Professional Documents

Culture Documents

Ar 2

Ar 2

Uploaded by

Sharmaine Beran0 ratings0% found this document useful (0 votes)

11 views8 pagesOriginal Title

AR 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views8 pagesAr 2

Ar 2

Uploaded by

Sharmaine BeranCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

teenth. ree _

CHAPTER 16 |

ACCOUNTS RECEIVABLE

Problem 16-1 (AICPA Adapted)

me Company provided the following information for the current

Accounts receivable on Ji

Credit sales Petia naa

Collections from customers, excluding recovery 4,750,000

Accounts written off 125,000

Collection of accounts written off in prior year

(customer credit was not reestablished) 25,000

Estimated uncollectible receivables per aging e

of receivables at December 31 165,000

What is the balance of accounts receivable, before allowance for _

doubtful accounts onDecember31? "eR a by

a. 1,825,000

b. 1,850,000

c.

d.

. 1,950,000

|. 1,990,000

Solution 16-1 Answer a

Accounts receivable - January 1,300,000

Add: Credit sales 5,400,000

Total 6,700,000

Less: Collection from customers "4,750,000

Accounts written off ~ 125,000 4,875,000

Accounts receivable - December 31 1,825,000

The recovery of accounts written off does not affect the balance of

accounts receivable because the effect is offsetting.

205

a

Problem 16-2 (AICPA Adapted)

year:

Jey Company provided the following data forthe curent

650,000

Accounts receivable, January 1 2,700,000

Credit sales 75,000

Sales returns 40,000

Accounts written off, 2,150,000

Collections from customers 50000

Estimated future sales returns at.December 31 110,000

Estimated uncollectible accounts at 12/31 per agi08

ber 312

‘Whats the amortized cost of accounts receivable on Decem

1,200,000

b. 1,125,000

c. 1,085,000

4. 925,000

Solution 16-2 Answer d

650,000

‘Accounts receivable ~ January! 2,700,000

Credit sales 3,350,000

Total

Less: Collections from customers 2

Accounts written off Bam 2.265.000

Sales returns rsoot

‘Accounts receivable ~ December 31 LZ

1,085,000

‘Accounts receivable ‘ieaoo

Less: Allowance for doubtful accounts NW 160,000

Allowance for sales returns ee

‘Net realizable value =

a is the net

The amortized cost of accounts receivable is the same asthe

‘realizable vale.

206

;

F

t

|

\

CPA Adaneg

j !)

Bok Company "Pere he loving inomaton yearn

Trade 80unts ressvahy

Aine rat ft uncllestibieaceqg ‘

Sencterarese ey

tin Nov

Selling rice of unsold pes, 30,000

Miami on consignnten

‘ot included in Mines 130% of cost and

iami’s,

used for storing some inventories 300,000

Total 1,500,000

‘What total amount, ‘ould be reported as trade and other receivables

under current assets at year ery

a 940,000

b. 1,200,000

c. 1,240,000

4. 1,500,000

Solution 16-3 Answer q

Trade accounts receivable 930,000

Allowance for uncoltectible accounts . € 20,000)

Claim receivable # 30,000

Total trade and other receivables 340,000

The selling price of goods ‘on consignment is excluded from accounts

receivable because the goods are still unsold.

The cost of the consis

igned goods of P200,000 (260,000 / 130%)

should be included in’

inventory.

‘The security depositis a noncurrent receivable.

207 :

i eee cree cee

Problem 16-4 (AICPA Adapted) Scene

Faith Company provided the following information relating

operations:

4,000,000,

‘Accounts receivable, January 1 (5,400,000)

Accounts receivable collested (2,000,000)

Cash sales 4,800,000,

Inventory, January 1 (4 400,000

Inventory, December 31 8,000,000

Purchases 200,000

Gross margin on sales

317

8,200,000

b. 6,200,000

© 2,000,000

4. 4,200,000

Solution 16-4 Answer b

000

Inventory ~ January on

Purchases 000.000

: 00

Goods available for sale 128000

Inventory — December 31 (4400,000)

Cost of goods sold 3,400,000"

Gross margin on sales 4.200.000

Gross sales 12,600,000

Cash sales 2,000,000)

Credit sales 10,600,000

Accounts receivable — January 1 4,000,000

Total 14,600,000

Accounts receivable collected (8,400,000)

Accounts receivable ~ December 31 820,000

208

fuses

‘What amount should be reported as accounts receivable on December

re en

problem 16-5 (AICP, Adapted)

Steven Company provid, see

yearof operations: *“Ollowing information during the fist

Total mershandite purchases forthe year

Merchandise inventory gr (aay — ¢7.000,600

Colestions rom eur eRe 31 “tatason

December 31?

