Professional Documents

Culture Documents

TDS

Uploaded by

Narayan NarayanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS

Uploaded by

Narayan NarayanCopyright:

Available Formats

TDS

Options

Non Editable IT Details: If this option is ticked then, it will not allow us to edit or enter any details in

Computation Details window.

Standing Instructions Extrapolate: If this option is ticked then, insurance details will get extrapolate

in Computation Details.

Calculate on Proof Amount: If this option is ticked then, until we enter the proof amount in

computation details, the exemption will not happen.

Auto exemption for Food and Non Alcoholic beverages: Enter the per day amount for exemption.

For this the TDS ref should be Free food and Non alcoholic Breverage. The calculation will be Total

Present Days for the particular month *Entered amount.

Automated Int. Free Loans Calc

(Calculation: Opening Balance of the month * %age defined)/12

ded u/s 24-standard deduction 30% of net annual value id deductible irrespective of any expenditure

incurred by the taxpayer.

STCG (Short Term Capital Gain)

Gains arising at the time of sale of Short Term Capital Asset shall be computed in the following ways:

Total value of Sale Consideration

(less) Sale Expenses)

(less) Acquisition Cost- The price which the assesses has paid for acquiring the Assset

(less) Acquisition/Improvement Expenses

Auto Calculation

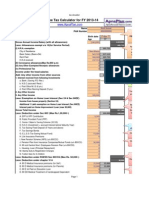

Car owned by employer and Used for Partial for Official

Reimbursed Car Capacity Driver Value of

Perquisites

Yes Upto 1.6 Lts Yes 2700

Yes Upto 1.6 Lts No 1800

No Upto 1.6 Lts Yes 1500

No Upto 1.6 Lts No 600

Yes >1.6 Lts Yes 3300

Yes >1.6 Lts No 2400

No >1.6 Lts Yes 1800

No >1.6 Lts No 900

80GG

Under this section, an Individual can claim deduction for the rent paid even if he don’t get HRA. Not

many people are aware of this deduction.

Exemption: 1) Rent paid minus 10 percent the adjusted total income (Gross total income).

2) Rs 2,000 per month.

3) 25 percent of the adjusted total income.

Least from the above will get exempt.

Gratuity Exemption

Exemption will be least of the below.

1) 15 days salary, based on last drawn salary for each year of service (i.e. 15 day’s salary *

length of service).

2) Rs 20,00,000/-

3) Gratuity actually received.

Leave Encashment

1) For government employee, leave encashment upon retirement or leaving the job is tax free

under section 10.

2) For non-government, it is exempt upto lease of the following.

i) Earned Leave (no. of months) * Average monthly salary.

ii) 10*Average monthly salary.

iii) Rs 3,00,000/-

iv) Actual leave encashment received.

Children Education Allowance

Maximum exemption is Rs 200 /month i.e. Rs 2,400/Fin Year, (Rs 100/Child).

Children Hostel Expenditure

Maximum exemption is Rs 600/month i.e. Rs 7,200/Fin Year, (Rs 300/Child).

Heads coming under section 10 for exemption

1) Gratuity

2) Leave Encashment

3) PF

4) HRA exemption

5) Conveyance.

You might also like

- Reading Challenge: Answer KeyDocument12 pagesReading Challenge: Answer KeyRaquelG13100% (3)

- The Healing of PlantDocument27 pagesThe Healing of PlantwisnuNo ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Compensation Analysis of Manufacturing IndustriesDocument14 pagesCompensation Analysis of Manufacturing IndustriesSankar Rajan100% (13)

- Structuring SalariesDocument11 pagesStructuring SalariesHemanth Kumar RajendakumarNo ratings yet

- Sithccc 020 Final Marking Guide Work Effectively As A CookDocument5 pagesSithccc 020 Final Marking Guide Work Effectively As A CookBaljeet SinghNo ratings yet

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- Signed Off - Food and Beverages11 - q4 - m5 - Provide Room Services - v3Document42 pagesSigned Off - Food and Beverages11 - q4 - m5 - Provide Room Services - v3Jellane Señora86% (14)

- BudgetDocument21 pagesBudgetshweta_narkhede01No ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Guidelines For Tax Declaration For The Financial Year 2014-15Document10 pagesGuidelines For Tax Declaration For The Financial Year 2014-15Sri vathsan (sri510)No ratings yet

- Tax FinalDocument21 pagesTax Finalshweta_narkhede01No ratings yet

- Direct Tax Code: Capital Gains Tax On Sale of Residential PropertyDocument5 pagesDirect Tax Code: Capital Gains Tax On Sale of Residential Propertykarthikeyan.mohandossNo ratings yet

- HRA - House Rent Allowance - Exemption Rules & Tax DeductionsDocument4 pagesHRA - House Rent Allowance - Exemption Rules & Tax DeductionsKrishna SwainNo ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- Taxable Income RahulDocument18 pagesTaxable Income RahulRahul ParitNo ratings yet

- Upload 2Document27 pagesUpload 2NAGESH PORWALNo ratings yet

- Comparison Between I.T. and DTCDocument23 pagesComparison Between I.T. and DTCsharma.shalinee1626No ratings yet

- 01 Revision Salary IncomeDocument24 pages01 Revision Salary IncomeUmer ArabiNo ratings yet

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDocument7 pagesScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Salaried Class - The Soft Target For Income Tax Collections: CMA Arif FarooquiDocument2 pagesSalaried Class - The Soft Target For Income Tax Collections: CMA Arif Farooquiमहेन्द्र ऋषिNo ratings yet

- Tax GuideDocument10 pagesTax GuideossymbengwaNo ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Taxation Flow PresentationDocument73 pagesTaxation Flow PresentationMohan ChoudharyNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Othuser Guide For Investment Declaration 22-23 - MyPayroll User GuideDocument19 pagesOthuser Guide For Investment Declaration 22-23 - MyPayroll User GuideRiyaan SultanNo ratings yet

- Click Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyDocument24 pagesClick Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyHARSHITA JOSHINo ratings yet

- Tax Saving InstrumentsDocument19 pagesTax Saving Instrumentsharry.anjh3613No ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- How To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABDocument12 pagesHow To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABPradeep PandeyNo ratings yet

- Tax PPT - DeductionsDocument20 pagesTax PPT - Deductionsjayparekh28No ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Income Tax 1Document26 pagesIncome Tax 1Vismaya CholakkalNo ratings yet

- 7th Term - Legal Frameworks of ConstructionDocument79 pages7th Term - Legal Frameworks of ConstructionShreedharNo ratings yet

- Budget 14 AnalysisDocument19 pagesBudget 14 AnalysisSaurav BharadwajNo ratings yet

- 16 Total IncomeDocument7 pages16 Total IncomeHritik HarlalkaNo ratings yet

- Institute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurDocument24 pagesInstitute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurRambres SainiNo ratings yet

- 56 Incom Tax CalculatorDocument6 pages56 Incom Tax Calculatorspecky123No ratings yet

- MyPayroll User Guide For Investment Declaration For FY 2020-21Document18 pagesMyPayroll User Guide For Investment Declaration For FY 2020-21bhaavaNo ratings yet

- ItfjfygjDocument3 pagesItfjfygjKrishna GNo ratings yet

- Ca Inter Full Book 2Document32 pagesCa Inter Full Book 2Amar SharmaNo ratings yet

- Hussainkhawaja 1177 3641 2 LECTURE-10Document51 pagesHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Payroll Tax InformationDocument16 pagesPayroll Tax InformationVibhor MehtaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- How To Save Tax For Fy 2018 19Document55 pagesHow To Save Tax For Fy 2018 19Vinit Bhavsar 7No ratings yet

- MockDocument18 pagesMockSmarty ShivamNo ratings yet

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- FAQ - Tax ComputationDocument11 pagesFAQ - Tax Computationshailesh bhatNo ratings yet

- Direct Tax CodeDocument8 pagesDirect Tax CodeImran HassanNo ratings yet

- Taxable Income Lecturer: Mr. S.RameshDocument4 pagesTaxable Income Lecturer: Mr. S.RameshthineshlaraNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- Notes On SalariesDocument18 pagesNotes On SalariesParul KansariaNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- pr2 IntroductionDocument1 pagepr2 IntroductionMarco MendozaNo ratings yet

