Professional Documents

Culture Documents

Economic Equivalence Involving Interest

Economic Equivalence Involving Interest

Uploaded by

miang.gabriel0928Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Equivalence Involving Interest

Economic Equivalence Involving Interest

Uploaded by

miang.gabriel0928Copyright:

Available Formats

ECONOMIC EQUIVALENCE INVOLVING INTEREST

Why? It is common in engineering to compare alternatives.

THE MEANING OF EQUIVALENCE

In engineering economy two things are said to be equivalent when they have the same

effect. Unlike most individual involved with personal finance, industrial decision

makers using engineering economics are not so much concerned with the timing of a

project's cash flows as with the profitability of that project. This means that

mechanisms are needed to compare projects involving receipts and disbursements

occurring at different times, with the goal of identifying an alternative having the

largest eventual profitability [Lindeberg82].

EQUIVALENCE CALCULATIONS INVOLVING A SINGLE FACTOR

The interest equations are affected by three factors: (a) amounts, (b) times of

occurrence of amounts, and (c) rate of interest.

1. Single-Payment Compound-Amount Factor

F = P.[1 + i]^n

Example 1 : Let P = $1000, i = ??, n = 4 years, and F = $1200. The interest

rate is

F = $1200.00 = $1000.00 [1 + i ]^4

Rearranging terms in this equation gives i = 1.2^0.25 - 1 = 0.046635.

Example 2 : Let P = $1000, i = 10%, n = ?? years, and F = $1200.

F = $1200.00 = $1000.00 [1 + 0.10 ]^n

Rearranging terms in this equation gives n = 1.91 years.

2. Single-Payment Present-Worth Factor

F

P = ---------

[1 + i]^n

Example 1 : Let F = $1000, i = 12%, n = 4 years, and P = ?

$1000.00

P = ------------ = $635.5

[1 + 0.12]^4

3. Equal-Payment-Series Compound-Amount Factor

[ 1 + i ]^n - 1

F = A * ---------------

i

The derivation of this formula can be found on page 46 of the economics text.

Example 1 : Let A = $100.00, i = 10%, and F = $1000.00. How many years n

are needed ?

[ 1 + 0.12 ]^n - 1

$1000.00 = $100.00 * ------------------

0.12

Rearranging the terms in this equation gives n = 7.27 years.

4. Equal-Payment-Series Sinking-Fund Factor

i

A = F * ---------------

[ 1 + i ]^n - 1

Example 1 : Paying towards a future amount. Let F = $1000.00, i = 12%, and n = 4

years. What is A ?

0.12

A = $1000.00 * ------------------ = $209.20

[ 1 + 0.12 ]^4 - 1

5. Equal-Payment-Series Capital-Recovery Factor

i * [ 1 + i ]^n

A = P * ---------------

[ 1 + i ]^n - 1

Example 1 : Paying back a loan. Let P = $1000, i = 12%, n = 4 years, and A = ?

0.12 * [ 1 + 0.12 ]^4

A = 1000 * --------------------- = 329.2

[ 1 + 0.12 ]^4 - 1

6. Equal-Payment-Series Present-Worth Factor

[ 1 + i ]^n - 1

P = A * ---------------

i * [ 1 + i ]^n

Example 1 : Let A = 100, i = 10%, and n = 8 years.

[ 1 + 0.10 ]^8 - 1

P = 100 * ---------------------- = 533.49

0.10 * [ 1 + 0.10 ]^8

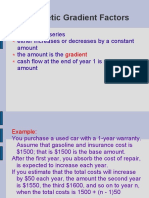

7. Uniform Gradient-Series Factor

As explained above, the gradient (G) is a value in the cash flow that starts with 0 at

the end of year 1, G at the end of year 2, 2G at the end of year 3, and so on to (n-1)G

at the end of year n.

This can be described as

*- -*

| 1 n |

A = G . | - - --------------- |

| i [ 1 + i ]^n - 1 |

*- -*

Example 1 : Let G = 100, i = 12%, n = 4 years, and A = ??