‘a.* 1,000,000

b. 3,840,000

¢. 5,000,000

4. 5,800,000

Solution 16-5 Answer b

Purchases

Inventory - December 31

Cost of goods sold

‘Markup on cost (40% x 5,600,000)

Sales (140% x 5,600,000) 7,840,000

Collections from customers (4,000,000)

‘Accounts receivable - December 3] 3,840,000

Sales ratio (100% + 40%)

140%

209

be

OO

Problem 16-6 (LAA) pod of ecsounting fr ch

oe the net price m 26,2021, the entity

Ae Comm teen ha ee

Sold merchandise witha ist price of P5000, ean vee,

Was given a trade discount of 20% 10%: rei

4/10, 130. :

: son freightcollect. Total freight

The gods wee shiped FOR desiration Ri er 77, 2001,

charge paid by the customer was P100,000. ty billed at 500,000,

the customer retuned damaged goods original

junts receivable on December

‘What is the net realizable vale of te accounts ;

31, 20217 y

3,420,000 |

. 2'920,000

. 2,703,000

4. 2/803:200

Solution 16-6 Answer c 0,000

Traeaoum 2x5 0040) (100.06

rade discount (20% x 5,000 ame

Trade discount (10% x 4,000,000) (400,000)

3,600,000

Trade discount (5% x 3,600,000) (180,000)

livoice price at gross i oe

Sales return at gross (500,000)

i 2,920,000

‘Gross amount of accounts receivable ”

Cash discount (4% 2,920,000) 116,800)

A iv :t 2,803,200

Freightchange able at net amount 100,000)

Net realizable value 2.103.200

FOB destination means that the sellers responsible forthe freight charge.

Freight collec meansthe common carer will collect the freight charge

ffomthe buyer tobe deducted fom th accounts receivable upon remitance

or payment from the buyer.

210

problem 16-7 (AICPA pag

'pted)

June 1, 2021, Pin

£000,000 to Burrog ace Sold merchandise with alist price of

nd 20%. "unt. it allowed trade discounts of 30%

nJune 11,2021, the customer pain

Creditterms were 210,39, Pe

pelt F200.(O0 ofc es aa FOB chiping prin,

‘What amount should be

! Teported

‘a. 5,000,000 ‘as sales revenue?

bi. 2800000 - Sty Fence

¢. 3,500,000 ©

d. 2,500,000

2 ‘What amount was received by Pit from Burras

remittance in full?

a. 2,744,000

b. 2,940,000

c. 2,944,000 ~

d. 3,140,000

Solution 16-7 Question I Answer 5 Question 2 Answer e

List price 5,000,000

‘Trade discounts:

30% x 5,000,000 1,500,000)

3,500,000

20% x 3,500,000 700,000)

Invoice price at gross ~ sales revenue 2,800.000

Cash discount (2% x2,800,000) (56,000)

Net amount 2,744,000

‘Add: Reimbursement of delivery cost 200,000

Total remittance from Burr 2,944,000

Note thatthe customer paid the accountin full within the discount

period.

FOB shipping point means the buyer is responsible forthe freight

charge.

Freight prepaid means the seller prepaid the freight charge as an

accommodation to be charged against the buyer upon full emittance.

21

0 SE

Problem 16-8 (PHILCPA Adapted)

Honduras Company revealed a balance ofP8200,000in he

receivable control account at year-end,

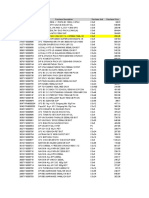

‘Analysis ofthe accounts receivable showed the folOWite:

Accounts known to be worthless

Advance payments to creditors on purchase orders

Advances to affiliatedentities Vs cok

Customers’ accounts reporting credit balances arising

from sales returns

Interest receivable on bonds

Trade accounts receivable — ‘unassigned

‘Subscription receivable due in 30. ‘days

‘Trade accounts receivable — assigned (Finance

‘Company's equity in assigned accounts is P500,000)

‘Trade installments receivable due | - 18 months,

including uneamed finance charge of P50,000

‘Trade accounts receivable from officers, due currently

‘Trade accounts on which postdated checks are held

‘and no entries were made on geceipt of checks

Total

100,000

1,000,000

600,000)

400,000

2,000,000

2,200,000

1,500,000

850,000

150,000

mann

‘so0an0

civable at

‘What amount should be reported as trade accounts receivable

year-end?

