2019 Analyst Note Overview of Tech Focused PE FundsDNo ratings yet

- Fundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Document2 pagesFundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Sheena RobiniolNo ratings yet

- Busines PlanDocument23 pagesBusines Planteme beyaNo ratings yet

- RbiDocument1 pageRbikhajabaigNo ratings yet

- ET Wealth Apr 6 - 12 2020Document23 pagesET Wealth Apr 6 - 12 2020Rony GeorgeNo ratings yet

- General LedgerDocument4 pagesGeneral Ledger21-53070No ratings yet

- Cac - Application Form With Declaration For SmeDocument2 pagesCac - Application Form With Declaration For SmeAbuNo ratings yet

- Retail Sector in Sri LankaDocument13 pagesRetail Sector in Sri LankaJegan SJNo ratings yet

- Role CFODocument32 pagesRole CFOChristian Joneliukstis100% (1)

- Other 2023-5Document11 pagesOther 2023-5syed asiqNo ratings yet

- Other Long-Term Investments: Sinking Fund Requirements Maturitie SDocument3 pagesOther Long-Term Investments: Sinking Fund Requirements Maturitie SXiena0% (1)