*- -*

| 1 4 |

A = 100.| ---- - ------------------ | = 135.9.

| 0.12 [ 1 + 0.12 ]^4 - 1 |

*- -*

You might also like

- Mathematics For FinanceDocument15 pagesMathematics For Financekirsten chingNo ratings yet

- Compound Interest:: Log A Log P + Tlog (1+ R)Document3 pagesCompound Interest:: Log A Log P + Tlog (1+ R)Aachal SinghNo ratings yet

- Engineering Economics - The PrinciplesDocument31 pagesEngineering Economics - The Principlesking.jabamanNo ratings yet

- FINVA100 B TimeValueAnalysis Estares JohnReyDocument6 pagesFINVA100 B TimeValueAnalysis Estares JohnReyJohnRey EstaresNo ratings yet

- (5-1) Economical Comparison of Engineering Projects:-: 1-Present Worth Methods (P.W.M)Document7 pages(5-1) Economical Comparison of Engineering Projects:-: 1-Present Worth Methods (P.W.M)Mr sfeanNo ratings yet

- Solution MS 291 - Assignment 1 MUDocument4 pagesSolution MS 291 - Assignment 1 MUM HarisNo ratings yet

- Multiple Compounding Periods in A Year: Example: Credit Card DebtDocument36 pagesMultiple Compounding Periods in A Year: Example: Credit Card DebtnorahNo ratings yet

- Lecture 2 - How Time and Interest Affect MoneyDocument50 pagesLecture 2 - How Time and Interest Affect MoneyDanar AdityaNo ratings yet

- Compound InterestDocument58 pagesCompound InterestnonononowayNo ratings yet

- GL4102-07-Equivalence and Compound Interest-BaruDocument34 pagesGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanNo ratings yet

- Presentation 1Document15 pagesPresentation 1Unrealistic GamerNo ratings yet

- (4-1) Future Value (FV) Single-Payment Compound Amount FormulaDocument6 pages(4-1) Future Value (FV) Single-Payment Compound Amount FormulaMr sfeanNo ratings yet

- Chapter 2 BDocument29 pagesChapter 2 BKenDaniswaraNo ratings yet

- Kuliah INVS-5Document11 pagesKuliah INVS-5Titoe Dhoni ValentNo ratings yet

- Simple Annuity: General MathematicsDocument18 pagesSimple Annuity: General MathematicsAezcel SunicoNo ratings yet

- CONSTRUCTION EconomicsDocument27 pagesCONSTRUCTION Economicshema16100% (1)

- Corporate Finance Chapter 6Document7 pagesCorporate Finance Chapter 6Razan EidNo ratings yet

- Chapter 2Document13 pagesChapter 2ObeydullahKhanNo ratings yet

- Mathematics of Investment 3Document21 pagesMathematics of Investment 3Reichstein CaduaNo ratings yet

- Pe Civil Cost Analysis Fall 2012Document67 pagesPe Civil Cost Analysis Fall 2012Anonymous PkeI8e84Rs100% (1)

- Chapter 1 3Document27 pagesChapter 1 3Marlon DominguezNo ratings yet

- HeartattackDocument6 pagesHeartattackVuinsia BcsbacNo ratings yet

- Mathematics Interest: Published by Exam Aid PublicationDocument12 pagesMathematics Interest: Published by Exam Aid PublicationFahim AhmedNo ratings yet

- Ordinary Annuity PDFDocument6 pagesOrdinary Annuity PDFCarl Omar GobangcoNo ratings yet

- Notes CF Last Year PaperDocument3 pagesNotes CF Last Year PaperprakosorezaNo ratings yet

- Mng111 Lecture 2Document17 pagesMng111 Lecture 2Alexis ParrisNo ratings yet

- Mng111 Lecture 2Document17 pagesMng111 Lecture 2Alexis ParrisNo ratings yet

- Simple Annuities FinalDocument95 pagesSimple Annuities FinalMae Ann KongNo ratings yet

- Assignment 1 FinDocument23 pagesAssignment 1 Finritesh0% (1)

- General Knowledge: EconomicsDocument32 pagesGeneral Knowledge: EconomicsrevandifitroNo ratings yet

- اقتصااد2019 2Document12 pagesاقتصااد2019 2Mohamad DuhokiNo ratings yet

- Module #2 Part 4 Gradient SeriesDocument15 pagesModule #2 Part 4 Gradient Seriessalubrekimberly92No ratings yet

