Professional Documents

Culture Documents

SMA Lecture 1 Worksheet

SMA Lecture 1 Worksheet

Uploaded by

Thảo HoàngOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMA Lecture 1 Worksheet

SMA Lecture 1 Worksheet

Uploaded by

Thảo HoàngCopyright:

Available Formats

QUESTION 1

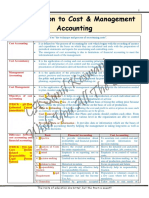

DIFFERENCES BETWEEN MANAGEMENT ACCOUNTING AND FINANCIAL ACCOUNTING

MANAGEMENT ACC FINANCIAL ACC

For external and internal use

For internal use

Is not binded by law and does not have Is regulated by law and needs to follow

standards to follow IFRS/GAAP

Future oriented Historical basis

Tends to focus on segments of the company to Focus on the whole organization activities

make decisions

Can be prepared whenever it is needed Be prepared annually, quarterly or once half a

year

QUESTION 2

EXPLAIN THE DIFFERENCE BETWEEN COST CLASSIFICATION AND COST BEHAVIOR.

Cost classification is the process of grouping costs referring to their nature: traceability into products.

There are direct costs, and indirect costs. Direct costs can be traced into making products,

manufacturing indirect costs can also be traced to determining product price.

Cost behaviour is how cost changes in relation to changes in activities: fixed, variable, semi-fixed,

semi-variable costs.

STRATEGIC MANAGEMENT ACCOUNTING

RECAP OF MANAGEMENT ACCOUNTING BASICS

QUESTION 3

PREPARE A RECONCILIATION BETWEEN THE VARIABLE COSTING SYSTEM AND ABSORPTION SYSTEM.

In general, reconciliation between variable and absorption costing can be made by using the profit

under marginal costing to adjust with the fixed manufacturing overheads allocated in opening

inventory brought in the beginning of the period (minus) or fixed manufacturing overheads allocated

in closing inventory at the end of the period (plus).

Example:

STRATEGIC MANAGEMENT ACCOUNTING

RECAP OF MANAGEMENT ACCOUNTING BASICS

Under marginal costing, fixed manufacturing overhead is fully eliminated in the period, while $5,000

of fixed manufacturing overhead is postponed into the next period through product cost of closing

inventory, therefore, the $10,000 marginal profit should be increased by $5,000 to $15,000 under

absorption costing.

STRATEGIC MANAGEMENT ACCOUNTING

RECAP OF MANAGEMENT ACCOUNTING BASICS

You might also like

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- ACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesDocument5 pagesACCA F5 - Part A - Specialist Cost and Management Accounting TechniquesMuneera Al Hassan100% (2)

- Management AccountingDocument18 pagesManagement AccountingFiyadNo ratings yet

- Project Cost ManagementDocument27 pagesProject Cost ManagementAlemuNo ratings yet

- Contents of The ManualDocument51 pagesContents of The ManualMinaw BelayNo ratings yet

- Account 203Document1 pageAccount 203RAVI KISHANNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- Chapter IDocument44 pagesChapter IBereket DesalegnNo ratings yet

- Overview of Management AccountingDocument6 pagesOverview of Management AccountingRenz Francis LimNo ratings yet

- Big Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You AreDocument51 pagesBig Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You Arekakao50% (2)

- Reviewer Compilation (b5 Notebook)Document3 pagesReviewer Compilation (b5 Notebook)Jessica AlbaracinNo ratings yet

- Topic 3 - Introduction To Cost & MGT AccountingDocument28 pagesTopic 3 - Introduction To Cost & MGT AccountingAct SriNo ratings yet

- 1 - 5 Accounting Standards - 2Document33 pages1 - 5 Accounting Standards - 2ashu629No ratings yet

- Standard Costing and Variance AnalysisDocument19 pagesStandard Costing and Variance AnalysisHardeep KaurNo ratings yet

- Cost and MGMT Acct IIDocument171 pagesCost and MGMT Acct IIAddisNo ratings yet

- Section - A 201: (I) Discuss About Accounting PrinciplesDocument7 pagesSection - A 201: (I) Discuss About Accounting PrinciplesPrem KumarNo ratings yet

- Essay Los 2015 Section D. Cost Management 20 %Document18 pagesEssay Los 2015 Section D. Cost Management 20 %lassaadNo ratings yet

- Cost and Management Accounting 2 CHAPTER 1Document44 pagesCost and Management Accounting 2 CHAPTER 1chuchuNo ratings yet

- Standard Costing Flexible Budget Variance Analysis IIUC MBADocument11 pagesStandard Costing Flexible Budget Variance Analysis IIUC MBANusrat JahanNo ratings yet

