Professional Documents

Culture Documents

Activity 3-IntAcc1

Uploaded by

0322-1975Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 3-IntAcc1

Uploaded by

0322-1975Copyright:

Available Formats

BALIWAG, DANNICA C.

2BSA1

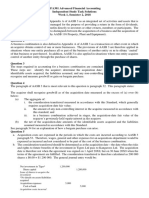

ACTIVITY 3 – RECEIVABLE FINANCING

I. PLEDGE

Debit Credit

Apr. 24 Cash 750,000

Loans Payable 723,000

Interest Expense 27,000

To record loans payable

II. ASSIGNMENT

a) Notification Basis

Debit Credit

Accounts Receivable - assigned 900,000

Accounts Receivable 900,000

Cash 750,000

Discount on Loan Payable 27,000

Loans Payable 723,000

b) Non-notification Basis

Debit Credit

Cash 350,000

Allowance for Doubtful Accounts 530

Sales Discount 560

Accounts Receivable – Assigned 351,090

Loans Payable 350,000

Interest Expense 7,500

Cash 357,500

c) Accounts Receivable – assigned (900,000 – 351,090) 548,910

Loans Payable (750,000 – 350,000) (400,000)

Equity in Assigned Receivables 148,910

III. FACTORING

Debit Credit

a) Cash 368,000

Due from Factor (2% x 400,000) 8,000

Loss on Sale of Receivables (6% X 400,000) 24,000

Accounts Receivable 400,000

b) Accounts Receivable 400,000

Due to DEF Financing Corp. 8,000

Financing Revenue 24,000

Loans Payable 368,000

Cash 368,000

Due from Factor 8,000

Loss on sale of Receivables 31,000

Accounts Receivable 400,000

Recourse Liability 7,000

IV. DISCOUNTING OF NOTES

Principal 1,000,000

Add: Interest (1,000,000 X 12% X 6/12) 60,000

Maturity Value 1,060,000

Less: Discount (1,060,000 X 16% X 3/12) (28,267)

Net Proceeds 1,031,733

Principal 1,000,000

Add: Interest (1,000,000 X 12% X 4/12) 40,000

Carrying amount of Notes Receivable (1,040,000)

Interest Expense (8,267)

a) Without Recourse Basis

Debit Credit

Nov. 01 Cash 1,031,733

Loss on NR Discounting 8,267

Notes Receivable 1,000,000

Interest Income 40,000

To record loans payable

b) With Recourse Basis – Conditional Sale

Debit Credit

Nov. 01 Cash 1,031,733

Loss on NR Discounting 8,267

Notes Receivable Discounted 1,000,000

Interest Income 40,000

To record loans payable

c) With Recourse Basis – Secured Borrowing

Debit Credit

Nov. 01 Cash 1,031,733

Interest Expense 8,267

Liability for NR Discounted 1,000,000

Interest Income 40,000

To record loans payable

You might also like

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- 2 Problems Problem 2-1 Analyzing Various Receivable TransactionsDocument9 pages2 Problems Problem 2-1 Analyzing Various Receivable TransactionsKristina KittyNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- 07 Receivable Financing 2 SolvingDocument3 pages07 Receivable Financing 2 Solvingkyle mandaresioNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Solution Manual INTACC3 SUMMERDocument25 pagesSolution Manual INTACC3 SUMMERRaven SiaNo ratings yet

- Chapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Document27 pagesChapter 2-Statement of Financial Position: Problem 2-1 (AICPA Adapted)Asi Cas Jav100% (1)

- PX Set H Solution PDFDocument14 pagesPX Set H Solution PDFChristine Altamarino89% (9)

- Chapter5 IA Problems1 9Document16 pagesChapter5 IA Problems1 9Anonn100% (1)

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- IA Chapter-8-10Document8 pagesIA Chapter-8-10Christine Joyce EnriquezNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- LQ 1 Sec C Solution PDFDocument14 pagesLQ 1 Sec C Solution PDFmaria evangelistaNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Adv Acc Prep 2024Document3 pagesAdv Acc Prep 2024Suhail AhmedNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Financial LibabilitiesDocument15 pagesFinancial LibabilitiesHatdogNo ratings yet

- Current LiabilitiesDocument5 pagesCurrent LiabilitiesPhoebe Dayrit CunananNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Chap 8 ExerciseDocument14 pagesChap 8 ExerciseK59 Dao Phuong MaiNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Akuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Document2 pagesAkuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Muhamad Rizal DinyatNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Chapter 1 Current LiabilitiesDocument7 pagesChapter 1 Current LiabilitiesThalia Rhine AberteNo ratings yet

- Practice Exercises # 2 - CH 14Document4 pagesPractice Exercises # 2 - CH 14Hamna AzeezNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Intangible Assets Discussion MaterialDocument20 pagesIntangible Assets Discussion MaterialKougane SanNo ratings yet

- ACCT101 YUNLEE SOLUTIONS Ch05Document19 pagesACCT101 YUNLEE SOLUTIONS Ch05KO YANG JINNo ratings yet

- Final Module Management Advisory ServicesDocument12 pagesFinal Module Management Advisory ServicesGwyneth Mae GallardoNo ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Problems On LiabilitiesDocument6 pagesProblems On LiabilitiesKorinth BalaoNo ratings yet

- 01 Quiz On Topic 02 With Answer KeyDocument7 pages01 Quiz On Topic 02 With Answer KeyNye NyeNo ratings yet

- (Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanDocument8 pages(Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon Rosales67% (3)