ce. 4,150,000

d. 4,050,000

Solution 16-8 Answer a

| Accounts receivable — unassigned

Accounts receivable — assigned

‘Trade installments receivable (850,000 - 50,000)

Trade accounts receivable from officers

‘Accounts on which postdated checks are held

Total trade accounts receivable

22

fa ae Es

2,000,000

1,500,000

100,000

150,000

200,000

a eee |

Problem 16-9 (AICPA Adapted)

When examining the accounts of Bute Company, it ascertained that

area eng 0 both receivables and pryablesee ee ea

contro!” witha debit balance

-up of this account revealed

9 Debit Credit

‘Aczounts receivable ~ customers

Trade accounts receivable — officers "Sgg'v00

Debit balances - creditors 300,000

Postdated checks from customers 400,000

Subscriptions receivable 806,000

‘Accounts payable for merchandise 4,500,000”

Credit balances in customers’ aeseunts 200,000

Cash received in advance from customers 100,000

Expected bad debts 150,000

‘After further analysis ofthe aged accounts receivable, its determined

that the allowance for doubtful accounts should be P200,000,

1. Whatis the net realizable value of accounts receivable?

a. 8,000,000 -

b. 8,500,000

©. 8,300,000

. 8'550,000

2. Whatamount should be reported as accounts payable?

a. 4,200,000

b. 4,700,000

c. 4,500,000

4. 4,800,000.

Solution 16-9 Question 1 Answer b Question 2 Answer c

‘Accounts receivable ~ customers

(7,800,000 + 400,000 postdated checks) 8,200,000

Allowance for doubtful accounts ( 200,000)

‘Trade accounts receivable-officers 500,000

Net realizable value

Accounts payable

n3

oo i

Problem 16-10 (IAA) ar

‘Von Company provider the fellowing data forthe current year

tosccounts receivable:

Debits 5

000

January | balance after deduetng credit balance of P3000, $3009

‘Charge sales

50,000

Charge for goods out on consignment 2,000

Shareholders subscription 4000

Accounts written off but recovered 000

25;

Cash paid to customer for January | credit balance ‘000

5 5

Goods shipped to cover January | eredit balance $00,000

Deposit on long-term contract, 400,000,

Claim against common carrier ‘4 300,000.

Advances to ‘supplier 44

Credits

Collections from customers, including overpayment

000

‘of PS0,000 5738 00

Writeoft 25,000

Merchandise returns 15,000

Allowances to customers for shipping damages 50,000

Collectiononcarrierclaim | 200,000

Collection on subscription *

ivable on

1, What amount should be reported as accounts receive’

December 317 x

a. $65,000

b. 595%000

tS

d. 495;

2. Whattotal amount of rae and other receivables shouldbe reported

under current assets?

a. 1,745,000

b. 2/045%000 ‘

1188 4

3. What total amount of other receivables should be reported under

moncurrent assets?

a. 1,650,000 i

b. 15,150,000

¢. 1,300,000

4. {600,000

214

Solution 16-10

Question I Answer b

‘Accounts receivable ~ January |

Charge sales ‘

‘Accounts written off but recovered

Total

Collections from customers

writeoft

Merchandise retums “

Allowance to customers for shipping damages

‘Accounts receivable ~ December 31

‘Accounts receivable ~ January |

Credit balance of customer

Adjusted accounts receivable

Collections from customers

‘Overpayment

Adjusted collections

Question 2. Answer ¢ i

Accounls receivable

Claim reeeivable’ (400,000 - 50,000)

‘Advances to supplier

Total trade and other receivables

Question 3 Answer ¢

Subscriptions receivable (1,006,000 -200,000)

Deposit on contract

Total long-term other receivables

25

560,000,

5,250,000

10,000

5,820,000

(5,150,000)

(35,000)

(25,000)

15,000)

595,000

530,000

800,000

500,000

1,300,000

CE

Problem 16-11 (IAA)

sons affecting

‘Wonder Company provided the following transactions

‘ecounts receivable during the current year:

Sales — cash and credit 1

Cash received from credit customers, all of whom

100k advantage of the discount feature of the

credit terms 4/10,1/30

ash received from cash customers

Accounts receivable written off as worthless

Credit memorandum issued to credit customers

for sales returns and allowances

Cash refunds given to cash customers for sales

returns and allowances ,

Recoveries on accounts receivable written off as

“uncollectible in prior periods not included in

cash received from customers stated above

Balances on January 1

Accounts receivable

Allowance for doubtful accounts

The entity provided for doubtful account expense

5,900,000

950,000

100,000

by crediting

forthe

allowance for doubtful accounts in the amount of P70,000

‘current year.

jivable on

1. What amount should be reported as accounts receival

December 31?