- Financial Management PPT Lesson 4Document35 pagesFinancial Management PPT Lesson 4Richelle Mae Baynosa OrtegaNo ratings yet

- Standard Costing and Variance AnalysisDocument26 pagesStandard Costing and Variance Analysislloyd madanhireNo ratings yet

- NEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Document20 pagesNEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Heleniya RenukaNo ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 DikonversiDocument44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 Dikonversirizky aulia100% (1)

- Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsDocument4 pagesPredetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsSomething ChicNo ratings yet

- Actg 132 Standard CostingDocument2 pagesActg 132 Standard Costingaly joyNo ratings yet

- Marginal CostDocument11 pagesMarginal Costapi-27014089100% (6)

- Amad NotesDocument96 pagesAmad NotesDalili Kamilia100% (1)

- Ch01 Introduction To Cost AccountingDocument5 pagesCh01 Introduction To Cost AccountingRenelyn FiloteoNo ratings yet

- Cost & Management AccountingDocument6 pagesCost & Management Accountingshivam goyalNo ratings yet

- MAS Absorption Costing/Variable Costing Study ObjectivesDocument6 pagesMAS Absorption Costing/Variable Costing Study ObjectivesMarjorie ManuelNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- Arens Auditing 16e SM 01Document15 pagesArens Auditing 16e SM 01Annisa NurNo ratings yet

- Summary Theory - Costing PDFDocument66 pagesSummary Theory - Costing PDFartizutshiNo ratings yet

- Acct 2321 Essay Q&A Exam - 2Document3 pagesAcct 2321 Essay Q&A Exam - 2Sayyaf NayefNo ratings yet

- Cost Best Theory NoteDocument84 pagesCost Best Theory NotebinuNo ratings yet

- Chapter 1Document6 pagesChapter 1ashish.s.shetty18No ratings yet

- MAS 5 - Module 1Document11 pagesMAS 5 - Module 1Razmen Ramirez PintoNo ratings yet

- CHAPTER 1 - Introduction To Cost AccountingDocument18 pagesCHAPTER 1 - Introduction To Cost AccountingDecery BardenasNo ratings yet

- ACC704 - Tutorial 1 QuestionsDocument4 pagesACC704 - Tutorial 1 QuestionsJake LukmistNo ratings yet

- Term Paper On Applicability of Variable Costing in Short-Term Decision Making Course: Managerial Accounting Section: 1 Semester: Fall 2020Document10 pagesTerm Paper On Applicability of Variable Costing in Short-Term Decision Making Course: Managerial Accounting Section: 1 Semester: Fall 2020akash sam100% (1)

- Budgeting Budgetary Systems 1. Rolling Budget: Shazwi Azid (SM'20)Document8 pagesBudgeting Budgetary Systems 1. Rolling Budget: Shazwi Azid (SM'20)Amir ArifNo ratings yet

- A201 - 1 - Intro To Cost Accounting (Jamero 2022)Document23 pagesA201 - 1 - Intro To Cost Accounting (Jamero 2022)MARIAN DORIANo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Finance For Managers-Management Accounting May 2020 CohortDocument110 pagesFinance For Managers-Management Accounting May 2020 CohortIness KyapwanyamaNo ratings yet

- Mba 507: Management Accounting: Revised Edition 2013 Published by Kenya Methodist University P.O. BOX 267 - 60200, MERUDocument73 pagesMba 507: Management Accounting: Revised Edition 2013 Published by Kenya Methodist University P.O. BOX 267 - 60200, MERUMarkmarie GaileNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- Cost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V SemDocument188 pagesCost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V Sempdd801852No ratings yet

- Incremental Budgeting: Session 2 Types of Budgets & Usages of The Budgetary SystemDocument3 pagesIncremental Budgeting: Session 2 Types of Budgets & Usages of The Budgetary SystemSyed Attique KazmiNo ratings yet

- Standard CostingDocument21 pagesStandard Costingkalpesh1956No ratings yet

- Cost and MGT Acct II ModuleDocument220 pagesCost and MGT Acct II ModuleyaibroNo ratings yet

- Chapter 1 Basic Concepts and Cost ClassificationDocument2 pagesChapter 1 Basic Concepts and Cost ClassificationApril Joy InductaNo ratings yet

- M1 Introduction To Cost ManagementDocument5 pagesM1 Introduction To Cost Managementwingsenigma 00No ratings yet

- Aeco2 MidtermDocument5 pagesAeco2 MidtermvsplanciaNo ratings yet

- Cost & Management Acct II ModuleDocument170 pagesCost & Management Acct II ModuleMekoya TerefeNo ratings yet

- Motivation, Budgets and Responsibility AccountingDocument5 pagesMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriNo ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet