Professional Documents

Culture Documents

Accounting Standard Policies

Uploaded by

ashishoraon789835Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Standard Policies

Uploaded by

ashishoraon789835Copyright:

Available Formats

Accounting Standard (AS)

Disclosure of Accounting Policies

Introduction

AS 1 refers to the disclosure of accounting policies. It states that an enterprise needs

to disclose significant accounting policies followed by it to prepare and present its financial

statements.

This is because a business entity’s state of affairs gets significantly impacted by the

accounting policies used in preparing its financial statements.

Typically, every enterprise follows accounting policies appropriate to its own

business as well as industry. Thus, an enterprise mandatorily needs to disclose its significant

accounting policies in order to present a true and fair view of its state of affairs.

Explanation

Fundamental Accounting Assumptions

Certain fundamental accounting assumptions underlie the preparation and

presentation of financial statements. They are usually not specifically stated because their

acceptance and use are assumed. Disclosure is necessary if they are not followed.

The following have been generally accepted as fundamental accounting assumptions :

—

a. Going Concern

The enterprise is normally viewed as a going concern, that is, as continuing in

operation for the foreseeable future. It is assumed that the enterprise has neither the intention

nor the necessity of liquidation or of curtailing materially the scale of the operations.

b. Consistency

It is assumed that accounting policies are consistent from one period to another.

c. Accrual

Revenues and costs are accrued, that is, recognised as they are earned or incurred (and

not as money is received or paid) and recorded in the financial statements of the periods to

which they relate. (The considerations affecting the process of matching costs with revenues

under the accrual assumption are not dealt with in this Standard)

Nature of Accounting Policies

Meaning of Accounting Policies

The term ‘accounting policies’ in AS 1 refer to the following while preparing financial

statements an enterprise:

specific accounting principles

methods to apply those accounting principles

No Standardized List of Accounting Policies

There is no standardized list of accounting principles applicable to varied circumstances

experienced by different enterprises.

Thus, varied accounting principles and methods to apply to those principles are followed

by different enterprises. These enterprises operate in a diverse and complex environment of

economic activity.

So, the management of each enterprise has to make considerable amount of judgement at

its own level. This is done in order to choose an appropriate set of accounting principles and

methods to apply those principles in specific circumstances faced by each of them.

Number of Alternative Accounting Policies Reduced

ICAI as well as other regulatory bodies have made efforts to reduce the number of

alternative accounting policies to be followed in preparing financial statements. These efforts

have been made, particularly in the case of corporate enterprises.

However, the possibility to completely eliminate the availability of the alternative

accounting principles and the methods to apply those principles is not likely. This is because

each enterprise has to encounter different circumstances under different conditions.

Areas in which Different Accounting Policies are Encountered

Following are the areas where different accounting policies may be adopted by different

enterprises:

Methods of depreciation, depletion and amortization

Treatment of expenditure during construction

Conversion or translation of foreign currency items

Valuation of inventories

Treatment of goodwill

Valuation of investment

Treatment of retirement benefits

Recognition of profit on long-term contracts

Valuation of fixed assets

Treatment of contingent liabilities

However, the above list is not an exhaustive list.

Considerations in the Selection of Accounting Policies

The basic consideration while selecting accounting policies to prepare financial

statements is that such policies should represent a true and fair view the company’s affairs.

This also includes presenting true and fair view of the profit or loss earned by a business

enterprise at the closing date.

Besides this primary consideration, there are a few major considerations to be kept in

mind while selecting accounting policies. These include:

1. Prudence

An enterprise cannot forecast its profits keeping in mind the uncertainty related to the

future events. Instead, it can only recognize the profits when they are realized.

Further, such recognized profits are not necessarily realized in cash. In addition to

this, an enterprise also creates a provision for all known liabilities and losses.

This is despite the fact that the amount of such liabilities and losses cannot be

determined with certainty. Thus, it means that such a provision represents only a best

estimate of such liabilities and losses according to the information available.

2. Substance over Form

As per this consideration, the accounting treatment and presentation of transactions

and events in the financial statements must be governed by their substance.

This means merely the legal form of accounting treatment and presentation of such

events in the financial statements should not be considered.

3. Materiality

The financial statements should disclose all the material items. The material items are

the ones that influence the decisions of the financial statement users once they become aware

of such items.