- Solution:: Problem 4: For Classroom DiscussionDocument2 pagesSolution:: Problem 4: For Classroom DiscussionAnika Gaudan PonoNo ratings yet

- Demo, Inc.: Accounts Receivable As of December 31, 2017Document9 pagesDemo, Inc.: Accounts Receivable As of December 31, 2017ALMA MORENANo ratings yet

- Chapter 4 To Chapter 5Document24 pagesChapter 4 To Chapter 5XENA LOPEZNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Output No. 3Document1 pageOutput No. 3chingNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- 4 Solution Exam Auditing 2Document5 pages4 Solution Exam Auditing 2Kristina KittyNo ratings yet

- Sol. Man. - Chapter 1 Current LiabilitiesDocument10 pagesSol. Man. - Chapter 1 Current LiabilitiesChristine Mae Fernandez Mata100% (4)

- Corporate Liquidation & Reorganization: Problem 1: True or FalseDocument20 pagesCorporate Liquidation & Reorganization: Problem 1: True or FalseRicalyn Bugarin0% (2)

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Activities On Module 1 - Partnership AccountingDocument4 pagesActivities On Module 1 - Partnership AccountingANDI TE'A MARI SIMBALANo ratings yet

- Bac 101Document6 pagesBac 101Ishak IshakNo ratings yet

- Bank AccountsDocument8 pagesBank Accountsswetha pandianNo ratings yet

- Jawaban Soal, Akuntansi Menengah 1Document7 pagesJawaban Soal, Akuntansi Menengah 1Mira OktaviaNo ratings yet

- Sol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 EditionDocument22 pagesSol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 Editiondianel villarico100% (1)

- BFA301 Independent Study Task Solutions Week 1 PDFDocument3 pagesBFA301 Independent Study Task Solutions Week 1 PDFerinNo ratings yet

- Financial Management HomeworkDocument33 pagesFinancial Management HomeworkShielaNo ratings yet

- Simple InterestDocument19 pagesSimple InterestHJNo ratings yet

- Financial Statement Analysis of Private Banks Ltd.-2025Document57 pagesFinancial Statement Analysis of Private Banks Ltd.-2025Zannatul Ferdousi Alam YameemNo ratings yet

- Cancellation of Mortgage SampleDocument1 pageCancellation of Mortgage SampleEsli Adam Rojas100% (6)

- Financial Services NotesDocument16 pagesFinancial Services NotesNupur ChaturvediNo ratings yet

- Fire Nymph Products LTD V The Heating CentreDocument8 pagesFire Nymph Products LTD V The Heating CentrenorshafinahabdhalimNo ratings yet

- Activity Sheet In: Business FinanceDocument8 pagesActivity Sheet In: Business FinanceCatherine Larce100% (1)

- Liquidation of Companies: After Studying This Chapter, You Will Be Able ToDocument47 pagesLiquidation of Companies: After Studying This Chapter, You Will Be Able ToRishi LodhNo ratings yet

- Toyota Indus Motors FOFDocument43 pagesToyota Indus Motors FOFAli HasanNo ratings yet

- More Credit With Fewer Crises 2011Document84 pagesMore Credit With Fewer Crises 2011World Economic ForumNo ratings yet

- MF - Unit IiiDocument15 pagesMF - Unit IiiIndrani DasguptaNo ratings yet

- Financing Options in The Oil and Gas IndustryDocument31 pagesFinancing Options in The Oil and Gas IndustrymultieniyanNo ratings yet

- Pefindo'S Corporate and Corporate Debt Securities Default Study 2007-2019Document35 pagesPefindo'S Corporate and Corporate Debt Securities Default Study 2007-2019Bangkit ZuasNo ratings yet

- ObligationsDocument10 pagesObligationsCharrie Grace Pablo100% (1)

- (Credit Trans) de La Paz vs. L&JDocument24 pages(Credit Trans) de La Paz vs. L&JCHERRIE LOU A AGSOYNo ratings yet

- Letters of Credit and Trust Receipt Digests Under Atty Zarah Castro-VillanuevaDocument16 pagesLetters of Credit and Trust Receipt Digests Under Atty Zarah Castro-VillanuevaBAMFNo ratings yet

- Analysis of LeverageDocument20 pagesAnalysis of LeverageIam JaiNo ratings yet

- Optimal Hedging StrategyDocument23 pagesOptimal Hedging StrategyanandkumarnsNo ratings yet

- 633833334841206250Document57 pages633833334841206250Ritesh Kumar Dubey100% (1)

- Richest Among The RuinsDocument256 pagesRichest Among The RuinsThoreau100% (2)

- Cost of Capital: Dr. A.N. SAHDocument41 pagesCost of Capital: Dr. A.N. SAHHARMANDEEP SINGHNo ratings yet

- Chapter IDocument67 pagesChapter IAnanth MandiNo ratings yet

- Abdi Jundi ResDocument43 pagesAbdi Jundi ResBobasa S AhmedNo ratings yet

- f8857 PDFDocument7 pagesf8857 PDFAnthony JacobsNo ratings yet

- The Nameless War - RamsayDocument119 pagesThe Nameless War - Ramsaysaskomanev254733% (3)

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- Eng. Mortgage DeedDocument4 pagesEng. Mortgage DeedKiran VenugopalNo ratings yet

- FHA Credit Policy ManualDocument146 pagesFHA Credit Policy ManualWeb BinghamNo ratings yet

- Contracts Project Trimester 3Document22 pagesContracts Project Trimester 3Mudit SinghNo ratings yet

- ch1 PDFDocument36 pagesch1 PDFJie Wen YUNo ratings yet