‘a. 1,300,000

b. 1,426,000

c. 1,280,000

d. 1,220,000

2, Whatamount should be reportedas allowance for doubtful accounts

on December 31?

a. 120,000

b. 200,000

©. 250,000

d. 170,000

Solution 16-11

Question J Answer a

‘Accounts receivable —

Credit sales

Total

Cash received from ere,

Sales discounts

‘Accounts receivable written off

Sales returns and allowances

‘Accounts receivable ~ December 31

January 1

dit customers

Total sales

Cash received from cash customers — cash sales

Credit sales

Gross accounts receival

(3,024,000 /96%)

Sales discounts (4% x 3,150,000)

ble collected

Cash received from credit customers

Gross amount

Cash discount (4/10 or 4% within 10 days)

Net amount

Question 2 Answer

Allowance for doubtful accounts - January |

Recovery of accounts written off

Doubtful accounts expense for current year

Total .

Accounts written off

Allowance for doubtful accounts - December 31

27

100,000

80,000

70.06

250,000

(50,000)

200,000

k

|

CO E:’~CQ—Olnhh OOOO

Problem 16-12 (PHILCPA Adapted) year.

‘Fermany Company started business tthe beginning fa ay

‘The entity established an allowance for doubtful accounts 750,000 of

5% of credit sales. During the year, the entity wrote Of

‘uncollectible accounts.

to

Further analysis showed that merchandise purchased in

9,000,000 and ending merchandise inventory wasPI,S00!

were sold 40% above cost.

sales.

The total sales comprised 80% sales on account and 20% 25h

spouted 10,

Total collections fom customers, excluding cashsales

6,000,000,

1. What amount should be reported as cost of goods 014?

a. 7,500,000

b. 5,400,000

c. 3,600,000

4. 6,900,000

2. What amount should be reported as sales on account?

10,500,000

18,750,000

12,000,000

8,400,000

pose

i it

3. What is the net realizable value of accounts receivable at

year-end?

1,980,000

». 2,350,000

1,930,000

|. 2,400,000

pees

218

Solution 16-12

Question | Answer a

Goods available for sale

Ending inventory

Cost of goods sold

Question 2 Answer d

Cost of goods sold

Markup on cost” (40% x 7,500,000)

Total sales

Cash sales (20% x 10,500,000)

Sales on account

Question 3 Answer a

Sales on account

Collections

Accounts written off

‘Accounts receivable ~ December 31

Provision for doubtful accounts (8,400,000 x 5%)

Accounts written off

Allowance for doubtful accounts ~ December 31

‘Accounts receivable

Allowance for doubtful accounts

Net realizable value

219

7,500,000

3,000,000

10,500,000. >

( 2,100,000)

8,400,000

8,400,000

(6,000,000)

420,000

( _$0,000)

370,000

2,350,000

(370,000)

1,980,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Introduction: Unpacking The SelfDocument6 pagesIntroduction: Unpacking The SelfSharmaine BeranNo ratings yet

- ARDocument8 pagesARSharmaine BeranNo ratings yet

- QuizDocument2 pagesQuizSharmaine BeranNo ratings yet

- Lesson 1: Sources of HistoryDocument19 pagesLesson 1: Sources of HistorySharmaine BeranNo ratings yet

- Understanding The Self - Physical & Sexual SelfDocument5 pagesUnderstanding The Self - Physical & Sexual SelfSharmaine BeranNo ratings yet

- Pas 38Document8 pagesPas 38Sharmaine BeranNo ratings yet

- Readings in Philippine HistoryDocument29 pagesReadings in Philippine HistorySharmaine BeranNo ratings yet

- Making Sense of The Past:: Historical InterpretationDocument17 pagesMaking Sense of The Past:: Historical InterpretationSharmaine BeranNo ratings yet

- Promissory NotesDocument13 pagesPromissory NotesSharmaine BeranNo ratings yet

- Simple Interest-Simple DiscountDocument55 pagesSimple Interest-Simple DiscountSharmaine BeranNo ratings yet

- Historical MethodDocument33 pagesHistorical MethodSharmaine BeranNo ratings yet

- Compound InterestDocument40 pagesCompound InterestSharmaine BeranNo ratings yet

- September 2016 WH Audit TemplateDocument61 pagesSeptember 2016 WH Audit TemplateSharmaine BeranNo ratings yet