Disclosure of Accounting Policies

It is necessary to disclose all the significant accounting policies adopted while

presenting & preparing financial statements. This is done to ensure proper

understanding of financial statements.

The disclosure of significant accounting policies should form part of the financial

statements.

Disclosure of accounting policies must be made in one place as it helps the financial

statement users in reading such statements. Such a disclosure should not be made in a

way that it is scattered over several statements, schedules and notes.

An enterprise should disclose any change in an accounting policy that has a material

effect. Further, the enterprise should also disclose the amount by which any item in

the financial statements is affected by such a material change. Such an amount needs

to be disclosed to the extent ascertainable. However, only the fact of such a material

change needs to be indicated where such amount is not ascertainable wholly or partly.

On the other hand, there might be cases where a change in the accounting policies

does not have a material impact on the current period’s financial statements. But are

reasonably expected to have a material impact in later periods. In such cases, an

enterprise needs to disclose the fact of such a change in the period in which the

change is adopted.

A business entity needs to keep in mind that a disclosure of accounting policies or of

changes therein cannot remedy a wrong or inappropriate treatment of the item in the

accounts.

You might also like

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Finance Project PrintDocument23 pagesFinance Project PrintYash ParekhNo ratings yet

- As1 CaDocument2 pagesAs1 CaĐėvıł ĶıñgNo ratings yet

- Accounting Standard 1Document7 pagesAccounting Standard 1api-3828505No ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- AS-1 Disclosure of Accounting Policies: CMA S. BaskaranDocument11 pagesAS-1 Disclosure of Accounting Policies: CMA S. BaskaranS. BaskaranNo ratings yet

- Final CHP T 2Document152 pagesFinal CHP T 2Marikrishna Chandran CA100% (1)

- Chap2 As 1 Disclosure of Accounting PoliciesDocument3 pagesChap2 As 1 Disclosure of Accounting PoliciesAashutosh PatodiaNo ratings yet

- Accounting Standard (AS) 1 (Issued 1979) : Disclosure of Accounting PoliciesDocument5 pagesAccounting Standard (AS) 1 (Issued 1979) : Disclosure of Accounting PoliciesSuhasini GummeNo ratings yet

- Unit 2: Overview of Accounting Standards: After Studying This Unit, You Will Be Able ToDocument138 pagesUnit 2: Overview of Accounting Standards: After Studying This Unit, You Will Be Able Totauseefalam917100% (1)

- Inbound 3522308407029868205Document18 pagesInbound 3522308407029868205KupalNo ratings yet

- Accounting Standard (As) 1 Disclosure Ofaccounting Policies: (Issued 1979)Document3 pagesAccounting Standard (As) 1 Disclosure Ofaccounting Policies: (Issued 1979)Sonali PuriNo ratings yet

- Chapter 6 - Accounting Concepts and PrinciplesDocument19 pagesChapter 6 - Accounting Concepts and PrinciplesRyah Louisse E. ParabolesNo ratings yet

- Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardDocument6 pagesGenerally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardRahul JainNo ratings yet

- Accounting PrinciplesDocument12 pagesAccounting PrinciplesBalti MusicNo ratings yet

- Accounting Standard (AS) 1: (Issued 1979)Document7 pagesAccounting Standard (AS) 1: (Issued 1979)anoop_mishra1986No ratings yet

- 3 Overview of Accounting StandardsDocument136 pages3 Overview of Accounting StandardsAlok Kumar100% (1)

- As-1 Disclosure of Accounting PoliciesDocument7 pagesAs-1 Disclosure of Accounting PoliciesPrakash_Tandon_583No ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesgimmyjoyNo ratings yet

- ACCOUNTING STANDARD-1: Some Salient Features: Considerations in The Selection of Accounting PoliciesDocument4 pagesACCOUNTING STANDARD-1: Some Salient Features: Considerations in The Selection of Accounting PoliciesAbhijeet DashNo ratings yet

- Recommendations and Conclusion:: Disadvantages-Of-Accounting-Standards-Accounting-Essay - Php#Ixzz3TrnjpbraDocument9 pagesRecommendations and Conclusion:: Disadvantages-Of-Accounting-Standards-Accounting-Essay - Php#Ixzz3TrnjpbraarpanavsNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesSatesh Kumar KonduruNo ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- Assignment On GAAP, AccountingDocument7 pagesAssignment On GAAP, AccountingAsma Hameed50% (2)