- Lec No 2Document23 pagesLec No 2engbabaNo ratings yet

- Time Value of MoneyDocument17 pagesTime Value of MoneyShelveyElmoDiasNo ratings yet

- SI CI UpdatedDocument34 pagesSI CI UpdatedPranjal SharmaNo ratings yet

- Sbipoe: Study Material For Quant AptitudeDocument7 pagesSbipoe: Study Material For Quant Aptitudemunaxemimosa8No ratings yet

- Topic 2 Time Value of MoneyDocument6 pagesTopic 2 Time Value of Moneysalman hussainNo ratings yet

- Engineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دDocument45 pagesEngineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دRommelBaldagoNo ratings yet

- Lec 8Document3 pagesLec 8Ahmed ShabanNo ratings yet

- Engineering Economy Summary PDFDocument11 pagesEngineering Economy Summary PDFCabdisamed Ciise GeneralNo ratings yet

- Lesson 6 Compound InterestDocument14 pagesLesson 6 Compound InterestDaniela CaguioaNo ratings yet

- Lecture (8) (31-12-2023)Document20 pagesLecture (8) (31-12-2023)Abdulrahman YounesNo ratings yet

- CH 1 and 2Document112 pagesCH 1 and 2DanialNo ratings yet

- Si Ci 2023Document40 pagesSi Ci 2023Prajual AgrawalNo ratings yet

- Chapter Three Compound Interest 2021Document9 pagesChapter Three Compound Interest 2021Fongoh Bobga RemiNo ratings yet

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocument5 pagesAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNo ratings yet

- Section+1 1234aaaaDocument28 pagesSection+1 1234aaaaYousef KhanNo ratings yet

- Problem SET: Submitted By: Jhoemel A. Bautista BSME-3Document7 pagesProblem SET: Submitted By: Jhoemel A. Bautista BSME-3Jom Ancheta BautistaNo ratings yet

- Comm298 Class03 PDFDocument20 pagesComm298 Class03 PDFBobMckenzieNo ratings yet

- MCR3U - Mr. Santowski: SS.02.1 - Simple Interest, Arithmetic Sequences and Linear GrowthDocument8 pagesMCR3U - Mr. Santowski: SS.02.1 - Simple Interest, Arithmetic Sequences and Linear GrowthlaubrantleyNo ratings yet

- Compounding InterestismDocument23 pagesCompounding InterestismJhay Mike BatunaNo ratings yet

- 4 General AnnuitiesDocument141 pages4 General AnnuitiesMark Allen LabasanNo ratings yet

- CompoundInterest Articlev0.1 26thseptember2021Document23 pagesCompoundInterest Articlev0.1 26thseptember2021Kailas RautraoNo ratings yet

- W4. Annual Worth Analysis AnnotasiDocument38 pagesW4. Annual Worth Analysis AnnotasiChrisThunder555No ratings yet

- Simple Interests: Important Facts and FormulaeDocument8 pagesSimple Interests: Important Facts and FormulaeOmer AliNo ratings yet

- CH 2 FactorsDocument11 pagesCH 2 FactorsRashadafanehNo ratings yet

- ASSIGNMENT 2 (Con't) - SolutionsDocument2 pagesASSIGNMENT 2 (Con't) - SolutionsMinh TuyềnNo ratings yet

- Economic AnalysisDocument3 pagesEconomic Analysismiang.gabriel0928No ratings yet

- Simple InterestDocument36 pagesSimple InterestKhynth Ezykyl CorroNo ratings yet

- Inverse Trigonometric Functions (Trigonometry) Mathematics Question BankFrom EverandInverse Trigonometric Functions (Trigonometry) Mathematics Question BankNo ratings yet

- SYNC 3 USB MAPS-Update-GuideDocument8 pagesSYNC 3 USB MAPS-Update-Guidetatamata2539No ratings yet

- Employer'S Virtual Pag-Ibig Enrollment FormDocument2 pagesEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- PentesterLab - Learn Web Penetration Testing - The Right WayDocument4 pagesPentesterLab - Learn Web Penetration Testing - The Right Wayjorge jesus perezNo ratings yet

- Swimming Pool Lighting DesignDocument2 pagesSwimming Pool Lighting DesignquletjavierNo ratings yet