- Tsuki Ga Michibiku Isekai Douchuu - Vol 5 NovelDocument225 pagesTsuki Ga Michibiku Isekai Douchuu - Vol 5 NovelPaula AlencarNo ratings yet

- Respiration s3 Bio NotesDocument9 pagesRespiration s3 Bio NotesKueiNo ratings yet

- Greek RecipesDocument30 pagesGreek RecipesMario KapitaoNo ratings yet

- The European Vampire Applied Psychoanalysis and Applied LegendDocument23 pagesThe European Vampire Applied Psychoanalysis and Applied LegendFerencz Iozsef100% (1)

- Tony Tan CaktiongDocument7 pagesTony Tan CaktiongCyndy PerezNo ratings yet

- Glossary - Botanical Glossary - Index (1.2 MB) (PDFDrive)Document22 pagesGlossary - Botanical Glossary - Index (1.2 MB) (PDFDrive)The oneNo ratings yet

- Dealing With Sore Throats - The Little Things in My HeadDocument9 pagesDealing With Sore Throats - The Little Things in My Headkh_chu_1No ratings yet

- Week 4 Bread & PastryDocument10 pagesWeek 4 Bread & PastryLiza Laith LizzethNo ratings yet

- Best Ever Keto Chocolate Cake (Sugar Free) - Sugar Free LondonerDocument2 pagesBest Ever Keto Chocolate Cake (Sugar Free) - Sugar Free LondonerAndrejaSkaricaNo ratings yet

- Cloze TestsDocument6 pagesCloze TestsNhựt Minh NGUYỄNNo ratings yet

- Platform TestsDocument12 pagesPlatform Testsmohityahoo67% (3)

- Medicion de Materiales CremDocument130 pagesMedicion de Materiales CremRUBENNo ratings yet

- Peer Review For The Research Essay 1Document15 pagesPeer Review For The Research Essay 1api-558830782No ratings yet

- Global Marketing Report: Name of The StudentDocument16 pagesGlobal Marketing Report: Name of The StudentPratik BasakNo ratings yet

- Asignatura Segunda Lengua Extranjera Ingles LecturaDocument3 pagesAsignatura Segunda Lengua Extranjera Ingles LecturaRocio Vargas AvilaNo ratings yet

- Quess Food Service Proposal KDA Hospital MumbaiDocument27 pagesQuess Food Service Proposal KDA Hospital MumbaiMonish DoifodeNo ratings yet

- Pathophysiology of Upper Gastrointestinal BleedingDocument1 pagePathophysiology of Upper Gastrointestinal BleedingkimmybapkiddingNo ratings yet

- MO DUL: Basic Education Grade 9Document4 pagesMO DUL: Basic Education Grade 9Josua AndesNo ratings yet

- Myth: Mice Love Cheese and It Makes A Great Bait For Mouse TrapsDocument2 pagesMyth: Mice Love Cheese and It Makes A Great Bait For Mouse TrapsAli ZerNo ratings yet

- Rafael Herida III Ronalyn Ca: Ñete Shairna Macasayon Angelique PalenciaDocument2 pagesRafael Herida III Ronalyn Ca: Ñete Shairna Macasayon Angelique PalenciaJan Jan SalvanNo ratings yet

- Sparkling Wine and Champagne HandoutsDocument10 pagesSparkling Wine and Champagne HandoutsTina Tahilyani�No ratings yet

- UAE HeritageDocument19 pagesUAE HeritageKumudu Nayanarashi100% (1)

- Menu Punjabi TadkaDocument4 pagesMenu Punjabi TadkaSheikh Muhammed TadeebNo ratings yet

- Music, Arts, Physical Education, and Health (Mapeh) : Quarter 3 - Module 4 (Week 4)Document20 pagesMusic, Arts, Physical Education, and Health (Mapeh) : Quarter 3 - Module 4 (Week 4)Albert Ian CasugaNo ratings yet

- The Standard Ogf Living by Dorothy Parker and Girls in Summer Dresses by Irwin Shaw En-UsDocument11 pagesThe Standard Ogf Living by Dorothy Parker and Girls in Summer Dresses by Irwin Shaw En-Usmarai80100% (1)