- Accounting Standard 1 PDFDocument4 pagesAccounting Standard 1 PDFChristopher Jacob MurmuNo ratings yet

- As1-Diclosure of Accounting PoliciesDocument6 pagesAs1-Diclosure of Accounting PoliciesDharmesh MistryNo ratings yet

- Chapter 1 Accounting ConceptsDocument6 pagesChapter 1 Accounting ConceptsJamEs Luna MaTudioNo ratings yet

- Accounting StandardsDocument24 pagesAccounting Standardslakhan619No ratings yet

- Assingnment On AccountingDocument5 pagesAssingnment On AccountingAbdul LatifNo ratings yet

- Accounting Standard (AS) 1 (Issued 1979) : Disclosure of Accounting PoliciesDocument4 pagesAccounting Standard (AS) 1 (Issued 1979) : Disclosure of Accounting Policiessaradindu123No ratings yet

- AS 1: Disclosure of Accounting Policies: IPCC Paper 1: Accounting Chapter 1 Unit 2Document31 pagesAS 1: Disclosure of Accounting Policies: IPCC Paper 1: Accounting Chapter 1 Unit 2sam hajamatNo ratings yet

- Accounting Standards (As) and International Financial Reporting StandardsDocument34 pagesAccounting Standards (As) and International Financial Reporting StandardsSD gamingNo ratings yet

- Document 2Document8 pagesDocument 2sohamNo ratings yet

- Accounting Policies1Document4 pagesAccounting Policies1szn1No ratings yet

- Advancd Acc Ca Inter cp-4Document15 pagesAdvancd Acc Ca Inter cp-4Pooja Suresh BNo ratings yet

- Accounting Standard-1: Disclosure of Accounting PoliciesDocument8 pagesAccounting Standard-1: Disclosure of Accounting Policieskeshvika singlaNo ratings yet

- As1 171222Document6 pagesAs1 171222spikysanchitNo ratings yet

- With Reference To Practical Examples, Explore The Difference Between Positive Accounting Theory Ad Normative Accounting TheoriesDocument13 pagesWith Reference To Practical Examples, Explore The Difference Between Positive Accounting Theory Ad Normative Accounting Theoriesmichelle NyazunguNo ratings yet

- What Is Accounting PrinciplesDocument17 pagesWhat Is Accounting PrinciplesvicenteferrerNo ratings yet

- Accountings AssignmentDocument12 pagesAccountings AssignmentDivisha AgarwalNo ratings yet

- Unit 6 - Accounting Concepts Standards-1Document20 pagesUnit 6 - Accounting Concepts Standards-1evalynmoyo5No ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsAnand MakhijaNo ratings yet

- Accounting Is The Art of Recording Transactions in The Best MannerDocument22 pagesAccounting Is The Art of Recording Transactions in The Best MannerSunny PandeyNo ratings yet

- Accounting Is The Art of Recording Transactions in The Best MannerDocument22 pagesAccounting Is The Art of Recording Transactions in The Best MannerSunny PandeyNo ratings yet

- Disclosure of Accounting PoliciesDocument8 pagesDisclosure of Accounting Policiesabdullah0331No ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- Accounting PrinciplesDocument6 pagesAccounting PrinciplesGabeno issachNo ratings yet

- Unit 2-Accounting Concepts, Principles and ConventionsDocument20 pagesUnit 2-Accounting Concepts, Principles and Conventionsanamikarajendran441998No ratings yet

- Acc 1Document3 pagesAcc 1navi4s3No ratings yet

- Presentation On Accounting Standard 1Document9 pagesPresentation On Accounting Standard 1ritusexyNo ratings yet

- 4.accounting StandardsDocument3 pages4.accounting StandardsbouhaddihayetNo ratings yet

- 13.2 AS 1 Disclosure of Accounting PoliciesDocument4 pages13.2 AS 1 Disclosure of Accounting PoliciesRohith KumarNo ratings yet

- Mba FsaDocument45 pagesMba FsaBlue Stone100% (1)

- Lecture One Role of Accounting in SocietyDocument10 pagesLecture One Role of Accounting in SocietyJagadeep Reddy BhumireddyNo ratings yet

- Accounting PrincipalDocument8 pagesAccounting PrincipalKrish ChandranNo ratings yet