- Improving And: Service Quality ProductivityDocument42 pagesImproving And: Service Quality ProductivityThuTrangNo ratings yet

- HP Compaq cq320 321 Inventec Villemont 2010 Intel-Uma Rev A02 SCH PDFDocument59 pagesHP Compaq cq320 321 Inventec Villemont 2010 Intel-Uma Rev A02 SCH PDFIIIkwarkaNo ratings yet

- SRS For ATM SystemDocument21 pagesSRS For ATM SystemUrja DhabardeNo ratings yet

- LTE OverviewDocument98 pagesLTE OverviewAnshul GuptaNo ratings yet

- Lecture9A - CpE 690 Introduction To VLSI DesignDocument20 pagesLecture9A - CpE 690 Introduction To VLSI DesignjvandomeNo ratings yet

- U.S. Citizenship and Immigration Services (Uscis) OnlineDocument2 pagesU.S. Citizenship and Immigration Services (Uscis) Onlinevm totoNo ratings yet

- 600 - Data Normalization Using Median & Median Absolute Deviation (MMAD) Based Z Score For Robust Predictions Vs Min Max NormalizationDocument10 pages600 - Data Normalization Using Median & Median Absolute Deviation (MMAD) Based Z Score For Robust Predictions Vs Min Max Normalizationrorrito33No ratings yet

- Lab and Project Work Sum 19Document556 pagesLab and Project Work Sum 19mohitNo ratings yet

- Enciclopedia Universale Del Bimby Volume 26 PDFDocument122 pagesEnciclopedia Universale Del Bimby Volume 26 PDFfabritteNo ratings yet

- Resume Mohamad Ashaari Bin AhmadDocument2 pagesResume Mohamad Ashaari Bin AhmadAshaari AhmadNo ratings yet

- Deli Yannis 2004Document19 pagesDeli Yannis 2004Marius AndroneNo ratings yet

- Beginning - Middle - EndDocument17 pagesBeginning - Middle - EndGrishma DaghaNo ratings yet

- Openswitch Opx Install Guide r221Document10 pagesOpenswitch Opx Install Guide r221Ahmad WahidNo ratings yet

- Participation in Collegial ActivitiesDocument6 pagesParticipation in Collegial Activitiesapi-453747665No ratings yet

- ICE Guidance Memo - Post Order Custody Reviews Responsibilities and Guidance (9/17/07)Document7 pagesICE Guidance Memo - Post Order Custody Reviews Responsibilities and Guidance (9/17/07)J CoxNo ratings yet

- ELD1-GW Sem2 Grammar WorkbookDocument42 pagesELD1-GW Sem2 Grammar WorkbookhuongquynhNo ratings yet

- GE Careguard User ManualDocument18 pagesGE Careguard User ManualSergio BergerNo ratings yet

- APRIL 2014 Issue PDFDocument92 pagesAPRIL 2014 Issue PDFSAMIM HASAN LASKARNo ratings yet

- The Marcus Device ControversyDocument8 pagesThe Marcus Device ControversyaasdasNo ratings yet

- G9-ICT-CSS-Q1-Week2-3 Hardware and SoftwareDocument11 pagesG9-ICT-CSS-Q1-Week2-3 Hardware and SoftwareRizaldo C. LeonardoNo ratings yet

- 4309 Psychology 101 Unit Outline 2010 f2f FINALDocument17 pages4309 Psychology 101 Unit Outline 2010 f2f FINALElliott PorterNo ratings yet

- Ipe Short Notes - SUEDocument3 pagesIpe Short Notes - SUEMunch ChiniNo ratings yet

- Disposal of Government Properties - 1Document5 pagesDisposal of Government Properties - 1juliet diazNo ratings yet

- The Effects of Using Songs To Teach Simple Past Tense' To Low Proficiency L2 LearnersDocument17 pagesThe Effects of Using Songs To Teach Simple Past Tense' To Low Proficiency L2 LearnersasunthaNo ratings yet

- College Admission - University of Makati 2Document3 pagesCollege Admission - University of Makati 2Ella Bajande SarteNo ratings yet

- Staff Development UBD Stage 3 Lesson PlanningDocument4 pagesStaff Development UBD Stage 3 Lesson Planningdebra_scott_6No ratings yet