- As-1: Disclosure of Accounting Policies: ObjectivesDocument58 pagesAs-1: Disclosure of Accounting Policies: ObjectivesAshutosh SinghNo ratings yet

- Financial AccountingDocument27 pagesFinancial AccountingShreya KanjariyaNo ratings yet

- Capital and Revenue ExpendituresDocument8 pagesCapital and Revenue Expendituresashishoraon789835No ratings yet

- Backup - of - R PANDRE MAHADEV BANNERDocument2 pagesBackup - of - R PANDRE MAHADEV BANNERashishoraon789835No ratings yet

- Backup - of - Certificate RVDocument2 pagesBackup - of - Certificate RVashishoraon789835No ratings yet

- Riya MisraDocument1 pageRiya Misraashishoraon789835No ratings yet

- Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesChapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeAnna TaylorNo ratings yet

- ACC1ILV - Chapter 1 Solutions PDFDocument3 pagesACC1ILV - Chapter 1 Solutions PDFMegan Joye McFaddenNo ratings yet

- 4 Chap 1 Audit An Overview RevDocument29 pages4 Chap 1 Audit An Overview RevJoen SinamagNo ratings yet

- CHAPTER 3 MCPROBLEMS, MCTHEORIES, SHORT PROBLEMS, COMPREHENSIVE PROBLEMS - Understanding-Financial-StatementsDocument99 pagesCHAPTER 3 MCPROBLEMS, MCTHEORIES, SHORT PROBLEMS, COMPREHENSIVE PROBLEMS - Understanding-Financial-StatementsRhedeline LugodNo ratings yet

- AOM NO. 01-Stale ChecksDocument3 pagesAOM NO. 01-Stale ChecksRagnar Lothbrok100% (2)

- Primary Books of AccountsDocument16 pagesPrimary Books of AccountsSaptha Gowda100% (1)

- Accounting Cycle of A Merchandising BusinessDocument21 pagesAccounting Cycle of A Merchandising Businesszedrick edenNo ratings yet

- Far 2 Exercise 5 Page 286Document5 pagesFar 2 Exercise 5 Page 286Kay HispanoNo ratings yet

- T24 Accounting Introduction - R14.01Document165 pagesT24 Accounting Introduction - R14.01JEGADEESWARINo ratings yet

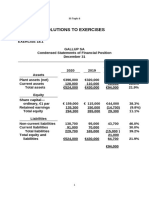

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution ManualDocument9 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manualbeatrice100% (24)

- Title: Accounts Receivable Accountant Code:: Job DescriptionDocument2 pagesTitle: Accounts Receivable Accountant Code:: Job DescriptionyamarideNo ratings yet

- SS Topic 6Document8 pagesSS Topic 6ibrahimkingpubg7No ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- TM 6 - Tugas CGDocument2 pagesTM 6 - Tugas CGauliaNo ratings yet

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- PT Unitex LaptahunanDocument108 pagesPT Unitex LaptahunanbereniceNo ratings yet

- Auditing and Ethics May 2024 1701670825Document6 pagesAuditing and Ethics May 2024 1701670825Anil ReddyNo ratings yet

- FORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyDocument14 pagesFORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyChelsea BynoeNo ratings yet

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasRidwanNo ratings yet

- Future-Student-Guide ANUDocument28 pagesFuture-Student-Guide ANUCynthia RaniNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Acca Ethics and Professionalism.Document22 pagesAcca Ethics and Professionalism.abirking50% (2)

- GST Configuration in SAP FICODocument5 pagesGST Configuration in SAP FICOKingpinNo ratings yet

- CFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinDocument3 pagesCFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinChetLatinNo ratings yet

- Final Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code GroupDocument2 pagesFinal Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code Groupzarif zakwanNo ratings yet

- Liquidity Ratios - ShyamDocument10 pagesLiquidity Ratios - ShyamYaswanth MaripiNo ratings yet

- Cash Flow in Capital Budgeting KeownDocument37 pagesCash Flow in Capital Budgeting Keownmad2kNo ratings yet

- MGMT201 Application 3 (Case Only) - 2021Document4 pagesMGMT201 Application 3 (Case Only) - 2021hieu maiNo ratings yet

- 6-4B SolutionDocument3 pages6-4B SolutionAnish AdhikariNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet